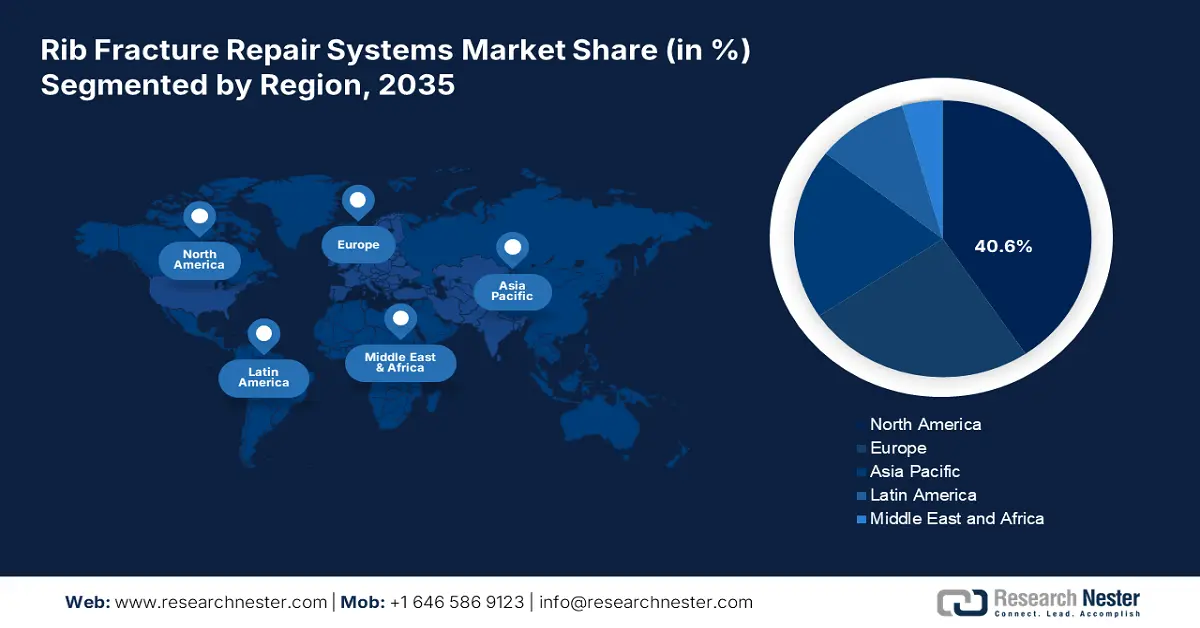

Rib Fracture Repair Systems Market - Regional Analysis

North America Market Insights

North America is expected to capture the highest share of 40.6% in the global market during the analyzed tenure. The continuous rise in trauma-related hospitalizations, an aging population, and favorable reimbursement policies are collectively cultivating a favorable business atmosphere for the merchandise in this region. Particularly, the growing number of thoracic injuries among older adults and patients with COPD is fueling the demand for surgical stabilization systems available in this sector.

According to the 2021 NLM findings, around 22-45 thousand people in the U.S. report rib fractures every year, costing more than an annual USD 469 million. Besides, a 10-year analysis from 2012 to 2021, published by the NLM in 2025, recorded a 52% and 96% increase in the rates of rib fracture incidence (per 100,000 people) and hospitalization across the country. These concerning figures are forcing the national medical system to adopt more advanced surgical tools from the market.

Canada is augmenting the rib fracture repair systems market steadily with massive public healthcare allocations and the growing focus on trauma and orthopedic care for elderly citizens. Particularly, dedicated organizations, including PHAC and BioteCanada, are actively promoting extensive research and early adoption of bio-compatible implants and minimally invasive techniques in this category. This subsequently encourages both domestic and foreign pioneers in this sector to invest in Canada on a larger scale.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global rib fracture repair systems market by the end of 2035. The concerning rise in trauma cases, a rapidly aging population, and supportive government initiatives are imposing favorable changes in the landscape. The region is primarily led by Japan, owing to the robust financial backing from the public authorities and a continuously expanding geriatric demography. Testifying to the same, a retrospective cohort study observed high occurrence rates of new fractures among patients aged 75 and over, accounting for 263 per 1000 person‐years, as per the NLM article published in 2024.

China is witnessing a steady rise in volumes of thoracic surgeries, which is ultimately propelling demand in the rib fracture repair systems market. According to the 2022 annual report from the Shanghai Chest Hospital, the count of these interventions in the facility surpassed a 10 thousand cases per year. Another estimation from the 2021 NLM study revealed that the number of patients in China with rib fractures ranged between 1.5 million and 2.0 million annually. Such a substantial patient population ultimately attracts greater investment in this sector.

India is also making strides in the rib fracture repair systems market with consistent government investments in trauma care infrastructure. The rising number of road traffic accidents and bone-related conditions is also contributing to the country’s growth in this sector by enlarging the consumer base. This is pushing the governing authorities of India to take prompt action to prevent accidental mortality nationwide. Regarding the same, in August 2023, a total of 196 trauma care facilities (TCFs) were sanctioned in government hospitals and medical colleges across the country.

Opportunities Presented by the Key Landscapes

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Switzerland |

2.2 billion |

500.1 million |

|

Netherlands |

1.1 billion |

1.2 billion |

|

Germany |

1.0 billion |

1.3 billion |

|

France |

470.4 million |

721.1 million |

|

Belgium |

323.3 million |

404.0 million |

|

Ireland |

175.2 million |

175.2 million |

|

Italy |

149.4 million |

310.8 million |

|

Spain |

88.1 million |

445.3 million |

|

UK |

85.9 million |

456.7 million |

Europe Market Insights

The Europe rib fracture repair systems market is estimated to garner a notable industry value from 2025 to 2037. This surge is primarily driven by an aging population and robust MedTech advances. In terms of progressive culture, government-led programs like NextGenerationEU and Horizon Europe are heavily investing in extensive medical device-related R&D, translating to massive improvement in the functionality and scalability of the existing product pipeline in this sector. In this regard, a report published by the International Journal of Basic & Clinical Pharmacology revealed that the region-wide annual expenditure on osteoporosis-related fractures can potentially rise from USD 43.0 billion to USD 89.2 billion by 2050.

The UK rib fracture repair systems market is growing steadily, with immense support from the National Health Service (NHS). On the other hand, osteoporosis-related fractures are becoming a severe medical crisis in the country, prompting service providers to accommodate reliable surgical fixation solutions for the enlarging patient population. Furthermore, the nation’s focus on improving trauma care services, alongside investments in advanced orthopedic technologies, also supports substantial growth in this sector.

Germany is a leading supplier of associated devices for the rib fracture repair systems market in Europe. The strong presence of MedTech innovators and manufacturers empowers the country’s significance in this landscape. Its large geriatric population also contributes to a steady expansion in the epidemiology of osteoporosis-related fractures and trauma cases. Moreover, the hospitals, due to being well-equipped with cutting-edge orthopedic technologies and surgeons, are acting as the major investors and growth factor behind the country’s impressive progress in this category.

Orthopaedic or Fracture Appliances, nes Trade by Country (2022)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Switzerland |

2.2 billion |

500.1 million |

|

Netherlands |

1.1 billion |

1.2 billion |

|

Germany |

1.0 billion |

1.3 billion |

|

France |

470.4 million |

721.1 million |

|

Belgium |

323.3 million |

404.0 million |

|

Ireland |

175.2 million |

175.2 million |

|

Italy |

149.4 million |

310.8 million |

|

Spain |

88.1 million |

445.3 million |

|

UK |

85.9 million |

456.7 million |

Source: WITS