Retail Cloud Market Outlook:

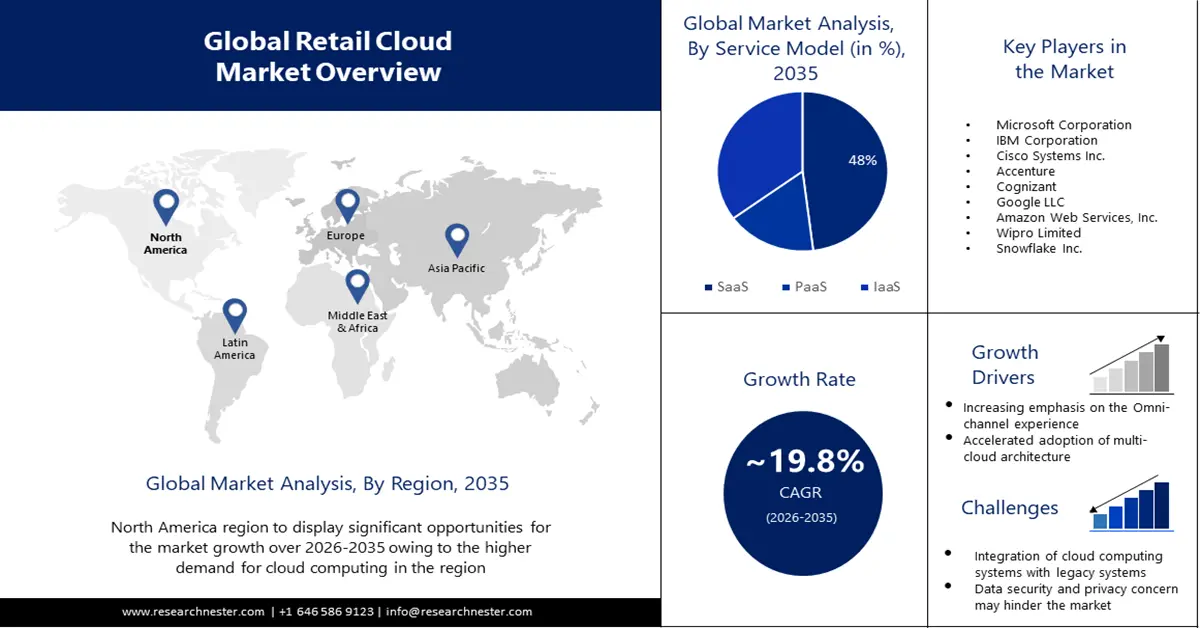

Retail Cloud Market size was valued at USD 61.97 billion in 2025 and is expected to reach USD 377.35 billion by 2035, registering around 19.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of retail cloud is evaluated at USD 73.01 billion.

Increasing adoption by retailers of cloud computing services is a major factor behind this expansion because it provides them with cost-effective and efficient solutions for their activities. Cloud technology is able to meet the increasing needs for flexibility and scale in retail, which allows companies to rapidly adapt to changes in the market. Every day, the world produces 2.5 quintillion bytes of data. A multiple public or private cloud is used by 80% of organizations.

In addition, retailers are working to enhance the customer experience and engagement by using cloud-based systems that enable seamless interactions as well as personalized services. The adoption of cloud services, giving retailers the chance to gain valuable insight and make data-driven decisions that will improve performance is being fueled by an increasing importance for data analysis in retailing.

Key Retail Cloud Solutions Market Insights Summary:

Regional Highlights:

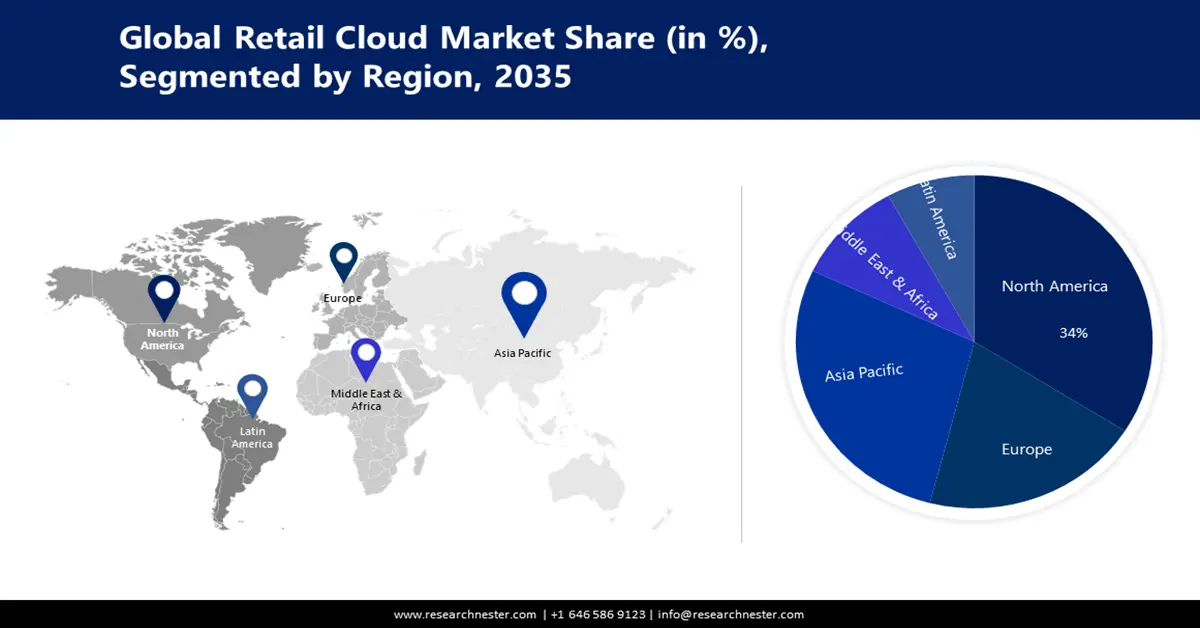

- The North America retail cloud market is projected to achieve a 34% share by 2035, driven by high retail cloud adoption due to large retail chains and innovative store sales strategies.

- The Asia Pacific market is expected to capture a 28% share by 2035, attributed to increasing demand from SMEs, strong economic growth, and investments in cloud infrastructure.

Segment Insights:

- The public cloud segment in the retail cloud market is projected to hold a 51% share by 2035, driven by scalability, flexibility, and cost efficiency offered to retailers.

- The saas segment in the retail cloud market is anticipated to achieve a 48% share by 2035, fueled by cost-effectiveness and global accessibility for retailers.

Key Growth Trends:

- Over the Coming Period, Swift Progress will be Made in Disrupting Technologies

- Increasing Emphasis on the Omni-channel Experience

Major Challenges:

- Integration of Cloud Computing Systems with Legacy Systems

Key Players: Microsoft Corporation, IBM Corporation, Cisco Systems Inc., Accenture, Cognizant, Google LLC, Amazon Web Services, Inc., Wipro Limited, Snowflake Inc.

Global Retail Cloud Solutions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 61.97 billion

- 2026 Market Size: USD 73.01 billion

- Projected Market Size: USD 377.35 billion by 2035

- Growth Forecasts: 19.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

Retail Cloud Market Growth Drivers and Challenges:

Growth Drivers

-

Over the Coming Period, Swift Progress will be Made in Disrupting Technologies- AI in retail simplifies their in-store operation, and efficiently manages new stock and supply chain management by enabling them to do so. In addition, AI enables retailers to offer their customers personalized service and sophisticated marketing strategies that assist them in attracting and retaining clients. The key strategies that will benefit the retail sector from the use of artificial intelligence are improved customer experience and support. In addition, more and more retailers are choosing to shop in stores. AI is being used by 35% of firms and 42% are looking into its deployment in the future. A total of 91.5% of the world's leading businesses are continuously investing in artificial intelligence.

-

Increasing Emphasis on the Omni-channel Experience- Omnichannel connects all the channels of communication between companies and their clients in order to produce a cohesive experience. 73% of consumers chose to shop on many channels during their purchasing trip. Retailers are attempting to enhance the Omnichannel experience for this reason.

-

Accelerated Adoption of Multi-Cloud Architecture- Multicloud adoption, in which businesses look to benefit from the advantages of using a combination of cloud service providers, is now emerging as an increasingly common trend within retail. In order to support both web and offline retail businesses, particular requirements have been laid down in the retail sector, e.g. need for scalable, flexibility and security of IT infrastructure. With the ability to adapt their IT infrastructure, and at the same time reduce risks of lost data or security violations, retailers will be able to take advantage of M2C environments that allow them to specify it in order to meet their needs.

Challenges

-

Integration of Cloud Computing Systems with Legacy Systems- Integrating cloud systems with legacy systems is one of the major hindrances to adoption of cloud computing systems in the retail sector. Many retailers have invested in legacy systems over the years, and these systems often handle critical functions such as inventory management, order processing, and payment processing. Integrating these systems with cloud-based systems can be challenging, but it is essential to ensure that retailers can leverage the benefits of cloud computing while still maintaining their existing systems.

-

Data security is a critical concern for any business, including those in the retail industry that use cloud. Growing security and privacy concerns are reluctance among some retailers to adopt cloud software in some developing countries.

Retail Cloud Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.8% |

|

Base Year Market Size (2025) |

USD 61.97 billion |

|

Forecast Year Market Size (2035) |

USD 377.35 billion |

|

Regional Scope |

|

Retail Cloud Market Segmentation:

Service Model Segment Analysis

The SaaS segment is anticipated to account for 48% share of the global retail cloud market during the forecast period. By offering subscription-based models that reduce hardware, software licenses and IT costs, SaaS solutions offer cost effectiveness. Without major investment, retailers can quickly expand their operation by using Software as a Service and be able to add or remove features and users if necessary. SaaS enables retailers to make data and applications available from any part of the world, which is advantageous for businesses with a global reach. Moreover, the user-friendliness of software as a service means that they are easily adopted and used for quick benefit by retailers with limited technical capacity. The subscription business model will account for 53% of all software revenue in 2022.

Deployment Model Segment Analysis

Retail cloud market from the public cloud segment is anticipated to hold 51% of the revenue share during the forecast period. The numerous benefits offered to retailers, such as scalability, flexibility, and cost efficiency, are part of the reason. The public cloud enables the use of services such as data storage, computing power, and analysis making it an attractive option for retailers. The dominant role of the public cloud is predicted to be maintained by retailers who want to take advantage of its benefits in order to enhance their business and keep up with competitors.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Service Model |

|

|

Deployment Model |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Retail Cloud Market Regional Analysis:

North American Market Insights

The North America region is anticipated to account for 34% share of the global retail cloud market during the forecast period. In particular in countries like the United States and Canada, North America's retail market is growing rapidly. Due to the presence of stores like Walrus, Costco, Kroger, Home Depot and Target in this region, retail is one of North America's largest markets. Furthermore, the demand for cloud retail solutions is highest in North America. Compared to many regions, the region has one of the most exploratory store sales scenarios. Furthermore, in specialty stores, there is a high proportion of use of cloud throughout the region. For example, a company called Bernhardt Furniture Company Inc. has used IBM retail cloud technology to develop the Mobile Sales Application and Analytics Platform which enabled them to increase sales by 20 % in just 10 weeks. The company reported that, on the occasion of sales events, its managers were able to reach out to 205 additional customers.

APAC Market Insights

Asia Pacific retail cloud market is anticipated to hold around 28% of the revenue share during the forecast period. In Asia Pacific, this growth is attributable to the growing demand for cloud computing services from SMEs. Strong economic growth, increasing Internet penetration and the growing adoption of mobile phones are taking place in countries such as China, India or Japan. In turn, the demand for effective retail cloud to support the booming e commerce sector is driven by this. In addition, the demand for retail cloud will increase as a result of substantial investment by governments and businesses in cloud infrastructure. SMEs invested 47% of their IT budgets a 67% increase from 2021 to 2022 in cloud services. By 2023, they will have spent more than 50% of their technological spend on cloud services.

Retail Cloud Market Players:

- Oracle Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- IBM Corporation

- Cisco Systems Inc.

- Accenture

- Cognizant

- Google LLC

- Amazon Web Services, Inc.

- Wipro Limited

- Snowflake Inc.

Recent Developments

- Wipro Limited, a technology services and consulting company, declared new retail solutions built on the Microsoft Cloud and Cloud for Retail and a new Retail Innovation Experience in Mountain View, California. This physical, virtual, and hybrid Experience would deepen collaboration between Microsoft and Wipro to accelerate the delivery of new solutions that would enable retailers to grow their business and build stronger customer relationships.

- Snowflake, the Data Cloud company, declared the introduction of the Retail Data Cloud, which primarily unites Snowflake- and partner-delivered solutions, Snowflake's data platform, and industry-specific datasets. The Retail Data Cloud mainly empowers manufacturers, retailers, consumer packaged goods (CPG) vendors, distributors, and industry technology providers to leverage their data, access new data, and seamlessly collaborate across the entire retail industry.

- Report ID: 5292

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Retail Cloud Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.