Rare Earth Metals Market Outlook:

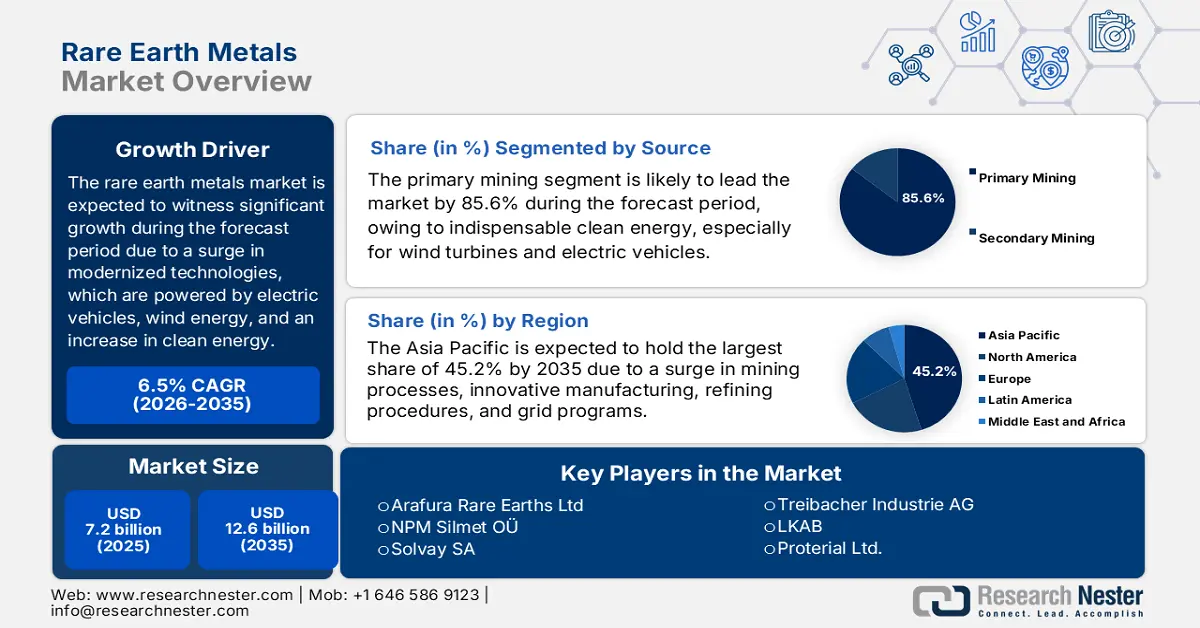

Rare Earth Metals Market size was over USD 7.2 billion in 2025 and is estimated to reach USD 12.6 billion by the end of 2035, expanding at a CAGR of 6.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of rare earth metals is assessed at USD 7.6 billion.

The international market is regarded to be indispensable for modernized technologies, readily powered from wind turbines, electric vehicle motors, defense, and semiconductor systems. With an increase in the global demand, the market is undergoing structural modifications, which are further shaped by sustainability imperatives, technological advancements, and policy interventions. According to an article published by the IEA Organization in 2025, electricity generation from renewables is projected to increase by 60% by the end of 2030, rising from 9,900 TWh in 2024 to 16,200 TWh by the end of the same year. Based on this, the wind power capacity is predicted to almost double to more than 2,000 GW by the end of the same year. Besides, an increase in battery electric vehicles globally is also uplifting the market’s exposure.

Yearly Battery Electric Vehicle Sales Internationally (2014-2024)

|

Year |

China |

Europe |

U.S. |

Rest of the World |

|

2014 |

- |

0.1 million |

0.1 million |

- |

|

2015 |

0.1 million |

0.1 million |

0.1 million |

- |

|

2016 |

0.3 million |

0.1 million |

0.1 million |

- |

|

2017 |

0.5 million |

0.1 million |

0.1 million |

- |

|

2018 |

0.8 million |

0.2 million |

0.2 million |

0.1 million |

|

2019 |

0.8 million |

0.4 million |

0.2 million |

0.1 million |

|

2020 |

0.9 million |

0.8 million |

0.2 million |

0.1 million |

|

2021 |

2.7 million |

1.2 million |

0.5 million |

0.2 million |

|

2022 |

4.4 million |

1.6 million |

0.8 million |

0.5 million |

|

2023 |

5.4 million |

2.2 million |

1.1 million |

0.8 million |

|

2024 |

6.4 million |

2.2 million |

1.2 million |

1.0 million |

Source: IEA Organization

Furthermore, the supply chain diversification, circular and recycling economy, sustainability mandates, technological integration, stockpiling, and strategic reserves are other factors that are also driving the market globally. As per an article published by the IEA Organization in 2025, the demand for cobalt and rare earth elements is continuously growing, with a projected surge of 60% by the end of 2040. Besides, copper is one of the materials with the highest presence, and its demand is expected to grow by 30% within the same timeline. Moreover, based on the Stated Policies Scenario (STEPS), an estimated USD 500 billion in new capital investment is essential for mining at the present up to 2040. In the case of the APS policy, there has been an increase in the demand for minerals for which almost 15% of capital requirements, amounting to USD 600 billion, is essential, thus making it suitable for bolstering the market’s growth internationally.

Key Rare Earth Metals Market Insights Summary:

Regional Highlights:

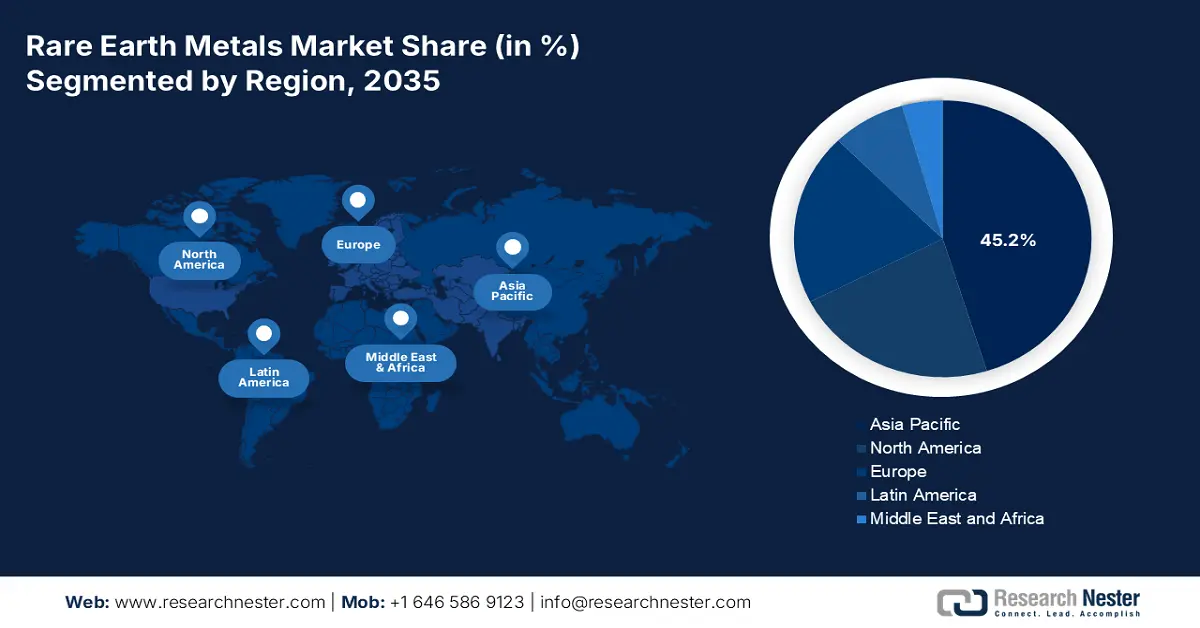

- Asia Pacific is forecast to capture a 45.2% share by 2035 in the rare earth metals market, reinforced by China’s refining leadership alongside Australia’s mining pipeline, India’s EV and grid initiatives, and advanced manufacturing bases in Japan and South Korea.

- Europe is projected to register the fastest growth during the forecast period, supported by strategic autonomy priorities, accelerated electrification, and continent-wide decarbonization initiatives.

Segment Insights:

- Primary mining, under the source segment, is anticipated to secure an 85.6% share by 2035 in the rare earth metals market, buoyed by its foundational importance across clean energy systems, high-tech electronics, and defense infrastructure.

- NdFeB, within the magnet type segment, is expected to attain the second-largest share by 2035, stimulated by its high magnetic performance requirements across electric vehicles, wind energy systems, and advanced electronics.

Key Growth Trends:

- Expansion in renewable energy

- Increased demand in aerospace and defense

Major Challenges:

- Price volatility and uncertainty in markets

- Technological substitution and innovation risks

Key Players: Chinalco Rare Earth Co., Ltd. (China), Shenghe Resources Holding Co., Ltd. (China), Ganzhou Rare Earth Group Co., Ltd. (China), Xiamen Tungsten Co., Ltd. (China), JL MAG Rare-Earth Co., Ltd. (China), Zhongke Sanhuan High-Tech Co., Ltd. (China), Lynas Rare Earths Ltd (Australia), MP Materials Corp. (U.S.), Iluka Resources Ltd (Australia), Arafura Rare Earths Ltd (Australia), NPM Silmet OÜ (Estonia), Solvay SA (Belgium), REEtec AS (Norway), Treibacher Industrie AG (Austria), LKAB (Sweden), Proterial Ltd. (formerly Hitachi Metals, Ltd.) (Japan), Shin-Etsu Chemical Co., Ltd. (Japan), IREL (India) Limited (India), Lynas Malaysia Sdn Bhd (Malaysia), Korea Resources Corporation (South Korea).

Global Rare Earth Metals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.2 billion

- 2026 Market Size: USD 7.6 billion

- Projected Market Size: USD 12.6 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Australia, Japan, Germany

- Emerging Countries: India, Vietnam, Canada, South Korea, Brazil

Last updated on : 19 December, 2025

Rare Earth Metals Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in renewable energy: Based on this driver, wind turbines usually depend on permanent magnets, thus making the rare earth metals market centralized to clean energy transitions. Besides, international wind capacity additions are considered major growth catalysts. According to the 2025 IEA Organization article, the renewable energy deployment for electricity generation, particularly for heat production for industry and buildings, is one of the ultimate enablers of keeping the average international temperature below 1.5 degrees Celsius. Besides, the aspect of modernized bioenergy is considered the highest source of renewable energy, with over 50% share readily utilized as of 2023. Therefore, with an increase in yearly additions mounting to almost 560 GW, the market is expected to grow continuously.

- Increased demand in aerospace and defense: The market is extremely critical for advanced weaponry, guidance systems, and radar, thereby driving governmental investments in gaining supply chains. As stated in an article published by AIA in June 2023, 12 critical minerals are tactically significant to the defense and aerospace sector. In addition, the U.S. comprises a net import reliance of more than 50% on all these minerals. Moreover, to secure a standard critical mineral supply chain, it is essential to revitalize the National Defense Stockpile, in association with the USD 1 billion fund authorization under the National Defense Authorization Act. Besides, guidance under Section 45x(c)(6) of the Inflation Reduction Act offers a 10% production tax credit, thus suitable for boosting the market’s exposure.

- Surge in consumer electronics: The presence and increased utilization of wearables, laptops, and smartphones demand metals in speakers, batteries, and displays, which has sustained the steady demand for the market’s expansion. According to the December 2025 Invest India Government report, the electronics industry in India is expected to reach USD 300 billion by the end of 2025. In addition, household-based electronics consumption is anticipated to reach USD 270 billion by the end of 2030, and small-scale cities in the country are readily driving the volume growth. This is further backed by an upsurge in personal disposable income, as well as increased urbanization, thereby proliferating the market’s development.

Challenges

- Price volatility and uncertainty in markets: The rare earth metals market is subject to extreme price fluctuations due to supply disruptions, geopolitical tensions, and demand surges from industries like EVs and renewable energy. For instance, neodymium prices have spiked multiple times in the past decade following China-based export restrictions or sudden increases in EV production. This volatility makes it difficult for manufacturers to plan long-term procurement strategies, as costs can swing dramatically within months. Small-scale organizations and startups in the magnet and electronics sectors are particularly vulnerable, as they lack the financial resilience to absorb sharp price increases. Additionally, speculative trading and limited transparency in rare earth markets amplify uncertainty.

- Technological substitution and innovation risks: While rare earths are critical today, continuous research into alternative materials and technologies poses a long-term challenge in the market. Companies and governments are investing in substitutes for neodymium and dysprosium magnets, exploring ferrite-based or composite solutions that reduce rare earth dependency. Similarly, advances in battery chemistry, such as solid-state or sodium-ion batteries, could diminish demand for lanthanum and cerium. If these technologies achieve commercial scale, demand for certain rare earths may plateau or decline, impacting producers who rely on specific elements for revenue. This substitution risk is compounded by the high cost of rare earth extraction and processing, which incentivizes industries to seek cheaper alternatives.

Rare Earth Metals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 7.2 billion |

|

Forecast Year Market Size (2035) |

USD 12.6 billion |

|

Regional Scope |

|

Rare Earth Metals Market Segmentation:

Source Segment Analysis

The primary mining sub-segment, which is part of the source segment, is anticipated to hold the largest share of 85.6% in the rare earth metals market by the end of 2035. The sub-segment’s upliftment is highly attributed to its importance for indispensable clean energy, especially for wind turbines and electric vehicles, strategic autonomy, powering modernized economies, along with high-tech electronics, and defense systems. According to an article published by the World Resources Institute Organization in October 2024, there has been a surge in mining by 52%, owing to an increase in the demand for industrial minerals, iron, coal, and other metals. However, there has been a loss of almost 1.4 million hectares of trees from mining-based activities. Besides, there exist 450,000 hectares of rainforests, 150,000 protected areas, and 260,000 hectares of Indigenous Peoples’ and local community lands, thus denoting a growth opportunity for mining.

Magnet Type Segment Analysis

By the end of 2035, the NdFeB segment, under the magnet type, is projected to cater to the second-largest share in the market. The segment’s growth is highly driven by its outstanding magnetic strength, high energy density, and thermal stability, making it indispensable for electric vehicle traction motors, wind turbine generators, robotics, and advanced consumer electronics. The surge in EV adoption globally is a primary driver, as each EV requires several kilograms of NdFeB magnets for efficient motor performance. Wind energy expansion further amplifies demand, with direct-drive turbines relying heavily on NdFeB magnets to reduce maintenance and improve efficiency. Governments across the U.S., EU, Japan, and India are investing in domestic NdFeB magnet manufacturing to reduce reliance on China-driven supply chains, which currently dominate global production.

Processing Stage Segment Analysis

Based on the processing stage, the oxides segment in the rare earth metals market is expected to account for the third-largest share during the forecast timeline. The segment’s development is highly propelled by its role in serving as the foundation for downstream applications in magnets, catalysts, ceramics, and phosphors. Oxides such as neodymium oxide, cerium oxide, and lanthanum oxide are widely used in polishing agents, automotive catalysts, and glass manufacturing, while dysprosium and terbium oxides are essential for enhancing magnet performance. The oxide segment is expected to hold a significant share of the market by 2035, driven by rising demand in clean energy technologies and advanced electronics. Cerium oxide, for instance, is extensively used in catalytic converters to reduce vehicle emissions, aligning with stricter environmental regulations worldwide.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Source |

|

|

Magnet Type |

|

|

Processing Stage |

|

|

Type |

|

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rare Earth Metals Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the rare earth metals market is anticipated to garner the highest share of 45.2% by the end of 2035. The market’s upliftment in the region is primarily attributed to Australia’s mining pipeline, India’s grid and electric vehicle programs, Japan's and Korea’s advanced manufacturing, and China’s refining dominance. According to an article published by the Singapore Economic Development Board in March 2022, the region is regarded as one of the international centers for manufacturing and caters to almost 48.5% of the global manufacturing output. Besides, as per an article published by CBRE in February 2024, at present, based on an estimated 48.5% of the international manufacturing output, companies are continuing to make expansion in their manufacturing footprint, particularly in the region. This positively impacts the region’s cost competitiveness, compelling investment incentives, and abundant talent supply. Meanwhile, the existence of the unemployment rate in the region denotes a huge opportunity to make advancements in manufacturing to proliferate the overall market.

Unemployment Rate Change in Asia Pacific (2018-2023)

|

Countries |

Unemployment Change % |

|

China |

0.4 |

|

Indonesia |

0.1 |

|

India |

-3.8 |

|

Philippines |

-0.6 |

|

New Zealand |

-0.5 |

|

Australia |

-1.6 |

|

Malaysia |

0.3 |

|

South Korea |

-1.1 |

|

Vietnam |

-0.1 |

|

Singapore |

-0.3 |

|

Thailand |

0.1 |

Source: CBRE

China in the rare earth metals market is growing significantly, owing to magnet fabrication, refining, and the integrated value chain from ore to separation. Additionally, supporting high-volume production of oxides and NdFeB magnets, process upgradation across associated chemicals and rare earths, and the presence of an industrial policy to prioritize supply security are other drivers fueling the market’s growth in the country. As per an article published by the State Council in November 2025, in terms of carbon neutrality plans, the country has gained the newest energy development, with an increase in non-fossil energy consumption from 16.0% to 19.8% as of 2024. Meanwhile, the installed photovoltaic and wind power capacity has also surpassed 1,690 GW, to almost 80% of the newly installed power generation capacity, thus denoting a huge growth opportunity for the market in the country.

India market is also growing due to electronics manufacturing, renewable energy, rapid growth in electric vehicles, along with an increase in the demand for NdFeB magnets in direct-drive wind turbines, traction motors, as well as catalysts and polishing oxides in chemicals to bolster domestic processing and separation volumes. As stated in an article published by the CCI India Organization in 2025, there has been a surge in the renewable power generation capacity, accounting for a 9.3% and further adding 11,788 MW of capacity. Additionally, the renewable energy in the country is set to play a critical role, since the country is focused on meeting its energy demand, which is projected to reach 15,820 TWh by the end of 2040, thus denoting an optimistic outlook for the overall market’s upliftment.

Europe Market Insights

Europe market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by tactical autonomy agendas, electrification, and decarbonization. According to an article published by CEFIC Organization in 2025, the region’s chemical industry accounts for €635 billion in turnover, along with 1.2 million employed people effectively supplying crucial materials to sectors, such as healthcare and automotive. Besides, with the presence of nearly 31,000 organizations, the majority of small and medium enterprises (SMEs) within the chemical industry are significantly woven into the region’s industrial fabric. This results in supporting employment and advancement across the overall continent, thereby making it suitable for bolstering the market’s expansion and growth.

Germany in the rare earth metals market is gaining increased traction, owing to automotive leadership, advanced manufacturing, and the presence of a large-scale chemical-industrial base. As stated in an article published by the CEFIC Organization in 2024, the country’s chemical and pharmaceutical industry accounts for a turnover amounting to €225.5 billion, and is regarded as the third-largest sector in the country behind machinery and equipment, as well as the automotive industries. In this particular dual industry, there exist 2,094 organizations, along with 479,542 direct employees. Additionally, the industry’s flourishment depends upon generous investment and funding, including €9.4 billion in capital expenditure and €14 billion for research and development. Therefore, based on all these developments and continuous growth, the market is gaining increased exposure in the country.

France in the rare earth metals is also developing due to the existence of industrial decarbonization initiatives, circular economy programs, and the strong public research infrastructure. As per an article published by the Europe Environment Agency in September 2025, the country’s net greenhouse gas emissions have readily decreased by 35%, but recently, between 2022 and 2023, this fell by 8%. Moreover, 67.9% of groundwater and surface bodies, along with 70% of coastal water bodies, have been in standard chemical conditions as of 2022. However, to guarantee water quality for the overall country, the water plan, which has been unveiled in 2023, successfully implemented 53 concrete action measures. Besides, the renewable energies share in gross final energy consumption readily increased in 2023, accounting for 22.3%, which is further projected to reach 33% by the end of 2030. Thereby, with all these upliftment, the market in the country is gradually growing.

North America Market Insights

North America in the rare earth metals market is projected to witness considerable growth by the end of 2035. The market’s growth in the region is highly propelled by the presence of advanced electronics, along with a surge in the demand for high-performance magnets in wind turbines and electric vehicle traction motors. According to an article published by the IEA Organization in 2024, the aspect of oil and gas investment, as part of a clean energy initiative, increased to USD 280 billion as of 2023, from USD 200 billion. Besides, the U.S. made an investment in the same segment for every USD 1.4 spent on clean energy in the same year. Moreover, trends, such as restricted integration of material traceability and upscaling the end-of-life catalysts and magnets reduction, along with co-manufacturing strategies, are also fueling the market’s growth in the region.

The rare earth metals market in the U.S. is gaining increased exposure due to wind and electric vehicle supply chains demanding SmCo and NdFeB magnets, polishing compounds, specialty oxides, and catalysts. These tend to increase the volume for environmentally responsible processing, solvent extraction, and chemical separation. Besides, as per an article published by the U.S. Department of Energy (DOE) in December 2025, the Office of Critical Minerals and Energy Innovation (CMEI) issued a Notice of Funding Opportunity (NOFO) for almost USD 134 million. The objective is to bolster domestic supply chains for rare earth elements. In addition, based on this funding, the DOE is poised to support projects that tend to demonstrate the commercial viability of refining and recovering rare earth elements from traditional feedstocks, thus suitable for boosting the market.

The rare earth metals market in Canada is also growing due to governmental policy and strategy support, supply chain diversification, international partnerships, net-zero and clean energy commitments, as well as investments and funding opportunities. As stated in an article published by the Government of Canada in October 2025, the Critical Minerals Infrastructure Fund (CMIF) is expected to offer nearly USD 1.5 billion in federal funding by the end of 2030. The objective is to focus on the domestic transformation infrastructure and clean energy projects, which are necessary to ensure the sustainable expansion and development of critical materials in the country. Moreover, almost USD 1.5 million under the CMIF Indigenous Grants program for 18 projects can enhance indigenous engagement and share activities related to clean energy projects, which in turn is proliferating the market’s growth.

Key Rare Earth Metals Market Players:

- Chinalco Rare Earth Co., Ltd. (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Shenghe Resources Holding Co., Ltd. (China)

- Ganzhou Rare Earth Group Co., Ltd. (China)

- Xiamen Tungsten Co., Ltd. (China)

- JL MAG Rare-Earth Co., Ltd. (China)

- Zhongke Sanhuan High-Tech Co., Ltd. (China)

- Lynas Rare Earths Ltd (Australia)

- MP Materials Corp. (U.S.)

- Iluka Resources Ltd (Australia)

- Arafura Rare Earths Ltd (Australia)

- NPM Silmet OÜ (Estonia)

- Solvay SA (Belgium)

- REEtec AS (Norway)

- Treibacher Industrie AG (Austria)

- LKAB (Sweden)

- Proterial Ltd. (formerly Hitachi Metals, Ltd.) (Japan)

- Shin‑Etsu Chemical Co., Ltd. (Japan)

- IREL (India) Limited (India)

- Lynas Malaysia Sdn Bhd (Malaysia)

- Korea Resources Corporation (South Korea)

- Chinalco Rare Earth Co., Ltd. is considered a subsidiary of Aluminum Corporation of China (Chinalco) and plays a strategic role in China’s rare earth industry. The company focuses on the production and processing of rare earth oxides, metals, and alloys, supporting applications in electronics, aerospace, and clean energy. Its integration with Chinalco’s broader nonferrous metals operations strengthens supply chain resilience and market influence.

- Shenghe Resources Holding Co., Ltd. is one of China’s most globally active rare earth companies, with investments and partnerships extending to Greenland and the U.S. It reported generous revenues, which are driven by strong rare earth metal sales despite declining oxide production. The company’s strategy emphasizes international expansion and recycling, positioning it as a bridge between Chinese supply and global demand.

- Ganzhou Rare Earth Group Co., Ltd., based in Jiangxi Province, is a major producer of heavy rare earths, particularly dysprosium and terbium. The company operates across mining, functional materials, and magnet manufacturing, with over 11 subsidiaries and 2,000 employees. Its role is critical in supplying heavy rare earths for high-performance magnets used in EVs and defense technologies.

- Xiamen Tungsten Co., Ltd. is a state-backed enterprise with a diversified portfolio in rare earths, tungsten, and new energy materials. The company is commissioning a permanent magnet plant in Baotou, targeting massive tonnes of NdFeB magnets annually. This expansion cements its role in China’s rare earth vertical integration and global magnet supply dominance.

- JL MAG Rare-Earth Co., Ltd. is one of the leading global manufacturers of NdFeB permanent magnets, supplying major clients such as Tesla, BYD, and Toyota. In 2024, it produced 29,300 tonnes of magnet blanks and plans to expand capacity to 60,000 tonnes by 2027. The company emphasizes ESG leadership, with 30% of inputs sourced from recycled rare earths and carbon-neutral certifications.

Here is a list of key players operating in the global market:

The worldwide rare earth metals market is extremely concentrated, with China-based producers controlling most refining and separation, while Australia and the U.S. scale mining and midstream capacity. Strategies include vertical integration (mine‑to‑magnet), long‑term OEM offtakes, recycling of end‑of‑life magnets, and process innovation in solvent extraction to cut costs and emissions. Western players pursue supply chain localization, grid and EV demand alignment, and financing via industrial policy. Besides, in March 2025, Handtmann has declared the production of components, extremely suitable for vehicle manufacturing, by utilizing the aluminum die casting process. Additionally, the company’s megacasting is projected to be expanded at the Biberach location, thereby creating an optimistic outlook for the rare earth metals market’s growth and upliftment.

Corporate Landscape of the Rare Earth Metals Market:

Recent Developments

- In September 2025, Critical Metals Corp. announced that it has successfully amended its deal to acquire Tanbreez Greenland Rare Earth Mine from Rimbal Pty Ltd. and deliberately increase its ownership stake from 42% to 92.5%.

- In January 2024, ReElement Technologies, along with Purdue, has been successful in utilizing the technology in rare earth elements production, which is severely critical to the semiconductor manufacturing.

- Report ID: 5142

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rare Earth Metals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.