Recycling Equipment Market Outlook:

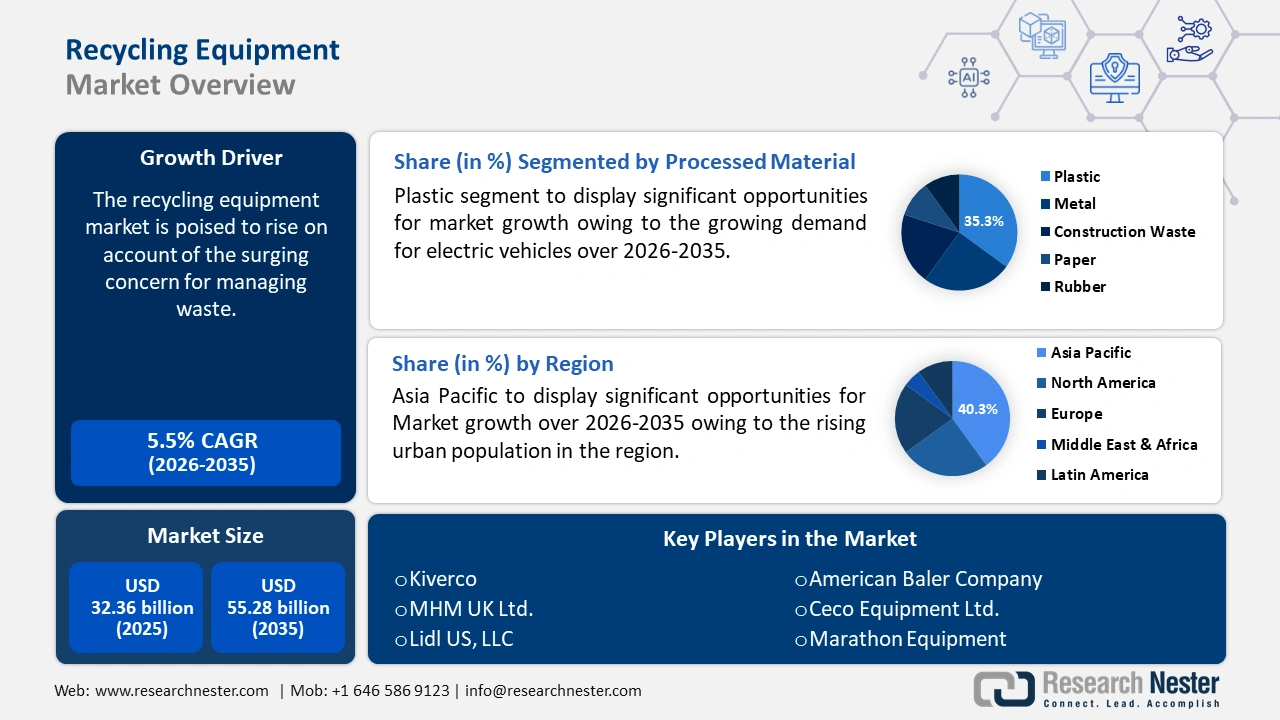

Recycling Equipment Market size was valued at USD 32.36 billion in 2025 and is expected to reach USD 55.28 billion by 2035, expanding at around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of recycling equipment is evaluated at USD 33.96 billion.

The surging concern for managing waste is the major factor driving the recycling equipment market growth. For instance, as estimated by the UN Environmental Program, the generation of Municipal solid waste is forecasted to surge globally to 3.8 billion tons by 2050 highest from 2023. As a result, the need for recycling to control waste creation is estimated to rise. As policymakers and brand owners alike consider how to reduce plastic pollution, recover and reuse more containers, and generally move towards a circular economy, deposit return systems are being evaluated as a policy tool for their ability to significantly raise beverage container recycling rates.

Key Recycling Equipment Market Insights Summary:

Regional Highlights:

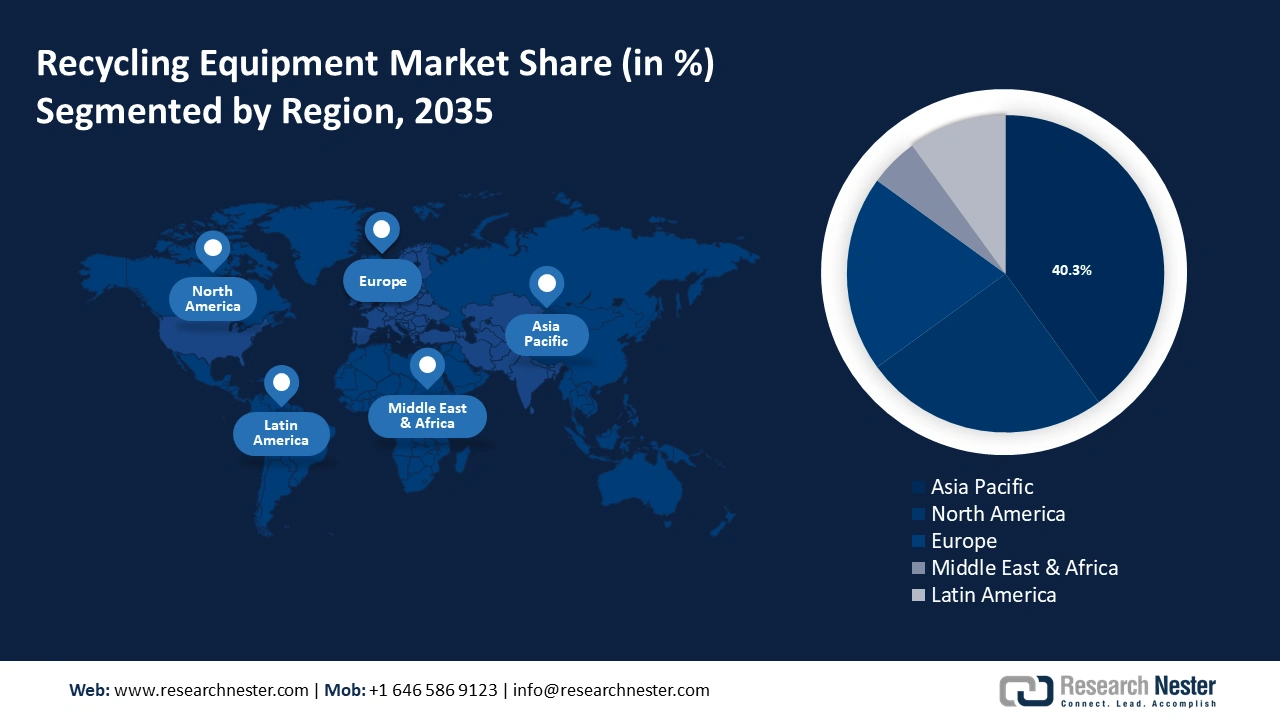

- The Asia Pacific recycling equipment market achieves a 40% share by 2035, driven by surging urban population and increasing waste generation.

Segment Insights:

- The plastic segment in the recycling equipment market is projected to achieve significant growth till 2035, attributed to the rising demand for electric vehicles incorporating recycled plastics.

- The baler press segment in the recycling equipment market is expected to achieve a 30.10% share by 2035, driven by increasing waste from construction activities and the baler press's efficiency in compressing materials.

Key Growth Trends:

- Growing need for recycling hazardous materials

- Increasing government initiatives to reduce carbon emissions

Major Challenges:

- Growing need for recycling hazardous materials

- Increasing government initiatives to reduce carbon emissions

Key Players: General Kinematics Corporation, Lidl US, LLC, Recycling Equipment Manufacturing, Inc., Charoen Pokphand Group.

Global Recycling Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.36 billion

- 2026 Market Size: USD 33.96 billion

- Projected Market Size: USD 55.28 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Recycling Equipment Market Growth Drivers and Challenges:

Growth Drivers

-

Growing need for recycling hazardous materials: The U.S. Environmental Protection Agency (EPA) has identified and categorized under the F, K, P, and U lists of the Code of Federal Regulations. The F-list comprises hazardous wastes from common industrial and manufacturing processes including spent and electroplating solvents, and other metal finishing wastes. Furthermore, the EPA has classified the producers of these wastes as large-quantity generators, which include industrial processes that generate 2,205 lbs. of hazardous waste every month, small quantity generators with byproducts between 220 lbs. to 2,205 lbs, and very small quantity generators that produce less than 220 lbs. per month.

Metal scrap is typically coated with cutting fluid, with potentially hazardous compounds such as paint waste, degreasers, lubricants, cutting fluids, and wastewater pretreatment sludges. Furthermore, depending on the cooling lubricant used and metal type swarf, grinding fines, shavings, and other metal waste could also be considered unsafe and lead to health problems. Metal scrap and fluid separation separating machines cater to the above-mentioned challenges and facilitate cost-saving by decreasing the total scrap weight that needs to be hauled away. This further creates an opportunity to reuse cutting fluids.

Furthermore, the introduction of automated equipment solutions for scrap segregation and recycling has aided in streamlining the overall process. The NxtCut mid-market scrap shear launched by Lindemann in August 2024 is designed to automate the processing of moderate volumes of assorted scrap metal. NxtCut 1025-8 variation caters to bulky mixed steel scrap using advanced structural analysis and an enclosed magnetostrictive pusher cylinder. Its energy efficiency aligns with the company’s commitment of ‘green steel cycle’. Focus on sustainability has gained traction to combat compliance consequences in cases of hazardous fluid leaking into the environment. - Increasing government initiatives to reduce carbon emissions: Governments of various countries have initiated programs to help reduce greenhouse gases and carbon footprints to mitigate the associated health risks. For example, the EU has set goals for its 27 Member States, targeting an increased rate of recycling and a reduced landfilling rate by 2025, making 55% of waste and 65% of packaging waste recyclable or reusable. Hence, the programs are accompanied by increased demand for equipment and technology for recycling to encourage sustainability.

This is further expected to protect the available natural resources and the amount of waste that might end up in landfills is also anticipated to be reduced. Furthermore, the availability of landfills is limited, and the amount of waste generated by increasing populations and consumerism is surging. Hence, governments are encouraging recycling practices through the implementation of laws such as landfill levies, landfill bans, and recycling targets.

Collaborative efforts among governments, businesses, and communities are vital to facilitate a conducive approach toward recycling. Initiatives such as extended producer responsibility programs and deposit-return schemes incentivize responsible recycling practices, thereby allowing the transition toward a circular economy. The ongoing efforts to support sustainable industrial process are projected to drive the recycling equipment market growth.

Challenges

-

Products made from recycled material lack quality: The quality of recycled aggregate (RA) is often compromised owing to its intrinsic porosity. The possibility of materials losing their essential physical and functional qualities hampers recycling equipment market adoption. However, the reinforcement of RA with permeable crystalline materials has showcase promising potential to attenuate this challenge and play a key role in the sustainable development of future constructions.

Recycling Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 32.36 billion |

|

Forecast Year Market Size (2035) |

USD 55.28 billion |

|

Regional Scope |

|

Recycling Equipment Market Segmentation:

Equipment Segment Analysis

The baler press segment in the recycling equipment market is anticipated to generate the highest revenue share of about 30.1% by the end of 2035. The baler press device is being significantly utilized in compressing and binding materials into small, controllable bundles. The baler press is frequently employed by manufacturing plants, recycling centers, and businesses for easier recycling storage and transportation.

Moreover, it has also been used for cleaning waste items in the construction sector. Hence, with the growing amount of waste created by construction activities, the segment is expanding. For instance, in UK, it is estimated close to 60% of the waste is generated by the construction industry. Additionally, by accurately compressing materials into minimal bundles, the baler press reduced the volume of better handling, storing, and transporting. Industries may decrease labor costs through the use of baler presses, which expedite the recycling process and reduce the quantity of material effort needed.

Additionally, the separator segment is also poised to rise during the projected timeframe. The separator is an integral part of recycling machinery that sorts materials based on attributes including density, size, or magnetic susceptibility. By helping in the separation of materials that include paper, plastic, rubber, and metals, the separator enhances safe recycling practices.

Processed Material Segment Analysis

Plastic segment is set to capture over 35.3% recycling equipment market share by 2035. This growth of the segment is poised by the growing demand for electric vehicles. For instance, according to the International Energy Agency, in 2023, about 14 million electric vehicles were sold across the world. Consequently, EV manufacturers are looking forward to incorporating recycled plastics in electric vehicles. For instance, in its upcoming EV vehicles, Kia aims to utilize recovered plastic from a 55-ton haul that was just recovered from the Pacific Ocean. As a result, owing to such efforts the segment is expected to flourish.

Our in-depth analysis of the recycling equipment market includes the following segments:

|

Equipment |

|

|

Processed Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Recycling Equipment Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to hold largest revenue share of 40% by 2035. The growth of the market in this region is poised to be influenced by a surging urban population. According to the UNFPA predictions, over 60% of the global population is estimated to reside in Asia Pacific. Furthermore, this determines close to 4.3 billion population dwelling in this region, and waste generation is also poised to grow.

Additionally, the recycling equipment market in China is driven by the proliferating plastic recycling in the country. Presence of globally dominating players including China Recycling Newell Equipment (Jiangsu) Co., Ltd. (CRNE) and Purui Machinery. CRNE has a strong alliance in the scrap recycling industry and has established strategic partnerships with BOSCH, MKS, ERIEZ, and ROCKWELL.

The India recycling equipment market is expanding ascribed to rising foreign investments. In July 2024, Linder a European shredding company established a subsidiary in India to strengthen its foothold in foreign markets.

Furthermore, the recycling equipment market in Japan is additionally expected to grow over the forecast period. The country has a stringent regulatory framework that governs and advocates the adoption of recycling equipment. For instance, the prevalent Home Appliance Recycling Law promotes the recycling of end-of-life home appliances as bulky and non-combustible waste.

North America Market Insights

The North America recycling equipment market is expected to have significant growth during the forecast period. The main element to influences the market expansion in this region is poised to be dominated by the increasing recycling of paper and cardboard. For instance, in the year 2022, in the U.S. cardboard boxes were predicted to be the most recycled material with a surge of about 92% compared to the year 2021.

Furthermore, the U.S. recycling equipment market growth is marked by ongoing product innovation and diversification by the local companies. For example, in 2021 American Baler Company unveiled W828 and W721 upgrades to their 2-Ram Baler models. These incorporate off-the-shelf Parker Din Cartridge and standard Directional Control valves. In July 2023, MSS Inc. a prominent domestic player collaborated with British-based Recycleye to develop MSS Vivid AI, an optical sorting solution infused with AI technology and strengthened its position in the market.

Moreover, the recycling equipment market in Canada is driven by the presence of prominent players who specialize in equipment production. This includes Durabac, Machinex Industries Inc., Komar Industries, Inc, Bondtech, and Cummins Allison Corp, amongst several others.

Recycling Equipment Market Players:

- General Kinematics Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lidl US, LLC

- Recycling Equipment Manufacturing, Inc.

- Charoen Pokphand Group

- American Baler Company

- Kiverco

- Danieli Centro Recycling

- MHM UK Ltd.

- Marathon Equipment

- Ceco Equipment Ltd.

The recycling equipment market is being influenced by the number of initiatives taken by key players to recycle waste. They are also investing rigorously to advance their system to boost the process of segregating and converting waste into new products. Some of the key players include:

Recent Developments

- In February 2024, Lidl launched a bottle return scheme trial which would allow shoppers in Glasgow to enjoy unlimited rewards in the form of cash in return for empty PET plastic and aluminium drinks containers through in-store reverse vending machines.

- In October 2023, General Kinematics revealed that it had finished a 42,000-square-foot extension of its principal manufacturing site in Illinois, which has high bay ceilings for 80 ton cranes, in addition to more capital equipment and storage. The company can fulfill the increasing demand for its products by expanding its manufacturing capacity and expanding its 262,000-square-foot facility.

- Report ID: 6337

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Recycling Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.