Robotics Technology Market Outlook:

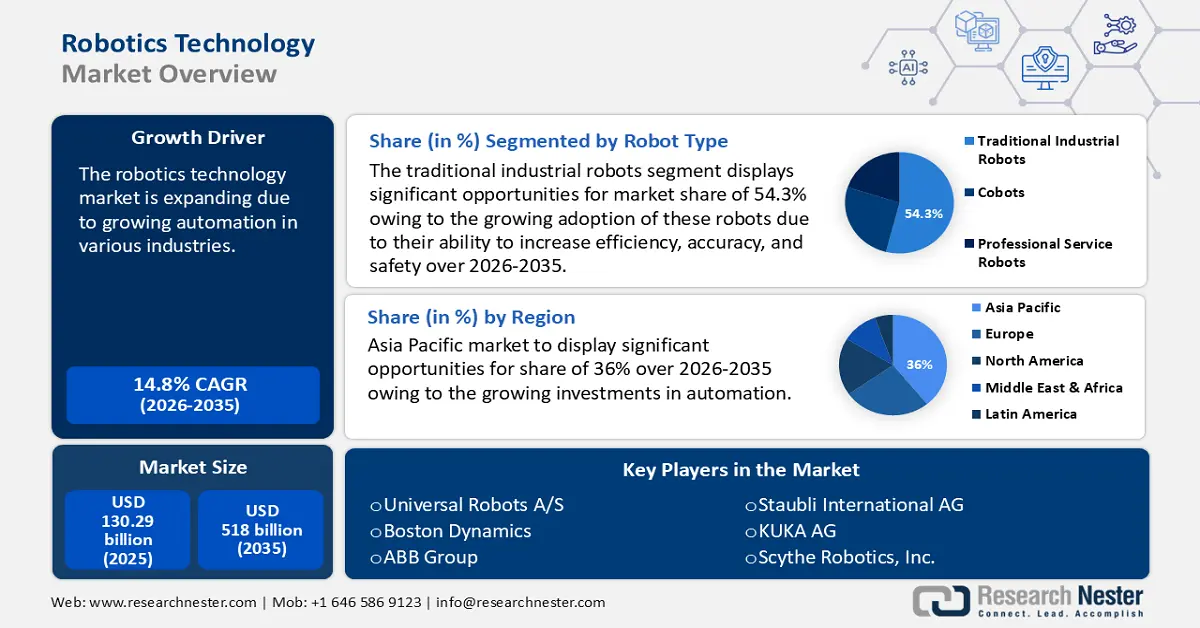

Robotics Technology Market size was over USD 130.29 billion in 2025 and is projected to reach USD 518 billion by 2035, growing at around 14.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of robotics technology is evaluated at USD 147.64 billion.

The robotics technology market expansion is attributed to the rising adoption of automation across various industries. Companies across different sectors increasingly seek automation to relieve employees of monotonous tasks. By delegating these tasks to software, businesses can enhance customer satisfaction, reduce error rates, ensure compliance, and alleviate team stress. According to a 2020 report by the World Economic Forum, over 50% of employers anticipate accelerating the automation of some tasks in their organizations, and over 80% of company executives are speeding up plans to implement new technology and digitize work processes.

Advancements in artificial intelligence (AI), machine learning (MI), and sensors are driving the development and deployment of more sophisticated robotics systems. Moreover, businesses are increasingly investing in robotics to automate tasks that were formerly performed by humans. This shift helps companies reduce operational costs, increase efficiency, and maintain competitiveness. Also robotics can address labor shortages and perform tasks that are unsafe or unfavorable for human workers, further accelerating their adoption.

Key Robotics Technology Market Insights Summary:

Regional Highlights:

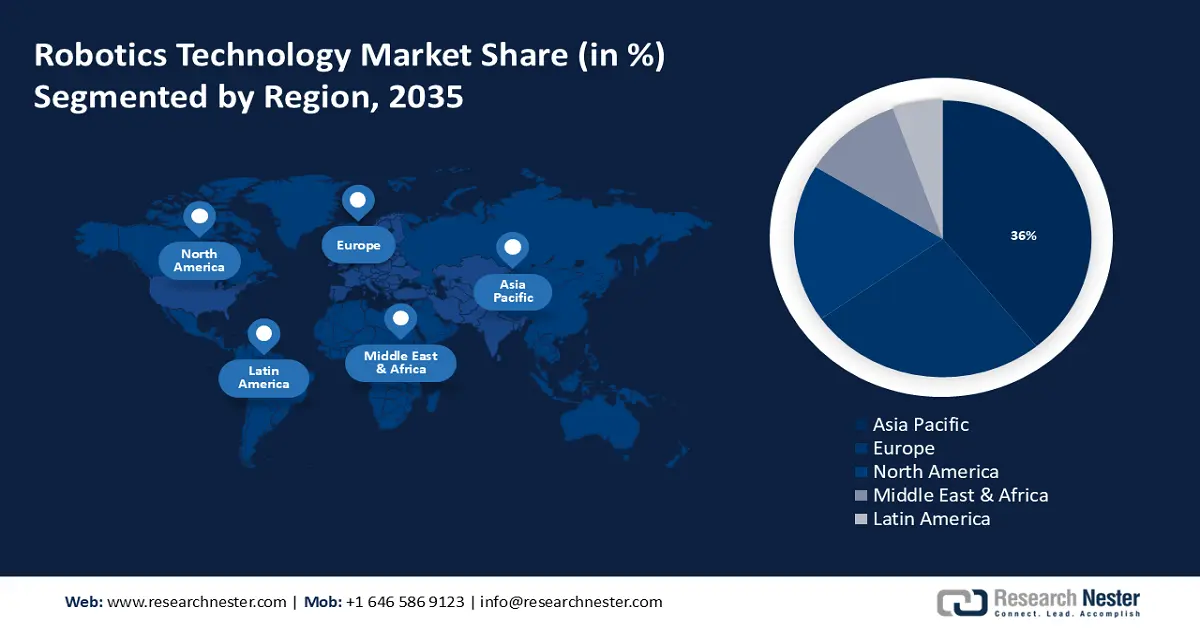

- The Asia Pacific robotics technology market achieves a 36% share by 2035, driven by the growing investments in automation of various industries to improve productivity and efficacy in manufacturing plants.

- The Europe market will register significant growth during the forecast timeline, driven by the rising demand for educational, industrial, interactive, and service robots and the introduction of 5G technology.

Segment Insights:

- The traditional industrial robots segment in the robotics technology market is projected to capture a 54.30% share by 2035, driven by the growing adoption of traditional industrial robots for enhanced efficiency and safety.

Key Growth Trends:

- Increasing demand for service robots

- Growing integration of AI & ML

Major Challenges:

- Higher implementation cost

- Versatility and adaptability issues

Key Players: Universal Robots A/S, Boston Dynamics, Northrop Grumman Corporation, ABB Group, Staubli International AG, KUKA AG, Scythe Robotics, Inc., Anduril Industries, iRobot Corporation, Rethink Robotics.

Global Robotics Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 130.29 billion

- 2026 Market Size: USD 147.64 billion

- Projected Market Size: USD 518 billion by 2035

- Growth Forecasts: 14.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Robotics Technology Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for service robots: The need for service robots is growing highly, driven by fastidious consumers who require precision and accuracy in tasks such as healthcare, logistics, and manufacturing. According to the International Federation of Robotics, in 2022, there were 158,000 service robots sold worldwide for professional use, a 48% increase. Additionally, advanced service robots are equipped with powerful sensors, light detection and ranging (LiDAR) cameras, depth sensors, and tactile sensors, that help them maneuver intricate spaces, recognize objects and people, and interact with the physical world with extreme precision.

- Growing integration of AI & ML: The integration of AI and ML in robotics has optimized operational efficiency, boosting the growth of the robotics technology market. Artificial intelligence has been an invaluable asset to robotics, increasing automation, accuracy, and flexibility. Additionally, AI can help to develop more effective computer systems and enhance customer service by employing intelligent virtual assistants. Also, machine learning techniques such as deep learning, reinforcement learning, and neural networks are being used to boost robot perception, decision-making, and control.

- Augment of humanoid robots: Humanoid robots designed to perform multiple duties in diverse scenarios are witnessing tremendous advancements. With its two arms and two legs, the robot looks like a human, making it suitable for various tasks in work environments. Additionally, major key players have increased the pace of development of these robots due to their heightened demand. For instance, in July 2024, NVIDIA announced a suite of services, models, and computing platforms to the top robot manufacturers, AI model developers, and software developers in the world to assist them developing, training, and building the next generation of humanoid robotics to accelerate the pace of progress in humanoid development globally.

Challenges

- Higher implementation cost: Robotics deployment is expensive and poses a risk of investment. While most companies will eventually recover their investment over time, the short-term costs are high. Therefore, high implementation costs may impede the growth of the robotics technology market.

- Versatility and adaptability issues: Adaptability is a major barrier in the field of robots as robots are typically engineered to execute precise, specific tasks. While this narrow focus is advantageous in certain contexts, it presents challenges when these robots need to adapt to new or evolving environments without extensive reprogramming or reconfiguration. Consider the demands of an industry that necessitates adaptability and frequent changes in production processes. In such cases, the inflexibility of robots can pose a significant hindrance in the robotics technology market expansion.

Robotics Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.8% |

|

Base Year Market Size (2025) |

USD 130.29 billion |

|

Forecast Year Market Size (2035) |

USD 518 billion |

|

Regional Scope |

|

Robotics Technology Market Segmentation:

Robot Type Segment Analysis

The traditional industrial robots segment is poised to capture 54.3% robotics technology market share by 2035. The segment growth can be attributed to the growing adoption of traditional industrial robots due to their ability to increase efficiency, accuracy, and safety. According to the European Commission report in 2022, the number of new industrial robots installed in companies worldwide reached an all-time high of 517,385 in 2021, up 31% from the previous year. The use of various forms of production control techniques, as well as automation solutions, is an important component of contemporary production improvement strategies. Furthermore, as industrial robots gain popularity, they are finding applications in a wide range of industries, including manufacturing and healthcare.

Application Segment Analysis

The healthcare segment in the robotics technology market is set to garner a notable share in the forecast period. The increasing use of robots to aid surgeons in performing minimally invasive procedures is driving market expansion. Robotic surgical systems like the da Vinci system enable surgeons to perform delicate procedures with improved accuracy and reduced patient recovery times. According to the National Institutes of Health, over the last three years, there has been a 400% increase in the number of civilian hospitals running five or more da Vinci systems on a single site. Furthermore, by helping with sample processing and sorting, robotics in healthcare helps automate laboratory procedures, leading to improved efficiency and reduced errors. Similarly, telemedicine robots improve accessibility to healthcare services by enabling remote patient monitoring and consultation.

Our in-depth analysis of the robotics technology market includes the following segments:

|

Component |

|

|

Robot Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Robotics Technology Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to dominate majority revenue share of 36% by 2035. The market growth in the region can be accredited to the growing investments in automation of various industries to improve productivity and efficacy in manufacturing plants and factories. According to the International Monetary Fund, Asia leads the globe in automation, accounting for 65% of industrial robot usage globally in 2017. Furthermore, various approaches are being adopted by market players, which is contributing to the expansion of the robotics technology market in Asia-Pacific.

In China, the adoption of manufacturing robots has been given top priority by the government, which is supporting it with substantial subsidies. According to the Organization for Research on China and Asia, Dongguan (a city in China) has launched 4,653 machine-for-human projects since 2014, attracting investments totaling 8.2 billion USD by 2023. Additionally, the city's annual fund of USD 28.07 million is dedicated to supporting industrial automation, with manufacturing firms eligible for a reimbursement of 10-15 percent of their expenses for new equipment.

The growing utilization of robots in the automotive sector in India is stimulating the robotics technology market. According to the International Federation of Robotics, in the automotive sector, India's robot density-defined as the number of industrial robots per 10,000 workers-reached 148 in 2021.

The integration of AI, cloud technology, and advanced manufacturing processes is propelling the growth of the robotics technology market in South Korea. This innovation is driving the modernization of manufacturing practices, making them more productive and raising the standards of intelligent production.

Europe Market Insights

The robotics technology market in Europe is expected to experience significant growth. This is due to the rising demand for educational, industrial, interactive, and service robots during the forecast period. Also, the introduction of 5G technology is expected to transform the robotics sector by enabling quicker and more reliable communication. For instance, 5G is used by 10% of all mobile connections in Europe. This will allow for real-time data sharing, boosting robot capabilities, particularly in applications that need low latency.

The UK government is increasingly investing in robotics and AI to maintain its position as a world leader and foster economic expansion. For instance, in 2023 the UK government announced that USD 13.95 million in government financing was distributed to nineteen innovative initiatives advancing automation and robotic technologies to increase productivity, food security, and sustainable farming methods.

Collaborative robots, or co-bots, have experienced an upsurge in demand in Germany's robotics technology market. These robots are made to collaborate with people, enhancing productivity and security in production procedures. The creation of AI-powered robots, which have machine learning skills to adjust and enhance their performance over time, is another trend accelerating the market growth.

Robotics Technology Market Players:

- Universal Robots A/S

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boston Dynamics

- Northrop Grumman Corporation

- ABB Group

- Staubli International AG

- KUKA AG

- Scythe Robotics, Inc.

- Anduril Industries

- iRobot Corporation

- Rethink Robotics

Prominent players in the industry are actively pursuing diverse tactics, such as collaborations and procurements, to augment their range of products and develop enduring competitive benefits.

Recent Developments

- In February 2022, Northrop Grumman Corporation's SpaceLogistics announced a launch agreement for its Mission Robotic Vehicle (MRV) spacecraft and the sale of its first Mission Extension Pod (MEP). The launch will be the first time a robotic-capable spacecraft will enter space to enable continuous robotic servicing capabilities in geostationary orbit (GEO).

- In March 2021, Boston Dynamics, a global pioneer in mobile robotics, unveiled Stretch, a new box-moving robot designed to meet the growing demand for flexible automation solutions in the logistics industry. This marks the company's official entry into the warehouse automation business, which is rapidly expanding due to increased e-commerce demand.

- Report ID: 6366

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Robotics Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.