Regenerative Braking System Market Outlook:

Regenerative Braking System Market size was valued at USD 8.13 billion in 2025 and is expected to reach USD 22.07 billion by 2035, registering around 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of regenerative braking system is evaluated at USD 8.9 billion.

The integration of regenerative braking systems in high-performance electric and hybrid vehicles is rapidly increasing to enhance driving dynamics and energy efficiency. The optimization of energy recovery through RBS is expected to help electric hypercar makers and high-performance EV manufacturers enhance battery control and achieve extended driving distances. Manufacturers in the automotive sector are working on building improved regenerative braking systems that maintain vehicle stability through optimized braking force distribution during energy recovery operations. These innovations are expected to deliver improved performance skills and assist sustainability efforts through their reduction of traditional brake systems and decreased brake component wear while lowering environmental emissions.

In addition, the continually increasing smart city initiatives and green transportation projects are receiving support from governments and private organizations, enhancing the rapid adoption of electric and hybrid vehicles with regenerative braking systems. The advancements in reliable electrical vehicle charging infrastructure also serve as a fundamental aspect of this initiative, attributed to its ability to enable broad EV adoption, further anticipated to result in regenerative braking technology implementation

Key Regenerative Braking System Market Insights Summary:

Regional Highlights:

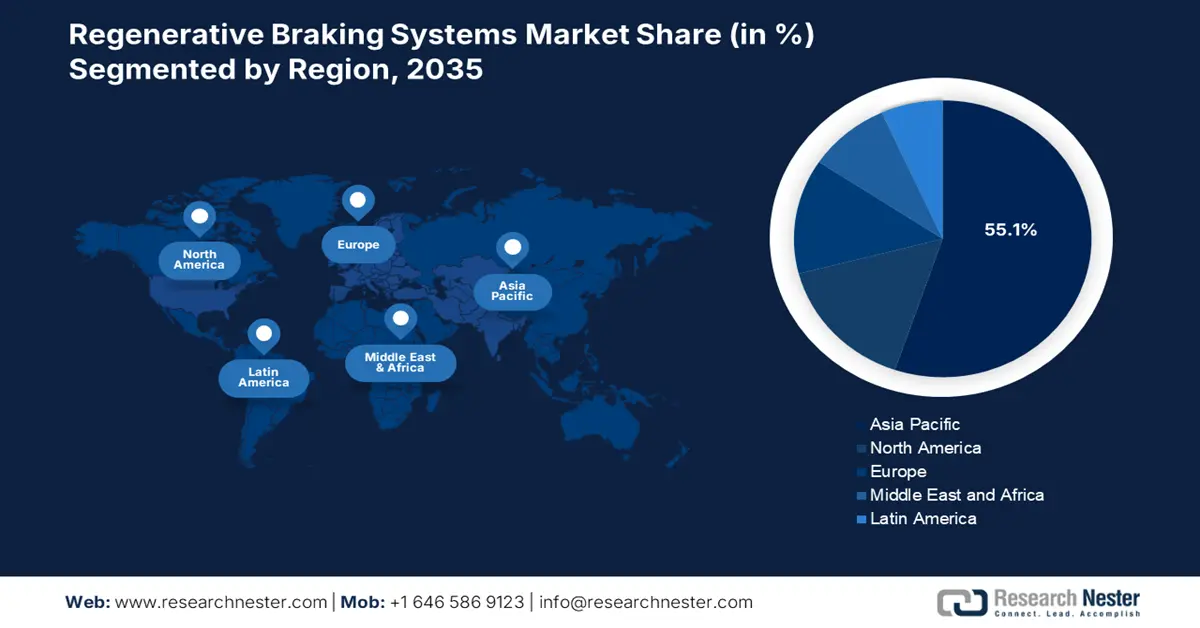

- Asia Pacific commands a 55.1% share in the regenerative braking system market, driven by rising support for electric cars and strict pollution standards, positioning it for significant growth through 2035.

Segment Insights:

- BEVs segment are forecasted to generate significant revenue by 2035, driven by improvements in high-voltage battery design and energy efficiency demands.

- The Battery segment is projected to hold a 41.4% share by 2035, driven by technological advancements and strategic collaborations in battery technology.

Key Growth Trends:

- Development of advanced energy storage systems

- Rising strategic investments

Major Challenges:

- Limited efficiency in conventional vehicles

- Weight and space constraints

- Key Players: Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, and BorgWarner Inc.

Global Regenerative Braking System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.13 billion

- 2026 Market Size: USD 8.9 billion

- Projected Market Size: USD 22.07 billion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 12 August, 2025

Regenerative Braking System Market Growth Drivers and Challenges:

Growth Drivers

- Development of advanced energy storage systems: Companies involved in automotive manufacturing are dedicating their resources to developing sophisticated storage solutions that help their vehicles perform better and consume less energy. The advancements in battery systems are anticipated to allow rapid energy collection from braking along with enhanced power redirection, increasing the demand for RBS technologies. ZapBatt collaborated with Toshiba in July 2022 to integrate its customized AI software functions into Toshiba's lithium titanium oxide battery cells. This strategic collaboration is working together to construct an efficient energy-saving and advanced battery system for micromobility systems that are expected to expand its use to larger electric vehicles.

- Rising strategic investments: Several key players are investing in R&D activities to improve power efficiency and decrease environmental pollutants. For instance, in February 2023, BP announced its commitment to invest USD 1 billion in expanding electric vehicle charging stations throughout the U.S. until 2030. The company is planning to construct over 100,000 charging points globally, while rapid and ultra-fast chargers are expected to make up 90% of this total. Through this initiative, the adoption of EVs is expected to be easier, and regenerative braking systems are expected to gain more traction at the same time due to an increased number of road vehicles capable of efficient energy recycling. In addition, strategic investments from public and private sectors are speeding up the incorporation of regenerative braking technologies, helping cities to be more sustainable and energy efficient in their transportation systems.

Challenges

- Limited efficiency in conventional vehicles: The regenerative braking systems are serving electric and hybrid vehicles specifically, attributed to their capabilities to capture kinetic energy and turn it into stored energy. Internal combustion engine vehicles are not able to use energy recuperation due to their lack of electric drivetrain systems that prevent storing excess energy for later application. The lack of an electric drivetrain in ICE cars is leading to the replacement of RBS with mechanical friction brakes, thus reducing its effectiveness. The need for comprehensive adoption is hindered as the RBS technology is restricted by its inability to serve conventional vehicles, making up the large automotive sector, hampering the shift to regenerative braking systems.

- Weight and space constraints: The implementation of regenerative braking systems requires power converters as well as energy storage units and electronic controllers to meet such requirements, thereby increasing vehicle weight and creating space constraints. Space restrictions are creating significant problems for producers of compact cars and small commercial vehicles as these vehicles need maximum room efficiency. Additional vehicle weight in hybrid models cuts into fuel efficiency and partly eliminates the energy savings advantages the technology is meant to provide. The technological requirements are restricting RBS deployment in smaller vehicles, thus slowing down its widespread use in the complete automotive sector.

Regenerative Braking System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 8.13 billion |

|

Forecast Year Market Size (2035) |

USD 22.07 billion |

|

Regional Scope |

|

Regenerative Braking System Market Segmentation:

By Component (Battery, Motor, ECU, Flywheel)

Battery segment is set to account for regenerative braking system market share of more than 41.4% by the end of 2035, owing to increasing advancements in technology and strategic collaborations between major players. Lithium iron phosphate batteries effectively improve energy storage capabilities, efficiency, and reliability of RBS operations. Key players are implementing advancements in battery technologies to attain high performance. For instance, in January 2025, BorgWarner presented high-energy LFP battery systems at the Bharat Mobility Global Expo. The blended cell technology from FinDreams Battery implements modular batteries to strengthen vehicle range and safety characteristics and to enhance regenerative braking system performance.

Automotive producers, together with technological companies, are creating innovative battery systems for RBS targets through their partnerships. Such alliances are combining the creative deployment of advanced battery technologies with regenerative braking systems to improve vehicle efficiency and energy recovery efficiency. Collaborative partnerships are expediting innovations and RBS adoption, which in turn drives the market expansion of the battery segment.

Propulsion Type (BEV, PHEV, FCEV)

The BEV segment in regenerative braking system market is expected to register significant revenue during the forecast period due to improving high-voltage battery designs and increasing demands for energy efficiency. Optimizing regenerative braking energy recovery is imperative for BEVs as this process is directly extending the driving range and producing better vehicle output. Several automakers are working toward creating powerful battery packs to manage energy inputs from RBS systems, resulting in enhanced battery longevity and improved energy storage capabilities.

Modern innovations are enhancing the effectiveness of regenerative braking systems, further driving manufacturers to adopt these systems at faster rates for electric vehicles. Strategic collaborations between the companies are also propelling the segmental growth. For instance, in January 2023, Honda partnered with GS Yuasa to produce electric vehicle lithium-ion batteries with high capacity and output capabilities to improve regenerative braking efficiency. The companies are expected to develop advanced battery systems through strategic alliances to improve electric vehicle energy retention alongside regenerative brake efficiency.

Our in-depth analysis of the global regenerative braking system market includes the following segments:

|

Component |

|

|

Propulsion Type |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Regenerative Braking System Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific in regenerative braking system market is expected to hold over 55.1% revenue share by the end of 2035, driven by the rising support for electric cars and official support for environmentally friendly transportation. China, Japan, and India are introducing strict pollution standards along with subsidies for electric and hybrid vehicles, supporting the adoption of energy-efficient RBS technologies. The region is standing out as an expanding regenerative braking system market due to fast-paced urban development and growing populations in megacities, generating higher requirements for clean transportation solutions that increase the necessity of regenerative braking systems for electric and hybrid vehicles.

The China regenerative braking system market is expected to grow, as the EV sector is partnering strategically as well as the acceleration of advanced technology in the EV field. The leading automotive companies in the country are jointly working on battery-swapping infrastructure development with simultaneous efforts to enhance energy recovery systems to enable smooth integration of regenerative braking capabilities. These programs are working to create standardized battery solutions while maximizing vehicle performance and encouraging the broad implementation of RBS throughout the regenerative braking system market. New energy vehicle guidelines and environmental regulations from government bodies are creating an acceleration of demand for state-of-the-art braking systems that optimize energy retrieval capacity.

The India regenerative braking system market is anticipated to accelerate with the increasing popularity of smart and connected vehicle technologies in the country. Automakers in the nation are implementing cutting-edge telematics systems and AI-driven braking technology to boost their vehicle efficiency levels. The adoption of RBS technology is increasing, owing to the intelligent braking systems that apply regenerative braking effectively due to real-time analysis of driving conditions and traffic data. In addition, government initiatives for intelligent transport systems are promoting auto manufacturers to adopt advanced braking technologies in electric and hybrid vehicle products that propel the market growth.

North America Market

The North America regenerative braking system market is expected to witness a rapid expansion between 2026 and 2035 due to the increasing demand for high-performance electric and hybrid vehicles. The rising need for energy-efficient and sustainable vehicles is driving automakers in the region to use advanced braking technology to recover braking power. Advanced braking energy recovery systems are finding applications in electric models to create greater range possibilities and increased efficiency.

The region is also experiencing a rapid growth of electrified commercial fleets, which is leading to increased use of regenerative braking systems. Logistics and delivery companies are shifting their fleets to electric trucks and vans as electric transportation helps cut down operational expenses and fulfill their sustainability promises. Fleet operators prefer vehicles with regenerative braking systems as it let them maximize battery effectiveness and reduce their energy expenses. The increasing adoption of electric fleets is fueling the integration of RBS systems, thus adding significant importance to commercial vehicle efficiency in the region.

The U.S. regenerative braking system market is anticipated to achieve a steady growth, attributed to rising smart infrastructure investment and linked vehicle technology advancements. Highway regulatory bodies, along with federal entities, are supporting the introduction of intelligent transportation systems that use regenerative braking systems to boost energy conservation. Through the combination of smart road networks with V2G technologies, the usability of RBS systems is achieving significant efficiency through enhanced energy management solutions.

The regenerative braking system market in Canada is experiencing significant growth owing to stringent environmental regulations and goals to lower carbon emissions. The local government policies are driving automotive manufacturers to use energy-saving regenerative brakes for electric and hybrid vehicles. The push toward zero-emission vehicles, together with tightening emissions requirements, is encouraging manufacturers to adopt RBS systems as they enable better energy efficiency and help fulfill sustainability targets. EV adoption is gaining support from the Zero-Emission Vehicle Infrastructure Program, which benefits regenerative braking adoption through its expansion of electric vehicle charging facilities.

The RBS market in the country is experiencing growth due to heightened interest in electrifying heavy-duty and commercial vehicles. Major fleet operators in Canada are entering the electric transformation of their transportation sector by adopting electric trucks and delivery vans with regenerative braking systems for optimized efficiency. The government support of sustainable freight transport alongside growing green supply chain requirements is fueling commercial EV market growth, boosting the regenerative braking system implementations across different automotive sectors.

Key Regenerative Braking System Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- ZF Friedrichshafen AG

- BorgWarner Inc.

- Hyundai Mobis

- Eaton

- Brembo S.P.A

- Skeleton Technologies GmbH

The competitive landscape of the regenerative braking system market is rapidly evolving, attributed to the integration of advanced technologies in the industry by key players. They are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global regenerative braking system market:

Recent Developments

- In January 2025, Panasonic Energy Co. Ltd. and Lucid Group announced that the Lucid Gravity Grand Touring would be powered by Panasonic Energy’s lithium-ion EV battery cells.

- In September 2024, Accelera launched its new integrated brake chopper resistor at the IAA Transportation in Hannover, Germany. The iBCR includes robust cyber security features with improved performance and reliability.

- Report ID: 7279

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Regenerative Braking System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.