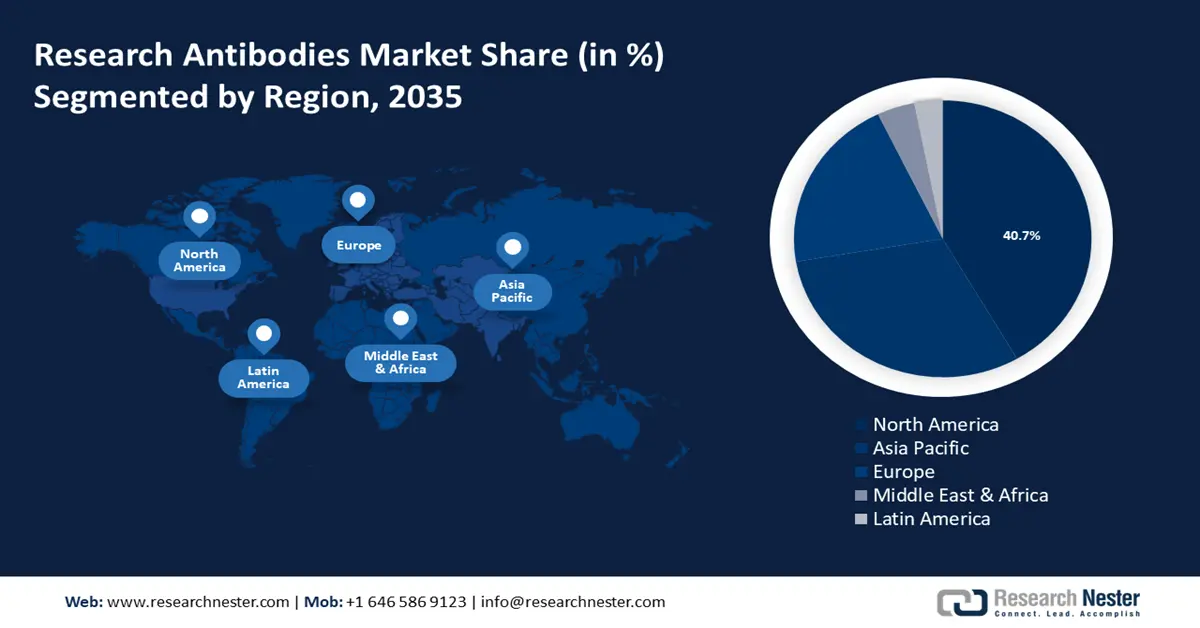

Research Antibodies Market Regional Analysis:

North America Market Insights

North America industry is set to account for largest revenue share of 40.7% by 2035, due to robust technological infrastructure, increasing investment by government in research & development, and strong regulatory frameworks.

In the U.S., biotechnology hubs like San Francisco Bay Area and San Diego contribute to a research-oriented ecosystem, boosting research antibodies market growth. Another significant driver is the presence of robust infrastructure, world-class universities, and top pharmaceutical companies which increase the demand for research antibodies. The US Food and Drug Administration (FDA) plays a stellar role in helping the commercialization of research antibodies while ensuring quality control. For instance, FDA approved the third anti-amyloid antibody for Alzheimer's by Eli Lilly in July 2024, and GSK’s B7 H3 targeted antibody drug in August 2024.

Canada holds a considerable share in the research antibodies market due to the extensive government support in the life sciences industry and a strong technological infrastructure. In October 2023, the government invested USD 15 million to create a nationwide genome library. The government is focused on creating a genome library for personalized medicines to cater to the rising demand for research antibodies. For instance, in February 2024, AbbVie and OSE immunotherapeutic announced a partnership to research and develop a novel monoclonal antibody that will help fight chronic inflammation.

APAC Market Insights

Asia Pacific is projected to witness a massive surge in the research antibodies market during the forecast period due to drivers such as increased investment in the healthcare sector of emerging economies, increasing spending on healthcare, and the rising trajectory of chronic diseases in the region.

In India, rising cases of chronic diseases such as cancer have boosted the demand for research antibodies. The emerging economy now has a significant population with high spending on healthcare, thereby increasing the demand for advanced care. This drives the need for research antibodies for personalized medicines. Key market players are capitalizing on the demand. For example, in March 2024, Roche launched a monoclonal antibody for two critical eye diseases in the country named Vabysmo.

China holds a significant revenue share in the APAC research antibodies market owing to its rapid economic development, increasing investments in research, and large domestic population. The regulatory approval ecosystem in China is robust and has led to a smooth approval process for products. In 2021, Mabwell Bioscience’s Anti St2 antibody was approved for clinical trial by the Centre for Drug Evaluation (CDE). The government invested USD 8 billion in its precision medicine plan which boosted the demand for research antibodies. In 2024, Duoning Biotech announced the commercialization of a single cell sorting system for antibody discovery.

Japan is a significant player in the APAC research antibodies market and is expected to hold a strong revenue share during the forecast period owing to rising government investments in research and focus on precision medicine due to the rapidly aging society. Recently, in March 2024, AstraZeneca’s Trugap was approved by the Ministry of Health, Labour and Welfare (MHLW) for recurrent PIK3CA.