Rare Earth Metals Market Outlook:

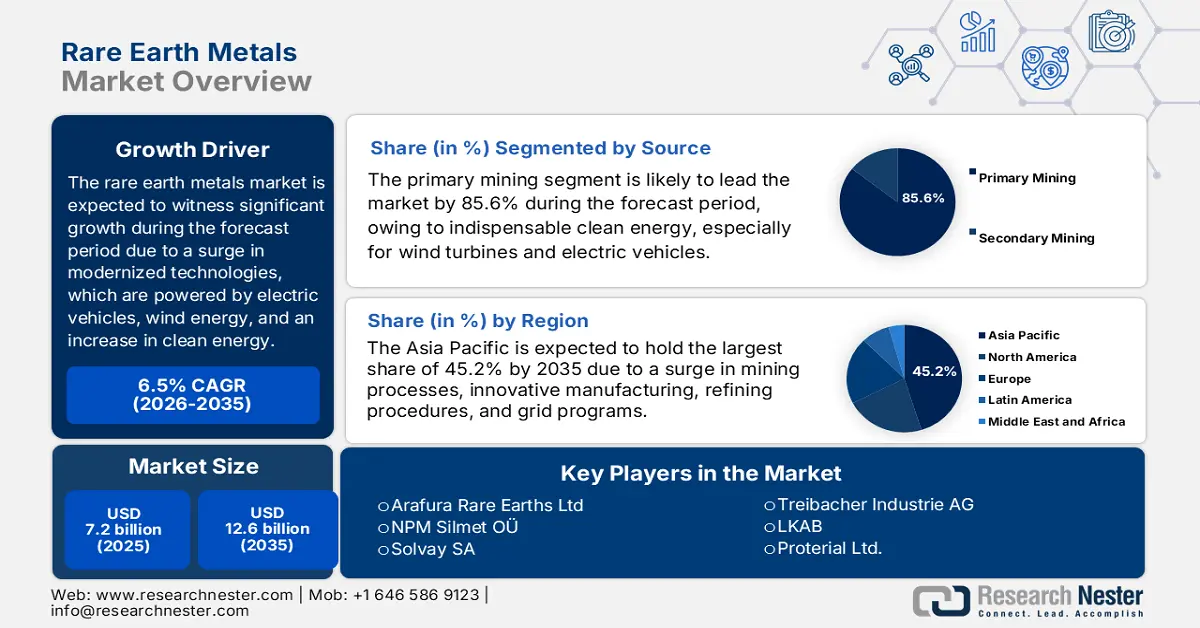

Rare Earth Metals Market size was over USD 7.2 billion in 2025 and is estimated to reach USD 12.6 billion by the end of 2035, expanding at a CAGR of 6.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of rare earth metals is assessed at USD 7.6 billion.

The international market is regarded to be indispensable for modernized technologies, readily powered from wind turbines, electric vehicle motors, defense, and semiconductor systems. With an increase in the global demand, the market is undergoing structural modifications, which are further shaped by sustainability imperatives, technological advancements, and policy interventions. According to an article published by the IEA Organization in 2025, electricity generation from renewables is projected to increase by 60% by the end of 2030, rising from 9,900 TWh in 2024 to 16,200 TWh by the end of the same year. Based on this, the wind power capacity is predicted to almost double to more than 2,000 GW by the end of the same year. Besides, an increase in battery electric vehicles globally is also uplifting the market’s exposure.

Yearly Battery Electric Vehicle Sales Internationally (2014-2024)

|

Year |

China |

Europe |

U.S. |

Rest of the World |

|

2014 |

- |

0.1 million |

0.1 million |

- |

|

2015 |

0.1 million |

0.1 million |

0.1 million |

- |

|

2016 |

0.3 million |

0.1 million |

0.1 million |

- |

|

2017 |

0.5 million |

0.1 million |

0.1 million |

- |

|

2018 |

0.8 million |

0.2 million |

0.2 million |

0.1 million |

|

2019 |

0.8 million |

0.4 million |

0.2 million |

0.1 million |

|

2020 |

0.9 million |

0.8 million |

0.2 million |

0.1 million |

|

2021 |

2.7 million |

1.2 million |

0.5 million |

0.2 million |

|

2022 |

4.4 million |

1.6 million |

0.8 million |

0.5 million |

|

2023 |

5.4 million |

2.2 million |

1.1 million |

0.8 million |

|

2024 |

6.4 million |

2.2 million |

1.2 million |

1.0 million |

Source: IEA Organization

Furthermore, the supply chain diversification, circular and recycling economy, sustainability mandates, technological integration, stockpiling, and strategic reserves are other factors that are also driving the market globally. As per an article published by the IEA Organization in 2025, the demand for cobalt and rare earth elements is continuously growing, with a projected surge of 60% by the end of 2040. Besides, copper is one of the materials with the highest presence, and its demand is expected to grow by 30% within the same timeline. Moreover, based on the Stated Policies Scenario (STEPS), an estimated USD 500 billion in new capital investment is essential for mining at the present up to 2040. In the case of the APS policy, there has been an increase in the demand for minerals for which almost 15% of capital requirements, amounting to USD 600 billion, is essential, thus making it suitable for bolstering the market’s growth internationally.