Rice Husk Ash Market - Regional Analysis

Asia Pacific Market Insights

The Asia-Pacific is expected to account for 43.5% of the worldwide rice husk ash market by 2035 due to the region's substantial rice cultivation and rising demand for environmentally friendly building materials. Rice Husk Ash (RHA) is gaining popularity in the region in terms of its sustainable construction and industrial uses. An article in Materials discovered that cement can be made 30% less permeable and 35% less chloride-diffusive by substituting cement with RHA, which improves the longevity of cement in hostile environments. Additionally, studies conducted in Discover Sustainability indicated that a 100 percent burned RHA contained 87% to 97% silica (SiO 2), which renders it very reactive and a good pozzolanic material when used in cement and concrete. Furthermore, a study conducted in the Philippines exhibited that the addition of 10% RHA in a concrete mix raised compressive strength to approximately 19.68 MPa, whereas the 15% and 20% replacements were a bit below. Also, the 10% replacement mix by RHA was approximately 4.4% less expensive than traditional concrete.

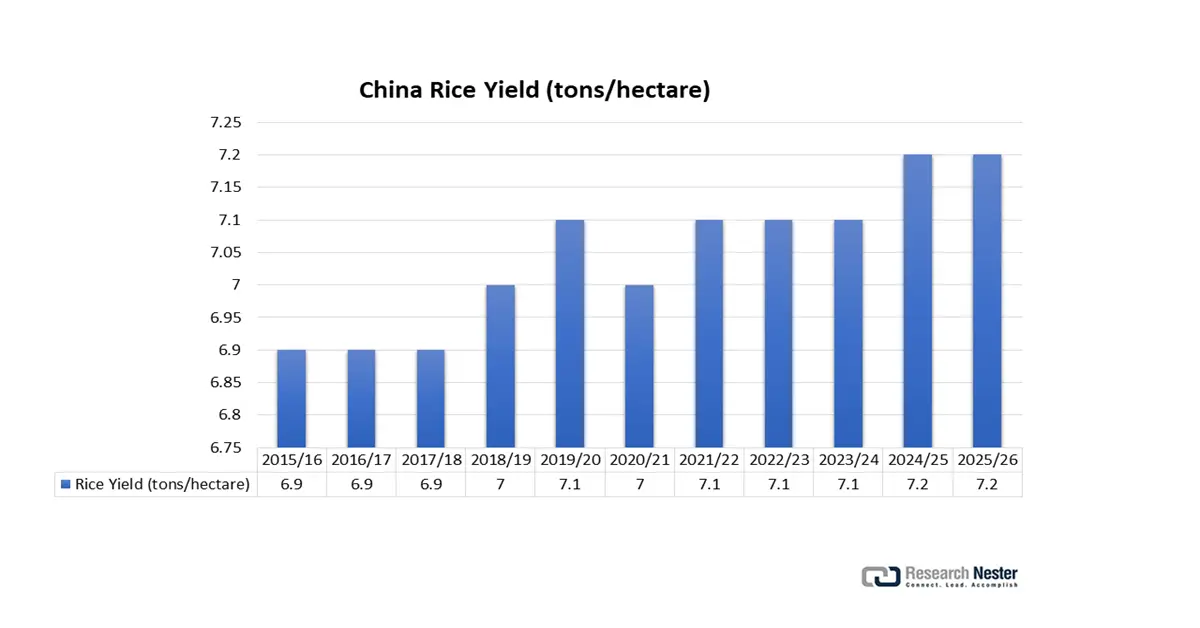

By 2035, China’s rice husk ash market is projected to dominate the Asia Pacific region with the largest revenue share, owing to its extensive rice output, significant government investment, and growing building industry. China has a leading position in the Asia-Pacific rice husk ash market because it has a huge production of rice, and its construction industry is also huge. According to the Government of China in 2021, the production of the construction industry amounted to RMB 29.3 trillion (USD 4.22 trillion), which indicates that the demand in the country is high in terms of construction materials. In addition, according to the National Bureau of Statistics of China, the cement production in the country was 2.377 billion tons in 2020 with an annual growth of 1.6%. Moreover, in September 2024, at the national level, 8,429 green building materials certifications were issued, which indicates that China is increasingly interested in the practice of sustainable construction. This growing interest in the use of eco-friendly materials helps the growing requirement of rice husk ash as an ecologically friendly cementitious option in the Chinese market.

Source: usda.gov

The rice husk ash market in India is anticipated to grow with the fastest CAGR from 2026 to 2035. Government support for sustainable materials, the nation's thriving building industry, and the growing use of RHA in a variety of applications are all factors contributing to this expansion. The Indian government has been encouraging the use of agricultural residues such as rice husk in a sustainable manner by initiating multiple projects. For example, the campaign that was advanced by the Ministry of New and Renewable Energy (MNRE) to use biomass as a power source, such as rice husk. Such projects are to decrease reliance on fossil energy and encourage more environmentally friendly energy sources. Furthermore, the Department of Science & Technology (DST) has been involved in the creation of technologies that turn rice husk into value-added products, thus making the manufacturing of RHA economically viable. Moreover, the encouragement of biofertilizers and organic nutrients by the government is also meant to lower the use of chemical fertilizers and improve the health of the soil, hence helping in sustainable farming. Such initiatives add to the supply of rice husk, which is one of the primary raw materials to produce RHA, and strengthen the prospects of market growth.

North America Market Insights

The North American rice husk ash market is projected to grow with a significant revenue share of 28.8% over the forecast period. This growth is supported by increasing preference towards a more sustainable construction and agriculture. By June 1, 2025, there were 69.7 million cwt of rough rice stocks held by the U.S., which is 15% higher than the stock held the year before. As the U.S. produces and stores millions of tons a year of rice, the husk waste generated presents a huge potential for Rice Husk Ash (RHA) production. This increasing number of agricultural leftovers directly promotes the movement of sustainable materials such as RHA in the construction and agricultural sectors in North America. In addition, RHA is on the increase in use as the demand for cement, silica, and insulation industries rises. RHA can be included as an additional cementitious material by the environmental agencies, such as the U.S EPA, in support of its use in green building practices. The growing interest in Canada in taking advantage of biomass can also be viewed as supporting the growth of RHA in the region.

The rice husk ash market in the U.S. is likely to lead the North America region with the highest revenue share by 2035. In 2021, the United States was also able to produce 191.6 million hundredweight (cwt) of rough rice, of which nearly 75% was long-grain rice. Some of the major areas of rice production are California, Arkansas, and the Mississippi Delta. The U.S is the fifth largest rice exporter in the world, with 40-45% of the total rice produced in the country being exported. When implemented in practice, it lowers carbon emissions by substituting Portland cement, which is in line with the U.S. sustainability objectives in the Inflation Reduction Act of 2022. Additionally, the U.S. EPA has accepted rice husk ash as an additional cementitious material containing a large amount of silica with the ability to improve concrete performance and sustainable building, Furthermore, price in California is traditionally between USD 3.31 and USD 11.02/tons of rice husk ash, which is far below the viability threshold of power plants and comparable to other supplementary cementitious materials.

Canada’s rice husk ash market is predicted to grow steadily over the projected years from 2026 to 2035. Canada imports rice and its byproducts to be used in industries and research. In 2022, the value of imported rice in Canada was about USD 122 million, and it was mainly imported by the U.S. and Thailand. Despite low domestic production of rice, imports play a role in the availability of rice husks, which offer an increasing chance of production of Rice Husk Ash (RHA). This underpins the growing attention to sustainable materials and circular economy projects in the construction and agriculture of Canada. The demand for RHA arises from its usage as a pozzolanic substance in concrete and its implementation as a soil conditioner in agriculture. As the federal sustainability targets in construction operations are established through the Green Infrastructure Fund, RHA is becoming a hot research topic and a target of construction companies. The Canadian Standards Association (CSA) is evaluating bio-based SCMs, such as RHA, to be included in the green building code in the future. Even though the data is scant, the push towards circular economy practices by Canada places the country as an expanding RHA market through imports.

Europe Market Insights

Europe’s rice husk ash market is anticipated to grow significantly with a revenue share of 23.6% during the projected years by 2035, attributed to the growing need for sustainable materials in the metallurgy, building, and agricultural sectors. According to Eurostat, biomass production in agriculture in the EU is high, with a considerable percentage being used in the energy and construction industries, under sustainability frameworks. In addition, the Joint Research Centre (JRC) of the European Commission also releases combined assessments on biomass production and utilization, helping the EU transition to green policies by utilizing materials sustainably, such as the use of rice husk ash in construction. These initiatives underpin the expansion and environmental applicability of rice husk ash into the market of sustainable materials in Europe.

Additionally, Germany rice husk ash market is likely to have the largest revenue share in the European rice husk ash market. Its sophisticated industrial sector, attention on sustainable practices, and large investments in green technologies are all responsible for this. For instance, Weber & Schaer, based in Germany, are enforcing the idea of sustainable silicas based on rice husk ash (RHA), which also proves that there is an increasing interest in biomaterials based on RHA in industry. This is an indicator of the wider German direction towards the manufacture of raw materials that are eco-friendly. These efforts will help in supporting the increased demand for RHA in the construction, rubber, and chemical industries in the nation. Germany's leadership in the rice husk ash market is further supported by its national climate neutrality plans and its dedication to the European Green Deal.