Reverse Logistics Market Outlook:

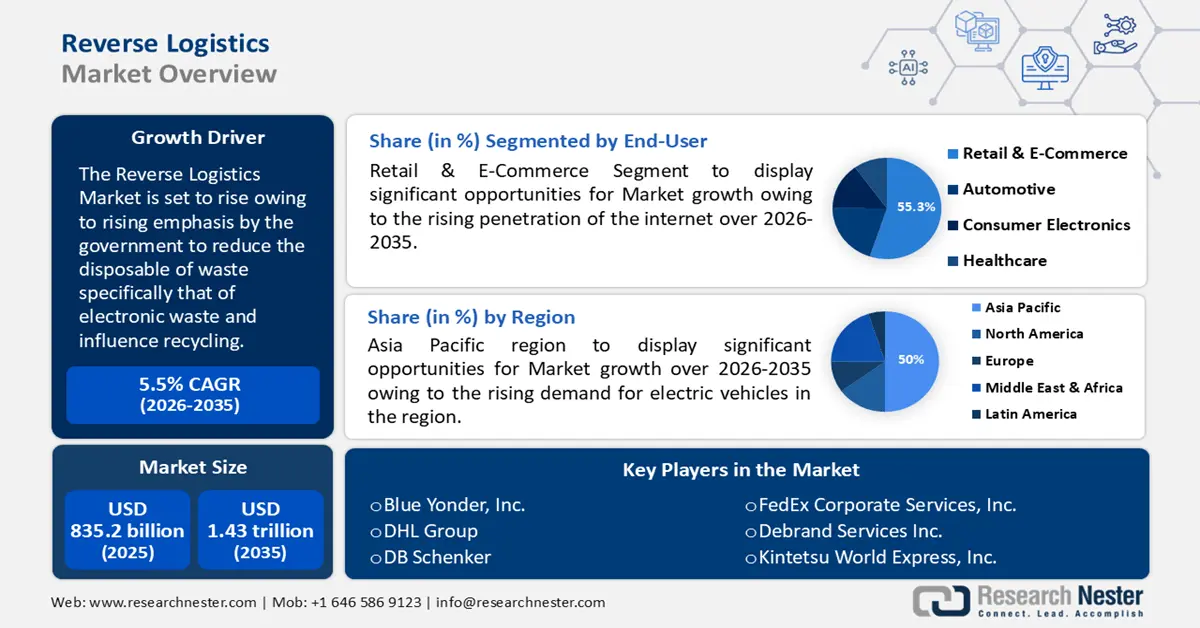

Reverse Logistics Market size was valued at USD 835.2 billion in 2025 and is expected to reach USD 1.43 trillion by 2035, expanding at around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of reverse logistics is evaluated at USD 876.54 billion.

The market growth is expected to be encouraged by rising emphases by the government to reduce the disposal of waste, specifically electronic waste, and influence recycling. A 2024 study by the United Nations Institute for Training & Research stated, over 62 million tonnes (Mt) of e-waste were disposed off in 2022 in the environment which is the highest by about 82% as compared to 2010 across the globe. Therefore, the government plays a key role in building reverse logistics infrastructure through funding, facilitating, and incentivizing, along with the strict rules, and regulations related to the product standard.

Key Reverse Logistics Market Insights Summary:

Regional Highlights:

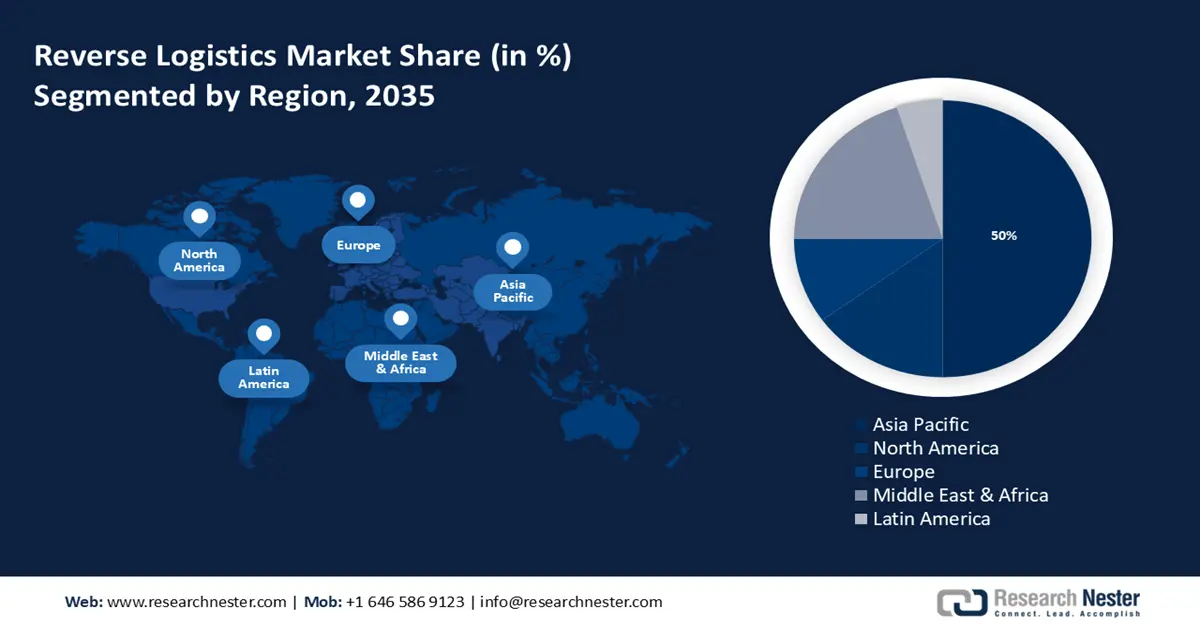

- The Asia Pacific reverse logistics market is anticipated to capture 50% share by 2035, driven by rising electric vehicle registrations.

- The Middle East & Africa market will register significant growth during the forecast timeline, driven by increased highway construction and logistics investments.

Segment Insights:

- The retail & e-commerce segment in the reverse logistics market is expected to achieve significant growth till 2035, driven by rising online shopping trends and growing product return volumes.

- The transportation segment in the reverse logistics market is expected to achieve notable CAGR till 2035, fueled by the importance of transportation in efficient return management.

Key Growth Trends:

- Surging utilization of automation & robotics in reverse logistics systems

- Growing e-commerce activity

Major Challenges:

- Uncertainty in the operation of reverse logistics

- High price of implementing reverse logistics

Key Players: FedEx Corporation, United Parcel Service, Inc. (UPS), DHL Supply Chain, XPO Logistics, Inc., C.H. Robinson Worldwide, Inc., DB Schenker, Kuehne+Nagel International AG, CEVA Logistics, Ryder System, Inc., Reverse Logistics Group (RLG).

Global Reverse Logistics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 835.2 billion

- 2026 Market Size: USD 876.54 billion

- Projected Market Size: USD 1.43 trillion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (50% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Reverse Logistics Market Growth Drivers and Challenges:

Growth Drivers

- Surging utilization of automation & robotics in reverse logistics systems - Robots minimize warehouse backlogs and economically provide returned goods with another opportunity to be marketed to customers as part of the reverse logistics process. According to the International Federation of Robotics data published in 2023, close to 4945 units of robots were installed in industries in India.

Moreover, autonomous mobile robots, or AMRs, collaborate with individuals to transport items to their proper destinations within distribution centers and minimize the backlog of returns. For instance, On 3 October 2023, Blue Yonder announced its partnership with GXO Logistics, Inc., to deploy innovative end-to-end supply chain software solutions to GXO direct network in the United States which includes the robotics hub. This further allows workers to concentrate on more urgent elements of the returns process rather than routine tasks, relieving them of laborious work. - Growing e-commerce activity - The success of any e-commerce business depends upon customer retention, and reverse logistics is one of the major operations that must be managed well to have a competitive advantage in terms of customer loyalty over their competitors.

The increasing online store's sales prime focus is on reverse logistics to earn more from discarded, defective, and waste products. As per the Research Nester’s research in 2024, retail e-commerce sales are predicted to cross USD 6 trillion in 2024 across the globe. Hence, it not only encourages sustainability in the environment but also builds trust among the customers to improve company revenue in the future. - The rising importance of blockchain technology in reverse logistics - Blockchain enables reverse logistics to track and manage a good's whole lifecycle more efficiently, from the time producers buy component materials to the time the product is disposed of. Consequently, the major companies in the logistics sector are currently experimenting with blockchain technology to enhance reverse logistics operations.

Blockchain technology additionally renders it simpler to track the performance of the suppliers in the logistics sector such as delivery, returns, spot difficulties with high return rates, and others. DB Schenker announced the collaboration with VeChain, on 12 June 2018, to develop a third-party evaluation system via blockchain. As a result, with the surging advancement of blockchain technology, the demand for reverse logistics is poised to expand.

Challenges

- Uncertainty in the operation of reverse logistics - The manufacturing or retail business is dependent on the logistics service provider, consequently, it lacks immediate authority over its operations.

In addition, there's an actual danger to the quality of the finished item because the manufacturer is unable to keep close tabs on warehouse activities. A confidentiality breach caused by outsourcing to a third-party reverse logistics (3PL) provider would also probably disclose client personal data or spread financially sensitive data. Therefore, the lack of supplier control over reverse transportation services is projected to limit reverse logistics market growth in the upcoming years. - High price of implementing reverse logistics - Reverse logistics process execution and oversight may prove expensive for companies. Hence, its expenses may have a detrimental effect on company margins, especially with low-value products.

Reverse Logistics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 835.2 billion |

|

Forecast Year Market Size (2035) |

USD 1.43 trillion |

|

Regional Scope |

|

Reverse Logistics Market Segmentation:

End-User Segment Analysis

Retail & e-commerce segment is projected to dominate reverse logistics market share of over 55.3% by 2035. Several factors that contribute to the growth of this segment are customer convenience to buy products remotely, the surging trend of online shopping, and growing internet penetration. According to the Research Nester's survey in 2024, more than 25 % of the world's population shop online. As a result, the volume of returns has also increased, leading retailers, & e-commerce companies to opt for strong reverse logistics processes to manage return products adequately.

Additionally, reverse logistics serves a vital role in the online shopping sector because it facilitates transportation and the replacement and reselling of items, all of which contribute to the growth of the segment in the market.

Return Type Segment Analysis

B2B returns & commercial return segment in the reverse logistics market is predicted to register lucrative growth till 2035. This segment's growth can be impelled by the surging concern associated with carbon emissions from B2B & commercial returns. As per Optoro 2021 Impact Report, returned inventory in the United States increased to USD 761 billion in 2021 from USD 428 billion in 2020. Moreover, e-commerce returns contribute to nearly 24 million metric tons of carbon dioxide emissions, each year. Nowadays, companies are becoming more aware of the return impact on the environment, thus, opting for reverse logistics to minimize carbon footprint.

Service Segment Analysis

The transportation segment in reverse logistics market is predicted to have notable growth in the revenue over the forecast period. In any logistics supply chain, the means of transport structure is the single most crucial element. An excellent transportation system provides enhanced performance in logistics, further reducing overall costs of operation and enhancing customer service. Therefore, a reliable transportation system is necessary to manage product returns efficiently, and effectively.

Our in-depth analysis of the global market includes the following segments:

|

Return Type |

|

|

Service |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Reverse Logistics Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 50% by 2035. This market growth in this region is expected to be dominated by rising demand for electric vehicles. For instance, a 2023 study by the International Energy Agency states that the number of electric automobile registrations in India increased by 70% year or by 80,000 units in 2024. On the other hand, 8.1 million new electric vehicle registrations emerged in China in 2023 accounting for a 35% growth over 2022. As a consequence, the demand for reverse logistics is also estimated to surge since with the rise in EV vehicles, the need for maintaining batteries has also grown. Reverse logistics allow EV users to replace or repair non-functioning batteries, which is why this market is observing growth in the APAC region.

Moreover, the market in China is also poised to rise owing to the rising demand for reverse logistics in the healthcare sector over the coming years.

Additionally, the Indian market for reverse logistics is set to show significant growth due to factors including growing demand for smartphones.

Furthermore, with the surge in investment made in encouraging digitalization, the market in Japan for reverse logistics is predicted to expand.

Middle East & Africa Market Insights

The Middle East & Africa reverse logistics market is projected to experience a significant rise in revenue over the forecast period. The main element set to encourage market expansion in this region is the growing construction of highways to ease transportation. For instance, the Saudi Eastern region observed the launch of close to USD 789 million road construction projects in 2023. On that account, the market is poised to observe a surge in this region.

Further, in this region, the Israel market for reverse logistics will also observe the highest growth in the upcoming years. This could be owing to the rising disposable income in this region.

Moreover, the South Africa market for reverse logistics is to expand over the forecast period. This growth in the reverse logistics market is predicted to be dominated by growing investment in logistics.

Reverse Logistics Market Players:

- Blue Yonder, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Debrand Services Inc.

- DB SCHENKER

- DHL Group

- FedEx Corporate Services, Inc.

- Kintetsu World Express, Inc.

- United Parcel Service of America, Inc.

- Reverse Logistics Group GmbH

- Core Logistic Private Limited

- Safexpress Pvt. Ltd.

The market for reverse logistics is set to rise owing to the growth of key players in this market. These key players are focusing on advancing their services and adopting novel methods for reverse logistics to sustain themselves in the market. Some of these key players include:

Recent Developments

- On October 12, 2023, Blue Yonder reported the completion of an acquisition agreement for Doddle, an initial and last-mile technology business. After finalization, the purchase will enable Blue Yonder to add full-circle expertise addressing the final mile, returns management, and reverse logistics solutions to its already outstanding range of supply chain management and commerce capabilities.

- On September 14, 2023, Debrand, situated in Canada, recently revealed the establishment of its new Surrey headquarters. Providing cutting-edge sorting technology for textile recovery, recycling, and reuse applications is expected to be the main goal of the new facility.

- Report ID: 6267

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Reverse Logistics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.