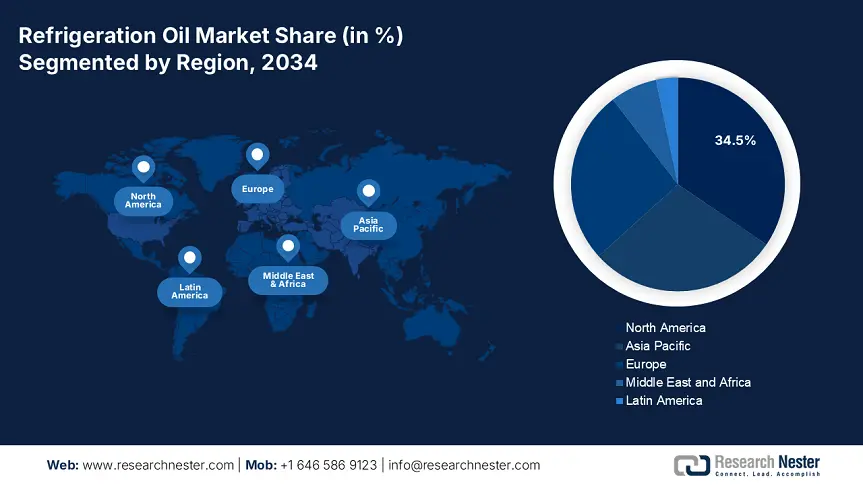

Refrigeration Oil Market - Regional Analysis

North America Market Insights

By 2034, the North American market is expected to hold 34.5% of the market share due to growth in the HVAC and industrial refrigeration sectors. The North American refrigeration oils market was valued at USD 481 million in 2024, and the U.S. is expected to account for >76% of this value. Growing cold storage development and growing food processing in Canada and Mexico are supporting the growth of refrigeration oils in these markets. It is reported by the U.S. EIA that energy consumption from commercial refrigeration in North America rose by 4.4% in 2023, which has provided additional demand for lubricants. Synthetic refrigeration oils are being adopted at an accelerated pace as environmental compliance ramps up.

In the U.S., the market for refrigeration oils was USD 361 million in 2024 with an expected CAGR of 4.0% from 2024-2030. The American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) reported that in 2023, there were >91 million HVAC units in operation throughout the U.S., implying that lubricant consumption from HVAC was growing. The fluid formulations are also being modified in consideration of moving to low-GWP refrigerants. Strong EPA SNAP response regulations are stimulating demand for synthetic oil replacements for mineral oil-based formulations. The major consuming sectors remain food retail, pharmaceuticals, and cold-chain logistics.

Asia Pacific Market Insights

The Asia Pacific market is expected to hold 28.8% of the market share due to demand from automotive, food processing, and HVAC activities. The region was valued at over USD 591 million in 2024, with China accounting for more than 41%. The Asia Pacific refrigeration oil market anticipates a growth rate with a CAGR of 5.9% between 2024-2034, reflecting in part the maturation of the economy for demand and rapid industrialization with demand for cold storage facilities and country-specific efficiency requirements related to refrigeration systems in Japan, India, and South Korea.

In 2024, China dominated the Asia Pacific refrigeration oil market with a market size of ~USD 241 million due to the substantial manufacturing capabilities in refrigeration and air conditioning equipment. The Asia Pacific refrigeration oil market is forecast to have a CAGR of 6.1% between 2024 and 2034 because of rising investments in commercial refrigeration for food preservation and pharmaceutical manufacturing processes. Additionally, the future government initiatives for energy-efficient refrigerants and oils are providing a strength for the demand for synthetic refrigeration oils to further meet environmental norms.

Country-Wise Statistics: Investments, R&D, Competitive Landscape

|

Country |

Investments ($ Million) |

R&D (% of Sales) |

Competitive Landscape Highlights (No. of Major Players / Facilities) |

|

Japan |

341 |

4.9% |

6 major refrigeration oil producers, 12 lubricant R&D centers |

|

China |

791 |

5.6% |

14 major players, 20+ specialized refrigeration oil plants |

|

India |

211 |

3.8% |

8 key players, 9 manufacturing facilities |

|

Indonesia |

96 |

2.2% |

4 main market participants, 3 blending facilities |

|

Malaysia |

89 |

2.7% |

5 active players, 4 blending plants |

|

Australia |

121 |

3.3% |

6 major suppliers, 5 distribution facilities |

|

South Korea |

266 |

5.0% |

7 prominent producers, 10 R&D centers |

|

Rest of APAC |

141 |

3.0% |

12 regional suppliers, 7 manufacturing/blending plants |

Europe Market Insights

The European market is expected to hold 26.3% of the market share due to the growth of food processing, industrial refrigeration, and HVAC. European countries will account for more than 26% of global refrigeration equipment exports in 2023. Stringent F-Gas regulations have increased the usage of high-performance POE and PAG oils that align with low-GWP refrigerants. In addition, the European automotive industry, which has produced over 12 million cars in 2023 according to ACEA, adds to the demand. Key suppliers, such as BASF, Fuchs, and ExxonMobil, continue to innovate low-viscosity, synthetic oils for enhancing energy efficiency.

Country-wise Refrigeration Oil Market Statistics

|

Country |

Key Statistics (Refrigeration Oil Market) |

|

UK |

~8% of Europe’s refrigeration oil demand; large cold storage capacity exceeding 40 million m³; major suppliers include Shell and Fuchs |

|

Germany |

~23% Europe share; 4.2 million cars produced (2023 ACEA); >24,001 industrial refrigeration systems; BASF and Fuchs leading |

|

France |

~15% market share; over 15 million m³ cold storage capacity; key suppliers: TotalEnergies and ExxonMobil |

|

Italy |

~11% market share; strong food processing sector with >70,001 food companies (ISTAT) driving demand |

|

Spain |

~10% share; largest fruit and vegetable cold chain in Europe; major suppliers: Repsol and Shell |

|

Russia |

~9% share; refrigeration oil demand impacted by sanctions; domestic supply focus with Lukoil dominant |

|

Nordic |

~7% share; high per capita cold storage capacity; major suppliers include Neste and ExxonMobil |

|

Rest of Europe |

~25% share; includes Poland, Netherlands, Belgium, Eastern Europe; significant food export and automotive manufacturing growth supporting the market |