Reverse Factoring Market Outlook:

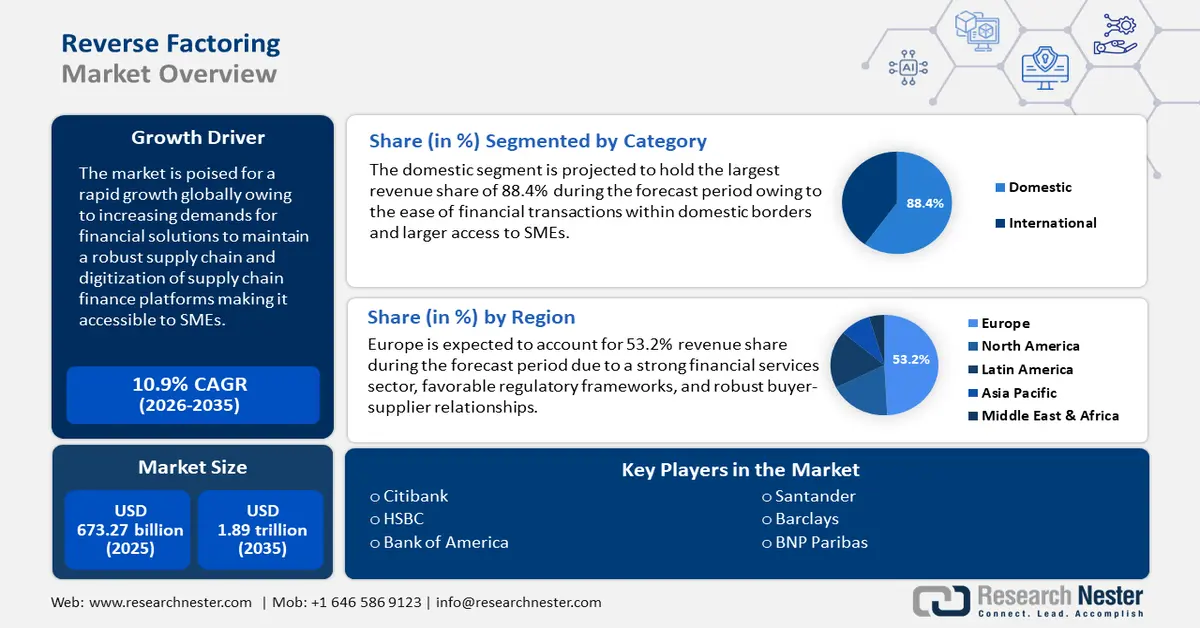

Reverse Factoring Market size was over USD 673.27 billion in 2025 and is poised to exceed USD 1.89 trillion by 2035, witnessing over 10.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of reverse factoring is estimated at USD 739.32 billion.

Reverse factoring is a financial arrangement where a large buyer helps suppliers clear financial dues earlier than the agreed-upon payment terms. Industries such as manufacturing, retail, construction, automotive, etc., are the primary users of reverse factoring to streamline capital management. In March 2023, the World Economic Forum (WEF) stated reverse factoring to be vital for small and medium-sized industries operating with limited capital and facilitating industries to strengthen their supply chains. WEF report highlights supply chain finance (SCF) i.e., reverse factoring can play a role in lowering emissions. In 2022, the global SCF award was earned by Henkel for implementing a successful SCF program.

The rising complexity of global supply chains has increased the need for efficient and reliable financing solutions. Reverse factoring helps mitigate the risk of bad debt by transferring the credit risk to the financial institution. In July 2024, a Forbes report stated that PUMA was close to achieving its environmental, sustainability, and governance goals by applying reverse factoring. PUMA collaborates with its banking partners such as HSBC, BNP Paribas, Standard Chartered, and the International Finance Corporation (IFC) on its Nexus digital platform to pay suppliers within 5 days and reduce the manual work involved. The positive growth of PUMA bodes well for the reverse factoring market as more global players adapt the SCF program to strengthen their supply chains.