Reflective Materials Market Outlook:

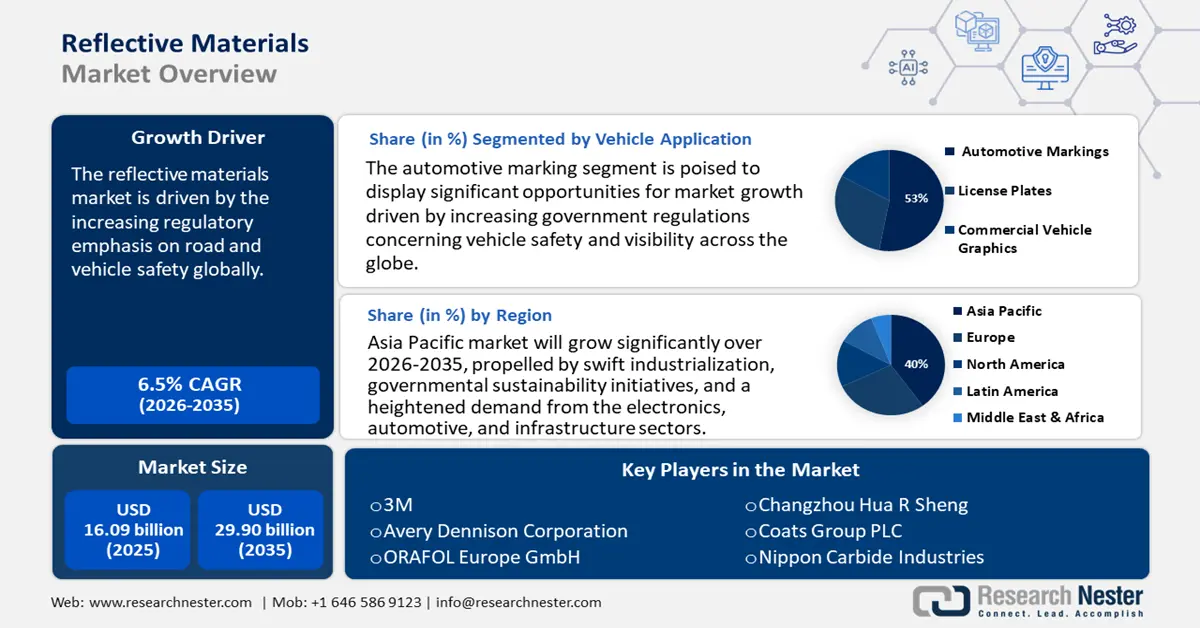

Reflective Materials Market size was valued at approximately USD 16.09 billion in 2025 and is projected to reach USD 29.9 billion by the end of 2035, rising to a robust CAGR of 6.5% during the forecast period from 2026 to 2035. In 2026, the industry size of reflective materials is evaluated at USD 17.11 billion.

The primary growth driver of the reflective materials market is the increasing regulatory emphasis on road and vehicle safety globally. Government mandates requiring enhanced visibility features in the automotive and transportation sectors have led to widespread adoption of reflective materials. For instance, the U.S. Department of Transportation’s Federal Highway Administration (FHWA) reports that improved reflective road signage reduces nighttime accidents at intersections by 33%-38%, and pedestrian and bicyclist accidents by 47%. Similarly, the European Commission’s road safety strategy underlines reflective materials as critical to meeting its Vision Zero target for reducing road fatalities. These regulatory frameworks continue to strengthen demand for reflective materials globally, especially in automotive and infrastructure projects.

The supply chain for raw materials such as micro prismatic sheeting and glass beads remains concentrated, with major production hubs in the Asia Pacific and North America. Investments in research, development, and deployment (RDD) are supported by government grants, notably in the U.S. and Europe, to improve retroreflective efficiency and durability. Regarding trade, the U.S. Census Bureau reports that reflective material imports grew annually between 2021 and 2023, primarily from Asia, while exports to Europe and Latin America have increased over the same period, reflecting expanding global assembly and distribution networks. Expansion in manufacturing capacity is ongoing, with several new assembly lines established in Southeast Asia to meet regional demand growth.