Rooftop Solar EPC Market Outlook:

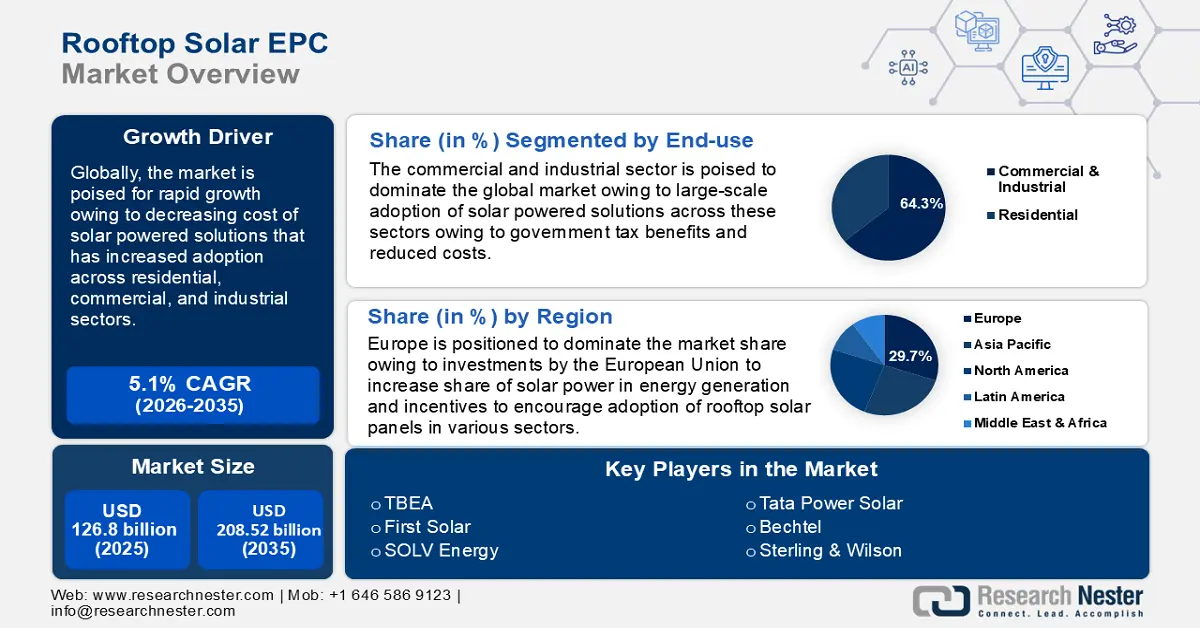

Rooftop Solar EPC Market size was over USD 126.8 billion in 2025 and is projected to reach USD 208.52 billion by 2035, witnessing around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rooftop solar EPC is evaluated at USD 132.62 billion.

The profitable growth curve of the global rooftop solar EPC market is attributed to rising focus on decentralized energy generation and growing demands for renewable energy solutions. The advancements in solar technology have made rooftop solar installations convenient and cost-effective, increasing adoptions across residential, commercial, and industrial sectors. The International Energy Agency (IEA) estimated the number of households relying on solar PV to grow from 25 million in 2022 to more than 100 million by 2030 in the Net Zero Emissions by 2050 scenario.

A major growth driver of the sector is the declining costs of photovoltaic (PV) panels that have led to greater accessibility of rooftop solar systems increasing demands for rooftop solar engineering, procurement, and construction (EPC). For instance, in June 2024, Our World in Data estimated solar PV costs to have reduced by 90% in the last decade. The global push for sustainable energy solutions benefits the robust growth of the rooftop solar EPC market as tax incentives and subsidies encourage market players to invest more in providing end-to-end solar energy services. Residential, commercial, and industrial end-users demand quality solar power solutions with minimal risk and quality assurance that boosts demand for solar EPC services. Additionally, a large-scale increase in solar PV manufacturing is poised to maintain a favorable growth curve of the sector in the future.

Regions such as Europe and Asia Pacific have abundant solar resources and growing demands for electricity positions the rooftop solar EPC market to benefit by leveraging sustainable energy solutions. Emerging economies globally are witnessing a sustained effort to harness solar power for energy solutions. For instance, in October 2024, a rooftop solar power plant was inaugurated at the Geological Survey of India Training Institute, Hyderabad marking a continued push to leverage renewable energy. Additionally, companies operating in the rooftop solar EPC sector can benefit from the growing scrutiny of corporate sustainability commitments, by offering end-to-end rooftop solar solutions to help businesses reduce carbon footprints. The global rooftop solar EPC market’s future will be shaped by continued technological advancements in energy storage systems and solar power equipment that can open new opportunities for energy security and grid independence.

Key Rooftop Solar EPC Market Insights Summary:

Regional Highlights:

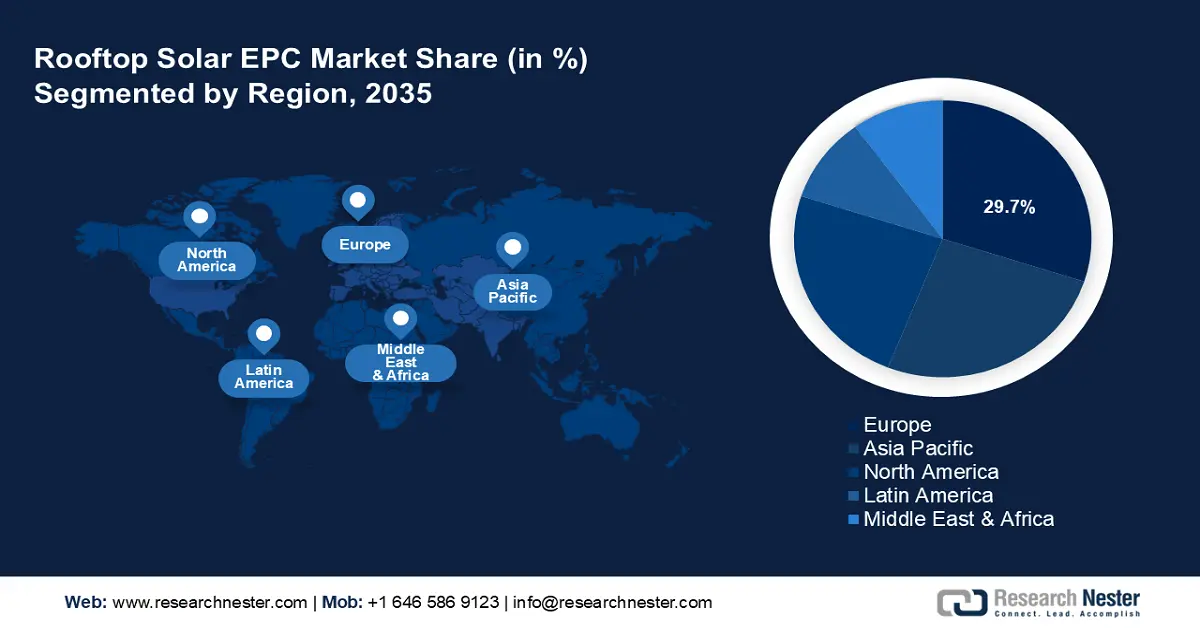

- Europe rooftop solar EPC market will account for 29.70% share by 2035, attributed to the decreasing cost of solar energy and EU-backed solar initiatives.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, driven by high solar insolation, equipment production, and favorable costs.

Segment Insights:

- Commercial & industrial segment in the rooftop solar epc market is forecasted to achieve 64.30% growth by the forecast year 2035, driven by government incentives and large-scale electricity use in industrial settings.

- The 10 to 50 kw capacity segment in the rooftop solar epc market is projected to increase its revenue share substantially by 2035, driven by its suitability for SMEs and large homes, supported by declining solar costs.

Key Growth Trends:

- Increasing government subsidies and investments

- Growth in manufacturing and declining costs of solar PV

Major Challenges:

- Geographical concentration of global supply chains

- Space constraints in urban areas

Key Players: TBEA, First Solar, Tata Power Solar, Sterling & Wilson, SOLV Energy, Bechtel, CDS Solar, Enel Green Power, Scatec, Lightsource BP, Ecotricity, Adani Solar.

Global Rooftop Solar EPC Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 126.8 billion

- 2026 Market Size: USD 132.62 billion

- Projected Market Size: USD 208.52 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (29.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, Japan

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Rooftop Solar EPC Market Growth Drivers and Challenges:

Growth Drivers

- Increasing government subsidies and investments: Globally, there is a sustained effort to reach net zero carbon emissions by 2050. The green energy sector is witnessing a profitable growth curve and solar energy is the most widely adopted renewable energy. Governments across the world have identified the potential of solar-powered energy solutions and have provided subsidies and incentives to help boost the rooftop solar EPC market’s growth. For instance, in November 2022, the government of Switzerland announced subsidies worth USD 636.3 million to support solar power extension across the country. Subsidies, tax breaks, and net metering policies boost the adoption of rooftop solar panels and provide opportunities for rooftop solar EPC end-to-end solutions.

Additionally, government-sponsored incentives to help the private sector in large-scale solar power solutions assist the growth of the rooftop solar EPC market. For instance, the World Economic Forum (WEF) reported U.S. incentivized private sectors investments through nearly USD 400 billion in federal funding in the form of tax credits via the US Inflation Reduction ACT (IRA). - Growth in manufacturing and declining costs of solar PV: The declining costs of solar PV have led to large-scale adoption as accessibility improves. The steep decline in costs is attributed to the rapid increase in manufacturing. Our World in Data estimated that global solar technology costs fell by almost 20% whenever the global cumulative capacity doubled. Currently, solar power is one of the cheapest energy solutions in many countries, and it is positioned to bolster the revenue growth of the rooftop solar EPC market.

Additionally, solar equipment production has increased drastically with China dominating global production. For instance, the IEA reported that solar PV exports from China were over USD 30 billion in 2021, accounting for almost 7% of the country’s trade surplus. Increased production also ensures supply chain optimization, ensuring a global cost decrease. These trends are positioned to drive the sector by the end of the forecast period. - Cost-effective solution to rising energy costs: Energy demands and costs have risen owing to heat waves suffered by numerous countries in the first half of 2024. For instance, in July 2024, the U.S. Energy Information Administration (EIA) released a report that the summer heat wave led to a 19% increase in electricity demand in the PJM region compared to the previous year. The rooftop solar EPC market is positioned to address the pain point of rising energy costs by providing cost-efficient solar-powered energy solutions that can reduce grid dependency. Solar energy is now the cheapest power source in many countries and offers a cost-effective alternative to traditional power grids. The price reduction trends in solar equipment correlate with the corporate push for sustainability measures, which is poised to increase the adoption of rooftop solar EPC services. For instance, in February 2021, the National Renewable Energy Laboratory estimated a steep decline in costs accounting for 64%, 69%, and 82% reduction in the cost of cost of residential, commercial-rooftop, and utility-scale PV systems, respectively between 2011 and 2021.

Challenges

- Geographical concentration of global supply chains: The geographical concentration of global supply chains can prove to be a challenge for governments. China accounts for the largest production and export of PV panels and any disruption of the supply chain can cause global disruptions. For instance, in September 2024, the U.S. imposed 50% tariffs on solar cells from China. This can lead to increased costs and delays in solar projects. To mitigate this issue stymying the rooftop solar EPC market’s growth, there is a need for diversification of manufacturing sources globally.

- Space constraints in urban areas: Lack of space in urban housing can cause issues in solar panel installation. High-rise buildings, congested layouts, and small roof surfaces challenge the scope of large-scale solar installations. This can pose challenges for the rooftop solar EPC sector. Additionally, older buildings in urban spaces may require structural reinforcements before the installation of solar panels installation which can drive costs of installation.

Market players providing rooftop solar EPC services require share-free roof areas for efficient installations and lack of it can prove to be a deterrent. Advancements in community solar projects are poised to answer the challenge and maintain the growth of the rooftop solar EPC market.

Rooftop Solar EPC Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 126.8 billion |

|

Forecast Year Market Size (2035) |

USD 208.52 billion |

|

Regional Scope |

|

Rooftop Solar EPC Market Segmentation:

End use Segment Analysis

Commercial and industrial segment is predicted to dominate rooftop solar EPC market share of around 64.3% by the end of 2035, owing to the increasing adoption of solar PV in commercial and industrial enterprises. Governments across the world are providing incentives for commercial and industrial spaces to integrate solar energy solutions as these sectors are some of the largest consumers of electricity as end users. This provides lucrative opportunities to companies that provide rooftop solar EPC services as commercial and industrial spaces seek to leverage solar power solutions. For instance, in January 2023, the Government of Japan was providing rate incentives to push larger adoption of industrial rooftop solar by offering higher prices for solar power produced on the rooftops of corporate buildings beginning from fiscal year 2024. Additionally, the segment is advantageous for the rooftop solar EPC market owing to the large roof space available in factories and industrial buildings for solar PV mounting systems.

The residential segment is poised to increase its revenue share during the forecast period due to increasing adoptions of solar energy solutions in the residential sector. The segment’s rapid growth is attributed to the decreasing price of solar power solutions. For instance, global solar module prices reduced by 30% to 40% by the end of 2023 owing to supply and demand imbalance in China. This allows large-scale adoption of solar-powered solutions in residential spaces boosting the segment’s growth. Additionally, government initiatives and benefits incentivize residential property owners to leverage rooftop solar PV solutions. For instance, in September 2020, the Department for Business, Energy, and Industrial Strategy (BEIS) announced the Green Homes Grant (GHG) that will fund up to two-thirds of the cost of improvements in installing energy-efficient improvements to residential properties.

Capacity Segment Analysis

The 10 to 50 kW segment by capacity of the global rooftop solar EPC market is projected to increase its revenue share substantially by the end of the forecast period. The segment caters to large residential properties and small and medium-sized businesses. The adoption rate of this capacity range is higher in small-scale operations requiring significant energy output but does not have the large-scale infrastructure of industrial applications. The declining costs of solar-powered solutions are a major growth driver of the large-scale adoption of this segment. For instance, in June 2022, Aptech Africa Limited announced that a 50 kW solar energy generation system will be installed and deployed at Njala University, Sierra Leone.

Our in-depth analysis of the global rooftop solar EPC market includes the following segments:

|

End use |

|

|

Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rooftop Solar EPC Market Regional Analysis:

Europe Market Insights

Europe industry is expected to dominate majority revenue share of 29.7% by 2035. The market’s profitable growth curve is attributed to solar energy becoming the fastest-growing energy source in the region and a conscious push by the countries in the region to reduce dependency on fossil fuels. The decreasing costs of solar energy also increase adoption across various sectors in the region, opening profitable opportunities for market players to provide end-to-end EPC solutions. For instance, the European Union reported the cost of solar energy to have decreased by 82% between 2010 and 2020. The decreasing costs along with the increasing capacity of solar energy production benefit the rooftop solar EPC market’s growth. For instance, the European Union (EU) estimated overall solar generation capacity to have increased by 58.4% from 2021 to 2023.

Germany is a leading market in the region owing to the government's push to reduce dependency on fossil fuels and benefits from the European Union’s programs to push greater adoption of solar energy. For instance, in March 2023, a World Economic Forum (WEF) reported the benefits of the feed-in tariff (FIT) scheme in Germany, where households that produce renewable energy can sell excess to the national grid and pay renewable energy producers a set rate per kilowatt-hour for excess electricity, they sell to the grid. Incentivizing the citizens on the use of solar-powered solutions benefits the adoption of solar PVs.

Additionally, Germany offers homeowners tax incentives for energy-efficient renovations where households can claim 20% of renovation costs of around USD 44 thousand if they replace inefficient systems with renewable alternatives. These measures coupled with public perception shifting towards sustainable solutions have hastened the adoption of solar PVs. For instance, in June 2024, Reuters reported Germany had increased solar installations by 35% in the first four months of 2024 owing to increased adoption in industrial spaces. The rooftop solar EPC market in Germany is poised to increase its market share by the end of 2035 by leveraging the favorable regulatory conditions in the country.

France has a significant share in the Europe rooftop solar EPC market and is projected to increase its profit share by the end of 2035. The market in France benefits from a favorable regulatory ecosystem that provides incentives and tax breaks for the adoption of solar-powered solutions. Additionally, France benefits from the EU’s policies supporting an increase in solar energy generation in the region. For instance, in May 2022, the European Commission adopted the EU solar energy strategy as a part of the broader REPowerEU plan, which will identify challenges in the solar energy industry and actively prepare solutions to overcome the barriers and accelerate the deployment of solar technologies in the region.

The backing by the European Union in the adoption of green solutions will benefit the robust growth of the rooftop solar EPC market in France as an increasing sustainability-concerned public is poised to adopt solar-powered solutions. In February 2024, a new tax credit covering investment expenditure in wind turbines, heat pumps, and solar panels was announced where subject to the French Ministry of the Budget, the tax credit for green energy investments can amount to around USD 382.6 billion. These trends are projected to provide increased opportunities for market players offering end-to-end solar EPC solutions in the country.

APAC Market Insights

Asia Pacific rooftop solar EPC market is poised to register the fastest growth by the end of the forecast period. The market’s robust growth curve is attributed to large-scale production of solar equipment in China, India, and Japan. China accounts for a majority share of the global distribution chain in the global solar power market. In 2024, Ember estimated solar power generation to increase in Asia Pacific. Additionally, South Asia benefits from high solar insolation and a high density of potential customers increasingly exploring renewable power solutions. The reduced costs of solar power solutions allow countries in Asia to invest in providing remote microgrid solutions to rural communities and bridge the communications divide by making electricity accessible to all. The trends ensure that APAC provides profitable opportunities in the rooftop solar EPC market.

China dominates the solar energy market globally since the country accounts for the highest production of solar equipment in the world. The country has played a key role in reducing the costs of solar power globally. For instance, IEA reported China to have more than 80% share in all manufacturing stages of solar panels and the production exceeds global demand, causing a surplus and pushing prices down. Additionally, China has actively invested in the domestic rooftop solar EPC market boosting the rooftop solar EPC sector’s growth. For instance, IEA reports USD 50 billion was invested in new solar supply capacity from 2011 to 2022 by the government and domestically China is installing twice as much solar power compared to other countries. The domestic providers of end-to-end EPC solutions for industrial, residential, and commercial sectors in the country are poised to leverage benefits from the global leadership of China in the solar power sector.

India is projected to increase its market share in APAC and the global rooftop solar EPC market. The market’s growth is attributed to the country’s position as third globally in solar-powered electricity generation as per a report by Ember. Additionally, tariffs set on China by the U.S. benefit India as the country can fill the supply gap. For instance, in February 2024, the government reported solar panels worth USD 1.3 billion exported from India in 2022-23. The massive exports coincide with a burgeoning domestic market that is seeing greater adoption of solar-powered solutions across various sectors, increasing rooftop solar EPC market opportunities for companies providing EPC solutions. Government incentives and tax breaks for the adoption of solar-powered solutions are set to increase adoption rates within the country. For instance, in February 2024, PM Surya Ghar Muft Bijli Yojana was launched which will provide subsidies of up to 40% of the cost of installing solar panels on roofs.

Rooftop Solar EPC Market Players:

- TBEA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- First Solar

- Tata Power Solar

- Sterling & Wilson

- SOLV Energy

- Bechtel

- CDS Solar

- Enel Green Power

- Scatec

- Lightsource BP

- Ecotricity

- Adani Solar

The global rooftop solar EPC market is poised to register profitable growth during the forecast period. The market has global and local players vying to provide efficient end-to-end EPC solutions and increase their profit share. Key market players are investing in expanding their portfolios, and acquisitions, and providing greater convenience to end-users to boost the market’s growth.

Here are some key players in the market:

Recent Developments

- In September 2024, EPC Power announced the launch of modular utility solar plus storage inverter, i.e., M System. The platform is designed to optimize solar plant design and energy storage.

- In June 2022, the World Bank announced USD 165 million support for renewable energy sector in India. The move will finance the residential sector of India to adopt rooftop solar systems and make solar energy more affordable.

- Report ID: 6575

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rooftop Solar EPC Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.