Rigless Intervention Services Market Outlook:

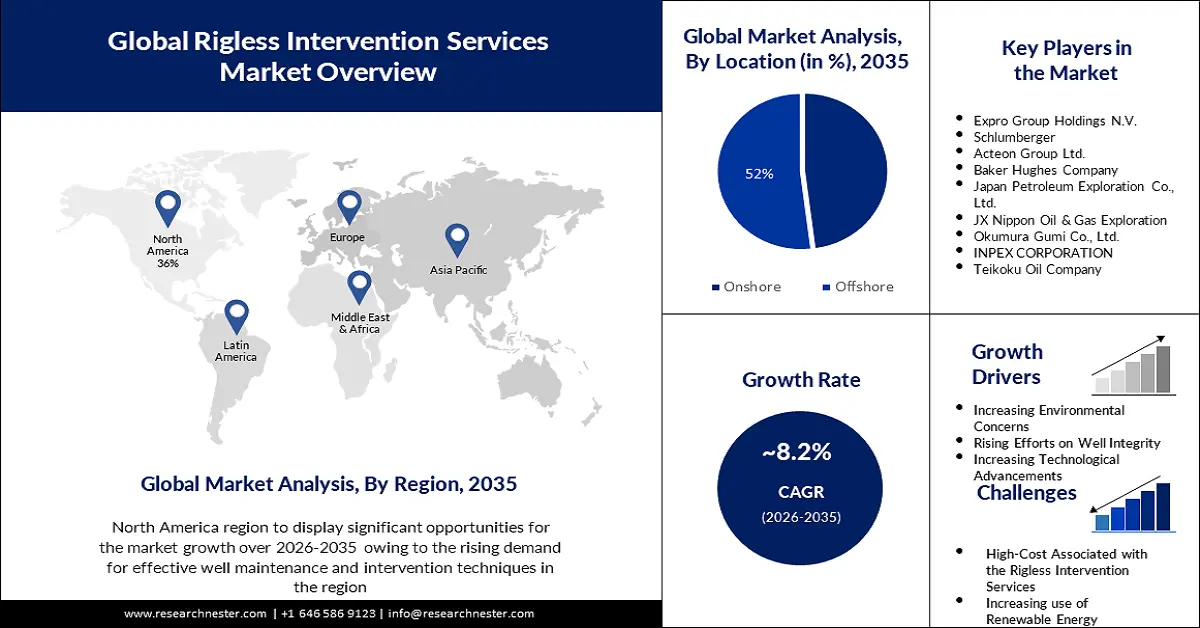

Rigless Intervention Services Market size was over USD 13.85 Billion in 2025 and is anticipated to cross USD 30.46 Billion by 2035, witnessing more than 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rigless intervention services is assessed at USD 14.87 Billion.

During the projected period, the oil and gas industry's growing demand for time and money-saving solutions for well maintenance and optimization will propel market growth. For instance, every year, more than 4 billion metric tons of oil are produced worldwide, with the Middle East holding close to half of all known oil reserves. Therefore, the expansion of the oil and gas industry is also driving the market growth. By doing away with the requirement for expensive rig mobility and minimizing downtime during good interventions, rigless technologies offer significant cost savings.

Furthermore, rigless technologies like coiled tubing and electric-line units give you the freedom to reach and service wells with limited surface space or intricate wellbore layouts. Also, the need for adaptable and diverse intervention systems to boost production and extend well life has increased due to the global increase in mature wells and aging oil and gas fields.

Key Rigless Intervention Services Market Insights Summary:

Regional Highlights:

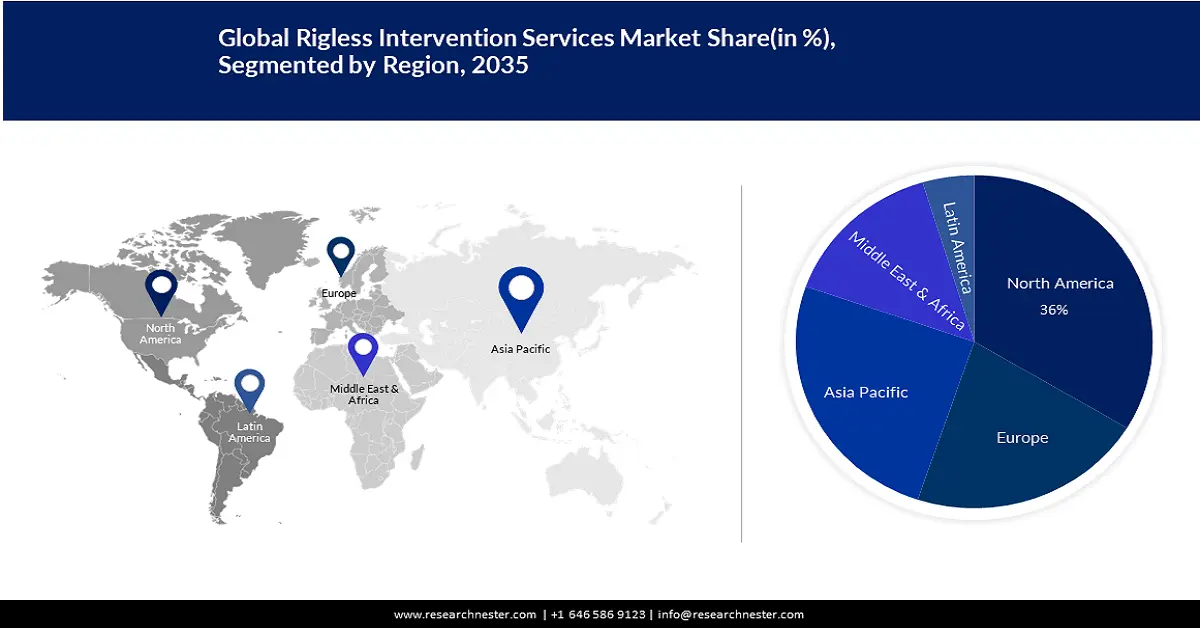

- The North America rigless intervention services market will hold over 36% share by 2035, driven by demand for well maintenance technologies and oil production expansion.

- The Asia Pacific market will secure 27% share by 2035, driven by investments in offshore E&P activities and rising energy consumption.

Segment Insights:

- The offshore segment in the rigless intervention services market is projected to experience substantial growth through 2035, driven by the need for rigless interventions for maintenance in offshore wells.

- The pre-installation services segment in the rigless intervention services market is expected to achieve a 47% share by 2035, fueled by rising demand for well-site preparation in unconventional reserves.

Key Growth Trends:

- Increasing Environmental Concerns

- Rising Efforts on Well Integrity and Production Optimization

Major Challenges:

- Unavailable or Uneconomical Rig may Hamper the Growth of the Market

- High-Cost Associated with the Rigless Intervention Services may become a Hindrance to Market Growth

Key Players: Halliburton Company, Expro Group Holdings N.V., Schlumberger, Acteon Group Ltd., Baker Hughes Company, Japan Petroleum Exploration Co., Ltd., JX Nippon Oil & Gas Exploration, Okumura Gumi Co., Ltd., INPEX CORPORATION, Teikoku Oil Company.

Global Rigless Intervention Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.85 Billion

- 2026 Market Size: USD 14.87 Billion

- Projected Market Size: USD 30.46 Billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Canada, Norway, United Arab Emirates

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 11 September, 2025

Rigless Intervention Services Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Environmental Concerns - Because of their capacity to solve escalating environmental and safety concerns, rigless intervention services are becoming more popular in the oil and gas sector. Traditional drilling rigs utilize a lot of energy and produce a lot of greenhouse gases, therefore rigless operations have a smaller carbon footprint and are more environmentally friendly. These systems also require less surface gear, which causes less environmental disruption. Furthermore, because less heavy equipment and employees are used during rigless operations, the danger of accidents is reduced. Operators are increasingly employing rigless intervention technologies to match sustainability aims and improve safety performance, which is helping the market grow as environmental rules become stricter and safety standards are stressed.

- Rising Efforts on Well Integrity and Production Optimization - For oil and gas operators looking for optimal reservoir performance, maintaining well integrity and increasing production rates are essential components. Systems for rigless intervention are essential to achieve these goals. In order to avoid future well failures and expensive shut-ins, rigless interventions enable quick diagnosis and treatment of well concerns such as sand production, scale, and corrosion. Additionally, these technologies make it possible for operators to improve reservoir productivity and lengthen the useful life of their wells by facilitating production optimization techniques like stimulation treatments and perforation adjustments. The need for rigless intervention devices is still rising as operators place a higher priority on good integrity and production optimization.

- Increasing Technological Advancements - The oil and gas sector is adopting rigless intervention methods more quickly as a result of continual technology developments and innovation. To increase the capabilities of rigless intervention, engineers and producers are continually creating new and better tools, equipment, and processes. Additionally, improvements in robotics and remotely operated systems allow operators to complete difficult tasks in difficult settings with more accuracy and efficiency. These advances in technology increase the rigless interventions' dependability, efficacy, and adaptability, making them more alluring to oil and gas operators looking for creative solutions to their good intervention demands. The market is constantly growing and being shaped by the ongoing search for cutting-edge technologies in rigless interventions.

Challenges

- Unavailable or Uneconomical Rig may Hamper the Growth of the Market - Since a rig is frequently either unavailable or uneconomical, many wellbore re-completion and recommissioning activities necessitate post-drilling well interventions. For the well interventions carried out in one of the most difficult offshore development projects, rigless operations are extremely relevant. Therefore, this factor may hamper the market growth of the rigless intervention services market.

- High-Cost Associated with the Rigless Intervention Services may become a Hindrance to Market Growth

- Increasing use of Renewable Energy may Hamper the Market Growth

Rigless Intervention Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 13.85 Billion |

|

Forecast Year Market Size (2035) |

USD 30.46 Billion |

|

Regional Scope |

|

Rigless Intervention Services Market Segmentation:

Location Segment Analysis

Rigless intervention services market for the offshore sector is anticipated to hold a share of 52% during the forecast period. Rigless intervention systems are essential in the offshore sector for performing maintenance, well diagnostics, and production optimization without the requirement for expensive and time-consuming rig mobilization. Offshore wells frequently encounter difficult problems, and rigless interventions provide a versatile and effective solution to problems including sand management, scale removal, and wellbore cleanouts.

Application Segment Analysis

Rigless intervention services market for pre-installation services is expected to hold a share of 47% during the forecast period. The expansion of this market may be attributable to rising demand for well-site preparation services, particularly in unconventional and constrained reserves.

Technique Segment Analysis

Rigless intervention services market for the wireless segment is anticipated to hold a share of 44% during the foreseen period. Wireless technologies have changed the game by enabling real-time data transfer and remote monitoring during well interventions, allowing operators to make knowledgeable decisions and maximize operational efficiency. The market for rigless intervention systems is expanding as a result of the deployment of coiled tubing, hydraulic workover, and wireless technologies in combination. These technologies give operators quick, flexible, and dependable options for well-servicing operations across a variety of oil and gas fields.

Our in-depth analysis of the global market includes the following segments:

|

Location |

|

|

Application |

|

|

Technique |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rigless Intervention Services Market Regional Analysis:

North American Market Insights

North America industry is likely to hold largest revenue share of 36% by 2035. As a major oil and gas producer, the area has a significant demand for effective well maintenance and intervention techniques, which is driving the development of rigless technologies. The country is focused on expanding its oil production. Market value is being increased by the adoption of strict wastewater treatment regulations for the mining, oil, and gas sectors, as well as by the expansion of industrial infrastructure, the construction industry, and oil refineries. For instance, the Permian Basin's abundant shale resources have led to a boom in well intervention activities.

APAC Market Insights

Asia Pacific is anticipated to hold a share of 27% by the end of 2035. The necessity for well intervention would be further exacerbated by the growing number of old wells. Additionally, to increase domestic output, the National Oil Company (NOC) is investing in offshore E&P activities, which is boosting the demand for rigless intervention services. In addition, many nations in the region are boosting their capital investments in order to meet future energy demands. Additionally, the growing industrialization and urbanization of nations like China and India have raised energy consumption and sparked a significant upsurge in oil and gas exploration. As a result, there is an urgent requirement for successful well interventions to guarantee maximum production and extraction effectiveness.

Rigless Intervention Services Market Players:

- Halliburton Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Expro Group Holdings N.V.

- Schlumberger

- Acteon Group Ltd.

- Baker Hughes Company

Recent Developments

- May 2021 - Schlumberger and NOV announced a partnership to hasten the deployment of automated drilling technologies by oil and gas producers and drilling service providers. Through the collaboration, clients will be able to combine NOV's rig automation platform with Schlumberger's surface and downhole drilling automation technologies to produce better well construction performance. By automating manual activities, this comprehensive service enhances drilling operations' safety, uniformity, and efficiency.

- May 2023 - The Anaconda Advanced Well Construction System's initial testing have been successfully completed, according to a recent announcement from Halliburton Energy Services (HES). This technology, which is based on revolutionary developments in the fields of composite materials, telemetry, and control sciences, will significantly affect offshore oil and gas exploration, development, and production. One of Halliburton Company's business divisions is Halliburton Energy Services.

- Report ID: 5365

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.