Reciprocating Compressor Market Outlook:

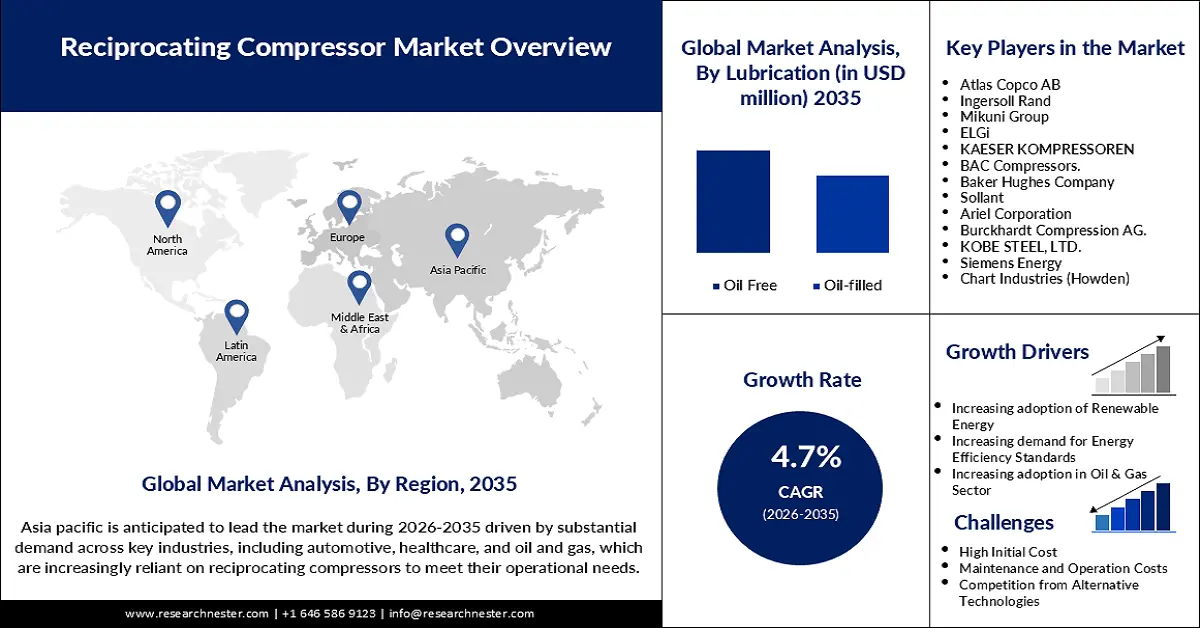

Reciprocating Compressor Market size was valued at USD 5.59 billion in 2025 and is set to exceed USD 8.85 billion by 2035, registering over 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of reciprocating compressor is estimated at USD 5.83 billion.

The global reciprocating compressor market is anticipated to record notable growth due to expanding applications across manufacturing industries, oil and gas, and refrigeration, among other sectors. Key players are improving the technologies to meet high performance and growing demands for energy efficiency. For example, in June 2023, Elgie introduced the LD Series direct-drive reciprocating air compressor with an integrated Neuron XT Controller, providing remote monitoring and fault diagnosis for operational efficiency at maximum. Also, many governments of different countries are encouraging industrial automation and infrastructure projects, which in turn increases the demand for high-capacity, robust reciprocating compressors in various industries.

The reciprocating compressor market finds further impetus from rising environmental concerns and the adoption of eco-friendly technologies, along with energy efficiency-related regulations. The manufacturers are working to develop low-emission, durable compressors. In May 2024, SIAD Group presented a 550-bar oil-free hydrogen compressor targeted at refueling and transportation industries for hydrogen. Such advancements reflect the industry's alignment with global sustainability goals and the rising focus on clean energy applications, paving the way for future growth.

Key Reciprocating Compressor Market Insights Summary:

Regional Highlights:

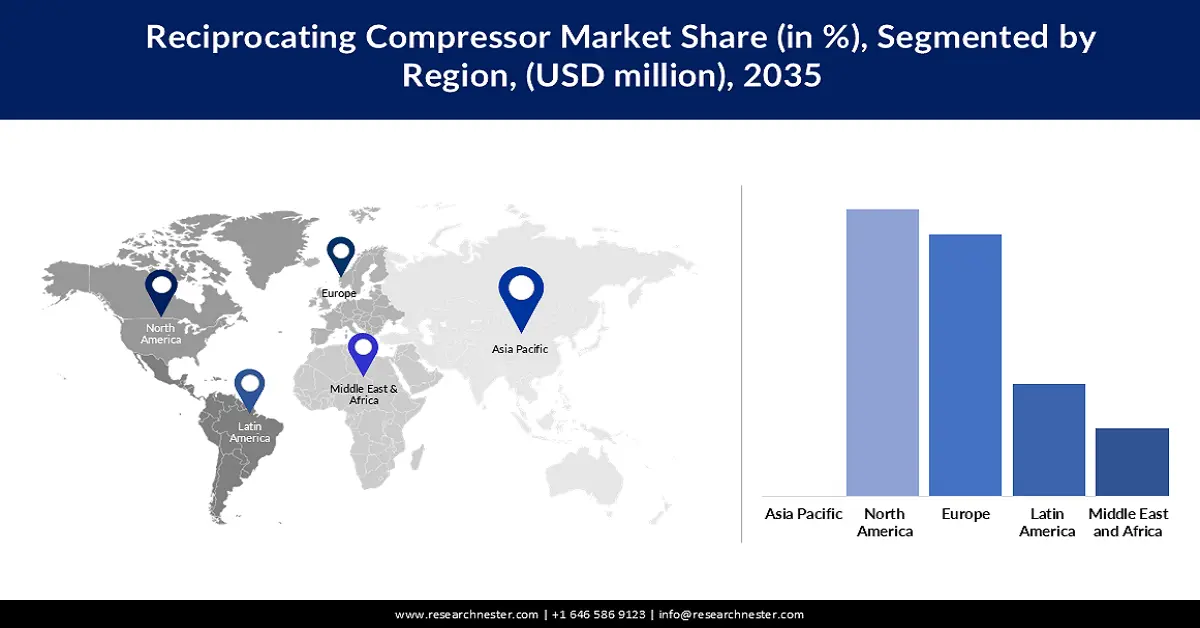

- Asia Pacific reciprocating compressor market will account for 41.60% share by 2035, attributed to industrial boom, urbanization, and green technology adoption in India and China.

- North America market will register substantial growth during the forecast period 2026-2035, driven by advancements in oil & gas exploration and industrial automation technologies.

Segment Insights:

- The oil-free segment in the reciprocating compressor market is projected to hold a 59.40% share by 2035, influenced by growing demand for clean and energy-efficient compressor technologies.

- The diaphragm-type reciprocating compressor segment in the reciprocating compressor market is projected to hold a 34.20% share by 2035, driven by its suitability for oil-free, contamination-free applications like pharmaceuticals and food processing.

Key Growth Trends:

- Industrial expansion and development of infrastructure

- Demand for energy efficiency and sustainability

Major Challenges:

- Raw materials price volatility

Key Players: Atlas Copco AB, Ingersoll Rand, Mikuni Group, ELGi, KAESER KOMPRESSOREN, BAC Compressors, Baker Hughes Company, Sollant, Ariel Corporation, Burckhardt Compression AG, KOBE STEEL, LTD., Siemens Energy, Chart Industries (Howden), J.P. Sauer & Sohn Maschinenbau GmbH, and MAYEKAWA MFG. CO., LTD.

Global Reciprocating Compressor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.59 billion

- 2026 Market Size: USD 5.83 billion

- Projected Market Size: USD 8.85 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Reciprocating Compressor Market Growth Drivers and Challenges:

Growth Drivers

-

Industrial expansion and development of infrastructure: The rapid growth of industrial sectors, especially in developing economies, is one of the key factors driving the demand for the reciprocating compressor market. Industries like automotive, chemicals, and construction are highly dependent on compressors for several applications. In June 2023, Elgie introduced its smart, direct-drive LD Series reciprocating air compressor with the new Neuron XT Controller. The new controller has a range of functions that cover remote tracking and manipulation to power efficiency optimization and fault diagnosis. These developments cater to increasing requirements for portable, reliable, and high-performance compressors.

-

Demand for energy efficiency and sustainability: The global trend of sustainable practice has made the demand higher for energy-efficient reciprocating compressors. A number of manufacturers have come up with new technologies to help reduce energy consumption. In September 2023, Atlas Copco, for example, launched a product of ZR/ ZT oil-free compressors, which were 100% oil-free and less harmful to the environment and conformed to strict regulatory standards. All these innovations are likely to reshape the compressor industry to achieve sustainability goals.

-

Advancements in smart and automated technologies: Reciprocating compressor manufacturers are integrating smart controllers and IoT capabilities, enabling remote monitoring, fault diagnosis, and predictive maintenance. In March 2023, TurboTides introduced AI/ML optimization in the latest turbomachinery design, thus allowing consumers and their product development teams to enhance efficiency. The integrated design system enables users to handle 1D and 3D designs, run finite element analysis, and perform 3D computational fluid dynamics. As a result, such advances meet the growing demand for intelligent systems that enhance operational productivity.

Challenges

-

Stringent environmental regulations: Strict environmental regulations on emissions and energy consumption present major challenges for the manufacturers of reciprocating compressors. To ensure that the companies comply, they must invest in considerable research and development to meet the rigid standards that involve increased costs and time to market launch. Also, compliance with regulations most of the time requires redesigning existing products and incorporating advanced technologies to make the manufacturing process even more complex. Governments worldwide are implementing stricter policies on carbon emissions, encouraging the companies to invest in energy-efficient and eco-friendly solutions.

-

Raw materials price volatility: Reciprocating compressors are highly vulnerable to changes in the fluctuating cost of raw materials, such as steel and aluminum. These materials make up a great constituent of manufacturing cost, and their sudden altercations disturb budget planning and operational efficiency very much. With the highly competitive market, many manufacturers struggle to maintain profitability while simultaneously offering competitively priced products. Furthermore, global supply chain issues and geopolitical tensions increase price volatility, making procurement and cost management increasingly complex.

Reciprocating Compressor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 5.59 billion |

|

Forecast Year Market Size (2035) |

USD 8.85 billion |

|

Regional Scope |

|

Reciprocating Compressor Market Segmentation:

Type Segment Analysis

The diaphragm-type reciprocating compressor segment is anticipated to account for reciprocating compressor market share of more than 34.2% by the end of 2035. The compressors see wide applications in industries requiring oil-free and contamination-free solutions, such as pharmaceuticals and food processing. In May 2024, SIAD Macchine Impianti launched a 550-bar, oil-free, high-pressure hydrogen compressor for the transport and hydrogen refueling station industry. This development highlights the increasing inroads that diaphragm technology is making into sustainable and sensitive applications.

Lubrication Segment Analysis

In reciprocating compressor market, oil-free segment is set to account for revenue share of more than 59.4% by the end of 2035, driven by increasing demand for clean and energy-efficient solutions. In April 2024, Copeland began producing single-screw compressors with Vilter-brand industrial CO₂ compressor units, targeted for transcritical as well as subcritical purposes. These units provide a large-capacity solution and contribute significantly to simplifying industrial refrigeration at a reduced component count. This development illustrates how oil-free technology contributes to environmental and operating demands compliance in the industry.

Our in-depth analysis of the global reciprocating compressor market includes the following segments:

|

Type |

|

|

Product Configuration |

|

|

Lubrication |

|

|

Number of Stages |

|

|

Portability |

|

|

Pressure |

|

|

Volume |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Reciprocating Compressor Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is anticipated to account for largest revenue share of 44.7% by 2035, The market growth is propelled by the industrial boom due to rapid growth in the manufacturing and energy sectors. Increasing urbanization and higher infrastructural investments across countries such as India and China add to the rising demand. For instance, newly emerging initiatives toward green technology adoption and sustainable practices are raising the demand for compressors in the food processing and energy sectors.

The demand for reciprocating compressors in India is driven by the growth of the manufacturing industry, further aided by government initiatives such as 'Make in India.' Moreover, the country's emphasis on renewable energy and clean energy solutions opens up opportunities for high-performance compressors. Coupled with this, the increasing rate of industrial automation and the adoption of high technologies are boosting the demand for more effective compression systems in India. Further, the rising focus of the industries on energy consumption has been driving innovations in compressor designs. All these factors together create a favorable background for the reciprocating compressor market to see steady growth in the years to come.

The large industrial base, along with emerging green technologies in China, continues to present a vital for reciprocating compressor market. Consequently, government investments in infrastructure modernization and the promotion of energy-efficient systems further accelerate the trend. In addition, compressors have reached a critical position that helps to drive industrial growth in the country due to growing adoption in various sectors. In May 2023, Embraco introduced variable-speed compressors based on propane (R290) targeted for the food service and retail sectors. Local production of fixed-speed compressors has further eased supply chain bottlenecks and substantially enhanced the country's capacity to meet both domestic and export demand.

North America Market Insights

North America region is poised to witness substantial growth through 2035, driven by higher advancements in oil and gas exploration and industrial automation. This reflects the modernization of industrial equipment in the region, which is mainly focused on increasing productivity while being sustainable. This would involve investments in energy-efficient technologies, wherein leading manufacturers are introducing innovations, such as those offered by ELGi in portable air compressors. Governmental initiatives toward clean energy and automation also back the strong industrial base of the region.

The U.S. leads the North America reciprocating compressor market due to massive investment in the industry of industrial automation and exploration of oil and gas. The country's push toward advanced manufacturing techniques and sustainable energy solutions is further raising demand for high-performance compressors. In March 2023, ELGi North America introduced the GP35FP and D185T4F portable compressors, addressed operational reliability with energy efficiency. Moreover, high growth in industries such as pharmaceuticals and food processing is also anticipated to contribute to the adoption of these systems across diverse applications.

The reciprocating compressor market in Canada is influenced by the country's emphasis on sustainable practices and clean energy. The strong oil and gas industry of the country also sustains a high demand for high-performance compressors. Additionally, development in infrastructure projects and the drive toward green technologies raise demand for energy-efficient compressor systems. The emerging investments in renewable projects, such as wind and solar, are opening more avenues for compressor technologies. Increased emphasis by Canada on the reduction of carbon emissions and attainment of environmental standards accelerates the movement toward modernized systems.

Reciprocating Compressor Market Players:

- Atlas Copco AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ingersoll Rand

- Mikuni Group

- ELGi

- KAESER KOMPRESSOREN

- BAC Compressors.

- Baker Hughes Company

- Sollant

- Ariel Corporation

- Burckhardt Compression AG.

- KOBE STEEL, LTD.

- Siemens Energy

- Chart Industries (Howden)

- J.P. Sauer & Sohn Maschinenbau GmbH

- MAYEKAWA MFG. CO., LTD.

- NEUMAN & ESSER

- MITSUI E&S Co., Ltd.

- IHI Rotating Machinery Engineering Co., Ltd.

- Gruppo SIAD

The nature of competition in the reciprocating compressor market is high among major players such as Atlas Copco AB, Ingersoll Rand, KAESER KOMPRESSOREN, Burckhardt Compression AG, and Ariel Corporation. Companies are focusing on the development of energy-efficient and smart compressor systems to meet changing industrial requirements. Their strategies include the expansion of product portfolios and enhancing global reciprocating compressor market presence.

In March 2023, Arneg introduced a CO₂-based refrigeration rack utilizing Emerson's Copeland scroll compressors, marking its first use of scroll technology for CO₂ systems. It aims to further improve the efficiency and reduce the footprint of the system in commercial refrigeration applications. These competitive moves have been indicative of the industry's focus on sustainability and imperatives for technological leadership in the global reciprocating compressor market.

Here are some leading companies in the reciprocating compressor market:

Recent Developments

- In October 2024, Dorin announced plans to launch an 8-cylinder transcritical CO₂ compressor with a capacity of up to 750 HP. The new unit, set for release in 2025, will be available in both semi-hermetic and open configurations, catering to large-scale refrigeration applications. This development aims to provide efficient and sustainable solutions for industrial refrigeration needs, aligning with the industry's shift towards natural refrigerants.

- In May 2024, SIAD Macchine Impianti launched a 550-bar, oil-free, high-pressure hydrogen compressor. This compressor is specifically designed to meet the needs of the transportation and hydrogen refueling station sectors, supporting the advancement of hydrogen as a sustainable energy source. Its oil-free design ensures high purity of the compressed hydrogen, making it suitable for fuel cell applications and contributing to the development of hydrogen infrastructure.

- In March 2023, Emerson expanded its Copeland transcritical CO₂ semi-hermetic reciprocating compressor lineup by introducing the 4MTLS28ME model. This compressor offers the largest displacement in the series, suitable for medium-temperature applications and as a parallel compressor in transcritical booster systems. It delivers a capacity of 330,000 BTU at 20°F, providing enhanced performance for commercial refrigeration systems.

- Report ID: 6752

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Reciprocating Compressor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.