Restaurant Point-of-Sale Terminals Market Outlook:

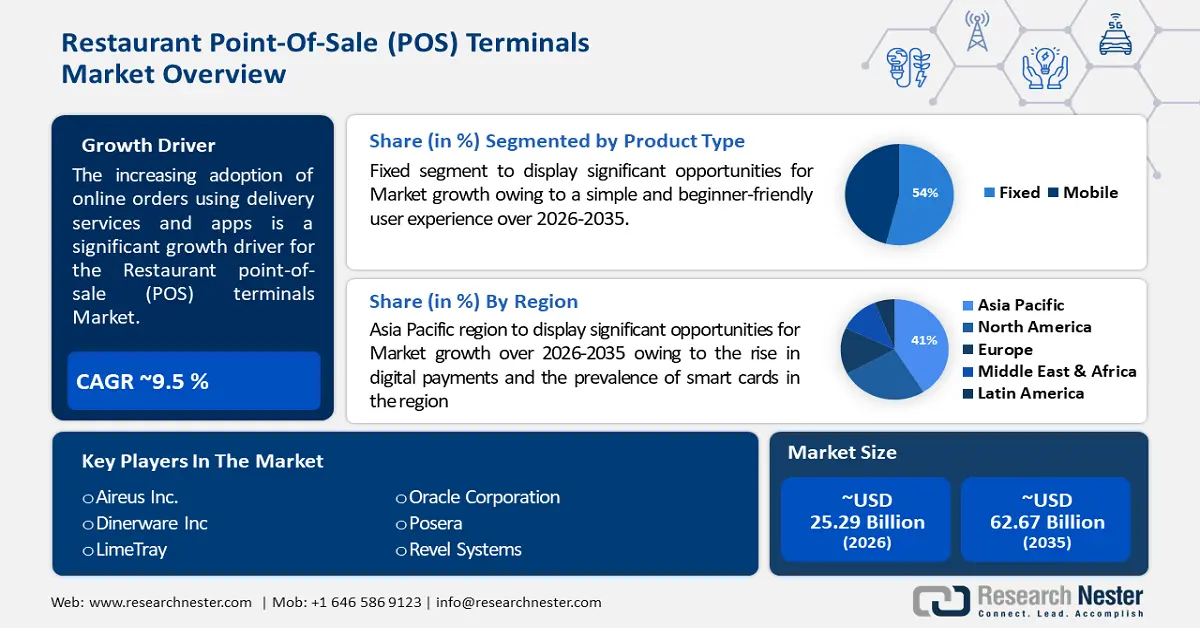

Restaurant Point-of-Sale Terminals Market size was valued at USD 25.29 billion in 2025 and is set to exceed USD 62.67 billion by 2035, expanding at over 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of restaurant point-of-sale terminals is evaluated at USD 27.45 billion.

The market growth is propelled by increasing surge in the adoption of online orders using delivery services and apps in the past few years. According to a report, food deliveries have increased to a worldwide market worth about 150 billion USD, which has more than tripled since 2017. Furthermore, there is a surge in demand for quick-service restaurants, also known as fast-food restaurants, which provide inexpensive, fast foods with minimal table service. The Quick-service restaurant (QSRs) heavily relies on point-of-sale (POS) terminals mainly for payment processing, order taking, data analysis, inventory management, and also for ensuring efficient and smooth restaurant management. According to a report by MediaRadar, the cloud-based sales enablement tool, is estimated to reach about 300 billion USD in 2021 from about 12% in 2020.

Key Restaurant Point-Of-Sale (POS) Terminals Market Insights Summary:

Regional Highlights:

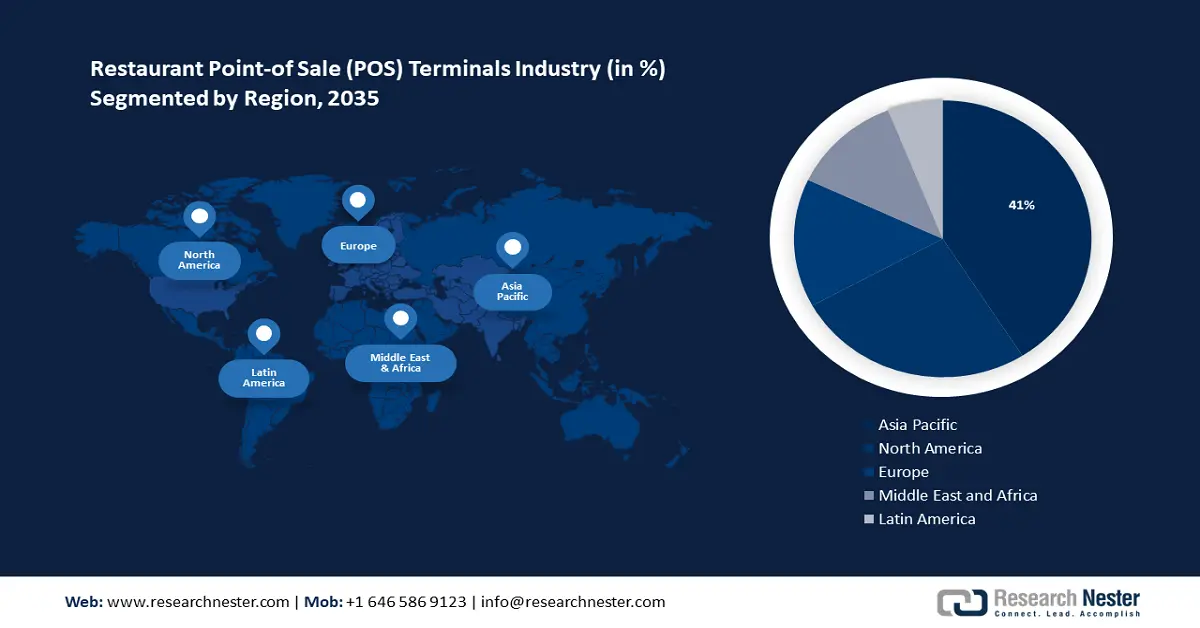

- Asia Pacific restaurant POS terminals market is poised to capture 41% share by 2035, driven by rising digital payments and government-backed e-payment promotion.

- North America market projects lucrative growth during the forecast timeline, driven by tech integration like AI and automation in POS systems.

Segment Insights:

- The fixed pos segment in the restaurant point-of-sale terminals market is projected to hold a 54% share by 2035, influenced by a beginner-friendly user experience that reduces training costs and attracts younger workforce.

- The hardware segment in the restaurant point-of-sale terminals market is expected to achieve a substantial share by 2035, fueled by the ability to deliver personalized experiences including targeted marketing and loyalty programs.

Key Growth Trends:

- Growing use of contactless payments

- High Demand for automation

Major Challenges:

- Difficulty in maintaining and updating software

- Limited availability of skilled labor

Key Players: Dinerware, Inc., EposNow, LimeTray, NCR Corporation, Oracle Corporation, ParTech, Inc., PAX Technology Limited, Posera, Posist, POSsible POS, Revel Systems, Asahi Seiko, TERAOKA SEIKO, TIMELEAP, TOSHIBA TEC.

Global Restaurant Point-Of-Sale (POS) Terminals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 25.29 billion

- 2026 Market Size: USD 27.45 billion

- Projected Market Size: USD 62.67 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, India, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Restaurant Point-Of-Sale Terminals Market Growth Drivers and Challenges:

Growth Drivers

-

Growing use of contactless payments- Contactless payments already gained a high popularity before the pandemic, but after the COVID-19 pandemic, this data has increased its utilization which acted as a growth driver and made this mode of payment the preferred mode of payment for many customers. This has led to an increased demand for POS terminals that enable contactless functionality. According to Worldwide India, In January 2020, only 25% of the transactions in supermarkets were contactless, but this percentage rose to 31% by January 2022.

-

High Demand for automation- Automation is becoming increasingly popular in the food service industry, and the pandemic has hastened this transition. This has driven the demand for POS terminals that can enable and facilitate automation. Such terminals can help reduce labor costs, improve the accuracy and speed of operations, and provide a better customer experience. This trend will continue to boost the growth of the US restaurant POS terminals market Growing demand for omni-channel retailing- Omni-channel retailing, allows the combination of various sale channels (in-store, online, and mobile) to create a seamless shopping experience for customers and is gaining popularity. This has driven the demand for POS terminals that can support such omnichannel transactions. As the demand for omnichannel retailing continues to grow in the coming years, the demand for POS terminals compatible with omnichannel systems will also increase.

- Growth of online food delivery apps: Online food delivery apps have gained massive popularity in recent years, and the COVID-19 pandemic has driven this trend even further. This has driven the demand for POS terminals that can serve as a link between the restaurant and the food delivery service, allowing for a seamless ordering and payment process for the customers. This trend will continue to drive the growth of the US restaurant POS terminal market in the coming years.

Challenges

-

Difficulty in maintaining and updating software- POS terminal systems, like any other software and hardware system, require a regular update and maintenance to keep the system functional and up-to-date. This is a challenge for several restaurants, as the software can be a bit complex and the updating process can be very long and costly, this asks for trained personnel to handle it, which can act as a restraining factor for the restaurant POS terminals market

-

Limited availability of skilled labor- The adoption of POS terminal systems requires trained and skilled staff to utilize the system's features and capabilities.

- Limited compatibility with the existing systems.

- Complexity and learning curve.

Restaurant Point-Of-Sale Terminals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 25.29 billion |

|

Forecast Year Market Size (2035) |

USD 62.67 billion |

|

Regional Scope |

|

Restaurant Point-Of-Sale Terminals Market Segmentation:

Product type Segment Analysis

Fixed POS is estimated to gain a robust market share of 54% in the coming years, owing to simple and beginner-friendly user experience, which helps to attract users and increase the newer and younger workforce. This also helps to reduce the cost of training, a significant challenge faced by several restaurant POS terminals market. According to a report, the turnover rate for restaurants was 72.9% nationally, while for the full-service restaurants by the end of 2017, according to their hourly staff turnover rate was about 102.8%.

Component Segment Analysis

The Hardware segment in restaurant point-of-sale terminals market is set to garner a substantial share by 2035, as it enables the Point-of-Sale terminals to provide users with more personalized experiences, that can support several features such as targeted marketing, loyalty programs, along with tailored recommendations also. This can lead to increased customer satisfaction and engagement, as consumers feel more connected and valued by the business.

Deployment Segment Analysis

The cloud-based segment in restaurant pos terminals market is estimated to hold largest share by 2035, due to improved data protection and security for user data which is managed and stored by the software. The data is stored on secured and remote servers and can ensure greater privacy and security from data breaches and losses. According to a survey by Netwrix in March 2022, more than 720 IT professionals were surveyed all over the globe using online questionnaires, and about 80% of the organization's data is stored in cloud-based storage.

Our in-depth analysis of the global restaurant POS terminals market includes the following segments:

|

Product Type |

|

|

Component |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Restaurant Point-Of-Sale Terminals Market Regional Analysis:

APAC Market Insights

The restaurant point-of-sale terminals market share in Asia Pacific is estimated to surpass 41% in 2035, as rise in digital payments and the prevalence of smart cards, mobile wallets, and online banking methods are contributing to the growth of POS terminals as they offer convenience and security for transactions. According to the World Bank two-thirds of adult populations worldwide make and receive a digital payment, with the total share in the developing economies that grew from 35% in 2014 to about 57% in 2021. While, in the developing economies, approximately 71% have an account at a bank, other financial institution, or with a mobile money provider, up from 63% in 2017 and 42% in 2011. Moreover, government initiatives promoting electronic payment methods are further encouraging the use of POS terminals in restaurants.

North American Market Insights

The North American restaurant point-of-sale terminals market is estimated to register lucrative CAGR during the forecast timeframe, led by integration of several advanced technologies such as machine learning along with automation into POS terminals and is expected to further drive the restaurant POS terminals market growth by enhancing operational efficiency and providing innovative solutions to restaurant owners.

Restaurant Point-Of-Sale Terminals Market Players:

- Aireus Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dinerware, Inc.

- EposNow

- LimeTray

- NCR Corporation

- Oracle Corporation

- ParTech, Inc

- PAX Technology Limited

- Posera

- Posist

- POSsible POS

- Revel Systems

Recent Developments

- Verifone, collaborated with Lavu, a seller of restaurant software this partnership aims to enable the cross-distribution of a unified point-of-sale system along with high-end payment solutions.

- ParTech, Inc., a restaurant POS provider, launched their PAR Wave, an All-In-One touch panel designed for hardware components for the hospitality industry. PAR's Wave combines its security, performance, functionality, and new design to meet the demands of the restaurant industry.

- Report ID: 2052

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Restaurant Point-Of-Sale (POS) Terminals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.