Residential Power Conditioner Market Outlook:

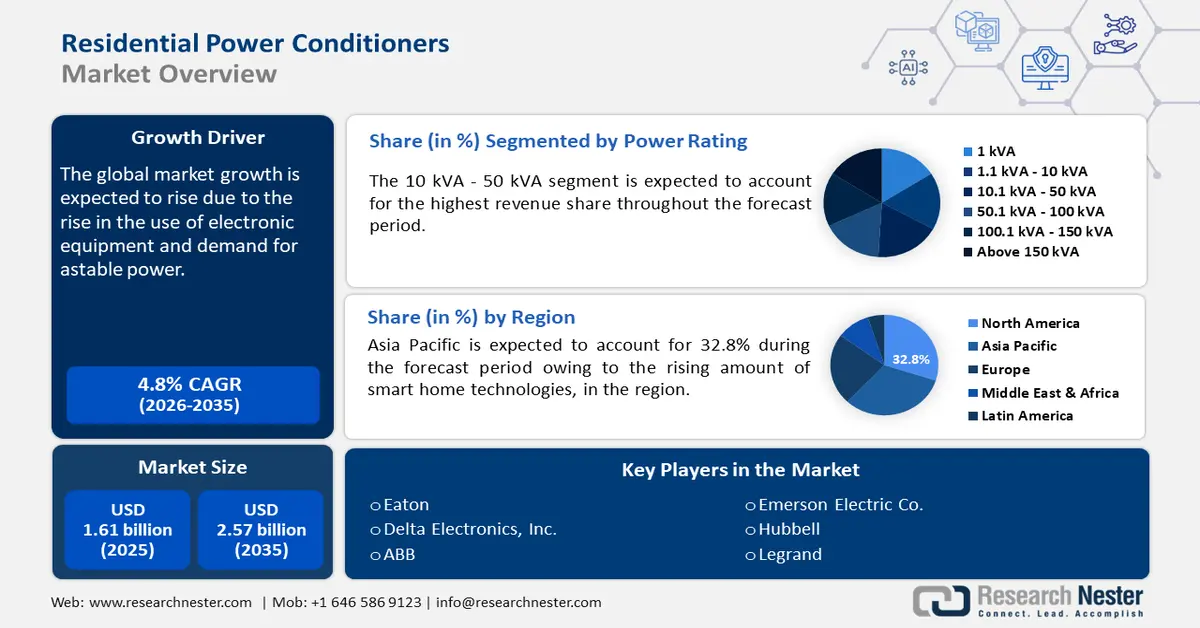

Residential Power Conditioner Market size was over USD 1.61 billion in 2025 and is poised to exceed USD 2.57 billion by 2035, witnessing over 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of residential power conditioner is estimated at USD 1.68 billion.

The global residential power conditioner market is witnessing steady growth owing to the rising need for reliable and stable electricity as modern homes become more dependent on sensitive electronic devices including integrated circuits. Rising home electrification due to smart home adoption, EV chargers, and renewable energy integration including rooftop solar, are driving homeowners to look for ways to stabilize their power supply and protect investments in advanced technologies. As per the International Council on Clean Transportation (ICCT) analysis in March 2024, the BEV fleet will require nearly 40.1 million chargers at single-family and multifamily homes by 2032, in the U.S. Moreover, technological advancements in the energy sectors including the development of smart grid and IoT are influencing the market growth.

Rising environmental regulations and energy standards are further encouraging energy-efficient device adoption. On a larger scale, several macroeconomic and technological factors are also driving the market growth. Urbanization and infrastructure development in emerging markets, especially in regions including Asia Pacific are increasing the demand for residential power protection solutions. As more people move into cities and develop new residential areas, the power grid may become overburdened, leading to voltage fluctuations and power quality issues. This surge in urbanization necessitates power conditioning solutions to maintain the stability of home appliances. The growing consumer awareness of energy management, driven by sustainability, is boosting the residential power conditioner market growth further.

Key Residential Power Conditioner Market Market Insights Summary:

Regional Highlights:

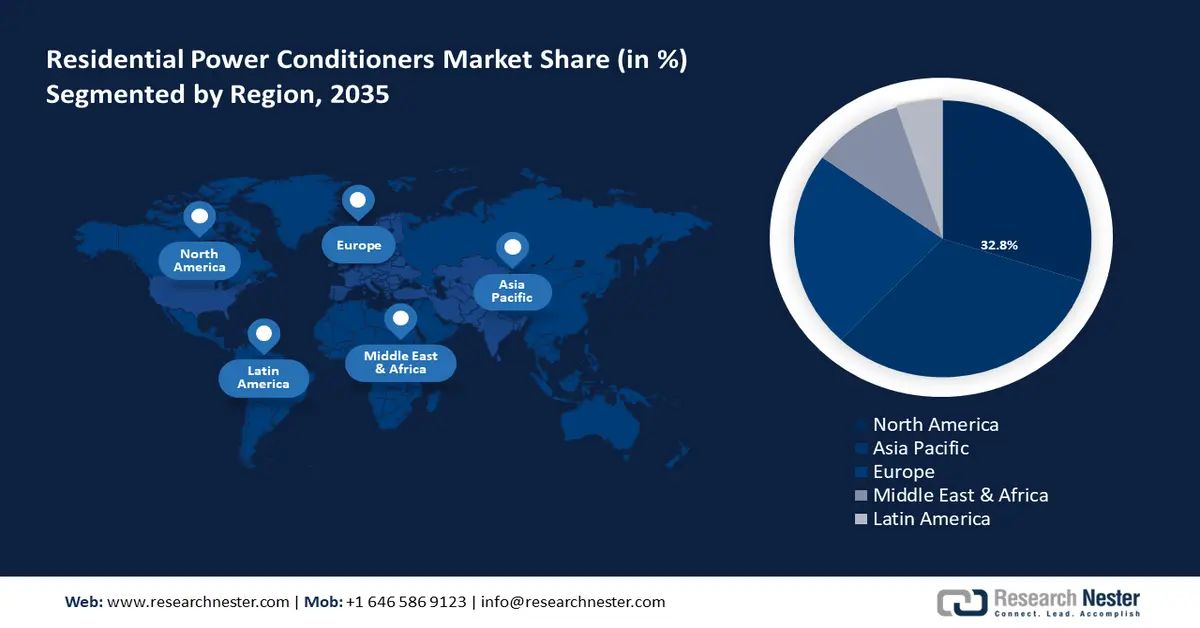

- Asia Pacific residential power conditioner market will account for 32.80% share by 2035, driven by increasing urbanization, rising disposable incomes, and growing awareness of power quality needs.

- North America market will register considerable CAGR during 2026-2035, driven by frequent power surges, rising home automation, and government incentives promoting power conditioners.

Segment Insights:

- Variable cycle regulator segment in the residential power conditioner market is expected to achieve a notable CAGR by the forecast year 2035, driven by increasing reliance on electronics and the need for stable, adaptive power regulation in homes.

- The 10.1 - 50 kva segment in the residential power conditioner market is anticipated to secure a dominant share by 2035, driven by rising energy demand from EV charging, smart home tech, and solar panel adoption.

Key Growth Trends:

- Booming semiconductor industry

- Increasing adoption of Power Conditioners in EVs

Major Challenges:

- High price of power conditioners

- Scarcity of qualified professionals

Key Players: Eaton Corporation plc, Schneider Electric SE, Emerson Electric Co., Siemens AG, ABB Ltd., General Electric Company, CyberPower Systems, Inc., Tripp Lite (Eaton), Legrand SA, Furman Power (Core Brands).

Global Residential Power Conditioner Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.61 billion

- 2026 Market Size: USD 1.68 billion

- Projected Market Size: USD 2.57 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Residential Power Conditioner Market Growth Drivers and Challenges:

Growth Drivers

- Booming semiconductor industry: The rising demand for high-quality power solutions that protect sensitive electronic devices is significantly contributing to the residential power conditioner market growth. As the proliferation of smart home technologies and advanced electronics continues, households require reliable power conditioning to eliminate power fluctuations and ensure optimal performance and longevity of the devices. The growth is further fueled by the rising adoption of renewable energy resources, which demands sophisticated power management systems.

Consequently, manufacturers are expanding their product lines to meet the evolving needs of consumers. For instance, in June 2024, Schneider Electric announced the launch of APC Back-UPS Pro Gaming in Australia which keeps gamers connected and, in the game, and protects gaming gear against harmful power irregularities. The product further ensures a shield from power disruptions and continuous connectivity for routers. - Increasing adoption of Power Conditioners in EVs: These devices enhance the efficiency and reliability of EV charging systems and help manage and stabilize voltage levels. Power conditioners ensure that charging stations provide consistent power, which is crucial in optimizing battery performance and longevity. With the growing infrastructure for EV charging, including home and public charging systems, the demand for effective power management solutions is rising. This is further supported by government incentives for EV adoption, encouraging advanced charging technologies investments incorporating power conditioners for safety.

In March 2022, Siemens and Tesla partnered to enhance EV charging by incorporating innovative power conditioning technologies to optimize charging speed and efficiency. These developments aim to improve the overall EV charging experience and address issues such as voltage fluctuations, with a focus on high performance, and reliability. As the EV market continues to expand, the integration of power conditioners is expected to play a crucial role in facilitating seamless charging experiences.

Challenges

- High price of power conditioners: As consumers often seek cost-effective solutions for home power management, the high price of these products becomes the challenge in their adoption. While these devices offer essential benefits, their premium pricing can deter potential buyers. This situation is combined with the availability of cheaper alternatives that fail to provide the same reliability, leading to long-term investment concerns in quality power conditioning products.

- Scarcity of qualified professionals: The unavailability of qualified professionals to install and maintain power conditioning systems, restrains the residential power conditioner market growth significantly. As products become more sophisticated with the evolving technologies, the need for skilled professionals to assess, install, and troubleshoot these systems becomes crucial. A lack of trained professionals results in suboptimal installations, leading to customer dissatisfaction and potential safety hazards. This hinders the growth of the residential power conditioner market.

Residential Power Conditioner Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 1.61 billion |

|

Forecast Year Market Size (2035) |

USD 2.57 billion |

|

Regional Scope |

|

Residential Power Conditioner Market Segmentation:

Power Rating Segment Analysis

The 10.1 - 50 kVA is projected to dominate the residential power conditioner market during the forecast period, owing to its ability to provide sufficient power management for larger homes and small residential complexes. Their scalability and capability to handle mid-range power loads make them particularly suitable for residential use. The energy demand is steadily rising for residential use majorly due to the integration of EV charging stations, and smart home technologies. Additionally, solar panels are significantly contributing to the segment’s growth.

As renewable energy systems including solar panels become more widespread, the need for stable power management grows, expanding the demand for robust conditioners in the 10.1 kVA - 50 kVA range. For instance, in February 2024, Delta Electronics showcased its smart energy infrastructure solutions for utilities under the theme Optimizing Energy Efficiency and Enabling Carbon Neutrality at The Smarter E Europe 2024. Delta will introduce its innovative SKID-based plug-and-play Energy Storage System (ESS), which combines power conditioning with integrated batteries and control systems to enhance energy management and improve solar power self-consumption.

Product Segment Analysis

The variable cycle regulator in the residential power conditioner market is projected to observe notable growth during the forecast period. Unlike traditional power conditioners, variable cycle regulators dynamically adjust to varying input voltages and cycles, ensuring stable output regardless of the grid’s inconsistencies. Additionally, these regulators offer better protection against brownouts, overvoltage, and electrical noise, which is increasingly essential for modern homes becoming more reliant on electronics and interconnected devices.

Increasing use of high-efficiency heat pumps and HVAC systems requires steady conditioned power to operate optimally, making these regulators essential for homes investing in energy-efficient heating and cooling technologies. For instance, the International System Dynamics Conference, in August 2024, released a report on Modeling the Slow Adoption of Heat Pumps in Germany. It talks about Germany’s initiative to accelerate the adoption of heat pumps as part of the country’s broader energy transition strategy, especially in MFH.

Our in-depth analysis of the residential power conditioner market includes the following segments:

|

Power Rating |

|

|

Product |

|

|

Phase |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Residential Power Conditioner Market Regional Analysis:

APAC Market Insights

APAC residential power conditioner market is experiencing significant growth with an expected 32.8% share during the forecast period. Increasing urbanization, rising disposable incomes, and growing awareness of the need for power quality are driving the Asia Pacific market significantly. Countries in the region are witnessing a surge in electronic device usage, which further amplifies the demand for effective power management solutions. Manufacturers are expanding their presence in the region to remain competitive. For instance, in January 2020, Delta Electronics launched its diversified cutting-edge technology with an energy-efficient solutions portfolio at Elecrama 2020. The key launches include AC chargers for both residential and commercial applications. AC MAX EV are wall-mounted chargers that reduce caring time up to 70%.

India residential power conditioner market is moving fast owing to the proliferation of smart appliances and the rising frequency of power quality issues. With the growing middle-class population resulting in rising energy consumption, the focus on the protection of sensitive electronics from voltage fluctuations has heightened. The Indian government is hence promoting renewable energy and energy efficiency initiatives, further driving advanced power conditioning solutions adoption.

China stands as a key player in the market, with a vast manufacturing base mainly for electronics, and infrastructure for EVs. As the population adopts more electronics, for smart home integration, the demand for high-quality power conditioners is set to rise. Manufacturers are focusing on the country’s requirements to enhance their market strategies and further accelerate the adoption of these devices.

North America Market Insights

North America residential power conditioner market is witnessing considerable growth owing to factors such as frequent power surges, voltage fluctuations, and electromagnetic interference. Reliable power management is highly in demand in the region due to rising home automation acceptance of smart-home technologies. The region’s government incentives including tax credits and refunds for energy conservation and related subjects are also driving power conditioner adoption in the region.

The rising number of residential solar installations in the U.S. is a major driving factor for the residential power conditioner market in the country. With citizens investing in home automation and renewable energy sources, efficient power conditioning has become crucial to protect sensitive equipment and ensure optimal performance. Additionally, regulatory initiatives are pushing homeowners to consider power conditioners as essential components of their electrical systems.

Canada residential power conditioner market is influenced by similar trends, with a strong emphasis on energy efficiency and sustainability. The country’s harsh weather conditions often lead to power instability, prompting consumers to invest in power conditioning solutions. Additionally, government incentives for energy-efficient home upgrades are also fostering the residential power conditioner market in the country.

Residential Power Conditioner Market Players:

- ABB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AMETEK Inc.

- Delta Electronics, Inc.

- Eaton

- Emerson Electric Co.

- Furman

- Hubbell

- Legrand

- NEELKANTH POWER SOLUTIONS

- Schneider Electric

- SERVOMAX LIMITED

- SOLAHD

- Sollatek

- SPECTRUMSTAB INDIA PVT. LTD.

- Static Power

- Unico, LLC

The global residential power conditioner market is dominated by several key players focusing on offering efficient and reliable power conditioners to address the rising demand for stable voltage. These players are particularly addressing the concerns for smart home technology and renewable energy systems. Partnerships and acquisitions are two of the key strategies adopted by prominent market players to remain competitive. For instance, in March 2021, Eaton announced the acquisition of Tripp Lite. This acquisition was aimed at expanding Eaton’s power quality business in America.

Recent Developments

- In June 2024, ABB announced the launch of ReliaHome Smart Panel, aimed at energy management systems for newly built smart homes. It helps homeowners optimize power consumption and manage distributed energy resources like solar panels, batteries, and EV chargers

- In February 2024, AMETEK SurgeX announced the launch of Vertical Series+. The PDU is ideal for space-efficient power distribution, quality assurance, and comprehensive power management

- In June 2021, Delta Electronics announced that EVO Power from Victoria is their approved System Integrator for PCS100 100KW 3P4W Power Conditioning System certified to ASNZS4777.2-2020. As per the Global Certification Company TUV, it is the first PCS to be globally certified to ASNZS4777.2 -2020

- Report ID: 6465

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Residential Power Conditioner Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.