Rooftop Wind Energy Market Outlook:

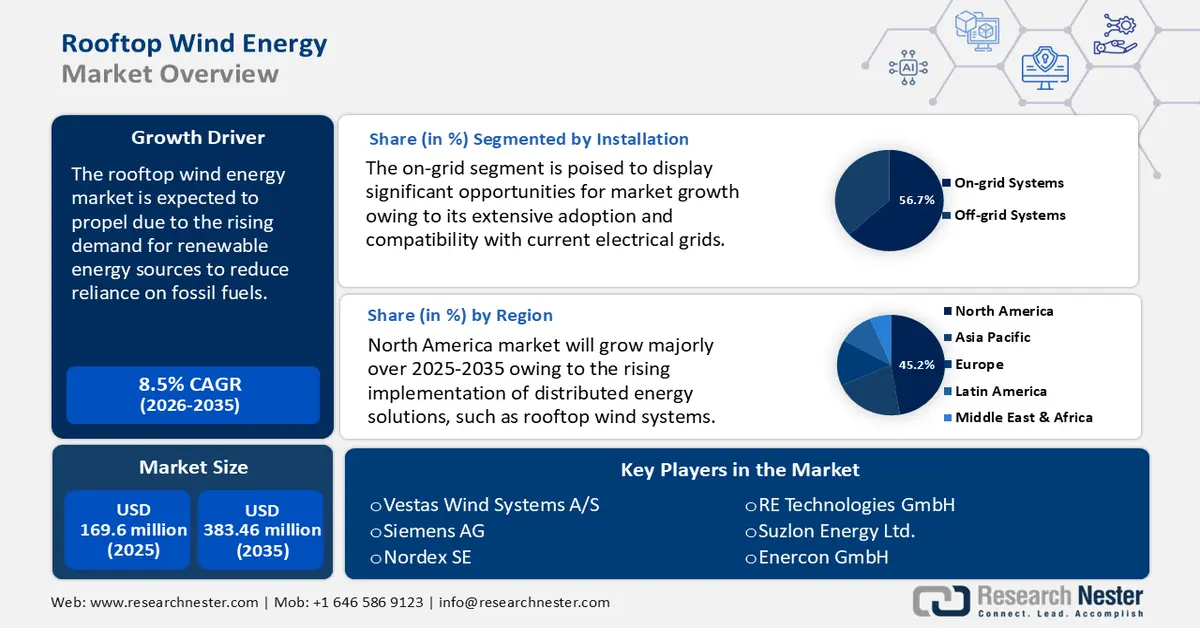

Rooftop Wind Energy Market size was over USD 169.6 million in 2025 and is anticipated to cross USD 383.46 million by 2035, witnessing more than 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rooftop wind energy is assessed at USD 182.57 million.

The global rooftop wind energy market is poised to boom due to the rising demand for environmentally responsible energy sources as consumers and firms actively seek to reduce their carbon footprint. The International Energy Agency (IEA) revealed that the percentage of renewable energy in the electrical sector is expected to increase from 30% in 2023 to 46% in 2030. Nearly all of this growth comes from solar and wind.

Adopting clean and sustainable energy sources is becoming highly important in a society where urgent environmental challenges such as climate change are causing concern. These requirements are well met by rooftop wind energy, which is distinguished by its renewable and environmentally benign qualities. Demand for rooftop wind systems has increased as a result of this increased environmental consciousness, offering people and businesses a practical way to contribute to the shift to cleaner energy.

The IEA reported that wind power generation experienced a record increase of 265 terawatt-hours (TWh), representing a growth of 14% in 2022, ultimately surpassing 2100 TWh. Following solar photovoltaic (PV) technology, wind power attained the second-highest growth among renewable energy sources. With approximately 2100 TWh generated in 2022—exceeding the combined output of all other renewable energy sources—wind power remains the predominant non-hydro renewable technology. In 2022, China was responsible for around 40% of the growth in wind generation, while the U.S. contributed 22%. Following significantly prolonged periods of low wind activity in 2021, wind generation in the European Union rebounded in 2022, increasing by 14%. To align with the Net Zero Scenario that projects wind power generation levels to reach approximately 7,400 TWh by 2030, it is essential to achieve an average annual growth of approximately 17% from 2023 to 2030.

Furthermore, the increased expansion of wind power generation is significantly driving the rooftop wind energy market, as decentralized and renewable energy solutions become essential for reducing carbon emissions. Governments and private organizations are heavily investing in distributed energy systems, including small-scale wind turbines for residential, commercial, and industrial rooftops, to supplement grid power and improve energy security.

Key Rooftop Wind Energy Market Insights Summary:

Regional Insights:

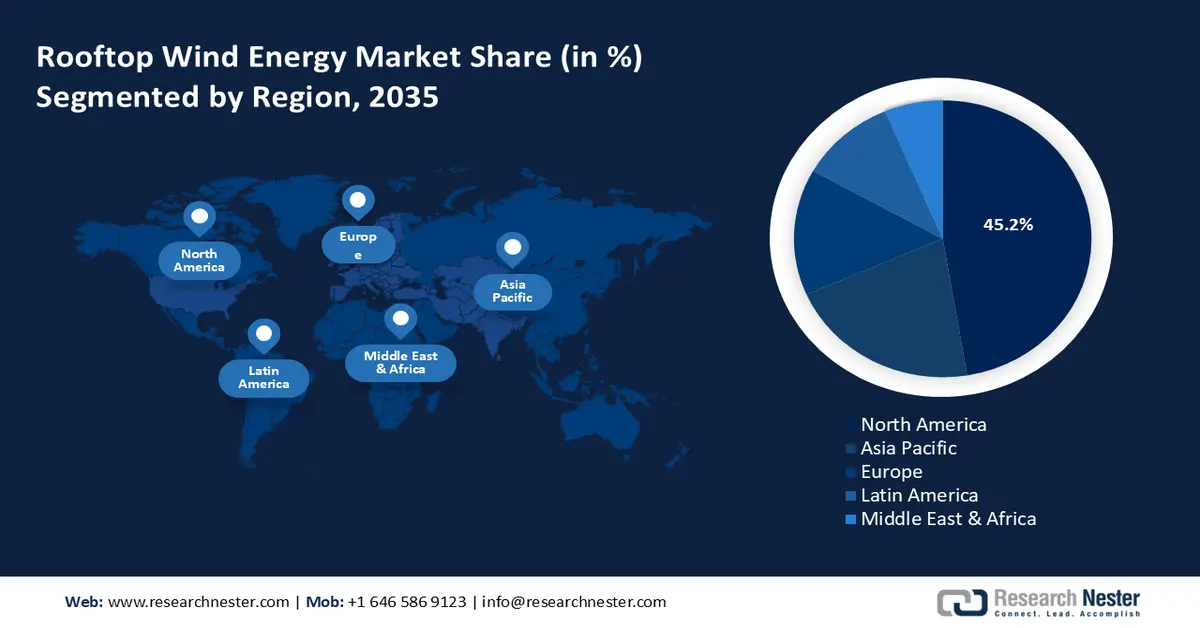

- By 2035, North America is projected to command roughly 45.2% share of the Rooftop Wind Energy Market, owing to strong governmental incentives promoting renewable adoption.

- Asia Pacific is anticipated to expand rapidly through 2026–2035 as rising urbanization and industrialization elevate the need for diversified energy sources.

Segment Insights:

- The On-grid segment is expected to secure around 56.7% share by 2035 in the Rooftop Wind Energy Market, propelled by its compatibility with existing electrical grids.

- The residential segment is poised to attain a notable share by 2035, underpinned by its suitability for urban and suburban deployment.

Key Growth Trends:

- Surging integration of hybrid renewable systems

- Energy cost savings amid rising electricity prices

Major Challenges:

- Unreliable wind supply

- Increase in material prices

Key Players: Vestas Wind System A/S, Siemens AG, Nordex SE, RE Technologies GmbH, Suzlon Energy Ltd., Enercon GmbH, Goldwind Science & Technology Co., Ltd., Bergey Windpower Co., Inc., XZERES Corp., ABB Group.

Global Rooftop Wind Energy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 169.6 million

- 2026 Market Size: USD 182.57 million

- Projected Market Size: USD 383.46 million by 2035

- Growth Forecasts: 8.5%

Key Regional Dynamics:

- Largest Region: North America (45.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, Australia, South Korea, United Arab Emirates

Last updated on : 3 December, 2025

Rooftop Wind Energy Market - Growth Drivers and Challenges

Growth Drivers

- Surging integration of hybrid renewable systems: The intermittency difficulties of both renewable resources can be addressed by the incorporation of hybrid energy systems that combine wind and rooftop solar. Compared to separate technologies, a hybrid solar-wind system contributes to steadier power generation throughout the day.

During the day, solar power generation can compensate for low wind levels, and vice versa. As a result of this complementarity, hybrid systems are better equipped to handle the fluctuating demands for electricity and are more dispatchable. According to IEA, in 2023, global power demand increased by 2.2%, which was smaller than the 2.4% growth recorded in 2022. While the demand for energy in China, India, and many Southeast Asian nations grew rapidly in 2023, advanced economies saw significant drops as a result of a weak macroeconomic climate and high inflation, which lowered industrial and manufacturing output.

For buildings seeking to use renewable self-generation, they offer the best option. By offsetting a larger portion of their electricity consumption, system owners can benefit from net metering laws. Hybrid systems are regarded by utilities as a dependable off-grid substitute that relieves grid limitations. Additionally, a broader spectrum of commercial and industrial adopters is drawn to their versatility and scalability. All things considered, hybrid energy has a great deal of promise to accelerate the rollout of decentralized renewable energy, which will encourage rooftop wind energy market expansion. - Energy cost savings amid rising electricity prices: The World Bank Organization released a report in 2023 disclosing that even if the 11% predicted drop in energy prices in 2023 comes to be, energy prices will still be 75% higher than their five-year average. These exorbitant rates have had detrimental effects on people, such as making food unaffordable owing to increased transportation expenses, triggering factory blackouts that resulted in the loss of necessary commodities, and prohibiting children from attending school due to a lack of electricity.

To address this, businesses and homeowners are increasingly shifting to small wind turbines for increasing energy efficiency. Cost reductions, however, are a major consideration in the decision-making process in addition to these environmental advantages. Particularly in remote or off-grid locations where electricity costs are high or the infrastructure is unstable, small wind turbines can result in noticeable drops in energy bills. This economic advantage, combined with government incentives and tax credits, is making small wind turbines an attractive investment, accelerating the expansion of the rooftop wind energy market.

Challenges

- Unreliable wind supply: Rooftop wind turbines may unpredictably produce energy due to variations in wind direction and speed. It is difficult to depend entirely on rooftop wind energy as a reliable and constant power supply because of this intermittency. Wind-driven variations in energy production can result in an unstable energy supply, which could interrupt the production and use of power. This unreliability can make rooftop wind energy systems more expensive overall in commercial and industrial settings by creating operating difficulties and necessitating the use of additional power sources or energy storage devices. Additionally, in residential settings, rooftop wind energy's sporadic nature may make it difficult to meet daily energy demands, eroding residents' trust in the technology.

- Increase in material prices: Costs associated with wind projects are significantly impacted by commodity inputs such as freight, steel, and copper. Concerns about the post-Covid supply chain have increased input costs, which have been made worse by laws aimed at promoting the development of renewable energy. Costs are still significantly higher than before COVID-19, even though supply chain and cost inflation issues have lessened in 2023.

Rooftop Wind Energy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 169.6 million |

|

Forecast Year Market Size (2035) |

USD 383.46 million |

|

Regional Scope |

|

Rooftop Wind Energy Market Segmentation:

Installation Segment Analysis

On-grid segment is set to capture rooftop wind energy market share of around 56.7% by the end of 2035. The segment’s growth is ascribed to its extensive adoption and compatibility with current electrical grids. By smoothly reintroducing surplus energy into the grid, these technologies enable consumers to get credits or incentives. On-grid systems are the preferred option for cities with established grid infrastructure due to their dependability and affordability. On-grid installations are also frequently encouraged by government policies and organization investments in grid infrastructure, which increases their popularity.

The International Renewable Energy Agency (IRENA) revealed that the leading utility companies declared their combined intention to invest about USD 116 billion annually in clean power generation and power system grid infrastructure worldwide over the next several years. As the world approaches the halfway point of a critical decade of decarbonization, partners in the Utilities for Net Zero Alliance (UNEZA), which was launched at COP28 and is led by the International Renewable Energy Agency (IRENA) and the UN Climate Change High-level Champions, are intensifying efforts to accelerate the electrification agenda and power system transformation. Lastly, on-grid systems are a dominant force in the industry since they provide the ease of maintaining grid connectivity while generating sustainable energy.

End use Segment Analysis

The residential segment in rooftop wind energy market is poised to garner a significant share by 2035. Since rooftop wind energy is suitable for urban and suburban environments, the residential segment of the rooftop wind energy industry is experiencing tremendous expansion. A wide range of homeowners can install rooftop wind turbines as they don't require much space and can be mounted on existing homes.

Adoption has been further boosted by the growing interest in renewable energy among homeowners who care about the environment, as well as by government subsidies and net metering initiatives. Residential installations are also motivated by the goal of cost savings and energy independence, which supports the segment's significant market expansion.

Our in-depth analysis of the global rooftop wind energy market includes the following segments:

|

Technology |

|

|

Capacity |

|

|

Installation |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rooftop Wind Energy Market - Regional Analysis

North American Market Insights

North America rooftop wind energy market is poised to capture revenue share of around 45.2% by the end of 2035. North America holds a significant share of the rooftop wind energy market, attributable to various contributing factors. The region has experienced considerable government backing through incentives and policies that promote the adoption of renewable energy sources. Elevated energy demand, particularly in urban centers, has driven the implementation of distributed energy solutions, such as rooftop wind systems. Additionally, technological advancements, a robust renewable energy infrastructure, and an increasing commitment to sustainability have further enhanced rooftop wind energy market growth. The presence of a well-established construction sector and a favorable regulatory environment have also facilitated the installation of rooftop wind turbines, positioning North America as a key player in this rooftop wind energy market.

In the U.S., businesses and homeowners are seeking decentralized power sources to reduce reliance on the grid, especially in areas with frequent power outages. Advances in small-scale wind turbine technology have made them more efficient, quieter, and suitable for urban and suburban environments. According to the U.S. Department of Energy, in comparison to prior years, the capacity, number of turbines, and investment amounts added for small wind placed in the United States grew in 2023. The installation of 1,994 small wind turbines in 2023 cost USD 15.2 million. In the preceding two years, 1,745 turbines were installed in 2022, involving an investment of USD 14.6 million, and 1,742 turbines were installed in 2021, including an investment of USD 9.2 million.

Investments in the distributed wind sector is driving the growth of the rooftop wind energy market by funding advancements in small-scale wind turbine technology, improving efficiency, and reducing costs. Additionally, with more than USD 303 million in investment for underutilized technologies and technical support through USDA's Rural Energy for America Program (REAP), the distributed wind sector has a chance to develop and flourish. Also, to help farmers reduce expenses and boost income through REAP-supported dispersed wind projects, DOE and USDA announced the Rural and Agricultural Income and Savings from Renewable Energy (RAISE) Initiative in 2024.

In Canada, with many remote and off-grid communities relying on expensive diesel, rooftop wind energy offers a cost-effective and eco-friendly alternative. Urban areas are also exploring rooftop wind energy to complement solar power and enhance energy resilience. Also, government investments, net metering programs, and corporate sustainability commitments are further driving adoption. In September 2023, in addition to providing clean, affordable energy to communities, Canada's Minister of Energy and Natural Resources announced more than USD 175 million in federal funding for 12 sustainable energy projects in Alberta that would support local economic growth and generate thousands of jobs.

APAC Market Insights

Asia Pacific rooftop wind energy market is expected to grow at a significant rate during the projected period. Rapid urbanization and industrialization in the region have increased energy demand, leading to increasing emphasis on a variety of energy sources, such as rooftop wind. Government programs in nations such as China, India, and Japan have encouraged the use of renewable energy, which has led to rooftop wind energy market expansion. Rooftop wind energy is a feasible option due to the region's advantageous wind conditions, especially along the coast. Additionally, the growing awareness of environmental sustainability and the need to reduce greenhouse gas emissions further drive the adoption of rooftop wind solutions, solidifying Asia Pacific's significant rooftop wind energy market presence.

China is growing due to the country’s push for clean energy, rising urban electricity consumption, and the need for decentralized power solutions. With 159 GW of wind and 180 GW of utility-scale solar power now under construction, China is solidifying its position as the world leader in the development of renewable energy. The Global Energy Monitor highlighted that although data from the China Electricity Council estimated that the overall capacity, including distributed solar, was 1,120 GW, China's utility-scale solar and wind capacity reached 758 GW by the first quarter of 2024. Currently, wind and solar power make up 37% of the nation's total power capacity, up 8% from 2022. It is anticipated that by 2024, they will overtake coal power, which currently makes up 39% of the total.

Furthermore, by providing several incentives, including Generation Based Incentives (GBI), capital and interest subsidies, viability gap funding, concessional financing, fiscal incentives, and more, the Government of India is encouraging the use of rooftop wind energy. The Ministry of New and Renewable Energy indicated that more than 900 wind-monitoring stations have been placed nationwide by the government through the National Institute of Wind Energy (NIWE), and wind potential maps at elevations of 50, 80, 100, 120, and 150 meters have been released. A gross wind power potential of 695.50 GW at 120 meters and 1163.9 GW at 150 meters above ground level is indicated by the most recent assessment.

Also, as a result of a large number of tall buildings in crowded metropolitan regions, rooftop wind turbines have the potential a way to generate energy remotely without requiring a lot of land. Furthermore, by enabling each consumer category to produce electricity, rooftop wind turbines help to promote energy self-sufficiency and lessen reliance on conventional energy sources.

Rooftop Wind Energy Market Players:

- Vestas Wind Systems A/S

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Nordex SE

- RE Technologies GmbH

- Suzlon Energy Ltd.

- Enercon GmbH

- Goldwind Science & Technology Co., Ltd.

- Bergey Windpower Co., Inc.

- XZERES Corp.

- ABB Group

The rooftop wind energy market is witnessing fierce rivalry and shifting market dynamics due to the presence of numerous firms, both big and small. Businesses are striving to strengthen their competitive edge, whether they are big international corporations or regional providers. The rooftop wind energy market is dominated by multinational corporations and major organizations in terms of market share. In contrast, small companies are constantly enhancing their offerings to meet the needs of particular rooftop wind energy markets or providing specialized services. These industry participants are concentrating on implementing competitive strategies, such as creating novel methods of establishing partnerships and strategic alliances to broaden their portfolios and global reach, investing in new features, and recent advancements to improve their offerings.

Recent Developments

- In September 2024, RE Technologies | Senvion India unveiled its ground-breaking 4.2M160 wind turbine generator, signifying a significant technological development in harnessing the potential of wind energy. The 4.2M160, designed and developed in-house by R&D teams in India and Germany and manufactured locally, is intended to maximize energy output using advanced control technologies and adaptive systems that adjust to environmental changes for best performance.

- In 2022, Nordex's acquisition of Acciona Windpower for a substantial USD 5.58 billion reshaped the wind energy sector. This strategic move led to the creation of the world's largest wind turbine manufacturer, marking a significant milestone in the industry's evolution.

- Report ID: 7253

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rooftop Wind Energy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.