Rotary Steerable System Market Outlook:

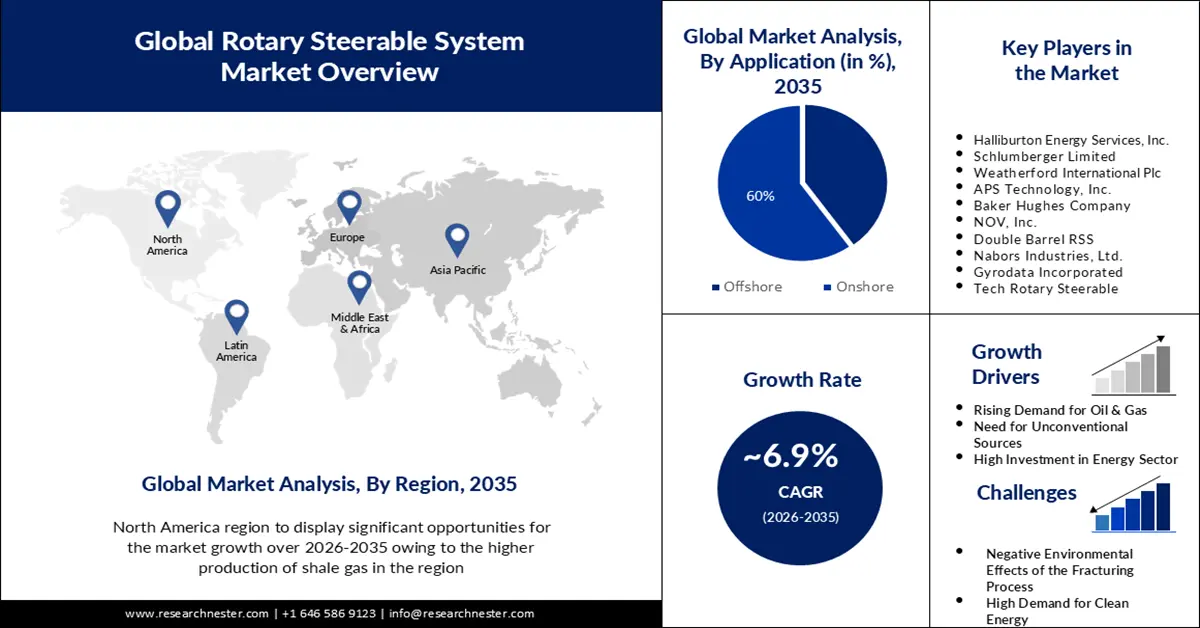

Rotary Steerable System Market size was over USD 5.08 billion in 2025 and is poised to exceed USD 9.9 billion by 2035, witnessing over 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rotary steerable system is estimated at USD 5.4 billion.

With the surging demand for renewable energy resources, the rotary steerable system (RSS) has found its potential application in this energy extraction. For instance, RSS technology can assist in effectively reaching and intersecting geothermal deposits, hence increasing overall energy output.

Following Russia's invasion of Ukraine, global oil prices skyrocketed to more than $120 per barrel. The emphasis on cost optimization and operational efficiency has increased as a result of increased oil prices. The adoption of rotary steerable system will increase as it aids correct well placement and higher drilling frequency thus significantly contributing to reducing operational cost.

Key Rotary Steerable System Market Insights Summary:

Regional Insights:

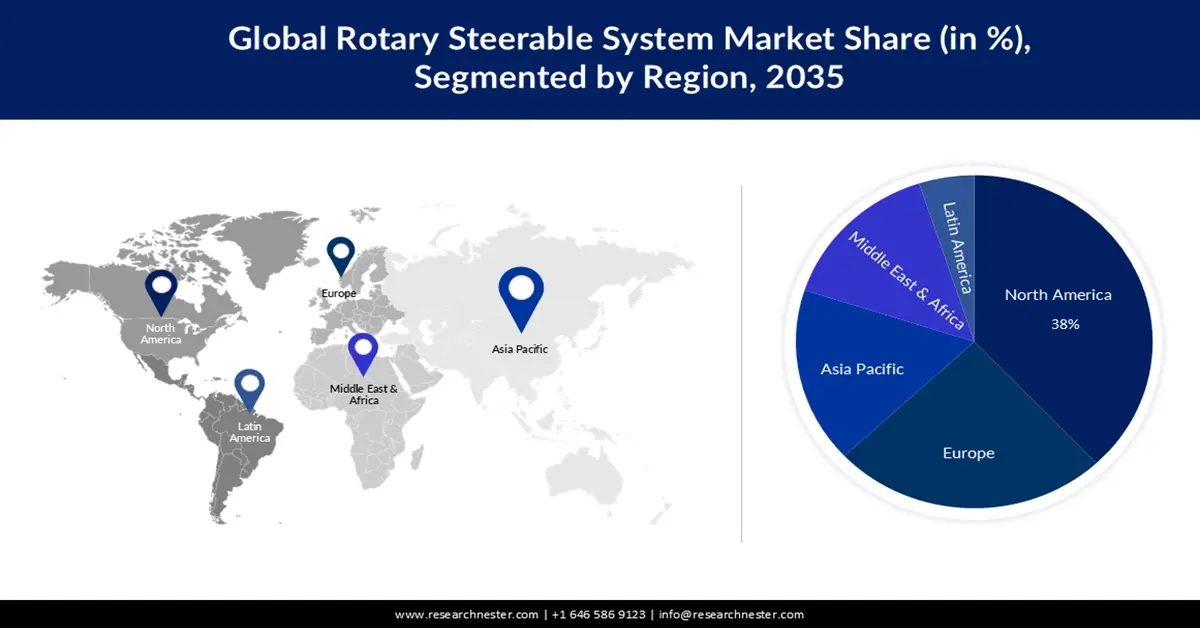

- North America is projected to hold a 38% share by 2035, impelled by rising shale gas production increasing the demand for directional drilling with rotary steerable systems.

- Europe is expected to capture a 25% share by 2035, fueled by higher oil consumption driving the need for faster drilling and increased production.

Segment Insights:

- Onshore Rotary Steerable System is projected to account for a 60% share by 2035, propelled by the high number of oil rigs on land and the need for extended-reach drilling.

- Push-the-Bit segment is gaining traction by 2035, owing to improved drilling efficiency and reduced drilling time.

Key Growth Trends:

- Surging Consumption of Energy

- Growing Reserves of Unconventional Energy

Major Challenges:

- Negative Impact on the Environment

- Growing demand for renewable energy

Key Players: D-Tech Rotary Steerable, Halliburton Energy Services, Inc., Schlumberger Limited, Weatherford International Plc, APS Technology, Inc., Baker Hughes Company, NOV, Inc., Double Barrel RSS, Nabors Corporate Services, Inc., Gyrodata Incorporated.

Global Rotary Steerable System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.08 billion

- 2026 Market Size: USD 5.4 billion

- Projected Market Size: USD 9.9 billion by 2035

- Growth Forecasts: 6.9%

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Canada, Saudi Arabia, Russia, China

- Emerging Countries: Brazil, Mexico, India, Norway, UAE

Last updated on : 24 November, 2025

Rotary Steerable System Market - Growth Drivers and Challenges

Growth Drivers

- Surging Consumption of Energy– Owing to rapid industrialization, and urbanization, there has been a surge in the consumption of energy. Hence, the increasing production of energy depends upon the rotary steerable system. Energy consumption is predicted to increase by 50% between 2005 and 2030, with developing countries accounting for the majority of the demand.

- Growing Reserves of Unconventional Energy–Rotary steerable system (RSS) are commonly used in unconventional oil and gas drilling, such as shale gas, and oil sand, they also act as directional drilling tools. Oil sands are discovered in many nations across the globe, but the largest volumes are found in Venezuela, and Alberta. Alberta's oil and sand reserves are the world's largest single oil reserves. It is estimated to hold oil accounting for 2 to 3 trillion barrels contained in complex oil sands and mixtures.

- Rising Investment in Offshore Drilling – In order to make up for the expanding demand for hydrocarbons, there has been rising investment in offshore drilling areas.

Challenges

- Negative Impact on the Environment- Hydraulic crushing procedures cause groundwater contamination, pollutants in the air, the release of methane, the motion of toxic gases, the groundwater quality degradation. Therefore, one of the biggest challenges impeding the rotary steerable system market growth is the adverse ecological effects of hydraulic fracturing activity.

- Growing demand for renewable energy

- Higher competition from conventional drilling technologies

Rotary Steerable System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 5.08 billion |

|

Forecast Year Market Size (2035) |

USD 9.9 billion |

|

Regional Scope |

|

Rotary Steerable System Market Segmentation:

Application Segment Analysis

The onshore rotary steerable system market is estimated to gain the largest revenue share of about 60% in the year 2035. The higher number of oil rigs present on the land and the extraction of crude oil from onshore rigs and other oilfield services will boost the segment growth. Onshore wells require drilling extended-reach sections to access remote or offshore. A rotary steerable system enables longer horizontal section drilling. The majority of the world's oil rigs are on land. There were around 1,309 operational onshore oil rigs at the end of 2021. Moreover, it is expected that by 2025, around 72 percent of the crude oil produced globally will be produced onshore.

Type Segment Analysis

Rotary steerable system market from the push the bit segment is gaining popularity owing to improved drilling efficiency and it even reduces the drilling time by increasing the penetration rates. The International Association of Directional Drilling (IADD) estimates that there were 70 different RSS tools on the market by August 2020 from various businesses. Out of which, 70% of these are push-the-bit systems, demonstrating the popularity of this method over alternative steerable technologies like mud motors and point-the-bit RSS.

Our in-depth analysis of the market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rotary Steerable System Market - Regional Analysis

North American Market Insights

North America industry is predicted to dominate majority revenue share of 38% by 2035. The rising production of shale gas is increasing the need for directional drilling with the use of rotary steerable system. According to the U.S. Bureau of Labor Statistics, shale gas extraction in the United States is poised to increase from around 7.8 million MMcf in 2011 to 16.7 million MMcf by 2040. Moreover, shale gas production in the United States is expected to account for more than 40% of total natural gas production in China by 2040. Moreover, shale gas output in Canada is set to rise further, accounting for over 30% of total natural gas production by 2040.

European Market Insights

The European rotary steerable system market is predicted to be the second largest, registering a share of about 25% by the end of 2035. The growth of the market can be attributed majorly to the higher consumption of oil which will increase the need for faster drilling and higher production of oil with the use of a rotary steerable system. As the COVID-19 limits were gradually abolished in the EU in 2021, consumption of most oil products surged, with jet kerosene increasing by 25.55% as stated by Eurostat.

Rotary Steerable System Market Players:

- D-Tech Rotary Steerable

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Halliburton Energy Services, Inc.

- Schlumberger Limited

- Weatherford International Plc

- APS Technology, Inc.

- Baker Hughes Company

- NOV, Inc.

- Double Barrel RSS

- Nabors Corporate Services, Inc.

- Gyrodata Incorporated

Recent Developments

- Schlumberger announced the launch of autonomous directional drilling which offers options for autonomously steering through any region of the wellbore.

- Halliburton Company introduced the iCruise XTM Intelligent Rotary Steerable System, the next generation of drilling platform designed for longer, harsher applications that need precision.

- Report ID: 4994

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rotary Steerable System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.