Railway Management System Market Outlook:

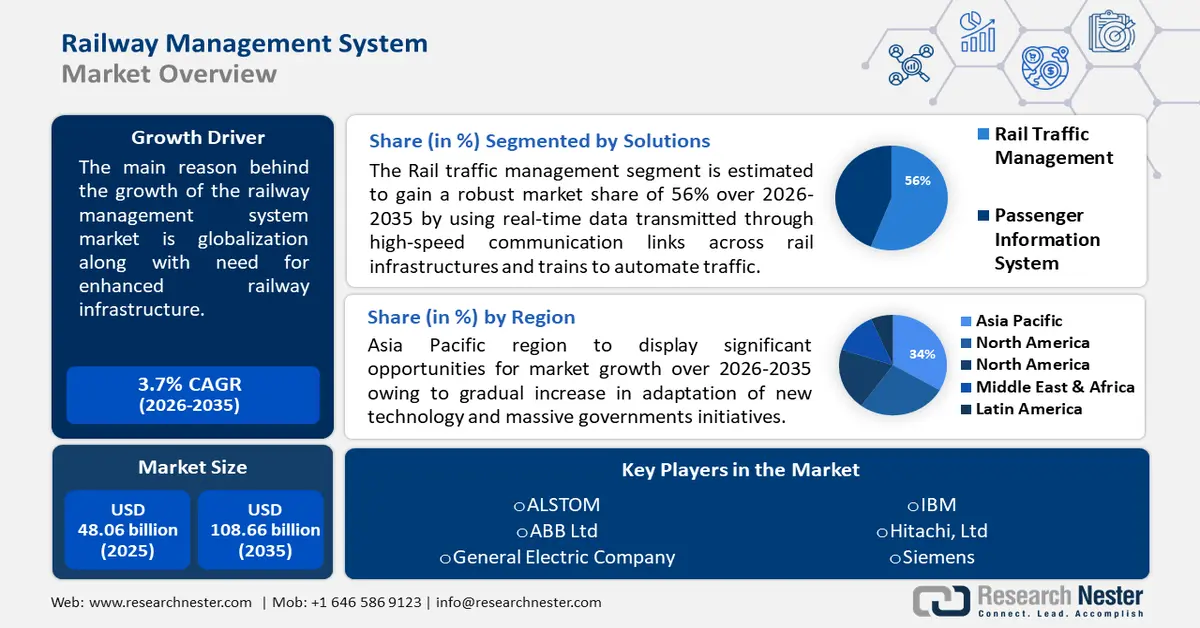

Railway Management System Market size was valued at USD 48.06 billion in 2025 and is set to exceed USD 108.66 billion by 2035, expanding at over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of railway management system is estimated at USD 51.74 billion.

The expected hike in the market activity is a result of traffic congestion due to deteriorating railway infrastructure, hence increasing the need for reliable and efficient transportation management systems. These consequences are under the play because the growing congestion from the aging railway infrastructure points out to railway management systems that will enhance scheduling and capacity, ease congestion, and improve overall performance of railway management system market.

In addition to these, factors that are believed to fuel the market include requirements for advanced transportation and rapid development in the cities. Railways are one of the most important drivers of development of any region, hence, focusing on improvisation of this sector is critical. Additionally, funds provided by the government play a key role in increasing the value of this of railway management system market.

Key Railway Management System Market Insights Summary:

Regional Highlights:

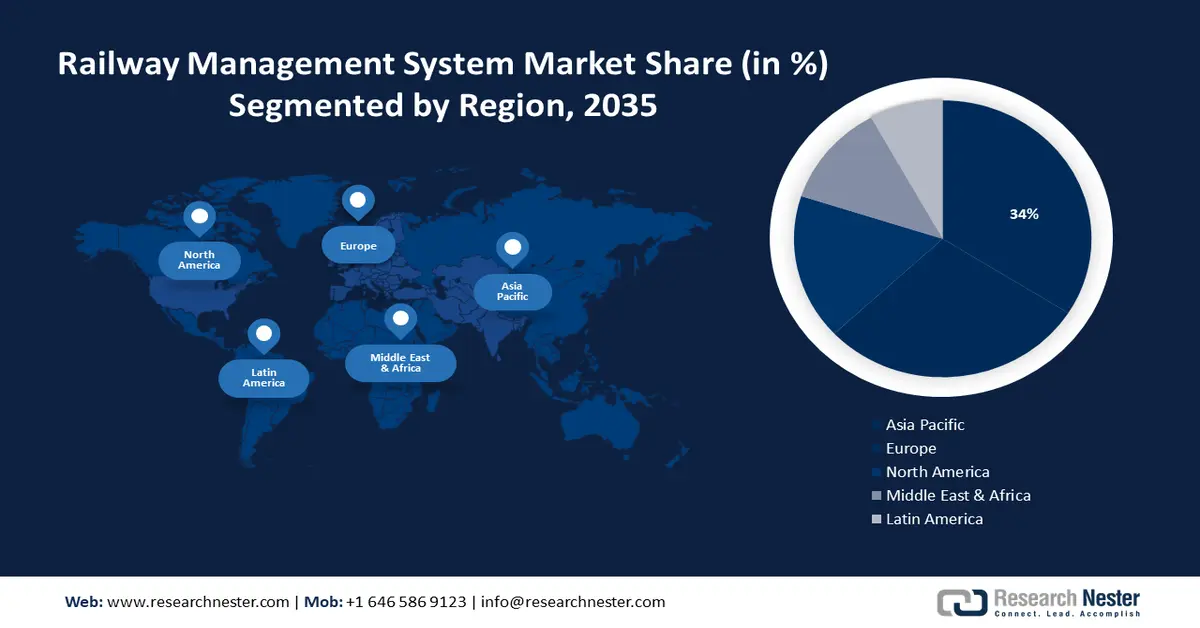

- Asia Pacific railway management system market will hold more than 34% share by 2035, fueled by increasing adoption of AI and massive government investments in digital transformation and rail infrastructure.

- Europe market will achieve a 29% share by 2035, driven by Europe focus on digitization, smart city projects, and high R&D investments enhancing efficiency and sustainability.

Segment Insights:

- The cloud segment in the railway management system market is anticipated to achieve a 74% share by 2035, influenced by faster deployment, reduced installation costs, and improved data management on cloud.

- The rail traffic management segment in the railway management system market is anticipated to experience strong growth till 2035, driven by centralized control systems automating rail traffic and enhancing connectivity.

Key Growth Trends:

- Rise in the trend of smart cities worldwide

- Surge in government funding and investments in railway sector

Major Challenges:

- Initial Deployment Costs Are High

- Complexity due to integrated use of technological elements

Key Players: Alstom, ABB, Hitachi, Ltd., General Electric Company, IBM, Siemens, Bombardier, Thales, DXC Technology.

Global Railway Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 48.06 billion

- 2026 Market Size: USD 51.74 billion

- Projected Market Size: USD 108.66 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, Germany, United States, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Railway Management System Market Growth Drivers and Challenges:

Growth Drivers

-

Globalization along with the need for enhanced transportation infrastructure - Railway management system market is expected to grow significantly due to the increase in demand for transport because of globalization and the rapid ageing of transport infrastructure. Recent reports from Office of Rail and Roads (UK) suggests, because of the opening of Elizabeth line and Barking Riverside project, 62.2km of electrified track has been added to the railway network. To get along with globalization, this of railway management system market has adapted to the changing global landscape. Globalization has led to higher demand for efficient transportation infrastructure along with enhanced speed and security. Railways have this context, as it is a cost-effective and eco-friendly means of transport for both passengers and goods. Liberal goods rail markets, improvised transportation networks, and inclination towards digitalization; all contribute to the of railway management system market growth.

-

Rise in the trend of smart cities worldwide - Incorporating technologies such as big data, AI and machine learning into urban infrastructure, which includes railway systems for smart cities. The demand for effective and integrated transportation systems, including railroads, increases as more cities adopt smart city initiatives. This merging enhances operational efficiency, passenger experience and utilization of resources. According to some reports, railway technology captured a market volume of 116 billion euros on average amid 2020-22. As smart cities evolve, so does the demand for efficient and technologically advanced railway systems, which drives the railway management system market.

-

Surge in government funding and investments in railway sector - Increased public investment in rail infrastructure modernization projects promotes the use of advanced technologies like signaling systems and predictive maintenance solutions. The railways investment, one of the 34 infrastructures across the country, amounted to around USD 126 billion between 2018-2022. The market’s main propellers are cost and energy efficiency, better connectivity of the suburbs and towns, promotion of travel and tourism, and reduction in rail traffic. The insertion of public funds into the railway sector also encourages collaborations between the public and private sectors, spurring innovations and creating opportunities for companies that specialize in railway management system market to develop and deploy their solutions.

Challenges

-

Initial Deployment Costs Are High- Expenses associated with financing a railway management system project may be a significant factor limiting of railway management system market growth. Huge capital expenditure (CAPEX), combined with rising upfront installation costs, is undoubtedly a barrier to the widespread adoption of railway management system necessitates a significant initial investment to install field-level devices, replace ageing infrastructure, arrange transmission networks between end users, and manage the integration of new and existing systems on railway premises.

-

Complexity due to integrated use of technological elements- The challenge arises due to the necessity of fluidly integration a myriad of technologies within the realm of railway operations, resulting in complex system interactions and interoperability dilemmas. Meticulous planning is imperative to guarantee the seamless operation diverse systems such as rail traffic management, asset management, control systems and communication networks. Given the swift advancements of novel technologies, the management of their amalgamation assumes paramount importance in upholding operational efficacy, safety protocols, and dependability within the railway system.

Railway Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 48.06 billion |

|

Forecast Year Market Size (2035) |

USD 108.66 billion |

|

Regional Scope |

|

Railway Management System Market Segmentation:

Services Segment Analysis

System integration segment is set to dominate railway management system market share of around 48% by the end of 2035. The segment growth can be attributed to their assistance in identifying the need for upgrade and adaptation to support smart railway software in the current infrastructure and avoid their limitations. This segment can provide many benefits including improvised efficiency in operational activities, enhanced safety in different sectors, and increased reliability of railway operations. This process will involve integrating public and technology to come up with high-performance railways. Reports of European Commission states IntegRail project has enhanced reliability up to 50%, 30% irregularities have been improved and 10% reduction costs has been reduced. System integration ensures the working of new technologies seamlessly and gradually decreases safety risks associated with integrating complexities. By identifying design conditions and effectively managing change processes, system integration enables successful decision-making in integrated railroads. Furthermore, it helps to reduce risk, increase operational efficiency, and it ensures a seamless transition between current and future operating conditions.

Deployment Segment Analysis

In railway management system market, cloud segment is anticipated to capture revenue share of over 74% by 2035. Along with the rise of railway management cloud programs on a global scale, there are concomitant improvements in the storage, processing and real-time operations with data management on cloud platforms. As per the reports, 45% of these projects were performed faster in North American railways. The migration toward cloud-based railway system is done in a bid to avoid integration complexity, reduce installation costs and software deployment that is quicker than the traditional on-premise setup.

Solutions Segment Analysis

By the end of 2035, rail traffic management system segment is expected to account for railway management system market share of more than 56% with the size of around USD 6574.12 Million. All the rail operations are regulated by the central control system. It uses real-time data transmitted through high-speed communication links across rail infrastructures and trains to automate traffic with the help of transportation management system. Rail traffic management includes train scheduling, traffic control, signaling and routing. Internation Union of Railways reported that companies have seen more traffic contraction in 2020 than that of 2019. The collaboration between governments, private entities, and international organizations, assures enhanced connectivity, development, and eco-friendly transportation solutions.

Our in-depth analysis of the global railway management system market includes the following segments:

|

Solutions |

|

|

Services |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Railway Management System Market Regional Analysis:

Asia Pacific Insights

Asia Pacific industry is expected to dominate majority revenue share of 34% by 2035.The market growth in the region is also expected on account of gradually increasing adaptation of new technologies like artificial intelligence; along with massive government initiatives i.e., surge in investments on digital transformation and expansion of railways in APAC countries. In the recently held meeting of Economic and Social Commission for Asia and Pacific at New Delhi, draft version for rail digitization was submitted which is accounted to be in power by 2030.

China has influential rail-based long-distance transport. By 2021, the length of its railway had already exceeded 155,000km thus making it the second biggest in the world. The projection was that in China, by the end of 2022, the world’s first high -availability seamless redundancy network would’ve been created. Also, as discussed earlier, Japan being the largest tech country in Asia, has regular innovative technology being introduced which is helping in enhancing the railway infrastructure. Rail operation optimization in economical manner tends to be the key factor to regularize efficiency in the railways of the country. For instance, in 2022, Japan’s Hitachi in partnership with Italy’s Trenitalia launched a new cutting-age high speed hybrid train that is able to switch between battery, electric or diesel and can function in both electrified and non-electrified lines.

European Insights

By the end of 2035, Europe railway management system market is anticipated to capture around 29% revenue share and will hold the second position with the share of USD 65.12 Million due to their pivotal role in enhancing capacity, efficiency, safety and sustainability by holding up with the system integration segment. This region has visible inclination towards digitization coupled with primary factors driving the growth of this market in this region including development in urban transit railway infrastructure, smart city projects involving cutting-edge technology, and high investments in research and development sector, further amplifies market expansion. According to our research, the European market occupies as much as 55% of all existing world train control and traffic management. The first pioneers in this area are moving block technology adopters that give signals in a queue allowing capacity increase by 18% and fully autonomous operations that enhanced capacity and safety.

To achieve the purpose of improving rail transport performance, efficiency and sustainability. The funds of 2021 were supposed to be about twice more than the amount funded in 2020 i.e., the funds were reaching USD 34 million. These funds were expected to increase till USD 50 million with the starting of 2024. The five-year budget for the program was USD 200 million overall.

On the other hand, France observed surge in the railway management system market because of its tourism industry. As international as well as domestic travelers prefer train travel. According to certain reports, France is on its way to generate revenue of USD 6 billion solely by the ticket bookings.

Railway Management System Market Players:

- ALSTOM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd

- General Electric Company

- Cisco Systems Inc.

- IBM

- Siemens

- Thales

- Bombardier

- DXC Technology

- Indra

Recent Developments

- Alstom- The Alstom contract wins approximately US 1 billion. The company has projected that it will build more 23 VLocityTM trains to to be stationed in Victoria, Australia. It is expected that the local supplies in the surrounding area will play a key role in providing parts, overhauling, repairing preventive maintenance and wheel machine.

- Siemens Ltd- Siemens Ltd accounted the revenue of USD 40 billion in the first quarter of 2024, concluded on 31st December, 2023 which is 22% surge over the preceding year.

- Report ID: 6104

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Railway Management System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.