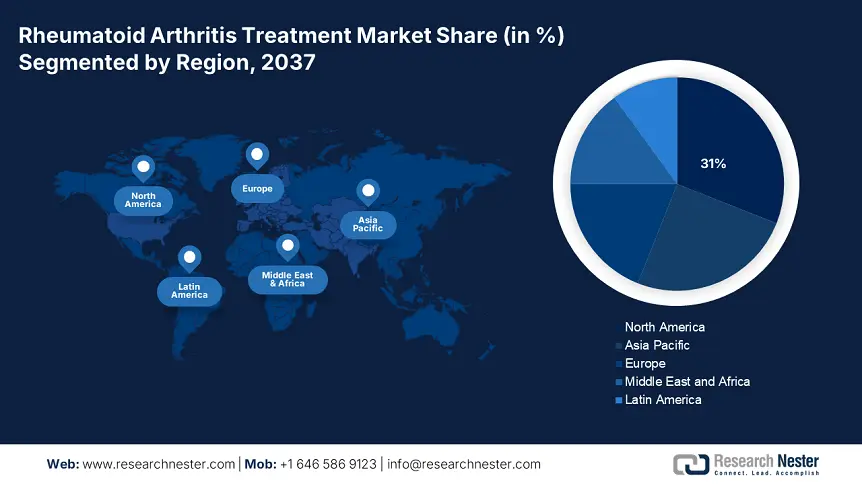

Rheumatoid Arthritis Treatment Market - Regional Analysis

North America Market Insights

North America is expected to dominate the global rheumatoid arthritis treatment market with a share of 31% by the end of 2037. The main drivers of this trend are the large number of people with rheumatoid arthritis (RA) in the population, a good payer system, and the rapid adoption of biologics and biosimilars more widely. In the United States, the existence of an integrated network of healthcare systems along with the expansion of Medicaid and Medicare coverage increased the demand. Also, new lanes that regulators have established and the use of real-world evidence have allowed biosimilars to gain traction at a faster rate. In Canada, the one-payer system and comprehensive provincial drug plan allow for equitable access. Overall, evidence suggests that biosimilars are experiencing a lot of uptake, and access trends in North America are also showing a significant uptake of biosimilars. Investments in implementation science in the areas of tele-rheumatology and digital monitoring or assessment tools are also enhancing adherence as well as outcomes.

The rheumatoid arthritis (RA) market in the U.S. is flourishing thanks to bipartisan support from federal and state agencies and payers. In fiscal year 2023, the National Institutes of Health's National Institute of Arthritis and Musculoskeletal and Skin Diseases (NIAMS Também) budget reached an astounding USD 675 million. Medicaid earmarked around USD Rates of on How-to Data for RA biologics and disease-modifying antirheumatic drugs for 2024. Other aspects of the U.S. RA market include 1) the rapid uptake of biosimilars once approved by the FDA, and the scope of telehealth enabled by improving CMS policy surrounding telehealth coverage, so that access has expanded for populations in rural areas. Finally, the investment in research for rheumatic diseases, through NIH grant programs and other investments, is steady and strong. Overall incorporation, the aligning of government funding, payer reimbursement, policies that advance the pace of change, and research investment are all contributing to growth in the U.S.

Canada's RA market benefits from single-payer provincial systems that foster considerable access to both biologics and the biosimilar products that are available. Ontario increased RA spending by 16% from 2021-2024. Public funding of RA Research from PHAC and the Canadian Institutes for Health Research is promoting home-grown innovation. Tele-rheumatology programs are extending care into rural communities. Innovative Medicines Canada is aligning with provincial payers to create opportunities for outcome-based drug reimbursement.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global rheumatoid arthritis treatment market by the end of 2037. Factors supporting growth include broadening the pathways for approving biosimilars, increasing and long-term burden of the disease, and increasing government funding. Overall, the region is entering a phase of growth that corresponds with increased access to biosimilars, effects from changes in reimbursement, changing demographics, and increasingly fluxing policy frameworks. According to the National Medical Products Administration (NMPA), in China, there were over 1 million identified RA patients in 2023. This resulted in a 14% increase in RA drug approvals. In India, ICMR acknowledges RA as a priority. The increased demand for services related to RA has been compounded by the growth of the senior population. For example, government spending on RA had reached USD 1 billion annually in 2023.

APAC Countries Spending and Developments

|

Country |

RA Patients (2023) |

2023 Spending (USD) |

Biologic/Biosimilar Access Notes |

|

Japan |

430,100 |

$9.5 billion |

Strong JAK inhibitor and biosimilar adoption |

|

Australia |

210,020 |

$2.2 billion |

Funded under PBS; rise in biologic use post-2021 |

|

Malaysia |

115,100 |

$241 million |

Formulary expansion since 2021, increased access |

|

South Korea |

650,100 |

$872 million |

High DMARD adoption, active biosimilar production |

Europe Market Insights

The Europe rheumatoid arthritis treatment market is estimated to garner a notable industry value from 2025 to 2037. The growth is driven by the global uptake of biosimilars, the availability of strong public reimbursement policies, and unique digitized patient registries across Europe. The developing Rx Guidance for biosimilars provided by the EMA and the EU pharmaceutical strategy that are promoting generic medicines will make a huge impact in Europe. Investments in primary care and access points have contributed to long-term cost reductions. The reimbursement practices in Italy and Spain have taken payment from cure to a sustainable implementation. The entire RA market is moving forward in Europe with better uptake of biosimilars, improved regulatory harmonization, and value-driven procurement.

Germany's forecast for RA continues to be the largest prop of the European RA market. The health system's high market share is propelled by its statutory health coverage. Germany is especially keen on RWE-based registries that help support value-based contracts. Increasing exposure to JAK inhibitors also bolsters the overall growth of the RA segment in Germany. The United Kingdom is well-positioned in the market owing to NHS-led biosimilar substitution. NICE health technology assessments help identify pricing models to increase cost-effective uptake rapidly. National registries such as the BSRBR-RA registries provide rapidly available safety/off-label use data. Notably, the United Kingdom is developing new value-based NHS commissioning for specific RA therapies. This will quantifiably tie reimbursement first to patient outcomes.