Road Haulage Market Outlook:

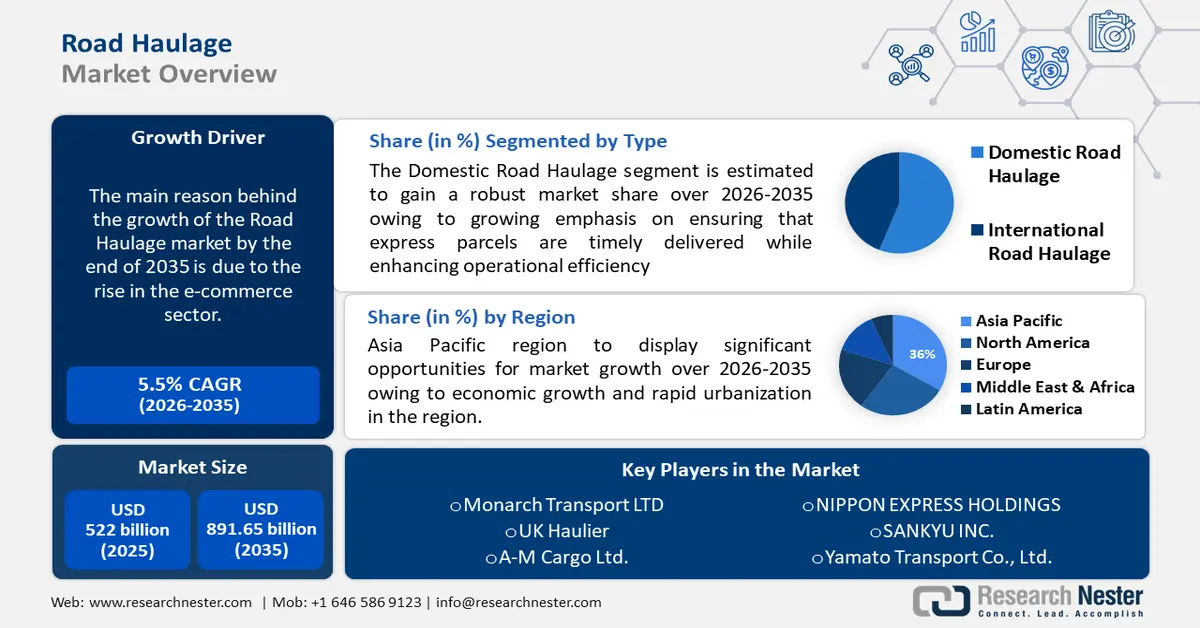

Road Haulage Market size was valued at USD 522 billion in 2025 and is expected to reach USD 891.65 billion by 2035, expanding at around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of road haulage is evaluated at USD 547.84 billion.

Urbanization and population growth result in increased demand for goods and services, leading to higher freight volumes. As observed by US Department of Transportation, the US transport system moved an average of about 53.6 million tonnes of freight, worth more than USD 54 billion, per day in 2021. As more people move to urban areas, there is a greater need for goods to be transported from distribution centers to retail stores and residences. Road haulage companies play a crucial role in facilitating this movement of goods within and between cities.

Key Road Haulage Market Insights Summary:

Regional Highlights:

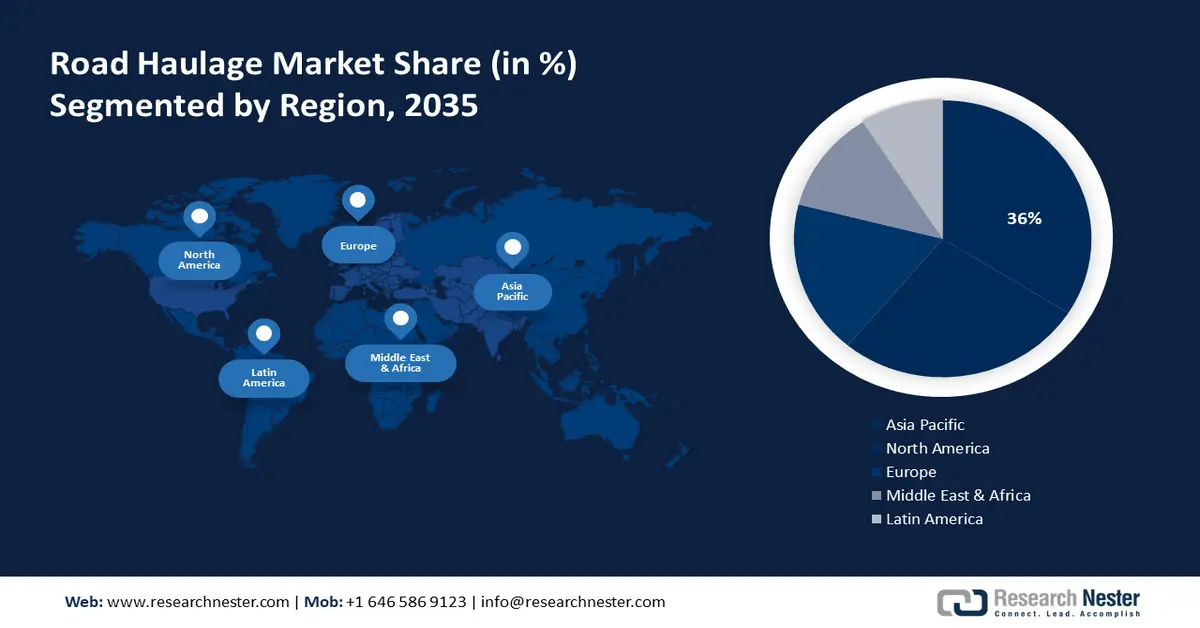

- Asia Pacific road haulage market is expected to capture 36% share by 2035, attributed to rising foreign investment and expanding e-commerce infrastructure.

- North America market will achieve a 24% share by 2035, fueled by robust commercial activity and highway infrastructure.

Segment Insights:

- The domestic road haulage segment in the road haulage market is anticipated to see substantial growth till 2035, attributed to the growing emphasis on timely parcel delivery and operational efficiency.

- The food & beverage segment in the road haulage market is expected to witness lucrative growth till 2035, driven by the demand for perishable goods and expansion of retail chains.

Key Growth Trends:

- Rise in infrastructure development and maintenance

- Technological advancements

Major Challenges:

- Environmental issues

- Miscellaneous concerns

Key Players: CONCOR, Kindersley Transport Ltd., Woodside Haulage (Holdings) Limited, Monarch Transport LTD, UK Haulier, A-M Cargo Ltd., LKWWALTER Internationale Transportorganisation AG, C.A.T. INC., Manitoulin Transport Inc., Gosselin Group.

Global Road Haulage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 522 billion

- 2026 Market Size: USD 547.84 billion

- Projected Market Size: USD 891.65 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, Thailand, Malaysia

Last updated on : 17 September, 2025

Road Haulage Market Growth Drivers and Challenges:

Growth Drivers

- Rise in infrastructure development and maintenance - Investments in infrastructure development and maintenance contribute to the growth of the road haulage market by improving the efficiency and reliability of transportation networks. The World Bank reported that in developing countries, investors have directed an average of USD 85 billion to infrastructure projects over the past five years. Upgrades to roads, highways, bridges, and tunnels reduce travel times, enhance safety, and enable the transportation of heavier loads, thereby benefiting companies in market.

- Technological advancements - Large market participants are concentrating on increasing the amount of goods they can transport by introducing cutting-edge delivery choices or forming partnerships with outside logistics service providers. Businesses are also placing a strong emphasis on enhancing the customer experience and cutting expenses associated with running their road haulage services by utilizing cutting-edge technologies like automated vehicles and the Global Positioning System (GPS) & Location-Based Services. To improve business operations, haulage companies are now establishing operations centers where they will store goods and vehicles and do any necessary vehicle repairs.

Moreover, over the aforementioned forecast period, the market will have numerous potential prospects due to the expansion of the automation and transportation industries. For instance, Businesses can solve the driver shortage in the US - which was over 60,000 in 2018 and is predicted to reach 160,000 by 2028—by automating freight. - Rising cross-border trade and liberalization of trade agreements - Global market dynamics are mostly driven by the liberalization of trade agreements. Cross-border trade is greatly increased as nations sign new trade agreements and remove current trade obstacles. The need for various haulage services has expanded as a result of these changes, which have also increased the import and export of products and services. Additionally, the ease of mobility has significantly grown as a result of nations concentrating on improving infrastructure.

Along with trade liberalization, improved road networks have made it simpler for haulage companies to develop internationally, guaranteeing quicker and more effective delivery of commodities. The estimated trade between the two countries in 2022 is USD 10 billion USD 12 billion, a 15 % increase from 2021. It's also critical to remember that a system of free and open international trade promotes specialization, competition, and innovation-all of which boost the market.

Challenges

- Environmental issues - The environmental effects of truck diesel engines, which pollute the environment and break emission regulations, pose the biggest threat to the market's expansion. This is the main obstacle to the market's expansion.

- Miscellaneous concerns - The growth of the market is expected to be slowed down by a number of important issues, e.g. increasing fuel prices, transport strikes and governmental rules on logistics and transportation.

Road Haulage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 522 billion |

|

Forecast Year Market Size (2035) |

USD 891.65 billion |

|

Regional Scope |

|

Road Haulage Market Segmentation:

Type Segment Analysis

Domestic road haulage segment is projected to dominate over 56% road haulage market share by 2035. The segment growth can be impelled by the growing emphasis on ensuring that express parcels are timely delivered while enhancing operational efficiency. Also, domestic deliveries are more economical as compared to international deliveries, thereby spurring the growth of the domestic segment.

As per Indian government, each year, India handles 4.6 billion tonnes of goods with an overall annual cost of INR 9.5 lakh crore. These products represent a variety of domestic industries and products: 22 % are agricultural products, 39 % are mining products, and 39 % are manufacturing related commodities.

Moreover, due to the lesser distances involved and their experience with local road networks, domestic road haulage businesses can offer delivery services that are more prompt and effective than those provided by international road haulage companies. This is crucial for firms that must deliver goods swiftly and consistently, including e-commerce stores and food delivery services, thus propelling the segment’s growth within the market.

Application Segment Analysis

Application segment in the road haulage market is poised to observe lucrative growth till 2035. The food & beverage industry requires effective haulage services due to the growing demand for perishable and fresh items. The market demand in this industry is being driven by the expansion of retail chains and the growth of the processed food sectors.

An important factor driving this segment is the introduction of strict laws pertaining to the secure transportation of food items. As observed by Research Nester analysts, in the United States, fresh fruit and vegetable sales increased by almost 20 % between 2019 and 2022, reaching almost 76 billion dollars.

Our in-depth analysis of the market includes the following segments:

|

Type |

|

|

Vehicle Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Road Haulage Market Regional Analysis:

APAC Market Insights

Road haulage market in the Asia Pacific region is anticipated to hold the largest with a share of about 36% by the end of 2035, growing at a CAGR of 6%. The region's increased foreign investment and better transportation infrastructure are credited with the rise. In addition, the rapidly expanding e-commerce sector in developing nations like China and India is increasing demand for efficient road haulage services.

In 2023, China remained the world's top manufacturing hub, the rise in production and exports is driving the demand for road services as the trucking industry plays a significant role in ensuring the timely delivery and distribution of manufactured goods domestically. In 2023, China's auto exports surged 57.9% YoY to a record high of 4.91 million vehicles. This growth was propelled by a surge in the exports of new energy vehicles (NEVs), which soared 77.6 YoY to more than 1.2 million units in 2023.

North America Market Insights

The North American region will also encounter huge growth for the road haulage market during the forecast period and will hold the second position, accounting for 24% of the market share. the regional market is expected to have a sizable part of the market due to its robust expansion.

The extensive highway network in the area, together with the growing volume and variety of commercial activities, are responsible for the regional market's growth prospects in vehicle networking. As the pre-workout supplements United States Department of Transportation; U.S. transportation network for freight evolved from 2012 to 2017, in 2017 it accumulated to a value of around USD 19 trillion.

Every province in 2021 had an increase in sales for the manufacturing sector, which led to a rise in the amount of manufactured goods being transported throughout Canada by road haulage. Sales increased by 11.3% in Ontario and 19.5% in Quebec, which was a significant gain. The primary metal, petroleum, and coal industries saw increased sales, which was a major factor in these regions' prosperity.

E-commerce businesses made more than USD 4.2 trillion in 2020. In a single year, the industry in the US expanded by over 40%, while sales to other countries increased by 20%. Last-mile trucking services are in more demand because to the rising domestic demand for e-commerce goods.

Road Haulage Market Players:

- CONCOR

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kindersley Transport Ltd.

- Woodside Haulage (Holdings) Limited

- Monarch Transport LTD

- UK Haulier

- A-M Cargo Ltd.

- LKW WALTER Internationale Transportorganisation AG

- C.A.T. INC.

- Manitoulin Transport Inc.

- Gosselin Group

The road haulage market is dominated by key market players who are gaining traction in the market by adopting several strategies including mergers and acquisitions.

Recent Developments

- CONCOR signed a Memorandum of Understanding (MOU) to begin a strategic relationship to promote innovation and efficiency in logistics. The collaboration seeks to maximize supply chain management, improve customer service, and promote industry growth by utilizing CONCOR and CWC's unique capabilities.

- Gosselin Group and Verhuizingen Meys and Meys Vastgoed, situated in Brasschaat, agreed in principle. The assets and personnel will be purchased by Gosselin and absorbed into the international moving segment of the Gosselin Group.

- Report ID: 6062

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Road Haulage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.