Rice Husk Ash Market Outlook:

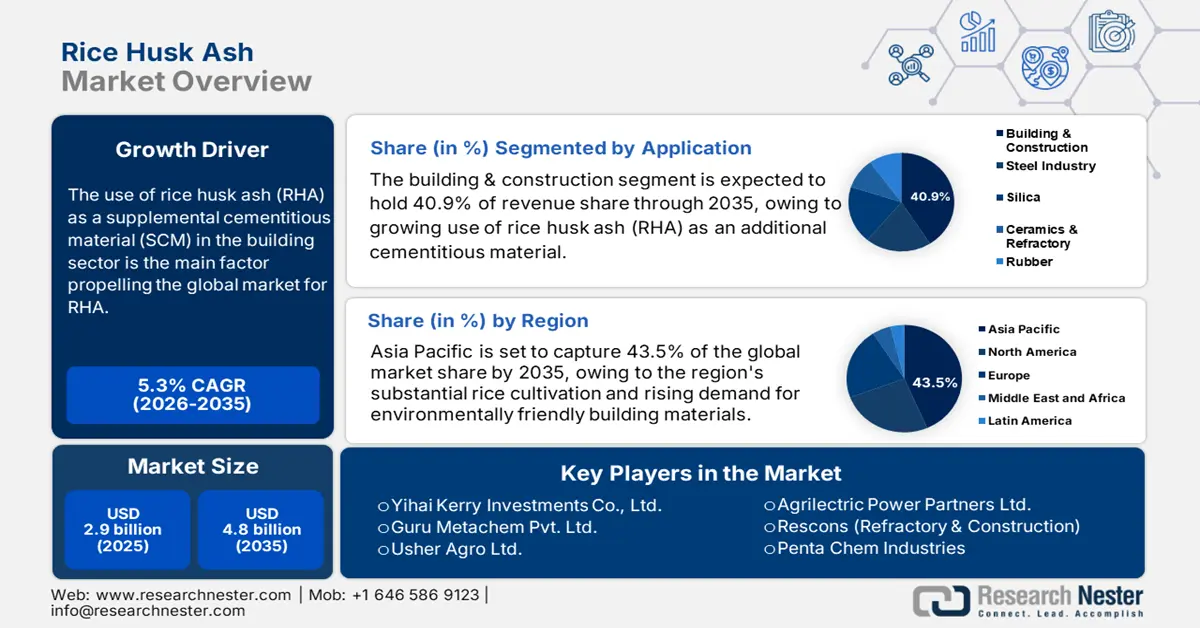

Rice Husk Ash Market size was valued at USD 2.9 billion in 2025 and is projected to reach USD 4.8 billion by the end of 2035, rising at a CAGR of 5.3% during the forecast period from 2026 to 2035. In 2026, the industry size of rice husk ash is estimated at USD 3.2 billion.

The rice husk ash market is expected to expand notably during the projected period, primarily driven by the use of rice husk ash (RHA) as a supplemental cementitious material (SCM) in the building sector. Because of its high silica concentration, RHA is a sustainable substitute for conventional cement in concrete, increasing its strength and longevity. The implementation of RHA has also been accelerated by government programs supporting sustainable construction methods. To illustrate its potential for infrastructure projects, the U.S. Department of Transportation, for example, has investigated the use of RHA in flowable fill concrete mix materials.

Moreover, the consistent supply of rice husks, a byproduct of rice milling, which in turn relies on the global rice production volume, is another factor driving rice husk ash market growth. The Food and Agriculture Organization (FAO) reports that the world production of rice on a milled basis has attained a production of about 517.1 million tons in 2021, a slight improvement of about 0.7% over the last year. Additionally, the FAO forecasts a turnaround with the world rice production projected to be at 543 million tonnes in the 2024/25 season due to good growing conditions, especially in India, Cambodia, and Myanmar. This continuous large amount of rice production guarantees a constant supply of rice husks, which may be burnt or refined to produce rice husk ash, which is a very important raw material in several manufacturing activities, including cement replacement and stabilization of soil.

The production of rice is inextricably related to the RHA supply chain, as rice husks are a by-product of milling. In India, for instance, almost 120 million tons of rice husk are produced each year. This plentiful supply helps RHA increase its manufacturing capabilities. However, consistent RHA quality is hampered by the absence of standardized processing techniques and quality control procedures. However, the global mobility of rice and its byproducts indicates a possibility for RHA trade, particularly in places with substantial rice production, even though detailed import/export statistics on RHA are scarce. Enhancing RHA processing methods and broadening its uses require research and development expenditures.

The U.S. Bureau of Labor Statistics has a PPI of Processed foods and Feeds Milled Rice (Including second heads, screenings, brewers, Bran, Sharps, Rice Flour, and Byproducts) in series WPU 02130201. This index, as of August 2025, was 163.095 (June 1984=100). In addition, the industry sources reveal that the prices for RHA are dependent on purity and usage. For example, in Panipat, India, RHA is estimated to cost 1000 rupees per 60-foot container, whereas in Ahmedabad, Gujarat, it costs 15 to 50 rupees per kilogram, depending on purity and form. Such prices are affected by the content of silica, the particle size, and the purpose for which they are to be used in high-performance concrete and ceramics.

Key Rice Husk Ash Market Insights Summary:

Regional Highlights:

- By 2035, the Asia-Pacific region is expected to command a 43.5% share of the Rice Husk Ash Market, driven by substantial rice cultivation and rising demand for eco-friendly building materials.

- North America is projected to secure a 28.8% share through 2035, owing to increasing adoption of sustainable construction and agriculture materials.

Segment Insights:

- By 2035, the building & construction segment of the Rice Husk Ash Market is poised to achieve a 40.9% share, propelled by the growing use of RHA as an additional cementitious material.

- The 85–89% silica content segment is anticipated to hold a 36.8% share by 2035, supported by its high pozzolanic activity for efficient construction applications.

Key Growth Trends:

- Increased pozzolanic activity driving cement and chemical additives demand

- Increased demand for low-carbon concrete additives

Major Challenges:

- High processing costs and energy requirements

- Stringent environmental regulations

Key Players: Yihai Kerry Investments Co., Ltd., Guru Metachem Pvt. Ltd., Usher Agro Ltd., Agrilectric Power Partners Ltd., Rescon (Refractory & Construction), Penta Chem Industries, Eco-Sil Ltd., Cargill Inc., Guru Corporation, Tokuyama Corporation, EnPower Green Energy, RK Chemicals, Imerys Performance Additives, PT Siam-Indo Gypsum Industry, Silicarbo Industries.

Global Rice Husk Ash Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.9 billion

- 2026 Market Size: USD 3.2 billion

- Projected Market Size: USD 4.8 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia-Pacific (43.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, India, United States, Japan, Brazil

- Emerging Countries: Indonesia, Vietnam, Thailand, Turkey, Mexico

Last updated on : 30 September, 2025

Rice Husk Ash Market: Growth Drivers and Challenges

Growth drivers

- Increased pozzolanic activity driving cement and chemical additives demand: Recent improvements in the thermal treatment of rice husk ash (RHA) have greatly amplified its reactive silica content, which would typically be over 85%-90% and which can increase its pozzolanic potential. This renders RHA a powerful and useful cementitious material (SCM) that enhances the strength and durability of the concrete, besides minimizing the use of clinker, which is the main source of CO2 emissions during cement manufacturing. The cement industry emits about 8% of the total carbon dioxide emissions in the world, as reported by the World Economic Forum. The replacement of clinker with RHA will allow manufacturers to decrease their carbon footprint and meet more stringent environmental requirements. This not only pushes the demand for RHA in cement but also serves as part of a sustainable chemical additive in industrial applications, which is part of the global movement towards the use of green construction materials.

- Increased demand for low-carbon concrete additives: The cement sector is responsible for close to 8% of the anthropogenic CO2 emissions throughout the globe, and low-carbon alternatives are therefore a priority as per the global climate schemes like the Paris Agreement. As a partial replacement of clinker in concrete manufacture, rice husk ash (RHA) is already gaining popularity because of its high silica content and its pozzolanic reactivity; it emits less CO2 per ton of cementitious material manufactured. The strict carbon tax and emission trading policies by the European Union are also an added incentive to the implementation of SCMs such as RHA in construction. This pushes manufacturers who operate with RHA to comply with regulatory guidelines and also achieve enhanced sustainability credentials to fuel market growth in areas impacted by decarbonization policies that are aggressive, as seen in the EU

- Nanotechnology and material science innovation: Rice husk ash (RHA) will be put forward as a useful raw material in the production of silica nanoparticles as catalysts and additives in modern chemical production. The nanoparticles that have been produced through RHA are highly surface-area and pure, improving the catalyst performance and the product in various industries such as the pharmaceutical and polymer industries. The U.S. Environmental Protection Agency (EPA) acknowledges the possibility of nanotechnology in promoting green chemistry to have more efficient processes that are less wasteful. The use of RHA in the synthesis of nanomaterials is a suitable choice in terms of sustainability since it involves the use of agricultural waste and minimization of silica, which is mined. This technology innovation is also expanding the high-value markets of RHA to help it increase the demand in specialty chemical industries.

1. Rising Rice Production & Raw Material Output Driving Rice Husk Ash Supply

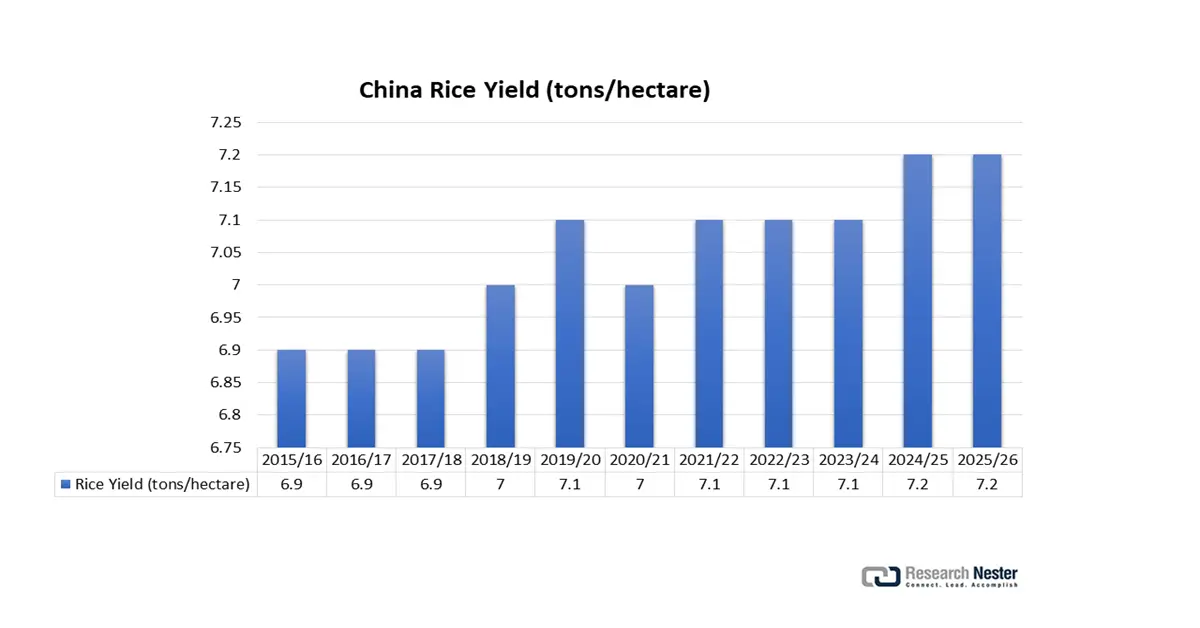

Rice Production Trends Driving Rice Husk Ash Supply in China

|

Market Year |

Area (1000 Ha) |

Milled Production (1000 Tons) |

Rough Production (1000 Tons) |

Yield (T/Ha) |

|

2015/2016 |

30,784 |

148,499 |

212,141 |

6.89 |

|

2016/2017 |

30,746 |

147,766 |

211,094 |

6.87 |

|

2017/2018 |

30,747 |

148,873 |

212,676 |

6.92 |

|

2018/2019 |

30,189 |

148,490 |

212,129 |

7.03 |

|

2019/2020 |

29,690 |

146,730 |

209,614 |

7.06 |

|

2020/2021 |

30,076 |

148,300 |

211,857 |

7.04 |

|

2021/2022 |

29,921 |

148,990 |

212,843 |

7.11 |

|

2022/2023 |

29,450 |

145,946 |

208,494 |

7.08 |

|

2023/2024 |

28,949 |

144,620 |

206,600 |

7.14 |

|

2024/2025 |

29,007 |

145,275 |

207,536 |

7.15 |

|

2025/2026 |

29,000 |

146,000 |

208,571 |

7.19 |

Source: usda.gov

U.S. Rice Acreage Trends Driving Rice Husk Ash Market Growth

|

Year |

Planted (Million Acres) |

Harvested (Million Acres) |

|

2016 |

3.15 |

3.10 |

|

2017 |

2.46 |

2.37 |

|

2018 |

2.95 |

2.91 |

|

2019 |

2.55 |

2.48 |

|

2020 |

3.03 |

2.98 |

|

2021 |

2.53 |

2.48 |

|

2022 |

2.22 |

2.17 |

|

2023 |

2.90 |

2.85 |

|

2024 |

2.91 |

2.87 |

|

2025 |

2.82 |

2.76 |

Source: usda.gov

2. Import/Export Trends

U.S. Rice Exports Driving Rice Husk Ash Market Growth

|

Market |

Shipments (1,000 tons) |

|

Mexico |

638.1 |

|

Central America |

533.3 |

|

Haiti |

421.0 |

|

Japan |

293.0 |

|

Canada |

250.7 |

|

Colombia |

136.0 |

|

South Korea |

132.0 |

|

Iraq |

111.3 |

|

Saudi Arabia |

100.6 |

|

Venezuela |

82.4 |

|

Jordan |

64.8 |

|

Taiwan |

56.1 |

|

Dominican Republic |

25.9 |

|

United Kingdom |

24.9 |

Source: usda.gov

Challenges

- High processing costs and energy requirements: RHA is produced in several steps, including collection, transportation, burning, and processing, all of which need a significant amount of energy and sophisticated machinery. These specifications result in higher production costs, which reduce the competitiveness of RHA-based goods in comparison to alternatives. In addition, the purification to high levels (amorphous) of silica requires strict regulation of the combustion temperatures (usually 600‑800 °C), specialized furnaces, filtering equipment, grinding and milling machines. The features of such equipment, such as the cost of fuel, skilled labor, and maintenance, result in huge fixed and operating costs. Lack of efficiency in transportation and unpredictable availability of raw husk are major issues in most of the developing areas, which also increases per unit prices, rendering RHA less competitive compared to cheaper alternatives.

- Stringent environmental regulations: It takes a lot of testing, certification, and investment in sustainable operations to meet environmental criteria. This procedure is expensive and time-consuming. Moreover, the rules about the emissions of particulate matter, volatile organic compounds, heavy metals, and crystalline silica that should not be present in the aerosol subject the operations to tight compliance. Toxicology testing, lab-scale tests, monitoring, record keeping, and legal/accreditation fees are associated with obtaining certifications (as in the case of REACH in the EU, ASTM, ISO, GB/T). Also, environmental impact tests, treatment of wastewater, and permitting can slow down project starts by months or even years, increasing the overall cost and risk for the producer.

Rice Husk Ash Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 2.9 billion |

|

Forecast Year Market Size (2035) |

USD 4.8 billion |

|

Regional Scope |

|

Rice Husk Ash Market Segmentation:

Application Segment Analysis

The building & construction segment in the rice husk ash market is projected to gain about 40.9% share through 2035. The growing use of rice husk ash (RHA) as an additional cementitious material is responsible for the building and construction sub-segment's dominance. By using less cement, RHA improves the strength and durability of concrete while also having positive environmental effects. Husk Ash (RHA) is an environmentally-friendly pozzolana used in building and construction to enhance the strength and durability of concrete. In addition, carbon emissions can be minimized with the help of replacing 15% of cement with RHA and improving the concrete properties.

RHA, as a concrete additive, increases durability, lowers permeability, and is a cement additive that enhances compressive strength. As per the research, compressive strength was boosted by 2.4% to 18.7% when cement content was substituted with RHA by 5% to 20% during 1-28 days. RHA is a viable substitute for cement replacement as it reduces cement consumption and carbon dioxide emissions. In another experimental research, it was found that 10% RHA replacement enhanced compressive strength by 6% over 56 days as compared to control mixes. The findings justify the implementation of RHA in green building operations, which will lessen the impact of cement-based materials on the environment.

Silica Content Segment Analysis

The 85-89% silica content segment in the rice husk ash market is expected to grow with a substantial revenue share of 36.8% over the projected years. Rice Husk Ash (RHA) that has 85-89% silica content is generally considered to possess a high pozzolanic activity and thus can be used in cement, concrete, and other industrial works. Such a level of silica is normally obtained by moderate burning conditions, especially with temperatures falling between 600 °C and 800 °C, with the subsequent use of an adequate cooling measure. Furthermore, a thorough study shows that the SiO 2 content of RHA is normally 76.4% to 97.9%, with the 85%-90% range most commonly observed under optimized processing. This segment is strategically important because of its performance/cost-efficiency in construction use.

Reactive pozzolanic ash in the 85-89% silica content range has a high proportion of amorphous silica along with a fine texture that makes it highly reactive in cementitious systems. As an illustration, a comparative test of silica fume and ground Rice Husk Ash (RHA) revealed that an RHA sample containing 82.9% SiO2 produced pozzolanic reactivity comparable to silica fume in strength increases in blended cement pastes and concretes during different curing stages. In addition, the general-purpose grade subsegment (in contrast) consists of RHA of similar silica content and less fineness or purity, which is used in non-critical construction mixes and provides moderate strength additions.

Product Form Segment Analysis

Powdered RHA is expected to experience a continuous growth over the estimated period between 2026 and 2035 because of its fine particles, which make it react better with cement, resulting in a higher level of strength and durability. For example, ground RHA with a substitution of 10-15% of cement demonstrated an increase in strength of approximately 11.4 percent compared to control concrete at 28 days. Furthermore, one patent outlines RHA nodules with low bulk density (0.72‑0.75 g/cm³), high apparent porosity (58-60%), and workable crushing strength (15‑25 kg/cm²) for use in making heat-insulating materials. Official studies often made on granules are aligned with most studies that have been conducted on powder and nodules, because the size of the particle has a significant effect on the pozzolanic activity and use in either concrete or insulation.

Our in-depth analysis of the rice husk ash market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Silica Content |

|

|

Product Form |

|

|

Process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rice Husk Ash Market - Regional Analysis

Asia Pacific Market Insights

The Asia-Pacific is expected to account for 43.5% of the worldwide rice husk ash market by 2035 due to the region's substantial rice cultivation and rising demand for environmentally friendly building materials. Rice Husk Ash (RHA) is gaining popularity in the region in terms of its sustainable construction and industrial uses. An article in Materials discovered that cement can be made 30% less permeable and 35% less chloride-diffusive by substituting cement with RHA, which improves the longevity of cement in hostile environments. Additionally, studies conducted in Discover Sustainability indicated that a 100 percent burned RHA contained 87% to 97% silica (SiO 2), which renders it very reactive and a good pozzolanic material when used in cement and concrete. Furthermore, a study conducted in the Philippines exhibited that the addition of 10% RHA in a concrete mix raised compressive strength to approximately 19.68 MPa, whereas the 15% and 20% replacements were a bit below. Also, the 10% replacement mix by RHA was approximately 4.4% less expensive than traditional concrete.

By 2035, China’s rice husk ash market is projected to dominate the Asia Pacific region with the largest revenue share, owing to its extensive rice output, significant government investment, and growing building industry. China has a leading position in the Asia-Pacific rice husk ash market because it has a huge production of rice, and its construction industry is also huge. According to the Government of China in 2021, the production of the construction industry amounted to RMB 29.3 trillion (USD 4.22 trillion), which indicates that the demand in the country is high in terms of construction materials. In addition, according to the National Bureau of Statistics of China, the cement production in the country was 2.377 billion tons in 2020 with an annual growth of 1.6%. Moreover, in September 2024, at the national level, 8,429 green building materials certifications were issued, which indicates that China is increasingly interested in the practice of sustainable construction. This growing interest in the use of eco-friendly materials helps the growing requirement of rice husk ash as an ecologically friendly cementitious option in the Chinese market.

Source: usda.gov

The rice husk ash market in India is anticipated to grow with the fastest CAGR from 2026 to 2035. Government support for sustainable materials, the nation's thriving building industry, and the growing use of RHA in a variety of applications are all factors contributing to this expansion. The Indian government has been encouraging the use of agricultural residues such as rice husk in a sustainable manner by initiating multiple projects. For example, the campaign that was advanced by the Ministry of New and Renewable Energy (MNRE) to use biomass as a power source, such as rice husk. Such projects are to decrease reliance on fossil energy and encourage more environmentally friendly energy sources. Furthermore, the Department of Science & Technology (DST) has been involved in the creation of technologies that turn rice husk into value-added products, thus making the manufacturing of RHA economically viable. Moreover, the encouragement of biofertilizers and organic nutrients by the government is also meant to lower the use of chemical fertilizers and improve the health of the soil, hence helping in sustainable farming. Such initiatives add to the supply of rice husk, which is one of the primary raw materials to produce RHA, and strengthen the prospects of market growth.

North America Market Insights

The North American rice husk ash market is projected to grow with a significant revenue share of 28.8% over the forecast period. This growth is supported by increasing preference towards a more sustainable construction and agriculture. By June 1, 2025, there were 69.7 million cwt of rough rice stocks held by the U.S., which is 15% higher than the stock held the year before. As the U.S. produces and stores millions of tons a year of rice, the husk waste generated presents a huge potential for Rice Husk Ash (RHA) production. This increasing number of agricultural leftovers directly promotes the movement of sustainable materials such as RHA in the construction and agricultural sectors in North America. In addition, RHA is on the increase in use as the demand for cement, silica, and insulation industries rises. RHA can be included as an additional cementitious material by the environmental agencies, such as the U.S EPA, in support of its use in green building practices. The growing interest in Canada in taking advantage of biomass can also be viewed as supporting the growth of RHA in the region.

The rice husk ash market in the U.S. is likely to lead the North America region with the highest revenue share by 2035. In 2021, the United States was also able to produce 191.6 million hundredweight (cwt) of rough rice, of which nearly 75% was long-grain rice. Some of the major areas of rice production are California, Arkansas, and the Mississippi Delta. The U.S is the fifth largest rice exporter in the world, with 40-45% of the total rice produced in the country being exported. When implemented in practice, it lowers carbon emissions by substituting Portland cement, which is in line with the U.S. sustainability objectives in the Inflation Reduction Act of 2022. Additionally, the U.S. EPA has accepted rice husk ash as an additional cementitious material containing a large amount of silica with the ability to improve concrete performance and sustainable building, Furthermore, price in California is traditionally between USD 3.31 and USD 11.02/tons of rice husk ash, which is far below the viability threshold of power plants and comparable to other supplementary cementitious materials.

Canada’s rice husk ash market is predicted to grow steadily over the projected years from 2026 to 2035. Canada imports rice and its byproducts to be used in industries and research. In 2022, the value of imported rice in Canada was about USD 122 million, and it was mainly imported by the U.S. and Thailand. Despite low domestic production of rice, imports play a role in the availability of rice husks, which offer an increasing chance of production of Rice Husk Ash (RHA). This underpins the growing attention to sustainable materials and circular economy projects in the construction and agriculture of Canada. The demand for RHA arises from its usage as a pozzolanic substance in concrete and its implementation as a soil conditioner in agriculture. As the federal sustainability targets in construction operations are established through the Green Infrastructure Fund, RHA is becoming a hot research topic and a target of construction companies. The Canadian Standards Association (CSA) is evaluating bio-based SCMs, such as RHA, to be included in the green building code in the future. Even though the data is scant, the push towards circular economy practices by Canada places the country as an expanding RHA market through imports.

Europe Market Insights

Europe’s rice husk ash market is anticipated to grow significantly with a revenue share of 23.6% during the projected years by 2035, attributed to the growing need for sustainable materials in the metallurgy, building, and agricultural sectors. According to Eurostat, biomass production in agriculture in the EU is high, with a considerable percentage being used in the energy and construction industries, under sustainability frameworks. In addition, the Joint Research Centre (JRC) of the European Commission also releases combined assessments on biomass production and utilization, helping the EU transition to green policies by utilizing materials sustainably, such as the use of rice husk ash in construction. These initiatives underpin the expansion and environmental applicability of rice husk ash into the market of sustainable materials in Europe.

Additionally, Germany rice husk ash market is likely to have the largest revenue share in the European rice husk ash market. Its sophisticated industrial sector, attention on sustainable practices, and large investments in green technologies are all responsible for this. For instance, Weber & Schaer, based in Germany, are enforcing the idea of sustainable silicas based on rice husk ash (RHA), which also proves that there is an increasing interest in biomaterials based on RHA in industry. This is an indicator of the wider German direction towards the manufacture of raw materials that are eco-friendly. These efforts will help in supporting the increased demand for RHA in the construction, rubber, and chemical industries in the nation. Germany's leadership in the rice husk ash market is further supported by its national climate neutrality plans and its dedication to the European Green Deal.

Key Rice Husk Ash Market Players:

- Yihai Kerry Investments Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Guru Metachem Pvt. Ltd.

- Usher Agro Ltd.

- Agrilectric Power Partners Ltd.

- Rescon (Refractory & Construction)

- Penta Chem Industries

- Eco-Sil Ltd.

- Cargill Inc.

- Guru Corporation

- Tokuyama Corporation

- EnPower Green Energy

- RK Chemicals

- Imerys Performance Additives

- PT Siam-Indo Gypsum Industry

- Silicarbo Industries

There are both domestic and foreign companies operating in the rather fragmented rice husk ash market for rice husk ash chemicals. Using vertical integration, strong supply chains, and patented ash processing methods, market leaders Yihai Kerry, Guru Metachem, and Agrilectric Power control a large portion of the market. Important companies are aggressively growing their geographic reach and capability, especially in North America and the Asia Pacific. Product innovation, sustainable sourcing, and strategic partnerships are fueling competition. In addition, businesses such as Tokuyama and Imerys are using R&D for sophisticated material applications, whilst companies in Indonesia and India concentrate on affordable solutions and government-supported expansion initiatives.

Top Global Manufacturers in the Rice Husk Ash Market

Recent Developments

- In January 2025, Evonik declared the strategic merger of its business units Silica and Silanes to form a single segment called Smart Effects. The purpose of this restructuring will be to increase the capacity of the company in providing innovative and high-performance solutions to the various industries, such as automotive, coatings, and construction. Through the merger of both business units, Evonik aims to develop sustainable products and increase the level of circularity in its value chain. The new Smart Effects department will concentrate on the development of specialty materials that are less environmentally impactful and, in addition, fulfill the changing customer needs. The move underscores the fact that Evonik is concerned with its sustainability, innovation, and competitive edge in the global chemical markets.

- In January 2024, Solvay introduced its first bio-circular highly dispersible silica (HDS), made out of rice husk ash, in its plant at Livorno, Italy. This new product has lowered the amount of CO2 emissions per ton by half as compared to the regular silica in the same product category, in line with the international initiatives of ensuring sustainability in tire production. The introduction has been supported by the major tire manufacturers in the world and highlights the transformation of the chemical industry to circular raw materials. After this successful launch, Solvay has declared that it will also extend to North American and Asian production with plants likely to be completed by 2026, and that will further promote the use of sustainable materials worldwide.

- In January 2024, Evonik increased its output of precipitated silica significantly at one of its plants in Charleston, South Carolina. The demand of the tire industry, particularly that of green tires, which demand the use of sophisticated silica materials to enhance their performance and environmental improvement, is such that this growth is being fueled by this demand. This project will boost the capacity of production by 50%, and this will help Evonik be in a position to supply its customers in North America better and also cater to the emerging sustainable mobility market. The investment it has made not only consolidates Evonik's silica business but also strengthens its intentions towards regional growth and innovation. This innovation has been made in line with the sustainability objectives of Evonik, where it has encouraged the use of materials, which will lead to decreased fuel usage and less carbon emissions in automobiles.

- Report ID: 3376

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rice Husk Ash Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.