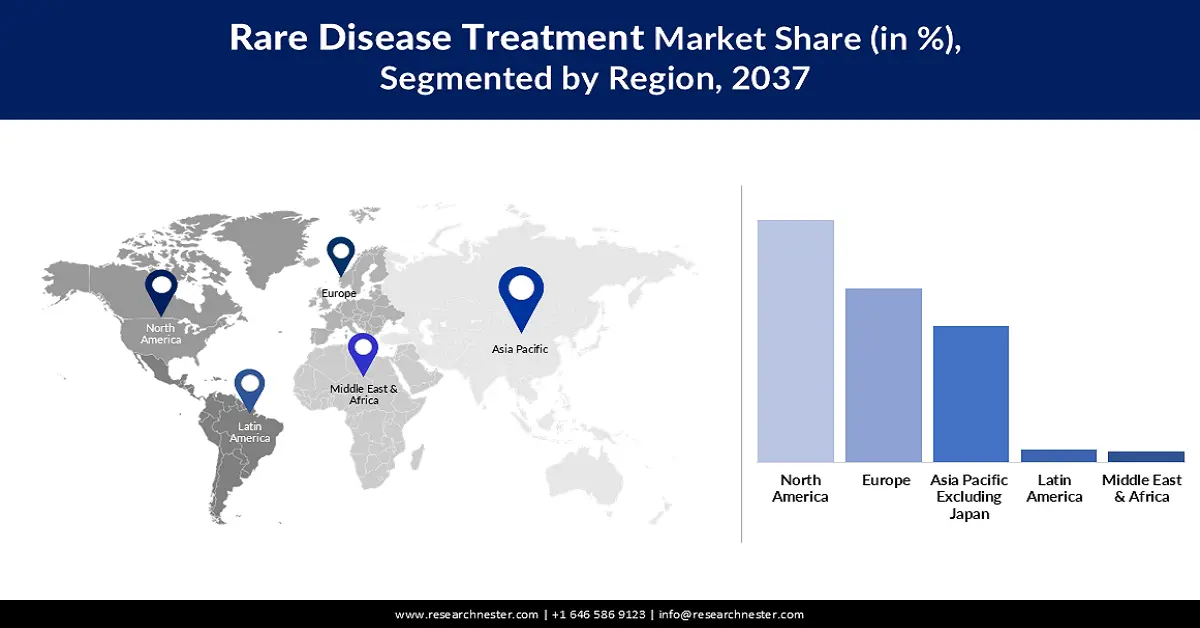

Rare Disease Treatment Market - Regional Analysis

North America Market Insights

North America is expected to dominate the market with a share of 57.6% throughout the assessed timeframe. Higher RD occurrence compared to other Pacific regions is the major growth factor in this landscape. The presence of leading companies and supportive government policies is also a driving asset for the region in this sector. As evidence of such support, a 2024 FDA report highlighted the beneficiaries and positive impact of the Orphan Drug Act on future drug development for rare diseases in the U.S. market. It enables up to USD 3.0 million waiver of the prescription drug user fee and 7 years of extensive market exclusivity for new drugs approved by the FDA.

The rising patient pool in the U.S. necessitates development and manufacturing capacity expansion in the rare disease treatment market. This can be testified by the 2024 FDA report, mentioning that the count of people suffering from RDs reached 30 million in the country. In addition, the U.S. is home to an advanced medical system that offers adequate infrastructure to avail next-generation diagnostic tools and services, thereby fueling the expansion in the region. Moreover, timely product approvals, the emergence of CRISPR-based therapies, and high public awareness in the U.S. are fueling the sector.

Approximately 1 in 12 individuals in Canada is affected by a rare disease, resulting in an urgent need for effective treatments and preventive measures. On the other hand, to combat the access gap, in 2023, the governing body of the country launched the National Strategy for High-Cost Drugs for Rare Diseases that subsidizes medicine purchases, which secures affordability for afflicted patients and profitability for manufacturers at the same time. Moreover, the drugs available in the market account for around one-tenth of pharmaceutical sales in Canada, reflecting the presence of a favorable landscape.

Asia Pacific Market Insights

Asia Pacific market is expected to register the highest CAGR of 11.5% by the end of 2037. Such a pace of growth in this sector is largely attributed to a high focus on expanding the rare disease care capacity and rising public and private healthcare investments. Particularly, in China, India, Vietnam, and Indonesia, the increased tendency to produce maximum biologics volume is fueling the sector remarkably in APAC. Moreover, streamlining clinical trials and updated regulatory pathways are allowing massive commercialization of early therapeutic options to combat mortality from disease progression.

Japan is one of the most popular innovation hubs and a demanding consumer base within the APAC market. The country’s growing emphasis on precision medicine and ambitious goal to overcome its drug loss state is prompting allocation of a robust healthcare budget to this category. The government's efforts to empower this cohort can further be testified by the policies of the Orphan Drug System, which provides 10-year market exclusivity, R&D subsidies covering 50% of clinical trial costs, and a 6-month faster review than standard medicines.

In China, the market is augmenting steadily with the rising number of rare disease cases and the presence of a centralized healthcare system. Besides, the improvements in compliance acquisition processes during the past few years are attracting large-scale investment and greater participation from both domestic and foreign companies in this sector. As evidence, the 2017 regulatory reforms in China attracted more than 50 multinational rare disease drug launches, inspired by the increase in orphan drug approvals in 2022, from 3 annually pre-reform to 30+.

Feasible Opportunities in Key Landscapes

|

Country |

Key Notes |

|

South Korea |

100% reimbursement for 167 designated rare diseases |

|

Japan |

Allocated 4% of the national health budget to intractable disease research |

|

India |

A patient population of 70 million, with only 5% properly diagnosed |

Source: Research Nester Report

Europe Market Insights

The rare disease treatment market in Europe is anticipated to account for a prominent position between 2025 and 2037. The well-structured reimbursement frameworks and regulatory incentives are the primary growth factors in this sector, fueling the region’s consistent expansion. With a 36.0 million RD patient pool, the landscape is also fostering an attractive business environment for the merchandise, as per the 2025 report from the European Parliament. Furthermore, the government efforts benefiting the market include the launch of the European Rare Diseases Research Alliance (ERDERA) in October 2024, funding research in prevention, diagnosis, and treatment of RD with USD 447.3 million until 2031.

In Germany, the market is expected to lead the Europe territory on account of its robust healthcare infrastructure that caters to the rising number of patients. The country also has a large network of specialized centers, including the ACHSE, which supports early diagnosis, treatment and patient care. Moreover, with rising focus on developing advanced drugs and next-generation biologics, the country is expected to expand in this sector at a rapid pace in the coming years.

The rare disease treatment market in France is largely driven by HAS and solidarity‑budget allocation. Nationwide efforts to strengthen the existing healthcare facilities for early intervention and diagnosis are also creating a lucrative surge in this field. In the coming years, the increasing public and private investments in gene and cell therapies are expected to reshape the existing pipelines in the country, while attracting more global investors to engage their resources in this landscape.

Feasible Opportunities for the Market

|

Initiative |

Key Notes |

Timeline |

|

European Reference Networks (ERNs) |

1,619 specialised centres located in 382 hospitals, to tackle rare, low-prevalence and complex diseases and conditions requiring highly specialised healthcare |

2017-2024 |

|

Joint Action on the Integration of Erns into National Healthcare Systems (JARDIN) |

Received USD 17.6 million from the EU4Health programme and USD 4.4 million from the EU Member States to facilitate greater patient access |

2024-2027 |

|

Clinical Patients Management System 2.0 |

The European Commission launched a new IT platform to offer better support to the ERNs, reducing the need for patient travel |

2024 |

Source: European Parliament