Reconstituted Milk Market Outlook:

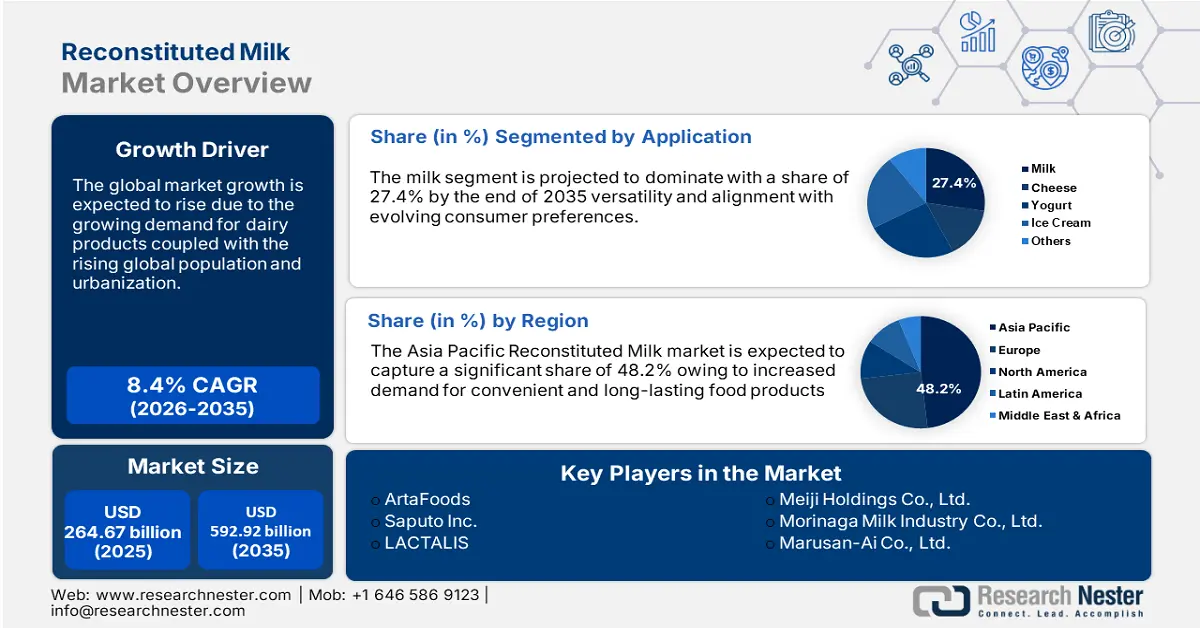

Reconstituted Milk Market size was valued at USD 264.67 billion in 2025 and is set to exceed USD 592.92 billion by 2035, expanding at over 8.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of reconstituted milk is evaluated at USD 284.68 billion.

Increasing awareness of the nutritional benefits of dairy products is driving the demand for reconstituted milk. According to analysts at Research Nester, 73% of consumers purchased probiotic dairy products for their health and nutritional benefits. With the rising global population and urbanization, consumers are seeking convenient and cost-effective alternatives to fresh milk, boosting the reconstituted milk market for powdered and reconstituted milk products.

Furthermore, as more consumers become health-conscious, they prefer reconstituted milk for its ability to provide essential nutrients like calcium and protein often at a lower cost than fresh milk, making it a popular choice for the health-conscious demographic. Moreover, dairy products and milk accounted for 9.1% of the overall energy supply. The percentages of calcium (54.7%), riboflavin (28.1%), vitamin B12 (26.1%), and phosphorus (24.6%) in the nutrient supply were found to be high (over 20%).

Key Reconstituted Milk Market Insights Summary:

Regional Highlights:

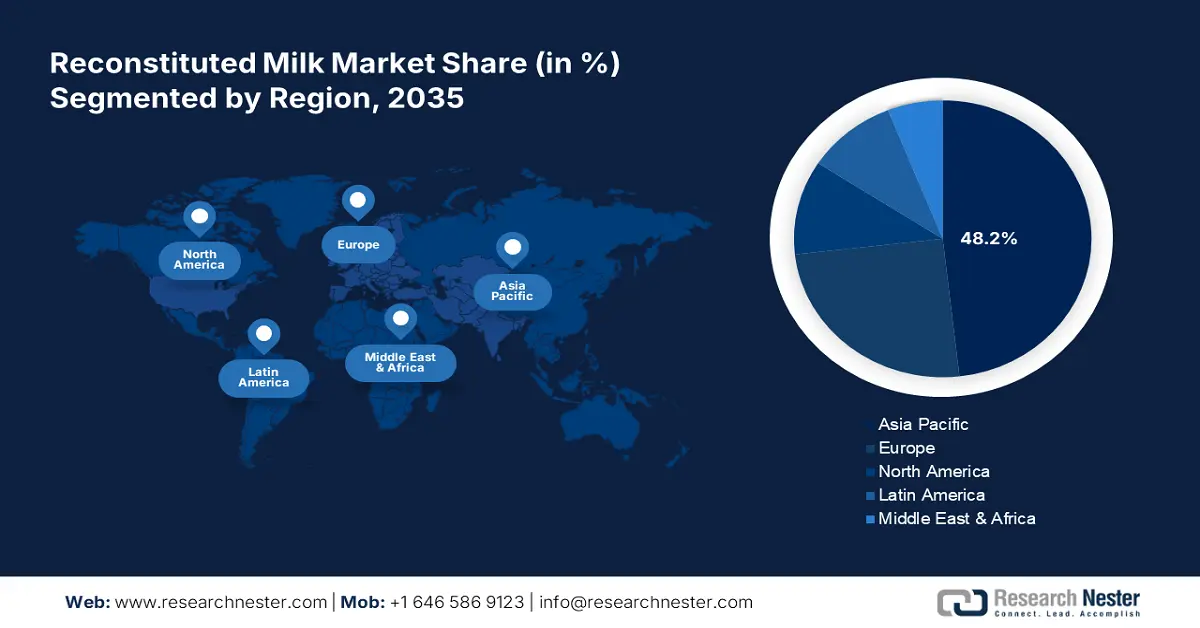

- Asia Pacific's 48.2% share in the Reconstituted Milk Market thrives due to rapid urbanization increasing demand for convenient and long-lasting food products, driving growth from 2026–2035.

Segment Insights:

- The milk segment is anticipated to hold a 27.4% share by 2035, driven by its versatility and alignment with evolving consumer preferences.

Key Growth Trends:

- Convenience and Shelf Stability

- Economic Factor

Major Challenges:

- Consumer preference for fresh dairy

- Stringent regulatory standards

- Key Players: ArtaFoods, Saputo Inc., LACTALIS, Pine Hill Dairy, Schreiber Foods Inc..

Global Reconstituted Milk Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 264.67 billion

- 2026 Market Size: USD 284.68 billion

- Projected Market Size: USD 592.92 billion by 2035

- Growth Forecasts: 8.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Brazil, Germany

- Emerging Countries: China, India, Indonesia, Brazil, Mexico

Last updated on : 14 August, 2025

Reconstituted Milk Market Growth Drivers and Challenges:

Growth Drivers

- Convenience and Shelf Stability: Reconstituted milk offers several advantages, particularly its long shelf life and ease of transport, which make it an ideal choice for areas with limited access to fresh dairy products. Unlike traditional milk, reconstituted milk can be stored without refrigeration until opened, allowing for greater flexibility in use. Additionally, it can be conveniently mixed with water to create liquid milk whenever needed, enhancing its practicality for households. Once reconstituted, powdered milk remains fresh in the refrigerator for four to five days, ensuring that it can be consumed at leisure while minimizing waste and maximizing convenience for users.

- Economic Factor: Reconstituted milk offers a cost-effective alternative to fresh milk, making it especially appealing to budget-conscious consumers. This trend is particularly evident in emerging reconstituted milk markets, where disposable incomes are generally lower, and consumers prioritize affordability in their purchasing decisions. The rise in popularity of reconstituted milk is reflected in the significant growth projections for milk powders worldwide. Between 2019 and 2028, the global production of skim milk powder (SMP) is expected to increase by 14.34%, while whole milk powder (WMP) is projected to rise by 11.48%. This trend signifies a shift in consumer preferences towards more economical dairy options.

Challenges

- Consumer preference for fresh dairy: Many consumers prefer fresh milk to reconstituted milk due to its perceived superior taste, creamy texture, and natural quality. This preference creates significant challenges for reconstituted milk products, which must overcome negative perceptions regarding their flavor and nutritional value. To compete effectively in regions with a strong demand for fresh dairy, these products must focus on improving marketing strategies and educating consumers about their benefits.

- Stringent regulatory standards: The production and labeling of reconstituted milk are subject to stringent food safety standards that vary by country. This inconsistency poses significant challenges for manufacturers looking to expand their operations globally. Navigating these regulations not only complicates compliance efforts but also increases operational costs and logistical difficulties in supply chain management.

Reconstituted Milk Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 264.67 billion |

|

Forecast Year Market Size (2035) |

USD 592.92 billion |

|

Regional Scope |

|

Reconstituted Milk Market Segmentation:

Application (Milk, Cheese, Yogurt, Ice Cream, Others)

By Application, the milk segment is anticipated to dominate around 27.4% reconstituted milk market share by the end of 2035. The is due to its versatility and alignment with evolving consumer preferences. From 524 million tonnes in 1992 to 930 million tonnes in 2022, the world's milk production has grown by more than 77%. It provides a cost-effective and long-lasting alternative to fresh milk, appealing to households seeking convenience amid busy lifestyles.

In Japan, the aging population drives demand for nutrient-rich options like reconstituted milk, which is often fortified with essential vitamins and minerals. Additionally, advancements in processing technologies have improved its taste and quality, fostering consumer trust. Its suitability for regions with limited access to fresh dairy and its role in emergency food supplies further boost its growth, especially in import-dependent markets like Japan.

Source (Skimmed Milk, Whole Milk, Anhydrous Milk Fat)

As per the division by source, the skimmed milk segment is estimated to hold the majority of the reconstituted milk market share over the forecast period. The segment’s growth is due to its appeal among health-conscious consumers seeking low-fat and calorie options. With rising awareness of the benefits of reduced fat diets, skimmed milk is gaining traction for its ability to provide essential nutrients like protein and calcium without the added fat content of whole milk.

It was predicted that the amount of skim milk powder consumed in the EU would rise by a total of 39 thousand tonnes between 2023 and 2033. Its extended shelf and affordability make it a practical choice for consumers in both developed and emerging markets. In Japan, the aging population and increased focus on managing lifestyle-related conditions, such as obesity and health, further drive demand for skimmed reconstituted milk products.

Our in-depth analysis of the global reconstituted milk market includes the following segments:

|

Application |

|

|

Source |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Reconstituted Milk Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is predicted to account for largest revenue share of 48.2% by 2035. The region is experiencing rapid urbanization, leading to increased demand for convenient and long-lasting food products. With 6114 convenience food product launches between 2019 and 2023, Japan tops the Asia Pacific area in New Product Launches (NPLs). South Korea comes in second with 3273 NPLs and China with 4302 NPLs. Reconstituted milk, with its ease of storage and preparation, is well-suited to the fast-paced lifestyles of urban regions.

China is solidifying its growth in E-commerce channels. The proliferation of e-commerce platforms in China has made reconstituted milk more accessible to a wider audience. By 2029, the milk consumer volume is anticipated to reach 23.49 billion kg. In 2025, the demand for milk is anticipated to expand by 6.9% in volume. Online sales channels offer convenience and competitive pricing, enabling consumers to purchase these products easily, and driving reconstituted milk market growth.

India homes booming food and beverage industry uses reconstituted milk as an ingredient in products like bakery goods, beverages, and confectionery. It is anticipated that India produced 195 MMT of fluid milk in CY 2020, up from an expected 191 MMT in CY 2019. Its long shelf life and consistent quality make it ideal for large-scale manufacturing, driving demand in the commercial sector.

Europe Market Analysis

Europe reconstituted milk market is also presenting lucrative growth opportunities. European consumers increasingly prefer shelf–stable products due to their convenience and reduced dependency on refrigeration. Overall, 55% of European consumers (compared to 74% of UK consumers) believe that food goods are typically safe. Reconstituted milk, with its extended shelf life, fits the needs of both urban and rural households, particularly in regions with inconsistent fresh milk availability.

Commitment to sustainable practices in Germany is driving demand for reconstituted milk. By using milk powder, manufacturers can reduce the carbon footprint associated with transporting fresh milk, aligning with consumer and government priorities for environmental responsibility. QM-Milch's participation in the Sustainable Dairy Partnership will encourage broader adoption of the SDP among German processors and make it easier to share on-farm sustainability performances with international dairy buyers, as the company covers an impressive 92% of dairy farms and 95% of milk production in Germany.

Furthermore, the busy lifestyles in urban France are driving demand for convenient food options, including reconstituted milk. It is anticipated that the average revenue per user (ARPU) will be USD 76 million Its long shelf life, easy storage, and quick preparation make it a preferred choice for modern households and food service establishments.

Key Reconstituted Milk Market Players:

- Nestle

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fonterra

- Dairy Farmers of America, Inc.

- ArtaFoods

- Saputo Inc.

- LACTALIS

- Pine Hill Dairy

- Schreiber Foods Inc.

- China Mengniu Dairy Company Limited.

- Sodiaal

Key players dominating the reconstituted milk market are exploring several growth and expansion strategies. Nestle focuses on fortifying its reconstituted milk products to cater to health-conscious consumers, while Danone emphasizes sustainability by improving its supply chain and packaging. FrieslandCapina invested in advanced processing technologies to enhance product quality. In June 2024, Saputo Inc. completed the sale of two fresh milk processing facilities in Laverton North, Victoria, and Erskine Park, New South Wales, to Coles Group Limited for approximately USD 105 million. This sale supports the Company’s network optimization strategy outlined in its Global Strategic Plan.

These companies drive innovation, ensuring reconstituted milk market growth and customer satisfaction.

Recent Developments

- In November 2023, Nestle announced the development of N3 milk, which is made from cow's milk. This milk contains all the essential nutrients found in traditional milk, including proteins, vitamins, and minerals. Additionally, N3 milk includes prebiotic fibers, has a low lactose content, and contains over 15% fewer calories.

- In October 2024, the International Osteoporosis Foundation (IOF) and Anlene announced a strategic partnership aimed at tackling the increasing global challenge of osteoporosis. This partnership was formalized during a signing ceremony at the Le Meridien Hotel in Ho Chi Minh City.

- Report ID: 6723

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Reconstituted Milk Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.