Residential Boiler Market Outlook:

Residential Boiler Market size was over USD 36.65 billion in 2025 and is anticipated to cross USD 65.02 billion by 2035, growing at more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of residential boiler is assessed at USD 38.6 billion.

The growth of the market can be attributed to growing shift of people to urban areas that require boilers for residential purposes. Around 4.4 billion people, or 56% of the world's population, reside in cities. By 2050, approximately 7 out of 10 people would live in cities, with the urban population predicted to more than double from its current level. Hence, owing to this, the construction activities are estimated to boost further driving the market growth.

Moreover, in urban areas, there has been a growing shift in lifestyle preferences among people. Also, a large number of people living in urban area demand for more comfortable space. Hence, the preference for residential boiler is anticipated to increase. Additionally, the energy efficiency of any heating system, including boilers, is one of the most crucial aspects to take into account. A higher grade indicates that more of the energy is used to heat the house and less is lost or wasted. High-efficiency appliances benefit the environment and could also help users save money on their utility costs each month. Therefore, the government is also encouraging population to adopt residential boilers and boosting spending on hydrogen fuel which is estimated to drive the market growth over the forecast period.

Key Residential Boiler Market Insights Summary:

Regional Highlights:

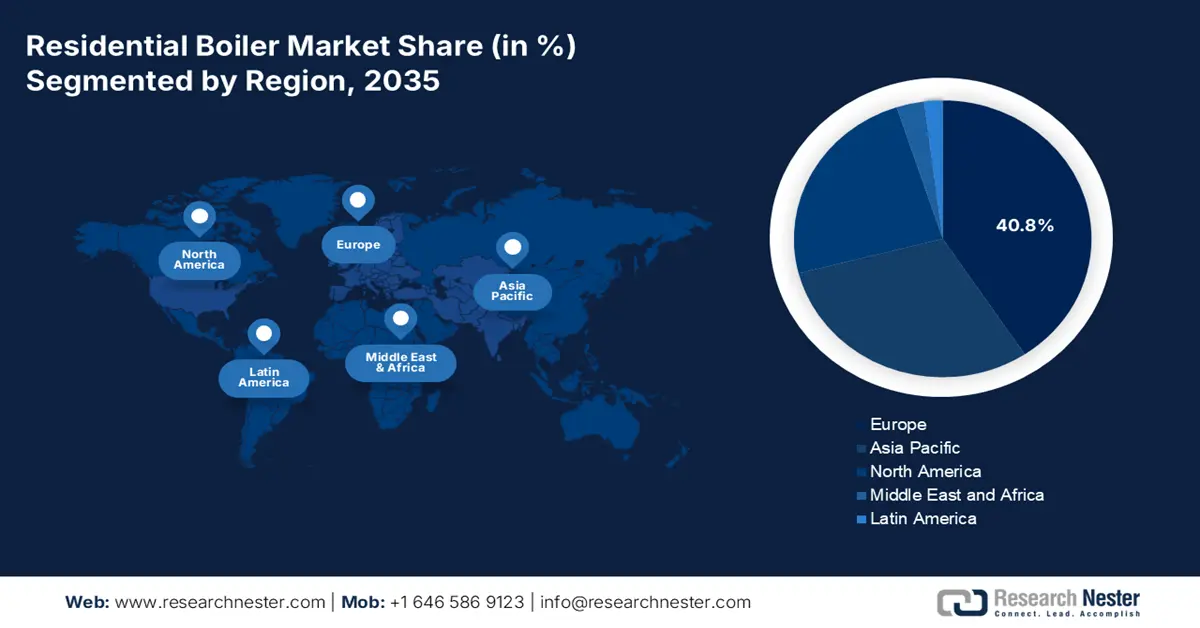

- Europe residential boiler market will dominate more than 40.8% share by 2035, driven by rising construction projects, increased use of renewable energy, and higher demand for residential boilers.

- Asia Pacific market records the highest CAGR during 2026-2035, attributed to rising heating demand, population growth, real estate expansion, and stricter carbon emission regulations.

Segment Insights:

- The fire tube segment in the residential boiler market is projected to achieve the highest market share by 2035, driven by its cost-effectiveness, safety, and ease of use in residential settings.

- The gas fired segment in the residential boiler market is poised for significant growth during 2026-2035, driven by government regulations targeting pollution control and emission reduction.

Key Growth Trends:

- Growing Construction Activities

- Rising Government Spending on Hydrogen Fuel

Major Challenges:

- Growing Construction Activities

- Rising Government Spending on Hydrogen Fuel

Key Players: Pricer, SES-imagotag, Samsung Electro-Mechanics, E Ink Holdings Inc., Displaydata Limited, NCR Corporation, Diebold Nixdorf, Incorporated, A.O. Smith Corporation, Robert Bosch GmbH, Viessmann.

Global Residential Boiler Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 36.65 billion

- 2026 Market Size: USD 38.6 billion

- Projected Market Size: USD 65.02 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 10 September, 2025

Residential Boiler Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Construction Activities - Public residential construction investments in the US saw a considerable rise in value between 2002 and 2021. In 2021, the public sector invested about USD 10 billion in residential development projects. Hence, owing to the growing construction activities, the demand for residential boilers is anticipated to increase the growth of the market.

-

Rising Government Spending on Hydrogen Fuel - In India, the expedition would cost a total of about USD 3 billion, according to the ministry. The government granted about 3 million, the first such allocation, for 2023–2024, the first year of the seven-year programme, with the goal of increasing the nation's output of green hydrogen.

-

Growing Concern for Green-House Emission - Greenhouse gas emissions from enterprises and houses were 13% in 2020, owing mostly to the use of fossil fuels for heating, the usage of some items containing greenhouse gases, and waste disposal.

-

Surge in Disposable Income - Since the disposable income of the population increases, they tend to spend more on making quality life which also includes purchasing house. Hence, large number of people is estimated to spend more on housing. The typical American spends about 36% of their gross income on housing.

-

Growing Trend of Private Homes - In 2022, the homeownership rate in the US increased marginally to reach its highest level since 2011. The percentage of homes with owner occupants was about 64% in 2022. Hence, owing to the growing trend of private homes the market is estimated to grow. Apart of residential buildings, boilers could also be placed in private homes. Private house most of the time is situated in area where central heating system is unavailable. Hence, the demand for residential boilers is estimated to increase. Boilers or furnaces are used to heat the majority of American homes in order to keep their spaces warm.

Challenges

- High Cost of Production

- Boost in Use of Renewable System - When hydrogen is burned, harmful nitrogen oxides (NOx) and steam are also produced. Similar to carbon dioxide, hydrogen influences other pollutants rather than the climate directly. Hence, the demand for renewable method of heating is growing. Solar thermal systems, often known as solar water heating systems, use the sun's heat to warm the water in the home. The system makes use of collectors, which are solar panels mounted on your roof. Sun heat is captured by the panels and used to warm water in a cylinder. This is known for causing less pollution. Hence, this factor is estimated to hinder the growth of the market.

- Maintenance Cost is High

Residential Boiler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 36.65 billion |

|

Forecast Year Market Size (2035) |

USD 65.02 billion |

|

Regional Scope |

|

Residential Boiler Market Segmentation:

Fuel Type Segment Analysis

The global residential boiler market is segmented and analyzed for demand and supply by fuel type into coal fired, oil fired, and gas fired. Out of which, the gas fired segment is anticipated to grow significantly over the forecast period. The growth of the segment can be attributed to growing government stringent rules to control pollution. For instance, by 2026, the UK government wants to outlaw the installation of conventional gas boilers in residential buildings and replace them with "hydrogen ready" heating systems. Since the housing stock is responsible for about a fifth of the UK's greenhouse gas emissions, replacing gas-fired boilers is a crucial component of the country's goal to attain net zero emissions by 2050. Natural gas is used in many gas-fired residential boilers. Energy efficiency, quiet operation, economic effectiveness, comfortable heating, and clean heating are just a few advantages of gas-fired residential boilers. These advantages are estimated to increase residential consumers' demand for gas-fired boilers, which would fuel the segment’s expansion throughout the course of the forecast period. Moreover, in larger apartments with boilers, natural gas is burned to generate electricity during power outages. Hence this factor is also estimated to boost the growth of the segment.

Type Segment Analysis

The global residential boiler market is also segmented and analyzed for demand and supply by type into water tube, fire tube, and electric. Out of which, the fire tube segment is anticipated to garner the highest revenue by the end of 2035, backed by growing disposable income, along with volatile climatic condition. Smaller industrial facilities with lower operating pressures frequently employ fire tube boilers as they are a more affordable option to water tube boilers. Moreover, a fire tube boiler's key benefits include its straightforward design, small size, and straightforward ability to adapt to sudden changes in steam demand. Also, since there is less pressure in a fire-tube boiler, there is less possibility of explosion. Hence, the adoption is estimated to increase since this tubes are safer is use, and it is predicted to boost the segment’s growth in the market.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Technology |

|

|

By Fuel Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Residential Boiler Market Regional Analysis:

Europe Market Insights

Europe region is set to dominate around 40.8% market share by 2035, driven by rising construction projects, increased use of renewable energy, and higher demand for residential boilers. Moreover, early projections from the EEA show that about 20% of the energy used in the EU in 2021 came from renewable sources. Despite the fact that conditions and consumption habits were different in the two years, this is the same as the level that was seen in 2020. Additionally, approximately 39% of the heating in Europe is provided by boilers designed specifically for each building, which burn natural gas to heat the water before piping it into the radiators in the buildings. Further, constant drop in temperature is also estimated to increase the demand for residential boilers. Buildings in German use an additional about 64 GWh of natural gas per day for every degree that the outside temperature drops. Hence, all these factors are estimated to drive the market growth in this region over the forecast period. Additionally, availability of hydrogen energy storage system is also estimated to drive the market in this region.

APAC Market Insights

The Asia Pacific residential boiler market, amongst the market in all the other regions, is projected to grow with the highest CAGR during the forecast period. The growth of the market in this region can be attributed to rising demand for space heating and water heating, along with rapid growing population and economic expansion. Further, owing to the growing population large number of construction activities are estimated to be carried out since they are demand more space. Moreover, growing government regulations and rising public awareness regarding carbon emission and initiatives to reduce it is also estimated to boost the growth of the market in this region. Also, there has been rapid growth in real estate line which is boosting the purchase of properties among people further also influencing the market growth.

North American Market Insights

Additionally, the market in North America is also estimated to have a significant growth over the forecast period. This growth is estimated to be influenced by availability of key producers and large consumer in United Nation for residential boilers. Moreover, severe weather conditions, such as below-freezing temperatures, and the rapid uptake of heating systems in the industrial sector would drive up product demand. Additionally, the residential boiler market is predicted to expand over the next years as a result of rising environmental pollution awareness spurred on by carbon and greenhouse gas emissions.

Residential Boiler Market Players:

- Pricer

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SES-imagotag

- Samsung Electro-Mechanics

- E Ink Holdings Inc.

- Displaydata Limited

- NCR Corporation

- Diebold Nixdorf, Incorporated

- A.O. Smith Corporation

- Robert Bosch GmbH

- Viessmann

Recent Developments

-

A. O. Smith Corporation, a leading provider of water technology, recently announced the acquisition of Giant Factory, Inc., a Canadian firm that makes residential and commercial water heaters and had sales of about USD 104 million over the previous 12 months. Subject to usual adjustments, the purchase price is approximately USD 190 million in cash.

-

Manufacturer Viessmann announced its forthcoming virtual event on June 17, 2021, would feature the unveiling of its newest goods. This announcement was supposed to highlight new boilers from the well-known Vitodens series as well as brand-new digital tools for contractors and homeowners. The newest generation of Vitodens condensing boilers, which was anticipated to become available in July 2021, was slated to be showcased at the product unveiling.

- Report ID: 4729

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Residential Boiler Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.