Global Rotary Encoder Market

- An Outline of the Global Rotary Encoder Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Rotary Encoder

- Recent News

- Regional Demand

- Rotary Encoder Market by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Rotary Encoder Demand Landscape

- Rotary Encoder Demand Trends Driven by Electrification, Downsizing, and Lightweighting (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Rotary Encoder Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Rotary Encoder Market – Key Player Analysis (2024)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2024 (%)

- Business Profile of Key Enterprise

- OMRON Corporation

- HEIDENHAIN

- Honeywell International Inc.

- Renishaw plc, TE Connectivity

- Pepperl+Fuchs

- Baumer Electric AG

- Dynapar

- Koyo Electronics Industries Co.Ltd.

- Panasonic Corporation

- Rockwell Automation, Inc.

- Sensata Technologies, Inc.

- Sick AG

- MTS Systems

- Bourns, Inc.

- Soterix Medical Inc.

- Business Profile of Key Enterprise

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Rotary Encoder Market Segmentation Analysis (2026-2036)

- By Type

- Incremental Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Absolute Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- By Output Type

- Digital Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Analog Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Technology

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Transmissive, Market Value (USD Million), and CAGR, 2026-2036F

- Reflective, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Resolution

- Low Resolution Encoders (Less than 100 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Medium Resolution Encoders (100 to 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- High Resolution Encoders (More than 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Industrial Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Healthcare Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Robotics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive Applications, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Type

- Incremental Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Absolute Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- By Output Type

- Digital Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Analog Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Technology

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Transmissive, Market Value (USD Million), and CAGR, 2026-2036F

- Reflective, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Resolution

- Low Resolution Encoders (Less than 100 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Medium Resolution Encoders (100 to 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- High Resolution Encoders (More than 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Industrial Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Healthcare Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Robotics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive Applications, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Type

- Incremental Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Absolute Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- By Output Type

- Digital Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Analog Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Technology

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Transmissive, Market Value (USD Million), and CAGR, 2026-2036F

- Reflective, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Resolution

- Low Resolution Encoders (Less than 100 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Medium Resolution Encoders (100 to 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- High Resolution Encoders (More than 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Industrial Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Healthcare Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Robotics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive Applications, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Type

- Incremental Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Absolute Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- By Output Type

- Digital Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Analog Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Technology

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Transmissive, Market Value (USD Million), and CAGR, 2026-2036F

- Reflective, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Resolution

- Low Resolution Encoders (Less than 100 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Medium Resolution Encoders (100 to 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- High Resolution Encoders (More than 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Industrial Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Healthcare Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Robotics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive Applications, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Type

- Incremental Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Absolute Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- By Output Type

- Digital Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Analog Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Technology

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Transmissive, Market Value (USD Million), and CAGR, 2026-2036F

- Reflective, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Resolution

- Low Resolution Encoders (Less than 100 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Medium Resolution Encoders (100 to 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- High Resolution Encoders (More than 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Industrial Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Healthcare Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Robotics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive Applications, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Type

- Incremental Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Absolute Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- By Output Type

- Digital Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Analog Output Encoders, Market Value (USD Million), and CAGR, 2026-2036F

- Technology

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Transmissive, Market Value (USD Million), and CAGR, 2026-2036F

- Reflective, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Optical, Market Value (USD Million), and CAGR, 2026-2036F

- Resolution

- Low Resolution Encoders (Less than 100 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Medium Resolution Encoders (100 to 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- High Resolution Encoders (More than 1000 PPR), Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Industrial Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Healthcare Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Robotics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive Applications, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

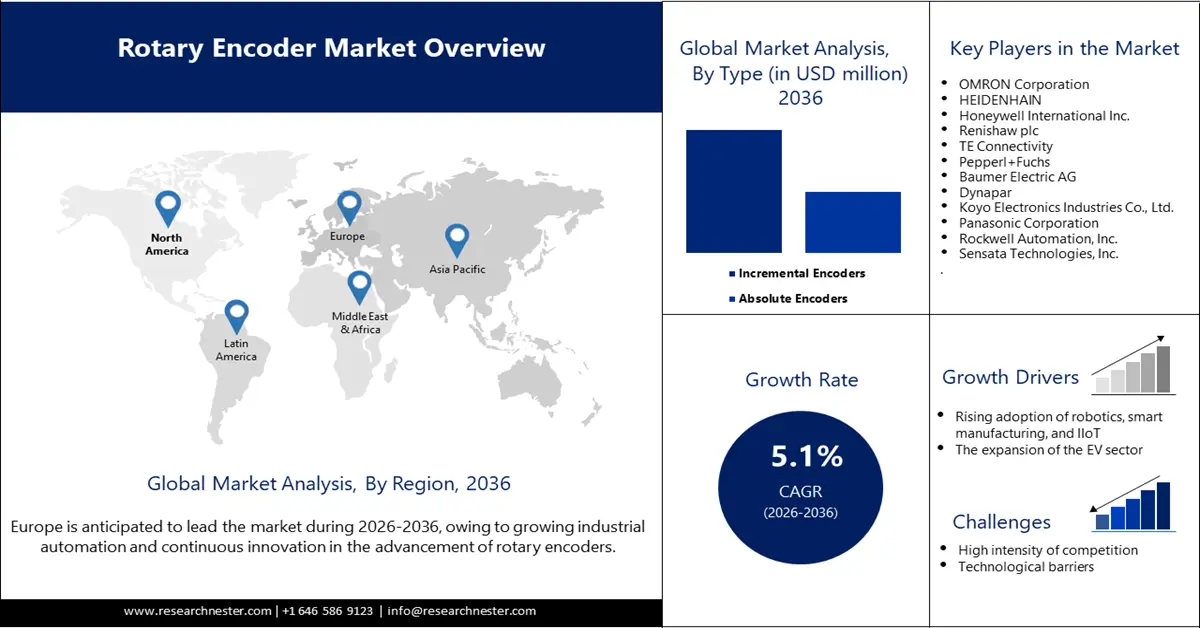

Rotary Encoder Market Outlook:

Rotary Encoder Market size was valued at USD 1.1 billion in 2025 and is expected to reach USD 1.8 billion by the end of 2036, registering a CAGR of 5.1% during the forecast period, i.e., 2026-2036. In 2026, the industry size of rotary encoder is assessed at USD 1.2 billion.

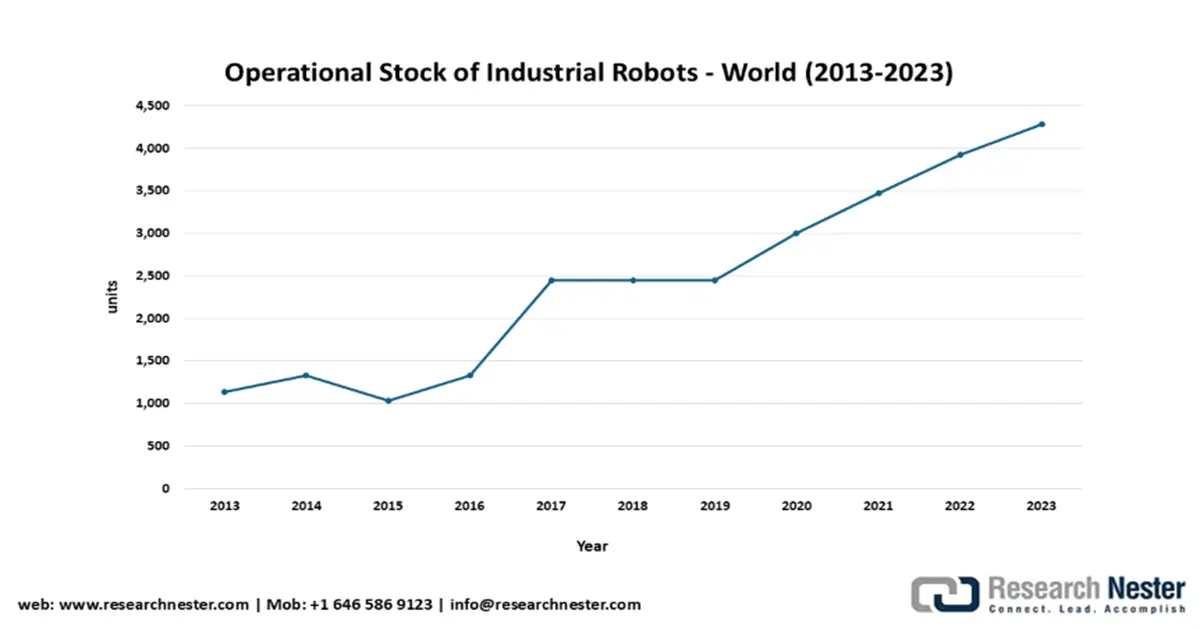

The increasing industrial automation globally is a key factor expected to boost the demand for different types of rotary encoders during the forecast period. The use of rotary encoders as sensors is crucial in industrial automation for position detection and speed in different mechanical systems. According to a 2024 report by the International Federation of Robotics, around 4,281,585 units were operating in factories worldwide in 2024, a significant increase compared to 2023. This is expected to increase the demand for rotary encoders in automation, motion control, and robotics.

Source: IFR

By region, nearly 70% new robots were deployed in industries in Asia, followed by 17% in Europe and 10% in the U.S in 2023. Here is a list of industrial robot installations in specific countries.

|

Region |

Country |

Installations 2023 (units) |

YoY Change |

|

Asia |

China |

276,288 |

-5% (vs 2022: 290,144) |

|

Japan |

46,106 |

-9% |

|

|

South Korea |

31,444 |

-1% |

|

|

India |

8,510 |

+59% |

|

|

Europe |

Total |

92,393 |

+9% |

|

Germany |

28,355 |

+7% |

|

|

Italy |

10,412 |

-9% |

|

|

France |

6,386 |

-13% |

|

|

Spain |

5,053 |

+31% |

|

|

Slovakia |

2,174 |

+48% |

|

|

Hungary |

1,657 |

+31% |

|

|

UK |

3,830 |

+51% |

|

|

North America |

Total |

55,389 |

-1% |

|

United States |

37,587 |

-5% |

|

|

Canada |

4,311 |

+37% |

Source: IFR

In addition, continuous innovations in the development of rotary encoder technology influence market growth. Innovations are mainly driven by companies associated with the market. For instance, in March 2025, Oriental Motor announced the expansion of its product line of rotary encoders with the introduction of a new 40 mm rotary encoder. The resolution of new encoders ranges from 100 to 4000 P/R, and they are capable of delivering diverse output types, including open collector, line driven, and voltage output.

Key Rotary Encoder Market Insights Summary:

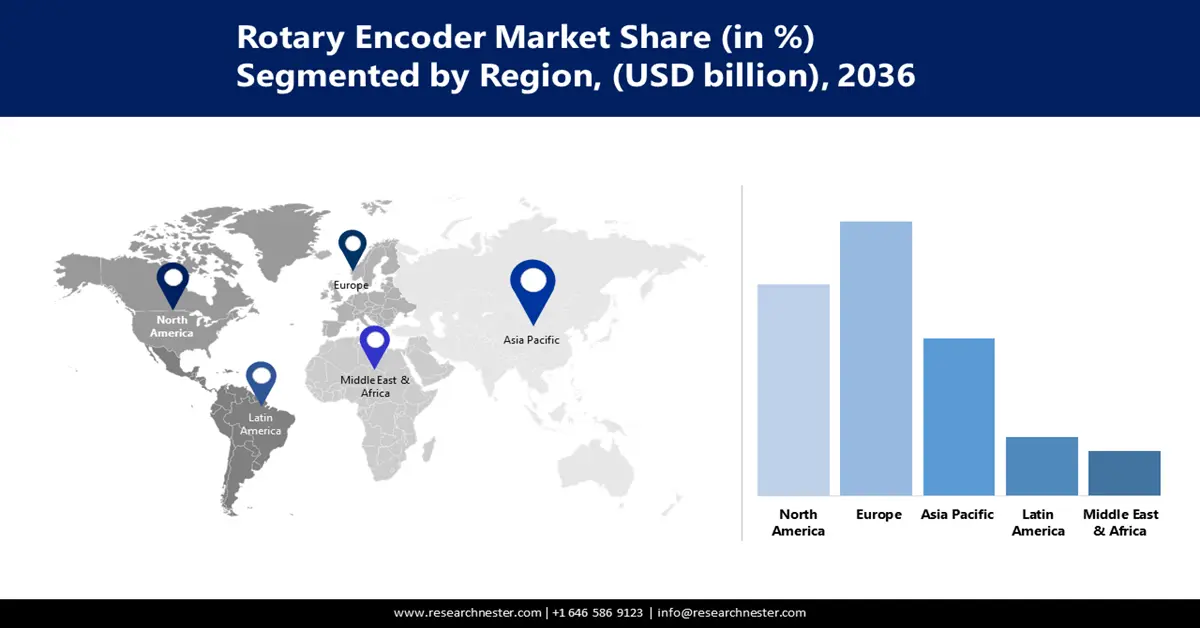

Regional Highlights:

- The Rotary Encoder Market in Europe is expected to capture a 34.6% revenue share by 2036, stimulated by the growing adoption of automation and machine learning technologies across industries.

- The Asia Pacific market is set to attain a substantial share by 2036, impelled by accelerated industrialization and urbanization initiatives.

Segment Insights:

- The incremental encoders segment is projected to hold a substantial share by 2036 in the Rotary Encoder Market, driven by lower production costs and simplified design.

- The digital output encoders segment is anticipated to capture a 58.2% market share by 2036, propelled by their superior performance and compatibility with modern automation systems.

Key Growth Trends:

- Rising adoption of robotics, smart manufacturing, and IIoT

- The expansion of the EV sector

Major Challenges:

- Rising competition from alternative sensors

- Technological barriers

Key Players: OMRON Corporation, HEIDENHAIN, Honeywell International Inc., Renishaw plc, TE Connectivity, Pepperl+Fuchs, Baumer Electric AG, Dynapar, Koyo Electronics Industries Co., Ltd., Panasonic Corporation, Rockwell Automation, Inc., Sensata Technologies, Inc., Sick AG, MTS Systems, Bourns, Inc.

Global Rotary Encoder Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.1 billion

- 2026 Market Size: USD 1.2 billion

- Projected Market Size: USD 1.8 billion by 2036

- Growth Forecasts: 5.1% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Europe (34.6% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 29 September, 2025

Rotary Encoder Market - Growth Drivers and Challenges

Growth Drivers

- Rising adoption of robotics, smart manufacturing, and IIoT: Industries including automotive, aerospace, and consumer electronics are increasingly adopting robotics, smart manufacturing, and IIoT to operate as sustainably as possible. The expansion of the industries with the integration of robotics technologies is likely to boost the adoption of rotary encoders. The sensors play a crucial role in encoding rotation angle and linear displacement in robotics applications. As reported by the International Energy Agency in November 2024, the average robot density in factories globally reached 162 units per 10,000 employees in 2023, doubling in the last seven years.

- The expansion of the EV sector: The rapid expansion of the automotive sector and adoption of advanced vehicles is expected to fuel global market growth. Therefore, rising EV adoption expands the need for rotary encoders. As reported by the International Energy Agency, EV sales in the first quarter of 2025 reached 4 million, an increase of 35% in relation to the first quarter of the previous business year. Developing economies are not behind in EV adoption. In January 2025, EV sales in India reached 1,69,931 units, a MoM increase of 19.4%, and an observed 17.1% YoY growth.

- Push for sustainability: Several regulatory bodies are introducing stringent regulations to achieve the sustainable development goals, which is expected to fuel the rotary encoders market growth in the coming years. For example, as revealed by the Association for Advancing Automation in March 2025, the update of ISO 10218-1 and ISO 10218-2 in 2025 obligates manufacturers and integrators of robotics technologies to meet functional safety requirements more explicitly. Thus, the demand for the sensors can increase with the rising adoption of robots.

Challenges

- Rising competition from alternative sensors: Competition in the global market is high, due to the widespread presence of a vast number of key players offering diverse products, and the availability of substitute product suppliers for consumers. Products, such as small, brushed DC motors or small, brushless motors, are easily accessible in the market. Competition in the industry is likely to influence deterioration in the sales performance of the businesses and obstruct the entry of new enterprises.

- Technological barriers: The inherent limitations of sensing technologies, such as optical and magnetic, used in rotary encoders, can hamper the market growth to a certain extent. These technologies are vulnerable to malfunctions that are often caused by fingerprints, scratches, and other environmental issues. Malfunctioning of such technologies can deteriorate the performance of the rotary encoder technologies and hinder the market growth.

Rotary Encoder Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2036 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 1.1 billion |

|

Forecast Year Market Size (2036) |

USD 1.8 billion |

|

Regional Scope |

|

Rotary Encoder Market Segmentation:

Type Segment Analysis

The incremental encoders segment is expected to acquire a significant market share by the end of 2036, owing to lower costs and a simple design. Mainly, the exclusion of the use of complex components and advanced manufacturing measures makes the costs of producing incremental encoders lower. Companies are also increasingly investing in the production of incremental encoders. In August 2023, Dynapar announced the launch of the HS35iQ Encoder with PulseIQ Technology. It is a hollow shaft incremental encoder, incorporated with color-coded LEDs and digital output, and suitable for use in self-diagnosis.

Output Type Segment Analysis

The digital output encoders segment is anticipated to expand extensively by acquiring a market share of 58.2% by the end of 2036, owing to their high performance and compatibility with modern automation systems. New easily incorporable digital output encoders are consistently launched by companies across different regions. Once such an example is the unveiling of the new HOG800 series at SPS 2024 by Baumer in October 2024. The technology is capable of responding in 10 ms, using a minimal blind zone (10 mm) and performing smart filter functions.

Technology Segment Analysis

The magnetic segment is expected to register rapid growth by the end of 2036, due to cost-effectiveness and improvements in the accuracy of the technology. Moreover, the widespread availability of magnetic technology facilitates its higher utilization in rotary encoders. Governments are also active in influencing the production of the technology. As revealed by the India Brand Equity Foundation (IBEF) in June 2023, the government is set to launch a scheme worth USD 404.4 million and focused on fueling the production of rare earth materials and magnets. This was an initiative to reduce the dependency of the country on China.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Output Type |

|

|

Technology |

|

|

Resolution |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rotary Encoder Market - Regional Analysis

Europe Market Insights

The rotary encoder market in Europe is poised to account for a revenue share of 34.6% by the end of 2036, owing to the rising adoption of automation and machine learning technologies across different business industries. The expansion of the automotive sector is another factor that is consistently increasing the use of rotary encoders. For instance, in May 2024, Wayve unveiled support from SoftBank in raising funds of more than USD 1 billion for the development of embodied AI products. This initiative was taken to enable automated driving, which fueled the need for smart rotary encoders.

Germany is expected to emerge as a rapidly expanding rotary encoders market in the coming years, due to growing preference for smart factories. Companies across Germany are increasingly investing in the establishment of smart factories, increasing the use of and demand for rotary encoders. For example, in December 2023, Bosch revealed its involvement in piloting generative AI and foundation models in enabling manufacturing. The plan of the business also included the development and scaling up of AI solutions for enabling optical inspection, influencing an acceleration in the use of rotary encoders.

France rotary encoder market is set to expand at a high CAGR between 2026 and 2036, as a consequence of the push from the government to optimize organizational operations. One such example is the launch of the France 2030 programme in 2021. Through this initiative, the government raised funding of USD 63.2 billion. The launch of the programme obligated companies, schools, and other organizations to undergo digital transformation, increasing the need for rotary encoders.

Asia Pacific Market Insights

The Asia Pacific market is poised to hold a high revenue share by the end of 2036, on account of the rapid industrialization and urbanization. As per UN-Habitat, urbanization in the Asia Pacific is likely to remain continuous, with the residence of 54% of the global urban population. With rapid urbanization, infrastructural projects are likely to be undertaken, which can fuel industrial growth and technology adoption. According to the International Trade Administration (ITA) 2024, industrial automation in emerging economies, including India, is at a fast pace, supported by government initiatives such as the Make in India policy, Smart Advanced Manufacturing and Rapid Transformation Hubs, or SAMARTH Udyog Bharat 4.0, and collaboration with the U.S. government.

Thus, the growing demand for advanced rotary encoders has resulted in rising trade activities. As reported by the Ministry of Commerce and Industry, the export of electrical machinery and equipment and parts, including rotary encoders, was USD 34,412.52 million in 2024 and is expected to reach USD 44,049.59 million in 2025, with a growth of around 28%.

The rotary encoder market in China is set to expand at a remarkable CAGR during the forecast period, as a consequence of the expansion of the automotive sector. As per the International Energy Agency, China is the global hub of EVs. The country accounted for over 70% of the global car production. This indicates the extent to which rotary encoders are in demand to be used as motion sensors in the automotive sector in China. The rapid development of robotics technology in China boosts the demand for rotary encoders significantly as well.

Japan is expected to emerge as an expanding market at an extensive CAGR between 2026 and 2036, due to a shortage of labor, increasing the need for deploying automated processes across various industries, ranging from manufacturing to automotive. As per the report by ASEAN+3 Macroeconomic Research Office (AMRO), published in May 2025, the shortage of labor is driven by the shrinking working-age population in Japan. Around 25% of the workforce in Japan is senior citizens. Thus, to remain sustainable in terms of productivity in different industries, the adoption of automation technologies is becoming integral for businesses in Japan, fueling the demand for rotary encoders.

North America Market Insights

North America rotary encoders market is anticipated to account for a remarkable revenue share by the end of 2036, as a consequence of the expansion of the automotive sector through the development of EVs and ADAS. Companies associated with the automotive sector are consistent in investment for the development of EVs and ADAS, accelerating the demand for rotary encoders. Rapid adoption of robotics technologies in different industries is also leading to an increased use and demand for rotary encoders, which is resulting in the development of rotary encoders that are compatible with robotics applications. For instance, in November 2023, Nikon announced the launch of MAR-M700MFA, the first multi-turn external battery-free absolute encoder with an all-solid-state battery. The encoder is effective in detecting the absolute values for robot-arm rotational displacement and relevant measurements.

The U.S. rotary encoder market is anticipated to expand at a rapid CAGR during the forecast period, owing to rapid industrial automation, increasing the demand for rotary encoders over time. Automakers operating in the U.S. are also active in the adoption of robotics technologies, indicating an increased use of rotary encoders. As reported by the International Federation of Robotics in May 2025, by 10.7%, the installation of industrial robots in the car industry increased and reached 13,700 units in 2024.

The rotary encoder market in Canada is poised to expand at an extensive CAGR, on account of the government initiatives to boost industrial automation, which fuels the demand for rotary encoders. With rapid industrialization. The demand for compact and high-performance encoders is likely to surge in Canada. Companies operating in Canada are also keen to supply such compact and high-performance rotary encoders. Global large companies involved in the production of rotary encoders are expanding their local presence across Canada, fueling the market growth.

Key Rotary Encoder Market Players:

- OMRON Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HEIDENHAIN

- Honeywell International Inc.

- Renishaw plc

- TE Connectivity

- Pepperl+Fuchs

- Baumer Electric AG

- Dynapar

- Koyo Electronics Industries Co., Ltd.

- Panasonic Corporation

- Rockwell Automation, Inc.

- Sensata Technologies, Inc.

- Sick AG

- MTS Systems

- Bourns, Inc.

The global market is highly competitive, with key players operating at global and regional levels. The market is expected to witness rapid growth, driven by the rising adoption of automation, robotics, and advanced motion control across industries such as automotive, aerospace, and electronics. These key players are focused on developing novel products and technology by implementing several strategies, such as mergers and acquisitions, product launches, and partnerships.

The following is the list of key players associated with the rotary encoder market:

Recent Developments

- In May 2025, SICK AG introduced the new next-generation ANS/ANM58 ProfiNet absolute encoder, capable of delivering high productivity and allowing easy integration. In other words, the rotary encoder has the capacity to deliver rapid, bi-directional communication at shorter cycle times with the use of PLCs. It also has high-precision movement.

- In May 2025, HEIDENHAIN unveiled its plan to display inductive rotary encoders at AUTOMATICA 2025. The encoders were developed through collaboration with brands that include RENCO, AMO, and RSF, and are an innovative motor feedback solution compatible with robots and cobots.

- Report ID: 5388

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rotary Encoder Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.