Real-Time Payments Market Outlook:

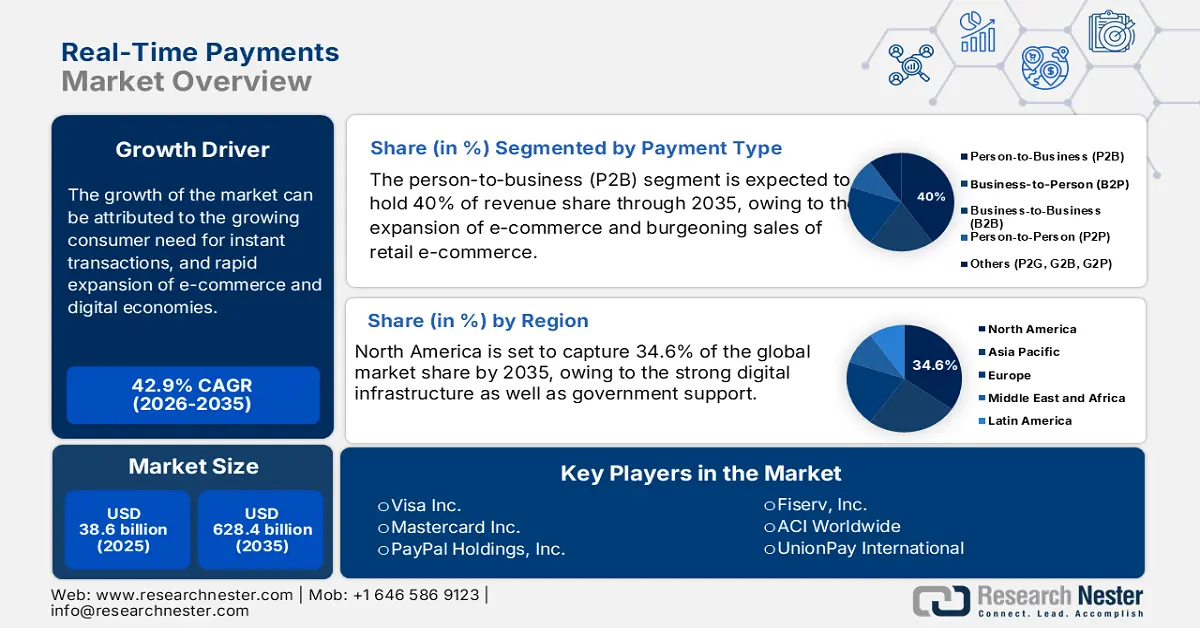

Real-Time Payments Market size was valued at USD 38.6 billion in 2025 and is projected to reach USD 628.4 billion by the end of 2035, rising at a CAGR of 42.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of real-time payments is evaluated at USD 49.2 billion.

The market for Real-Time Payments (RTP) is growing rapidly due to technological developments and regulatory endorsements. India has been the leader, with the UPI platform accounting for a substantial number of global RTP transactions. Other countries like the U.S. and China are also quickly building their own RTPs (FedNow and WeChat Pay). Europe is also making progress, with the government of Switzerland aiming for a complete instant payment system by 2026. Using ISO 20022 messaging standards has increased both security and efficiency in payments, while new technologies, such as biometric authentication, provide further protection against fraud. The introduction of digital wallets and mobile payment options is also changing how we most commonly conduct transactions. The attempts to initiate cross-border real. This time, payments are only an additional factor that the RTP market will continue to grow, demonstrating a meaningful and transformative movement toward faster models for delivering more accessible systems.