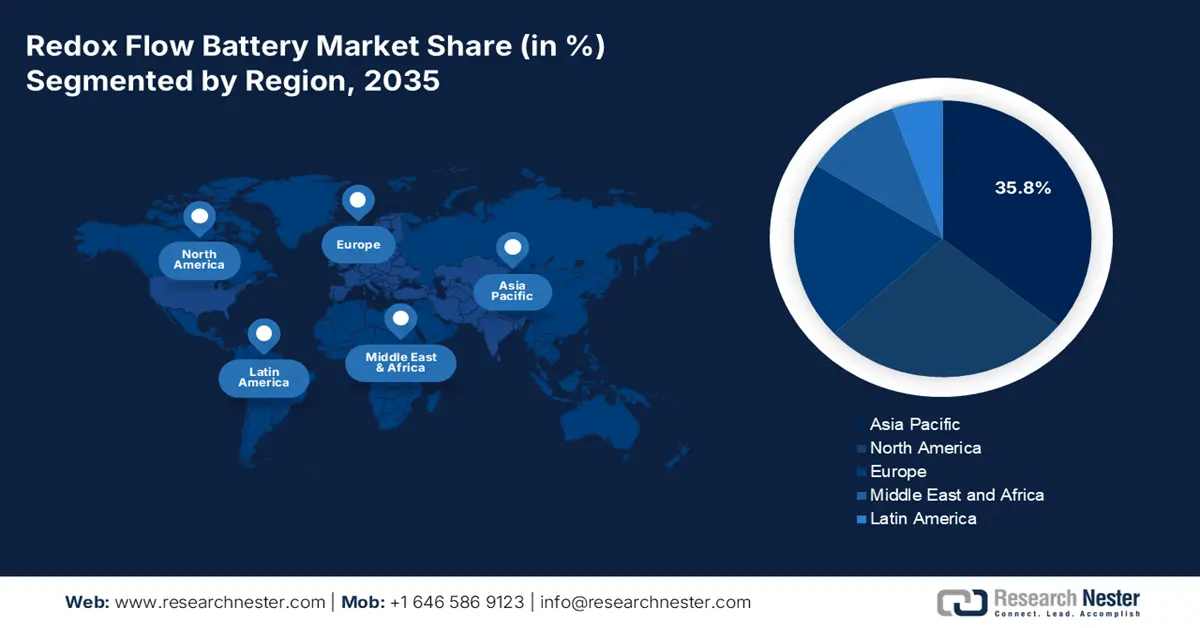

Redox Flow Battery Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 35.8% of the redox flow battery market share due to growing investments in renewable energy infrastructure, supportive national energy transition policies, and grid-scale energy storage projects. These leading countries have large-scale solar and wind prerogatives, resulting in energy storage alternatives being sought, thus a growing interest in long-duration storage capabilities. The Asia Pacific redox flow battery market growth is ascribed to increasing investments, local manufacturing opportunities, the rising frequency of grid instabilities being observed, and increasing demand for alternatives to lithium-based energy storage.

China is projected to undergo phenomenal growth, with the redox flow battery market value projected to reach USD 975.7 million by 2034, increasing from USD 210.8 million in 2025. These projections are mainly due to national goals of achieving carbon neutrality by 2060 and aggressive Victorian Electricity Commission's aggressive move to incentivize energy storage. China has commissioned numerous vanadium redox flow battery projects and surpassed 100 MWh of solutions, and has more planned for grid reliability and potential peak shaving. State-owned enterprises have increased investment in R&D, furthering supply chain investment and reducing unnecessary dependence on valuable lithium imports, while also putting redox flow batteries in immediate consideration for energy storage solutions.

Renewable Energy Adoption & Government Policy Support

|

Country |

Renewable Energy Capacity/Share of Clean Power Mix (2030 Target) |

|

Japan |

38% share in overall clean electricity

|

|

China |

Surpass 1,200 GW 2030 target 6 years early |

|

India |

500 GW non-fossil target |

Source: Ember, Climate Action Tracker, PIB

North America Market Insights

The North American market is expected to hold 27.2% of the redox flow battery market share and about 125 million USD, with an anticipated average growth of about 26% CAGR from 2024 to 2031. The U.S. has witnessed over USD 500 million in capital funding into redox flow firms in the last 15 years via an amalgamation of private equity/venture capital and public equity raises. According to the Pacific Northwest National Laboratory September 2024 report, long-duration energy storage (LDES) entrants were granted USD 3.4 billion through VC/private equity funding. The US flow battery sector has yet to reach commercial liftoff. In North America, there are established vendors such as Sumitomo, ESS Inc., VRB Energy, and others that are moving utility‐scale and hybrid deployments forward.

In 2024, the U.S. led North American adoption with over 370 MWh of redox flow battery capacity installed. The U.S. contributed approximately USD 99 million to the North American market in 2024, and grew at a staggering CAGR towards the end of 2020 across North America. The primary drivers of this growth are grid modernization, renewable integration, federal subsidies, pilot programs aimed at arbitrage, frequency regulation, and long-duration storage. Major suppliers supporting this market growth include US-based suppliers such as ESS, Vionx Energy, and hybrid innovators.

Europe Market Insights

The European market is expected to hold 20.9% of the redox flow battery market share, and expects that with the EU 2030 climate objectives and energy storage incentives that there will be significant deployments supporting those 2030 targets. The EU anticipates a wide variety of approaches that will include public-private partnerships and broader funding through Horizon Europe, which will support a growing redox flow battery presence at scale while keeping in mind that redox flow batteries represented and estimated 18% of large-scale storage deployments in 2024. Redox flow batteries showcase great potential for high-capacity stationary energy. However, they exhibit significant challenges in mass transport, and sluggish kinetics adversely affect their efficiency. As a result, the ERC-funded RECHARGE initiative that commenced in January 2024 will integrate structured 3D electrodes with pulsatile flow to elevate RFB output to new heights. The project intends for a 1,000 mW/cm² power density and a round-trip efficiency of 85%.