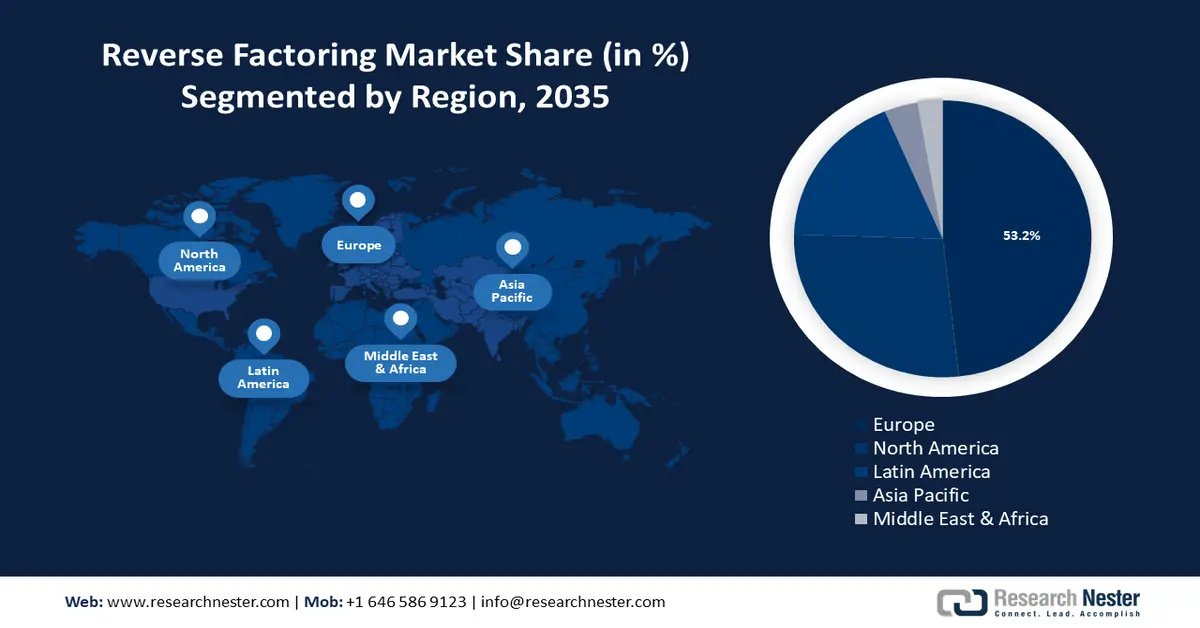

Reverse Factoring Market Regional Analysis:

Europe Market Insights

Europe industry is estimated to dominate majority revenue share of 53.2% by 2035. The rapid market growth is attributed to the well-established financial services sector with a multitude of banks and financial institutions offering reverse factoring services to MNCs and SMEs. The robust business activity in various sectors in Europe contributes favorably to creating an SCF ecosystem. For instance, in July 2021, Santander launched a reverse factoring operation under the European Guarantee Fund (EGF) to improve access to finance for SME suppliers.

Germany is projected to hold a dominant share in the reverse factoring market during the forecast period owing to the robust industrial base and reliance on complex supply chains requiring financial solutions. Another key factor of growth is the push for Industry 4.0 to digitize various sectors which is hastening the adoption of fintech solutions that streamline reverse factoring processes. Additionally, artificial intelligence (AI) and machine learning (ML) integration on web-based SCF portals is improving data analytics, benefiting businesses. For instance, SCF platform CRX in Germany has implemented AI and ML integrated analytics in their services.

France is gaining momentum in the reverse factoring market and is estimated to register an upward trajectory during the forecast period. The growth is attributed to the rising demand for SCF solutions in sectors such as retail, aerospace, manufacturing, etc. Businesses in France are seeking solutions to support their supplier networks and strengthen their supply chains. Government support for SMEs is also expected to boost market growth. In December 2020, the government launched the France Num loan guarantee to finance the digitization of very small enterprises (VSE) and small and medium-sized enterprises (SMEs). The scheme was further extended to December 2023. The robust trade regulatory framework in Europe is key to market growth in France due to the ease of business within Europe.

North America Market Insights

North America reverse factoring market is poised to witness rapid growth during the forecast period due to increasing drive of businesses to optimize cash flow management. Many businesses in the region have adopted reverse factoring financial solutions to maintain a robust supply infrastructure domestically and internationally. Additionally, the region has the presence of several multinational companies in various sectors that source supplies from around the world, leading to greater scalable opportunities for the reverse factoring market by offering fintech solutions.

In the U.S., the reverse factoring market is poised for impressive growth during the forecast period driven by the diverse industrial sector in the country which demands seamless finance solutions to maintain the supply chains. Banks and NBFIs in the U.S. are integrating digitization of their financial platforms to streamline the cash flow process. Rising awareness of blockchain technology is also improving accessibility for all kinds of businesses. For instance, in August 2021, Mitsubishi Corporation of the U.S. purchased metal commodities worth USD 43 million from Peru, and the purchases were made over multiple transactions using Skuchain’s currency-agnostic blockchain.

In Canada, the reverse factoring market is estimated to flourish owing to the presence of robust manufacturing, retail, and natural resources sectors fuelling the demand to maintain supply chains through financial solutions. Due to economic disruptions during the pandemic, there is a greater emphasis on cash flow management, prompting businesses to turn to reverse factoring. The government is making a push to improve the access of companies in Canada to global SCF platforms boosting the market’s rise. In 2020, Taulia announced that its SCF services will be administered via an automated system that can integrate with the ERP systems of the clients making it easier for suppliers to sign up and start using their program.