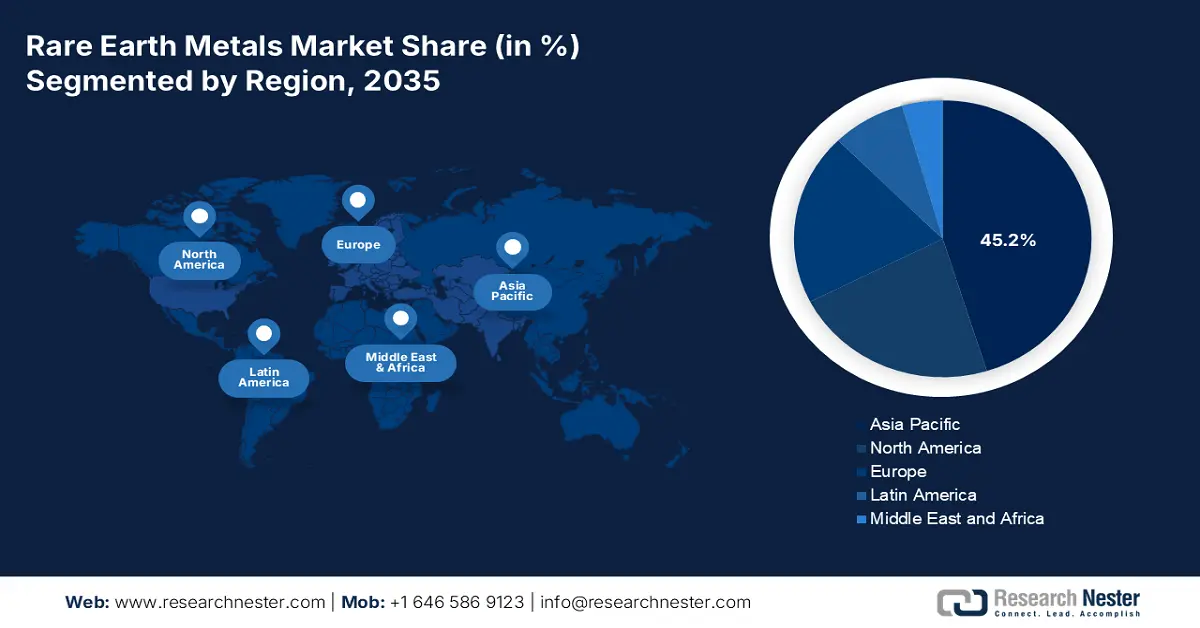

Rare Earth Metals Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the rare earth metals market is anticipated to garner the highest share of 45.2% by the end of 2035. The market’s upliftment in the region is primarily attributed to Australia’s mining pipeline, India’s grid and electric vehicle programs, Japan's and Korea’s advanced manufacturing, and China’s refining dominance. According to an article published by the Singapore Economic Development Board in March 2022, the region is regarded as one of the international centers for manufacturing and caters to almost 48.5% of the global manufacturing output. Besides, as per an article published by CBRE in February 2024, at present, based on an estimated 48.5% of the international manufacturing output, companies are continuing to make expansion in their manufacturing footprint, particularly in the region. This positively impacts the region’s cost competitiveness, compelling investment incentives, and abundant talent supply. Meanwhile, the existence of the unemployment rate in the region denotes a huge opportunity to make advancements in manufacturing to proliferate the overall market.

Unemployment Rate Change in Asia Pacific (2018-2023)

|

Countries |

Unemployment Change % |

|

China |

0.4 |

|

Indonesia |

0.1 |

|

India |

-3.8 |

|

Philippines |

-0.6 |

|

New Zealand |

-0.5 |

|

Australia |

-1.6 |

|

Malaysia |

0.3 |

|

South Korea |

-1.1 |

|

Vietnam |

-0.1 |

|

Singapore |

-0.3 |

|

Thailand |

0.1 |

Source: CBRE

China in the rare earth metals market is growing significantly, owing to magnet fabrication, refining, and the integrated value chain from ore to separation. Additionally, supporting high-volume production of oxides and NdFeB magnets, process upgradation across associated chemicals and rare earths, and the presence of an industrial policy to prioritize supply security are other drivers fueling the market’s growth in the country. As per an article published by the State Council in November 2025, in terms of carbon neutrality plans, the country has gained the newest energy development, with an increase in non-fossil energy consumption from 16.0% to 19.8% as of 2024. Meanwhile, the installed photovoltaic and wind power capacity has also surpassed 1,690 GW, to almost 80% of the newly installed power generation capacity, thus denoting a huge growth opportunity for the market in the country.

India market is also growing due to electronics manufacturing, renewable energy, rapid growth in electric vehicles, along with an increase in the demand for NdFeB magnets in direct-drive wind turbines, traction motors, as well as catalysts and polishing oxides in chemicals to bolster domestic processing and separation volumes. As stated in an article published by the CCI India Organization in 2025, there has been a surge in the renewable power generation capacity, accounting for a 9.3% and further adding 11,788 MW of capacity. Additionally, the renewable energy in the country is set to play a critical role, since the country is focused on meeting its energy demand, which is projected to reach 15,820 TWh by the end of 2040, thus denoting an optimistic outlook for the overall market’s upliftment.

Europe Market Insights

Europe market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by tactical autonomy agendas, electrification, and decarbonization. According to an article published by CEFIC Organization in 2025, the region’s chemical industry accounts for €635 billion in turnover, along with 1.2 million employed people effectively supplying crucial materials to sectors, such as healthcare and automotive. Besides, with the presence of nearly 31,000 organizations, the majority of small and medium enterprises (SMEs) within the chemical industry are significantly woven into the region’s industrial fabric. This results in supporting employment and advancement across the overall continent, thereby making it suitable for bolstering the market’s expansion and growth.

Germany in the rare earth metals market is gaining increased traction, owing to automotive leadership, advanced manufacturing, and the presence of a large-scale chemical-industrial base. As stated in an article published by the CEFIC Organization in 2024, the country’s chemical and pharmaceutical industry accounts for a turnover amounting to €225.5 billion, and is regarded as the third-largest sector in the country behind machinery and equipment, as well as the automotive industries. In this particular dual industry, there exist 2,094 organizations, along with 479,542 direct employees. Additionally, the industry’s flourishment depends upon generous investment and funding, including €9.4 billion in capital expenditure and €14 billion for research and development. Therefore, based on all these developments and continuous growth, the market is gaining increased exposure in the country.

France in the rare earth metals is also developing due to the existence of industrial decarbonization initiatives, circular economy programs, and the strong public research infrastructure. As per an article published by the Europe Environment Agency in September 2025, the country’s net greenhouse gas emissions have readily decreased by 35%, but recently, between 2022 and 2023, this fell by 8%. Moreover, 67.9% of groundwater and surface bodies, along with 70% of coastal water bodies, have been in standard chemical conditions as of 2022. However, to guarantee water quality for the overall country, the water plan, which has been unveiled in 2023, successfully implemented 53 concrete action measures. Besides, the renewable energies share in gross final energy consumption readily increased in 2023, accounting for 22.3%, which is further projected to reach 33% by the end of 2030. Thereby, with all these upliftment, the market in the country is gradually growing.

North America Market Insights

North America in the rare earth metals market is projected to witness considerable growth by the end of 2035. The market’s growth in the region is highly propelled by the presence of advanced electronics, along with a surge in the demand for high-performance magnets in wind turbines and electric vehicle traction motors. According to an article published by the IEA Organization in 2024, the aspect of oil and gas investment, as part of a clean energy initiative, increased to USD 280 billion as of 2023, from USD 200 billion. Besides, the U.S. made an investment in the same segment for every USD 1.4 spent on clean energy in the same year. Moreover, trends, such as restricted integration of material traceability and upscaling the end-of-life catalysts and magnets reduction, along with co-manufacturing strategies, are also fueling the market’s growth in the region.

The rare earth metals market in the U.S. is gaining increased exposure due to wind and electric vehicle supply chains demanding SmCo and NdFeB magnets, polishing compounds, specialty oxides, and catalysts. These tend to increase the volume for environmentally responsible processing, solvent extraction, and chemical separation. Besides, as per an article published by the U.S. Department of Energy (DOE) in December 2025, the Office of Critical Minerals and Energy Innovation (CMEI) issued a Notice of Funding Opportunity (NOFO) for almost USD 134 million. The objective is to bolster domestic supply chains for rare earth elements. In addition, based on this funding, the DOE is poised to support projects that tend to demonstrate the commercial viability of refining and recovering rare earth elements from traditional feedstocks, thus suitable for boosting the market.

The rare earth metals market in Canada is also growing due to governmental policy and strategy support, supply chain diversification, international partnerships, net-zero and clean energy commitments, as well as investments and funding opportunities. As stated in an article published by the Government of Canada in October 2025, the Critical Minerals Infrastructure Fund (CMIF) is expected to offer nearly USD 1.5 billion in federal funding by the end of 2030. The objective is to focus on the domestic transformation infrastructure and clean energy projects, which are necessary to ensure the sustainable expansion and development of critical materials in the country. Moreover, almost USD 1.5 million under the CMIF Indigenous Grants program for 18 projects can enhance indigenous engagement and share activities related to clean energy projects, which in turn is proliferating the market’s growth.