Research Antibodies Market Outlook:

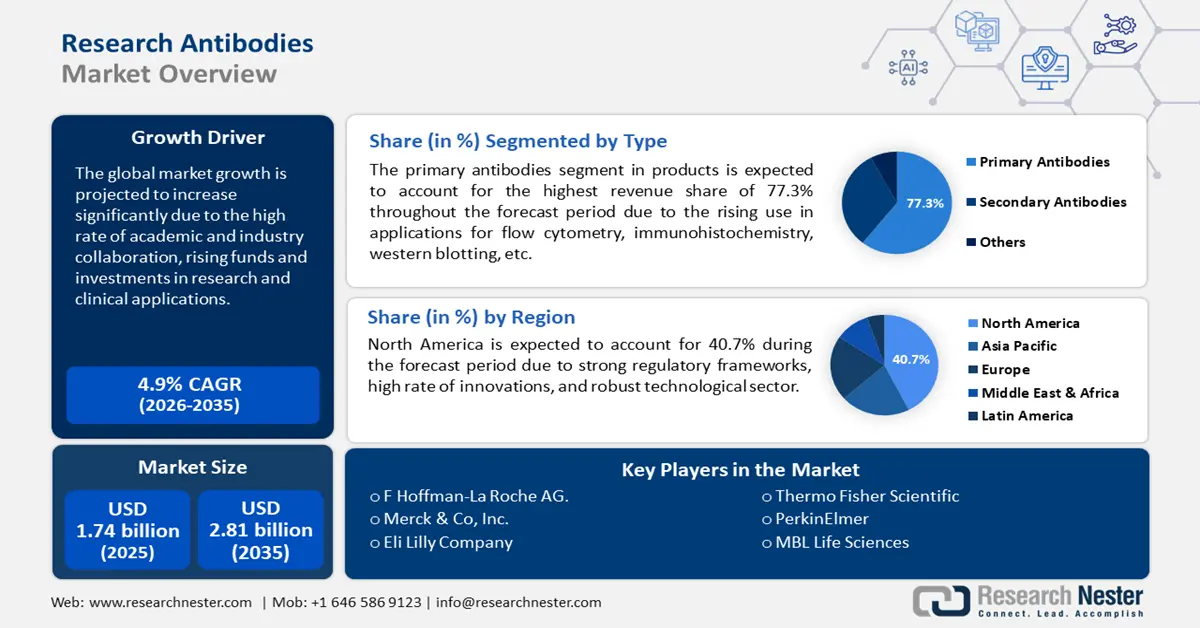

Research Antibodies Market size was valued at USD 1.74 billion in 2025 and is likely to cross USD 2.81 billion by 2035, registering more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of research antibodies is assessed at USD 1.82 billion.

Research academia and industry collaboration has grown manifold in the past few years. This trend has helped the market growth of research antibodies flourish. In 2019, Absolute Antibody partnered with the University of Georgia for medical applications of research antibodies developed at the university. Such collaborative efforts boost the speed of research efforts and provide licensing rights of breakthrough research to key research antibodies market players which can be effectively applied in commercial applications. For instance, in January 2023, Ono Pharmaceuticals Co., Ltd entered a collaboration agreement with Monash University to develop antibodies for G Protein-coupled receptors (GPCRs). Through this, the company will obtain the worldwide rights to commercialize existing antibodies developed by Monash along with any new antibodies arising from research.

Research antibodies are essential detection tools to understand cell functions. Researchers can use antibodies to identify how a cell function has gone wrong during its life cycle. For instance, a National Library of Medicine report in 2023, stated monoclonal antibodies (mAbs) are rapidly entering clinical therapeutics and have shown promise against HIV and malaria. As research and development continue to develop, the commercial applications of antibodies will grow significantly.

Key Research Antibodies Market Insights Summary:

Regional Highlights:

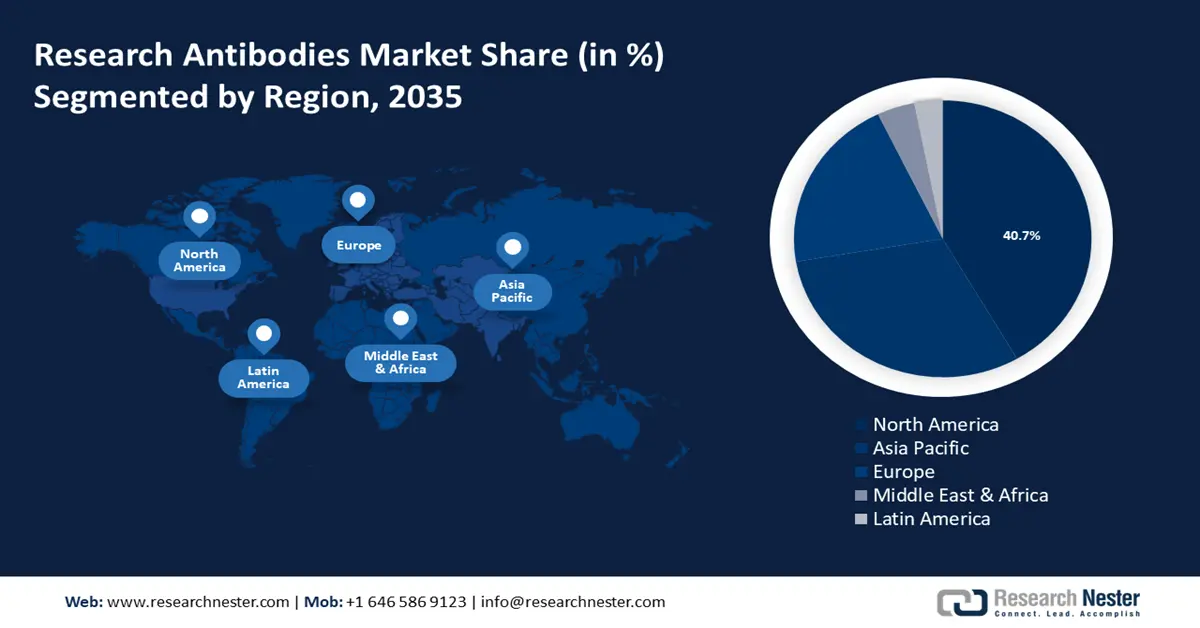

- North America research antibodies market will account for 40.70% share by 2035, driven by robust technological infrastructure, increasing government investment in R&D, and strong regulatory frameworks.

- Asia Pacific market will register massive growth during the forecast timeline, driven by increased investment in healthcare, rising healthcare spending, and a growing prevalence of chronic diseases.

Segment Insights:

- The primary antibodies segment in the research antibodies market is projected to grow significantly by 2035, fueled by rising demand for tools to study biological processes and biotechnology research.

- The monoclonal antibodies segment in the research antibodies market is projected to experience rapid growth till 2035, driven by increasing prevalence of chronic diseases and advancements in biotechnology.

Key Growth Trends:

- Rise of proteomics and genomics research

- Enhanced focus on biomarker development

Major Challenges:

- High cost of production

- Concerns on quality

Key Players: F. Hoffman La Roche AG, Merck & Co., Inc., AstraZeneca, Eli Lilly Company, Thermo Fisher Scientific, Abcam Plc, Immuno Biological Laboratories Co., MBL Life Sciences, PerkinElmer.

Global Research Antibodies Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.74 billion

- 2026 Market Size: USD 1.82 billion

- Projected Market Size: USD 2.81 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 18 September, 2025

Research Antibodies Market Growth Drivers and Challenges:

Growth Drivers

-

Rise of proteomics and genomics research: The rapid advancements in proteomics and genomics research are driving the research antibodies market. Increasing complexity in proteomics and genomics research warrants a wider range of research antibodies to study specific proteins and genes. In 2023, the latest findings from the Human Proteome Project (HGP) were shared in the Journal of Proteome Research. As per the latest findings, 18,397 of the 19,778 neXtProt predicted proteins in the human genome have been identified. Similarly, the HGP identified numerous unknown genes and proteins, leading to the identification of new drug targets and thereby increasing the demand for antibodies.

-

Enhanced focus on biomarker development: The increasing focus on biomarker research has driven the demand for research antibodies targeting specific proteins that are associated with various diseases. Increasing investments and funds in research have spurred the growth of antibody engineering techniques. In 2021, Roche’s VENTANA PD L1 antibody received Food and Drug Administration (FDA) approval.

-

Increasing need for personalized medicine: With considerable investments in genome studies, treatments for individual patients based on their genetic profile are possible which has driven the demand for antibodies. Next-generation sequencing (NGS) techniques identify human genomes faster and more accurately. These trends have led to a paradigm shift in the healthcare sector as personalized medicine demands have increased. As per a paper published at the University of Cape Town, the time and cost required to develop personalized therapies can be reduced through SNAP-tag fusion proteins that are based on antibodies.

Challenges

-

High cost of production: The production cost of research antibodies is high which can prove as a deterrent to market growth. Maintaining quality and also getting approval from regulatory bodies can escalate the production costs. The lack of cost-effectiveness can diminish the accessibility to smaller institutions or in emerging economies which can hamper the research antibodies market growth.

-

Concerns on quality: The lack of standardization in antibody production casts aspersion on quality control. Numerous studies have been retracted due to unreliable results which increases the time and investment in research. For instance, Nature Cell Biology research on insulin regulation was retracted after antibodies used in the research were deemed to be unspecific. Additionally, batch-to-batch variation and production bias pose challenges in reproducing findings.

Research Antibodies Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 1.74 billion |

|

Forecast Year Market Size (2035) |

USD 2.81 billion |

|

Regional Scope |

|

Research Antibodies Market Segmentation:

Product Segment Analysis

Primary antibodies segment is anticipated to dominate over 77.3% research antibodies market share by 2035. The key segment driver is the rising demand for tools to study and understand biological processes. These antibodies are used for research applications for immunohistochemistry, flow cytometry, and western blotting among others. The segment has also been boosted by the expansion of research activities in biotechnology and genomics. For instance, in 2021, the University of Cambridge developed single-domain antibodies (sdAbs) that can be used for treating acute coronary syndrome.

The secondary antibodies segment is expected to have considerable growth during the forecast period due to their role in improving detection sensitivity. The development of advanced detection techniques such as flow cytometry and fluorescence microscopy has enabled the growth of this segment. Key players in this segment are actively trying to improve measurement accuracy and reduce background noise. For example, Invitrogen Alexa Fluor Plus secondary antibodies were developed by ThermoFisher for a high signal-to-noise ratio.

Source Segment Analysis

The rabbit monoclonal antibody segment in research antibodies market is expected to hold a significant revenue share during the forecast period owing to its versatility. Rabbit monoclonal antibodies are used in various research techniques such as flow cytometry, immunohistochemistry, and western blotting. The adaptability increases their applications, thereby boosting research antibodies market growth. The key players in this segment are expanding their portfolio and investing in research & development activities to expand their market shares.

In February 2023, Roche launched the IDH1 R132H rabbit monoclonal primary antibody to identify mutation strains in patients diagnosed with brain tumors. In November 2022, Bruker Cellular Analysis launched Opto Memory B Discovery Rabbit Worfklow which assists in the discovery of rabbit antibodies suitable for research and diagnostics.

Type Segment Analysis

The monoclonal antibodies segment in research antibodies market is expected to register rapid revenue CAGR between 2026 and 2035 due to the increasing prevalence of chronic diseases, advancements in biotechnology, and the growing need for personalized medicine. Polyclonal antibodies help in testing for diseases such as herpes and HIV. The increased investments in research and development have enabled the primary market players of this segment to access new research breakthroughs. For instance, in May 2024, AstraZeneca’s Sipavibart trial demonstrated a decreasing level of COVID-19 symptoms in an immunocompromised population.

The polyclonal antibodies segment is also poised for significant growth during the forecast period owing to its cost-effectiveness. Advancements in antigen preparation have enabled the development of polyclonal antibodies with improved specificity. For instance, in 2021, ACTG announced the graduation of a novel polyclonal antibody therapy, SAB 185, for a phase 3 study.

Our in-depth analysis of the global research antibodies market includes the following segments:

|

Product |

|

|

Source |

|

|

Type |

|

|

Technology |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Research Antibodies Market Regional Analysis:

North America Market Insights

North America industry is set to account for largest revenue share of 40.7% by 2035, due to robust technological infrastructure, increasing investment by government in research & development, and strong regulatory frameworks.

In the U.S., biotechnology hubs like San Francisco Bay Area and San Diego contribute to a research-oriented ecosystem, boosting research antibodies market growth. Another significant driver is the presence of robust infrastructure, world-class universities, and top pharmaceutical companies which increase the demand for research antibodies. The US Food and Drug Administration (FDA) plays a stellar role in helping the commercialization of research antibodies while ensuring quality control. For instance, FDA approved the third anti-amyloid antibody for Alzheimer's by Eli Lilly in July 2024, and GSK’s B7 H3 targeted antibody drug in August 2024.

Canada holds a considerable share in the research antibodies market due to the extensive government support in the life sciences industry and a strong technological infrastructure. In October 2023, the government invested USD 15 million to create a nationwide genome library. The government is focused on creating a genome library for personalized medicines to cater to the rising demand for research antibodies. For instance, in February 2024, AbbVie and OSE immunotherapeutic announced a partnership to research and develop a novel monoclonal antibody that will help fight chronic inflammation.

APAC Market Insights

Asia Pacific is projected to witness a massive surge in the research antibodies market during the forecast period due to drivers such as increased investment in the healthcare sector of emerging economies, increasing spending on healthcare, and the rising trajectory of chronic diseases in the region.

In India, rising cases of chronic diseases such as cancer have boosted the demand for research antibodies. The emerging economy now has a significant population with high spending on healthcare, thereby increasing the demand for advanced care. This drives the need for research antibodies for personalized medicines. Key market players are capitalizing on the demand. For example, in March 2024, Roche launched a monoclonal antibody for two critical eye diseases in the country named Vabysmo.

China holds a significant revenue share in the APAC research antibodies market owing to its rapid economic development, increasing investments in research, and large domestic population. The regulatory approval ecosystem in China is robust and has led to a smooth approval process for products. In 2021, Mabwell Bioscience’s Anti St2 antibody was approved for clinical trial by the Centre for Drug Evaluation (CDE). The government invested USD 8 billion in its precision medicine plan which boosted the demand for research antibodies. In 2024, Duoning Biotech announced the commercialization of a single cell sorting system for antibody discovery.

Japan is a significant player in the APAC research antibodies market and is expected to hold a strong revenue share during the forecast period owing to rising government investments in research and focus on precision medicine due to the rapidly aging society. Recently, in March 2024, AstraZeneca’s Trugap was approved by the Ministry of Health, Labour and Welfare (MHLW) for recurrent PIK3CA.

Research Antibodies Market Players:

- F. Hoffman- La Roche AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co., Inc.

- Eli Lilly Company

- AstraZeneca

- Thermo Fisher Scientific, Inc.

- Abcam Plc

- PerkinElmer

- BGI Group

- Jackson ImmunoResearch Inc.

- Junshi Biosciences

The research antibodies market is competitive with the presence of global and regional players and new players venturing in for the market share. The significant growth potential is owed to the rapid advancements in biotechnology globally along with rising demand for precision medicines.

Some of the key players in the market are:

Recent Developments

- In July 2024, Thermo Fisher Scientific completed the acquisition of Olink which is expected to complement the life sciences offerings of Thermo Fisher Scientific.

- In May 2024, AstraZeneca laid the blueprint to build a USD 1.5 billion manufacturing facility for antibody-drug conjugates (ADC) in Singapore.

- In November 2021, Abcam and Nautilus Biotechnology, Inc. announced a strategic partnership. In the partnership, Abcam’s recombinant monoclonal antibody development technologies will enhance the research and development of Nautilus’ reagent.

- Report ID: 6416

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Research Antibodies Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.