Robot Preventive Maintenance Market Outlook:

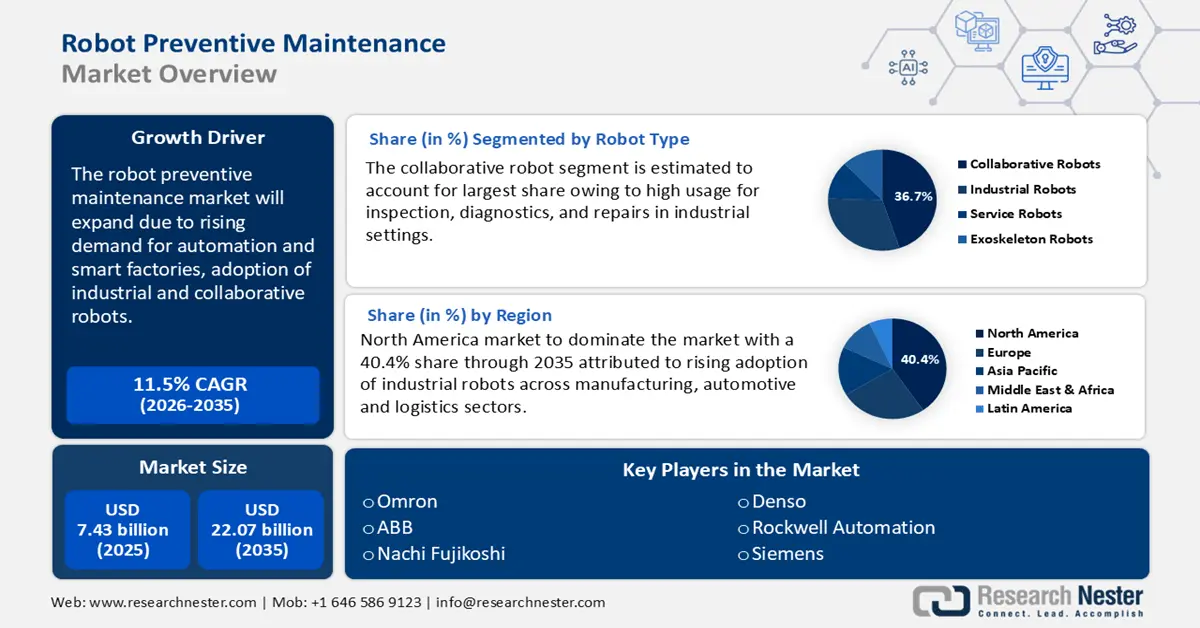

Robot Preventive Maintenance Market size was valued at USD 7.43 billion in 2025 and is expected to reach USD 22.07 billion by 2035, expanding at around 11.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of robot preventive maintenance is evaluated at USD 8.2 billion.

The robot preventive maintenance market is experiencing notable growth due to the increasing adoption of automation and industrial robots across several sectors such as manufacturing, healthcare, and logistics to enhance productivity and efficiency. More robots in operation lead to a higher demand for maintenance services. According to the World Robotics 2024 report, presented by the International Federation of Robotics (IFR), the new global average robot density reached a record of 162 units per 10,000 employees in 2023. Further, the report also states that there are over 4,281,585 units of robots that are currently operational in automotive factories worldwide. This count suggests having about one-third of all industrial robot installations. Additionally, 70% of all newly deployed robots in 2023 were installed in Asia, followed by 17% in Europe and 10% in America. With the expansion of smart factories and the usage of robots, the demand for preventive maintenance solutions is predicted to rise thus ensuring smooth robotic operations.

Predictive maintenance reduces unplanned downtime and increases operational efficiency. The integration of IoT sensors, AI, and machine learning technologies enables real-time monitoring of robotic systems. For instance, in February 2024, Siemens unveiled a new generative AI that employs AI-driven predictive maintenance solutions to monitor machinery health in real time, allowing for proactive interventions before any failure occurs. This technology provides information about temperature, vibration, torque, and speed and alerts human workers regarding any anomalies in work before failure.

Key Robot Preventive Maintenance Market Insights Summary:

Regional Insights:

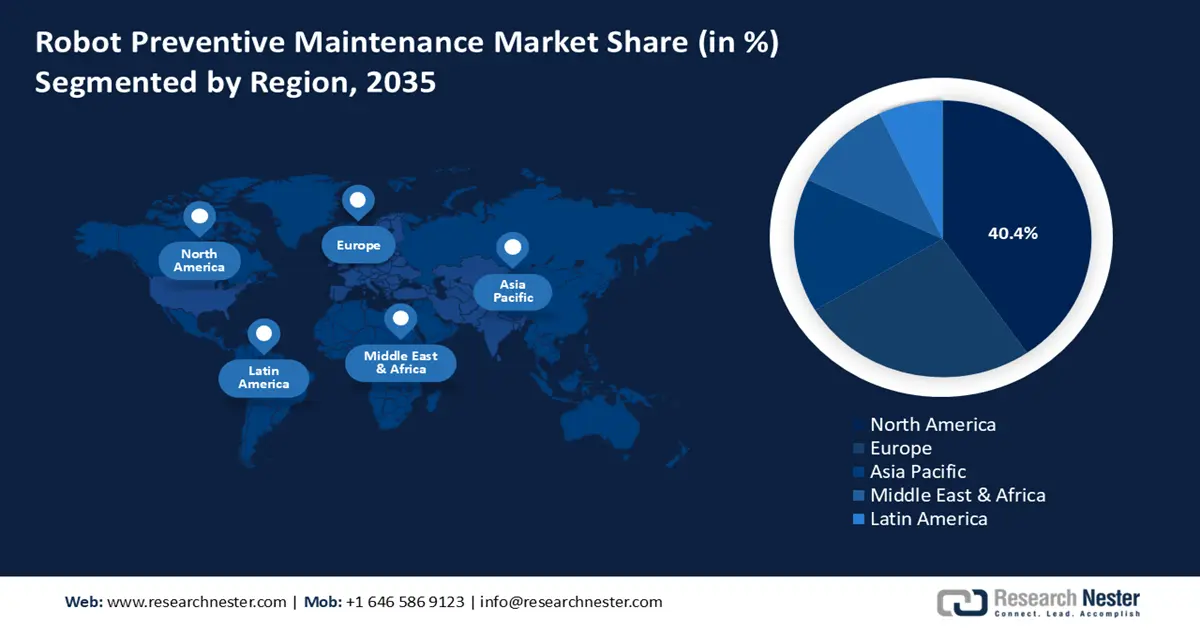

- North America is projected to secure over a 40.4% share of the robot preventive maintenance market by 2035, supported by rising automation adoption across manufacturing and logistics sectors.

- Europe is expected to command a significant share by 2035 as its preventive maintenance landscape strengthens with expanding AI- and IoT-enabled automation across key industries.

Segment Insights:

- The collaborative robots or Cobots segment is estimated to capture around 36.7% share of the robot preventive maintenance market by 2035, propelled by its growing role in real-time inspection, diagnostics, and safer human–robot collaboration.

- The automotive segment is anticipated to hold a substantial share by 2035 as its increasing reliance on robotics accelerates preventive maintenance needs amid the shift toward electric vehicles and persistent labor shortages.

Key Growth Trends:

- Growth of collaborative robots

- Rising demand for automation and smart factories

Major Challenges:

- High initial investment and maintenance costs

- Frequent software and hardware updates

Key Players: Omron, ABB, Nachi-Fujikoshi, iRobot and Yaskawa Electric Corporation, FANUC Corporation and KUKA AG.

Global Robot Preventive Maintenance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.43 billion

- 2026 Market Size: USD 8.2 billion

- Projected Market Size: USD 22.07 billion by 2035

- Growth Forecasts: 11.5%

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Mexico, Brazil, Indonesia

Last updated on : 3 December, 2025

Robot Preventive Maintenance Market - Growth Drivers and Challenges

Growth Drivers

-

Growth of collaborative robots: Cobots or collaborative robots are increasingly used in small and medium enterprises. These robots require regular maintenance to ensure safe human robot interaction. As the world is facing global labor shortages, robotics has emerged to address this challenge. As per the International Federation of Robotics 2024 report, collaborative robots reported 10.5% of the total 541,302 industrial robots installed in 2023. Collaborative robots involve various technological innovations that make them ideal, when compared to industrial robots, in a number of applications as these are known for their flexibility, safety, and productivity and are expected to expand sharply over the next few years. For instance, in September 2024, Premier Tech launched a new face of automation which utilizes cobot technology to help companies ease their packaging automation works.

- Rising demand for automation and smart factories: The emergence of industry 4.0 and smart manufacturing technologies are driving automation adoption. For instance, in October 2024, Amazon revealed its new AI powered fulfilment sector in Louisiana which is ten times more automated than its previous centres. It features Sequoia with multiple robotic arms handling over 30 million items. This shift towards smart factories emphasizes the need for robust preventive maintenance to ensure seamless operations. Businesses are investing in preventive predictive maintenance to avoid high value disruptions. Moreover, preventive maintenance helps reduce repair costs, production losses and downtime.

Challenges

-

High initial investment and maintenance costs: The costs to maintain can be a challenge for the adoption of preventive maintenance technology. Implementing predictive maintenance technologies such as AI, IoT and ML requires significant upfront investment in sensors, software and training. Small and medium enterprises may struggle to afford these advanced maintenance solutions. Moreover, due to uncertain return on investment, companies may hesitate to invest in predictive maintenance leading to slow adoption.

-

Frequent software and hardware updates: Robotics technology evolves rapidly which requires constant updates to hardware and software. These updates are essential for improving performance, safety and maintaining compatibility with other systems. Hence, keeping maintenance systems up to date while ensuring compatibility with existing robots can be challenging. Moreover, integrating different brands of robots in a factory setting can cause software errors.

Robot Preventive Maintenance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 7.43 billion |

|

Forecast Year Market Size (2035) |

USD 22.07 billion |

|

Regional Scope |

|

Robot Preventive Maintenance Market Segmentation:

Robot Type Segment Analysis

Collaborative robots or Cobots segment is estimated to dominate around 36.7% robot preventive maintenance market share by the end of 2035, owing to its use in assisting with inspection, diagnostics and repairs in industrial settings. Unlike traditional robots, cobots work alongside human technicians to enhance efficiency and safety in maintenance operations. These robots handle hazardous tasks and complex maintenance operations with precision. Rapid advancements in sensors, vision technologies, and smart grippers allow cobots to respond in real-time to changes in their environment and thus work safely alongside human workers. For instance, leading robot manufacturer Universal Robots has deployed 50,000 cobots across various industries. In the automotive sector, their cobots are used for tasks such as machine tending, assembly, and quality inspection. The cobots work alongside human operators to increase productivity and maintain the standards.

Industry Vertical Segment Analysis

The automotive segment is anticipated to hold a substantial robot preventive maintenance market share through 2035. According to the International Federation of Robotics Report of 2024, the automotive sector is the number one adopter of industrial robots, accounting for 33% of all installations in the US. Further, sales in the automotive segment rose by 1% with 14,678 robots installed in 2023. The growth of robotics in industrial sector mainly automotive segment can be attributed to the transition to electric vehicles as well as current labor shortages globally. The integration of robotics in the automotive industry has seen significant growth.

Our in-depth analysis of the global robot preventive maintenance market includes the following segments:

|

Robot Type |

|

|

Industry Vertical |

|

|

Maintenance Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Robot Preventive Maintenance Market - Regional Analysis

North America Market Insights

North America robot preventive maintenance market is set to hold revenue share of over 40.4% by the end of 2035. The sector is expanding rapidly due to the growing adoption of industrial robots across manufacturing, automotive, and logistics sectors. Major companies such as ABB, and Rockwell Automation offer predictive maintenance solutions to reduce downtime and improve efficiency. With the robotics market growing, the demand for preventive maintenance services will continue to rise. According to World Robotics 2024 Report, North America has highly adopted automation in manufacturing and has a robot density of 197 units per 10,000 employees reaching an up of 4.2%.

The robot preventive maintenance market in the U.S. is growing due to increasing automation in industrial manufacturing, electronics, logistic sectors. The IFR Report 2024 states that U.S. accounted the largest regional market share constituting of 68% of robot installations reaching to 295 units in 2023. Additionally, the investments by manufacturing companies in the U.S. drive automation. The U.S. witnessed an increase of 12% in total installations of industrial robots and reached 44,303 units in 2023. The highest adopted sector consisted of the automobile industry followed by the electrical and electronics sector. Thus, with rising investments and AI driven solutions demand for robots continue to surge.

The robot preventive maintenance market in Canada is expanding due to rising adoption of automation in automobile, manufacturing and healthcare sectors. According to the World Robotics 2024 Report released by International Federation of Robotics, robot installations in Canada rose by 37% reaching to 4,311 units. Additionally, the installation of robots in Canada depends on automotive sector as the car industry alone comprised 58% in 2023. With more robots in operation, preventive maintenance is becoming essential to maintain efficiency, reliability and competitiveness in the industrial sector.

Europe Market Insights

The robot preventive maintenance market in Europe is expanding due to widespread adoption of automation in manufacturing, automotive and logistics. Germany, UK and France lead the market with Germany being the largest industrial robot user in Europe. The region is witnessing rapid growth in predictive maintenance, integrating AI and IoT to enhance efficiency. According to the World Robotics 2024 Report released by IFR, Europe has a robot density of 219 units per 10,000 employees which reflects an increase of 5.2%. This reflects the region’s focus on automation and smart manufacturing demand leading to rise in robot’s use in preventive maintenance.

The robot preventive maintenance market in Germany is growing due to the country’s strong focus on automation and industry 4.0. As Europe’s largest industrial robot user, Germany has over 28,355 operational robots in the automobile and manufacturing sectors. Additionally in terms of robot density, the country ranks fourth by having 429 robots per 10,000 employees in the country. With advancements in AI, IoT and smart factories, demand for robot maintenance services is rising rapidly.

The robot preventive maintenance market in the U.K is rising as industries invest in automation to enhance productivity and reduce operational costs. The logistics and automotive sectors led by Ocado and Jaguar Land Rover, rely on proactive maintenance to ensure seamless robotic operations. Further, the government’s push for smart manufacturing and AI driven maintenance solutions is further accelerating robot preventive maintenance market growth. With increasing robot density in factories and warehouses, the need for preventive maintenance services is becoming more critical. The World Robotics 2024 report claimed that industrial robot installations in UK increased by 51% accumulating to 3,830 units in 2023. Further, investments were majorly focused on installations in the automotive industry, especially for assembly tasks.

Robot Preventive Maintenance Market Players:

- OMRON

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB

- Nachi-Fujikoshi

- iRobot

- Yaskawa Electric Corporation

- KUKA AG

- Denso

- Siemens

- Rockwell Automation

- Festo

- SMC

- Universal Robots

Top companies in the robot preventive maintenance market include ABB, Nachi-Fujikoshi, iRobot and Yaskawa Electric Corporation, FANUC Corporation and KUKA AG. These firms offer comprehensive maintenance solutions to ensure optimal performance and longevity of their robotic systems. The preventive maintenance programs are designed to minimize downtime and enhance operational efficiency. Here are some leading players in the robot preventive maintenance market:

Recent Developments

- In December 2024, Eureka Robotics raised USD 10.5 million Series A to accelerate deployment of physical AI for precision manufacturing and logistics. The funding aims to scale the company's operations in Singapore and Japan, as well as enable Eureka to fully enter the US market and expand its customers.

- In December 2023, Tesla launched Optimus Gen 2 Robot to check and replace air filters, inspect plumbing and electrical systems, and perform minor repairs autonomously. Tesla's Optimus Gen 2 is an advanced humanoid robot designed to tackle innumerable tasks and reduce the arising labour gap in trade.

- Report ID: 7248

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Robot Preventive Maintenance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.