Rift Valley Fever (RVF) Treatment Market Outlook:

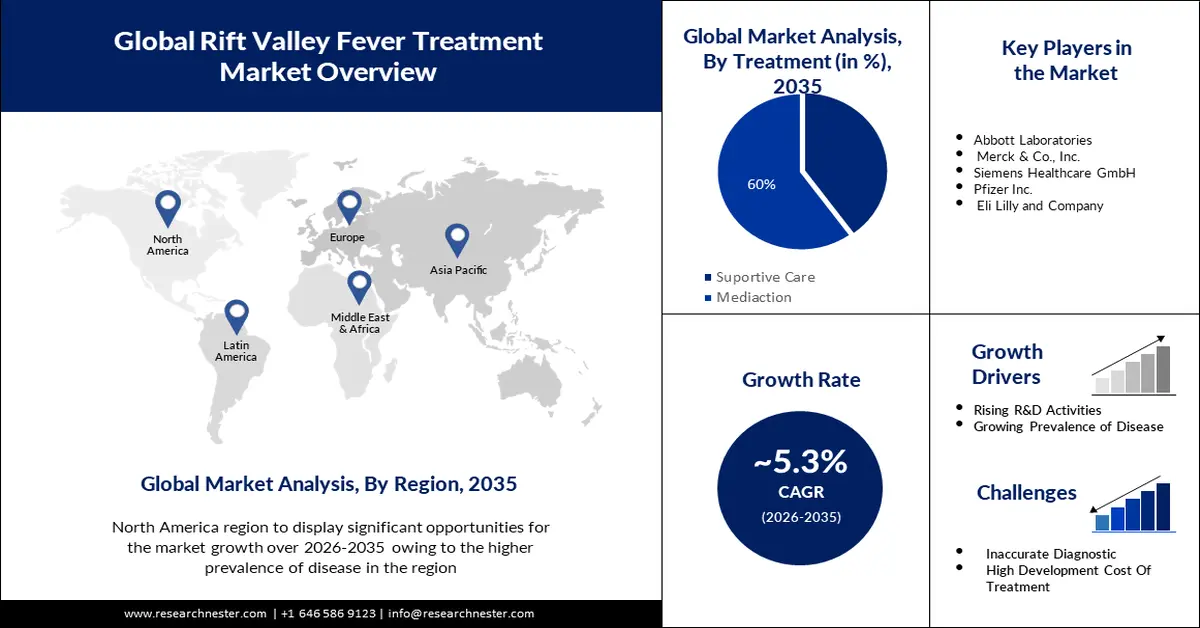

Rift Valley Fever (RVF) Treatment Market size was over USD 2.06 billion in 2025 and is poised to exceed USD 3.45 billion by 2035, growing at over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rift valley fever treatment is evaluated at USD 2.16 billion.

The growth of the market can be attributed to the rising cases of rift valley fever. Mosquito-borne rift valley fever seems to grow in humans and animals owing to factors such as climate change that are creating ideal mosquito breeding grounds. Further, increased outbreaks accelerate the demand for supportive care and highlight the urgent need for specific treatments. In people, the total RVF CFR was determined to be 27.5%. In people and animals, the overall pooled prevalence was 7.8% and 9.3%, respectively.

As the threat of river valley fever expands, governments and research institutions are investing more money in developing new treatments and vaccines for the disease. This investment is likely to lead to the development of new and more effective treatments for river valley fever in the forecast period. Therefore, the development of new treatment options and medications for the river valley fever cure is further predicted to drive the growth of this market in the future times.

Key Rift Valley Fever (RVF) Treatment Market Insights Summary:

Regional Highlights:

- North America industry is expected to dominate majority revenue share of 35% by 2035.

- Asia Pacific is anticipated to secure the second-largest share during 2026–2035, supported by rising disposable income and advancement in healthcare infrastructure in developing Asian countries.

Segment Insights:

- The mosquito vector segment is anticipated to hold a prominent share of 70% in the global rift valley fever (RVF) treatment market during the forecast period on account of the higher proximity of infection transmission.

- The medication segment in the market is predicted to hold the largest revenue share of 60% by the end of 2035.

Key Growth Trends:

- Surging Research and Development for Rift Valley Treatment

- Increased Awareness About Rift Valley Fever

Major Challenges:

- Inaccurate and Slow Diagnostics

- High Development Cost

Key Players: Abbott Laboratories, Merck & Co., Inc., Siemens Healthcare GmbH, Pfizer Inc., Eli Lilly and Company.

Global Rift Valley Fever (RVF) Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.06 billion

- 2026 Market Size: USD 2.16 billion

- Projected Market Size: USD 3.45 billion by 2035

- Growth Forecasts: 5.3%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Singapore, Brazil, Indonesia, United Arab Emirates

Last updated on : 19 November, 2025

Rift Valley Fever (RVF) Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Surging Research and Development for Rift Valley Treatment – There is currently no specific antiviral treatment for rift valley fever. Patients are typically treated with supportive care such as fluids, pain, relievers, and blood transfusions. According to a report by the Centers for Disease Control and Prevention (CDC), there is no FDA-approved treatment for RVF, and mild symptoms are treated using over-the-counter medications. This lack of a specific treatment creates a significant unmet medical need and is driving investment in the development of new river valley fever treatment. However, symptoms of this deadly disease include fever, muscle pain, headache, loss of appetite, vomiting, and other flu-like symptoms at the early stage of infection. These can be treated using general fever medications, or the infected person develops immunity against the virus. However, in severe cases, symptoms can be serious, such as retinal lesions, meningoencephalitis, loss of memory, hallucinations, vertigo, and hemorrhagic fever. According to the data from the World Health Organization, only 0.5-2% of patients develop eye or ocular diseases, and less than 1% experience meningoencephalitis and hemorrhagic fever.

- Increased Awareness About Rift Valley Fever- The awareness of rift valley fever among both the public and healthcare professionals. This is due to several factors, including media coverage of rift valley fever outbreaks and educational campaigns by public health organizations. This increased awareness is leading to increased demand for awareness is leading to increased demand for rift valley fever treatment and prevention measures.

Challenges

- Inaccurate and Slow Diagnostics – Existing diagnostic tests for rift valley fever can be slow, expensive, and require specialized equipment, limiting access in resource-limited requins. Early detection and outbreak control are hampered by these bottlenecks. This is predicted to hamper the rift valley fever (RVF) treatment market growth in the upcoming period.

- High Development Cost is another Substantial Factor Posing Limitation on the Market Expansion in the Future Times.

- Limited Healthcare Resources Availability for the Treatment is Anticipated to Limit the Market Growth in the Forecast Period.

Rift Valley Fever (RVF) Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 2.06 billion |

|

Forecast Year Market Size (2035) |

USD 3.45 billion |

|

Regional Scope |

|

Rift Valley Fever (RVF) Treatment Market Segmentation:

Transmission Segment Analysis

In terms of transmission, the mosquito vector segment is anticipated to hold a prominent share of 70% in the global rift valley fever (RVF) treatment market during the forecast period on account of the higher proximity of infection transmission through mosquitoes, along with the lack of preventive methods in case of mosquito vector transmission. There is no requirement for direct contact with animals in case of transmission by mosquitoes, which makes it more dangerous and easier to spread. Such factors are estimated to boost the segment growth. Additionally, as the mosquitos are becoming the primary transmission route the rift valley fever prevention strategies increasingly target mosquito control. This further drive demand for insecticides, mosquito nets, and larvicides as a result driving the segment growth in this market.

Treatment Segment Analysis

The medication segment in the rift valley fever treatment market is predicted to hold the largest revenue share of 60% by the end of 2035. Several promising antiviral drugs are in the development pipeline for rift valley fever. These target different stages of the viral replication cycle, offering the potential for more effective treatment. The successful development and commercialization of these drugs would significantly boost the medication segment of the market. Medication for fever and pain alleviation can be used to treat symptoms of the moderate type of RVF; however, individuals coming with severe symptoms are not yet treated with any specific or approved therapies.

Our in-depth analysis of the global market includes the following segments:

|

Transmission |

|

|

Symptoms |

|

|

Distribution Channel |

|

|

Treatment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rift Valley Fever (RVF) Treatment Market - Regional Analysis

North American Market Forecasts

North America industry is expected to dominate majority revenue share of 35% by 2035. RVF is a mosquito borne viral disease that could be highly seen in Africa and North America. Anyhow, due to climate change and growing mosquito migration, there is a growing risk of rift valley fever outbreaks in North America. In 2020, there was an outbreak of rift valley fever in Texas that infected over 200 cattle. Furthermore, as the risk of RVF outbreaks grows in the North America region there is also a growing alertness of the disease among healthcare professionals and the general public. This is leading to an increased demand for information about rift valley fever and its treatment.

APAC Market Statistics

The rift valley fever treatment market in the Asia Pacific is predicted to grow significantly by the end of 2035. Rising disposable income and advancement in healthcare infrastructure in developing Asian countries such as India and China offer lucrative growth opportunities for the market in this region. Furthermore, growing spending on public health and biosecurity measures by governments further stimulates the market growth in the Asia Pacific region. Several pharmaceutical companies are actively involved in developing vaccines and antiviral drugs for RVF. Clinical trials Asia Pacific region hold promise for future market availability of effective rift valley treatments. Advancements in research and development are anticipated to contribute significantly to market expansion further.

Rift Valley Fever (RVF) Treatment Market Players:

- Novartis AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sanofi-aventis Groupe

- Abbott Laboratories

- Merck & Co., Inc.,

- Siemens Healthcare GmbH

- Pfizer Inc.

- Eli Lilly and Company

- Cipla Limited

- Kemwell Biopharma Private Limited

Recent Developments

- Cipla Limited to collaborate with Kemwell Biopharma Private Limited a leading global CDMO. The collaboration aims to make cost-effective biotherapeutics. To achieve this, a joint venture business will be established with the intention of breaking into the respiratory biosimilars market. In accordance with the terms of the agreement, the joint venture will make use of Cipla and Kemwell's complementary competencies for clinical development, end-to-end product development, regulatory filings, manufacturing, and biopharmaceutical product commercialization. The combination of Kemwell's biologics knowledge with Cipla's respiratory capability will hasten the release of these vital drugs.

- Sandroz, a subsidiary of Novartis, declared the acquisition of cephalosporin antibiotics business of GSK, to expand its portfolio in manufacturing antibiotics. Subject to the terms of the transaction, Sandoz would pay GSK USD 350 million at closing and up to a further milestone amount of USD 150 million. Subject to customary closing conditions, such as legal clearance, the transaction should be completed in the second half of 2021.

- Report ID: 3640

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.