Road Marking Paints & Coatings Market Outlook:

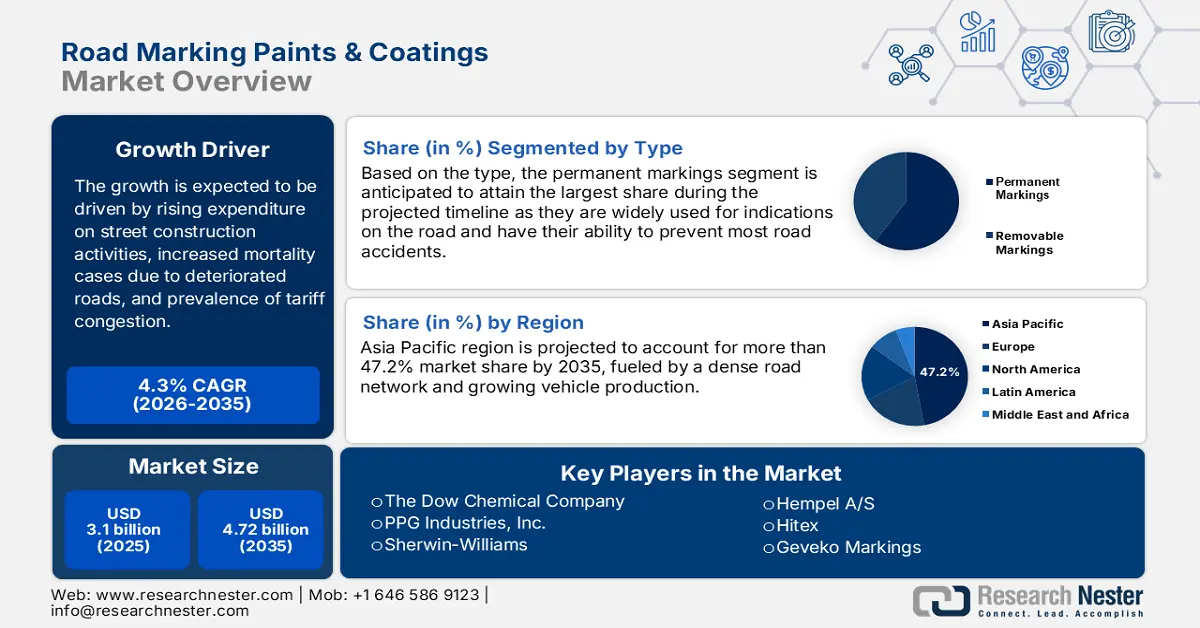

Road Marking Paints & Coatings Market size was over USD 3.1 billion in 2025 and is projected to reach USD 4.72 billion by 2035, witnessing around 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of road marking paints & coatings is evaluated at USD 3.22 billion.

The growth of the market can be attributed to the expansion of the global road length. As of 2018, there was a total of 64,285,009 km of roads in the world. Out of these, the length of expressways was 411,853 km and the rest 63,873,156 km were considered normal roads (paved and not paved). The addition of extra lanes and road routes helps to reduce the traffic. Also, it improves delivery time by reducing travel time and improving productivity. The increased fuel prices can be saved by traffic control and enhance the economic development of people. Further, the reduction in road traffic helps to minimize carbon emissions and promote an eco-friendly environment. All these factors together are estimated to hike the growth of the market.

Road marking is the process of applying paints and coatings to roadways, pavements, concrete, or asphalt to display information such as directions, lanes, zones, speed limits, parking, stopping, and safety to vehicles and pedestrians. Road marking is usually done either by skilled experts using non-mechanical road marking equipment or by the utilization of road marking machines such as fiber laser, or laser marking machines. The increase in the construction of roads across the globe is anticipated to foster the demand for road marking paints & coatings. Highways are constructed to provide proper road directions in every place to prevent accidents which are anticipated to have a positive impact on the growth of the road marking paints & coatings market. The construction data of India’s national highways were reported at 1,966 km in June 2022. This was an increase from the previous number of 1,307 km in May 2022.

Key Road Marking Paints & Coatings Market Insights Summary:

Regional Highlights:

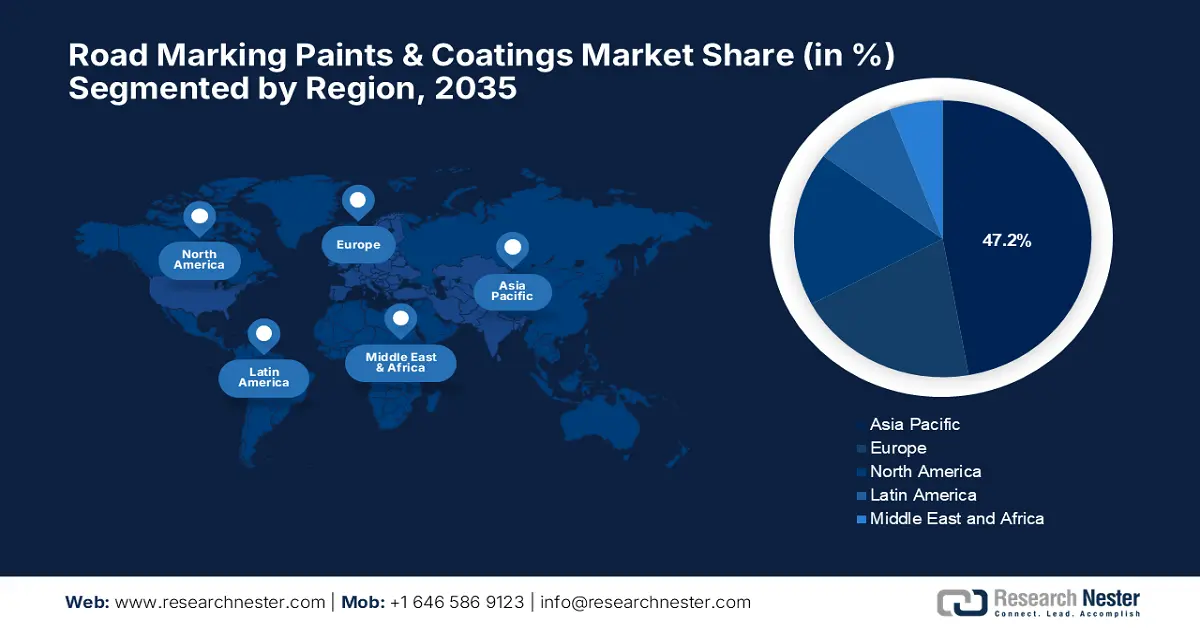

- Asia Pacific road marking paints & coatings market will hold around 47.2% share by 2035, driven by a dense road network and growing vehicle production.

- Europe market will secure the second largest share by 2035, driven by rising infrastructure standards and improved road safety regulations.

Segment Insights:

- The roads & highways segment in the road marking paints & coatings market is anticipated to achieve the largest share by 2035, fueled by a rise in government investment in highways.

- The permanent markings segment in the road marking paints & coatings market is anticipated to achieve a significant share by 2035, attributed to road safety benefits and prevention of road accidents.

Key Growth Trends:

- High Expenditure on Street Construction to Improve Road Facility

- Increase in the Number of Deaths in Road Accidents Owing to Damaged Roads

Major Challenges:

- Rising Concern for the Environment

- Fluctuating Costs of Raw Materials

Key Players: The Dow Chemical Company, PPG Industries, Inc., Sherwin-Williams, Geveko Markings, Crown Technology Inc., Nippon Paint Holdings Group, Hempel A/S, Allnex Netherlands BV, Teknos Group Oy, Aexcel Corporation, Hitex.

Global Road Marking Paints & Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.1 billion

- 2026 Market Size: USD 3.22 billion

- Projected Market Size: USD 4.72 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Road Marking Paints & Coatings Market Growth Drivers and Challenges:

Growth Drivers

- High Expenditure on Street Construction to Improve Road Facility – As per recent findings, the monthly spending on highway and street construction in the United States rose from USD 80 billion in 2012 to USD 100 billion in 2021. Further, the U.S. highway and street construction value are projected to rise to approximately USD 150 billion in 2025.

- Increase in the Number of Deaths in Road Accidents Owing to Damaged Roads – According to the data released by the World Health Organization in 2022, approximately 1.3 million people die each year due to road traffic crashes globally.

- Prevalence of Traffic Congestion with Increasing Vehicles on Road – The prevalence of traffic across the globe is estimated to increase the utilization of road marking paints & coatings to direct and clear the congestion within a short span. As of January 2020, the American motor vehicle fleet traveled about 240.6 billion vehicle miles. Further, between January and December 2021, the traffic volume in the U.S. came to around 3.2 trillion vehicle miles of travel.

- Rise in Demand and Sales of Vehicles with Increasing Disposable Income– As per the International Organization of Motor Vehicle Manufacturers (OICA), the global sales of vehicles rose from 78,774,320 vehicles in 2020 to 82,684,788 in 2021.

- Expansion in Research and Development Expenditure with Development in Economy – The statistics revealed by World Bank showed that research and development expenditure counted for 2.63% of total GDP in 2020.

Challenges

- Rising Concern for the Environment - The expansion of roads leads to the cutting down of forest land affects animal habitats, the destruction of beautiful landscapes, trees, and the reduction of the animal population. The increasing pollution from emissions of vehicles increases due to increasing road lanes and routes. This is the estimated reason for the hindrance of market growth during the forecast period.

- Fluctuating Costs of Raw Materials

- Stringent Regulations Governing VOC Emissions

Road Marking Paints & Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 3.1 billion |

|

Forecast Year Market Size (2035) |

USD 4.72 billion |

|

Regional Scope |

|

Road Marking Paints & Coatings Market Segmentation:

Application Segment Analysis

The roads & highways segment is anticipated to garner the largest revenue by 2035 owing to a rise in investment in the construction of highways and roads by the government. As per, the Department for Promotion of Industry and Internal Trade Policy (DPIIT), the construction development sector attracted Foreign Direct Investment (FDI) inflow worth USD 90.13 billion between April 2021 - December 2022. Further, according to the India Brand Equity Foundation, in 2021, the private sector invested around USD 1.98 billion in roads. Roads and highways are used by most passenger and commercial vehicles as they connect all the cities, towns, and villages. The introduction of by-pass routes and ring road constructions to eliminate the internal traffic of a city is estimated to rise the growth of the market. The highways are the longest roads that connect more than 1000 km road in a single line. The increasing number of automotive vehicles is also estimated to increase the growth of the market.

Type Segment Analysis

The permanent markings segment is expected to garner a significant share. Permanent traffic markings are applied on road to separate the coming and going vehicles from each other and to indicate the end of the road. The zebra crossings are also made of permanent markings as they are needed for the safety of pedestrians. Usually, thermoplastic aerosol paints are used to make permanent markings on these roads. The signs such as stop, pavement markings, parking restrictions, yellow lanes, turning and reversible lanes, and HOV lanes are marked with permanent paintings. Additionally, road markings prevent most road accidents caused due to no directions or visibility issues. Thus, road markings improve the safety of the roads. In the year 2021, the number of road accidents in India was estimated to be over 4,00,320. All these factors are anticipated to boost the market growth.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Road Marking Paints & Coatings Market Regional Analysis:

APAC Market Insights

Asia Pacific region is projected to account for more than 47.2% market share by 2035, attributed majorly to the presence of a large road network. As per recent estimates, in 2022, China had the largest roadway network compared to other countries in the Asia-Pacific region, calculated to be approximately 4.9 million kilometers. India followed China with a roadway coverage of about 4.6 million kilometers in the same year. The high density of roads available is estimated to propel the growth of the road marking paints & coatings market. Further, the increasing sales and production of automotive vehicles is the reason for the growth of the road marking paints & coatings market in the coming years. As per the International Organization of Motor Vehicle Manufacturers (OICA), the sales and registrations of new vehicles in the region rose from 40,322,544 vehicles in 2020 to 42,663,736 vehicles in 2021.

Europe Market Insights

The Europe region road marking paints and coatings market is estimated to share the second largest share in the coming years. The increasing development standards by the government of the European Union to improve road infrastructure and facilities. The increasing safety concerns decrease deaths on highways during traffic congestion. Additionally, it improves the surveillance, quality of building materials, and safety of people on roads. According to the estimations, in 2021, around 40 million road fatalities are registered in Europe with an increase of over 4% from 2020.

Road Marking Paints & Coatings Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PPG Industries, Inc.

- Sherwin-Williams

- Geveko Markings

- Crown Technology Inc.

- Nippon Paint Holdings Group

- Hempel A/S

- Allnex Netherlands BV

- Teknos Group Oy

- Aexcel Corporation

- Hitex

Recent Developments

-

The Dow Chemical Company launched DURATRACK 2K Technology for broad area markings, including green bike lanes. This new development is considered to yield superior adhesion, skid resistance, UV durability, and short drying time while promoting work zone safety through a speedy and efficient installation process.

-

PPG Industries, Inc. has established a new business unit called Traffic Solutions, following the acquisition of Ennis-Flint in December 2020. This unit is centered on manufacturing and supplying an array of pavement-marking products and other advanced technologies in various sectors.

- Report ID: 4183

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.