Radio Frequency Integrated Circuit Market Outlook:

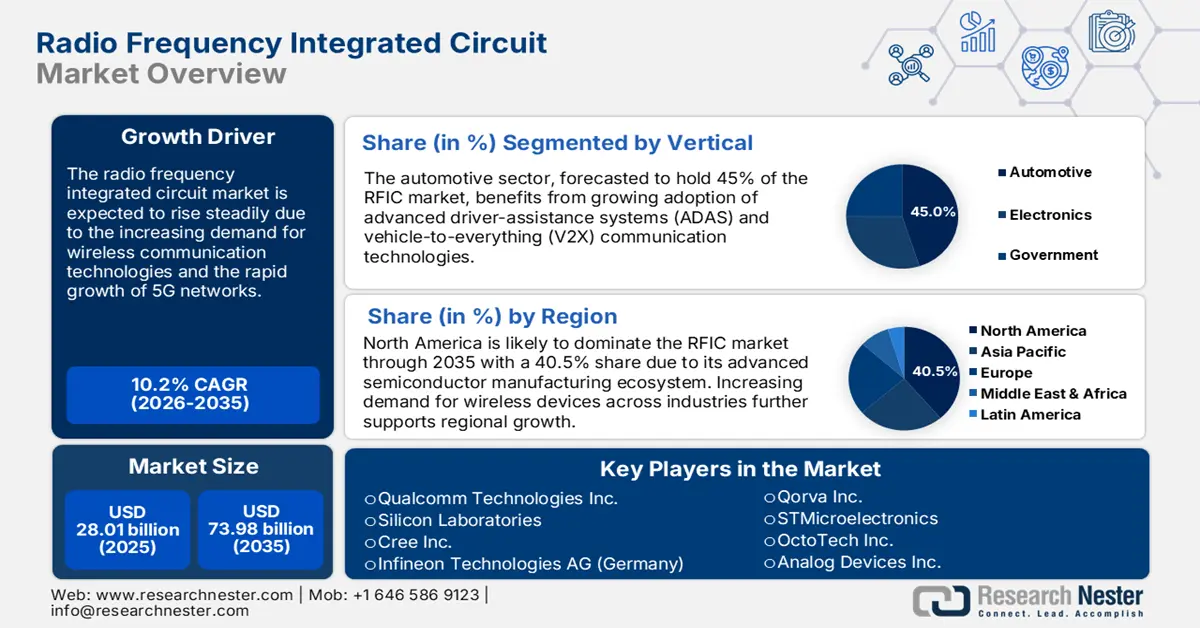

Radio Frequency Integrated Circuit Market size was over USD 28.01 billion in 2025 and is poised to exceed USD 73.98 billion by 2035, growing at over 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of radio frequency integrated circuit is estimated at USD 30.58 billion.

The radio frequency integrated circuit (RFIC) market experiences rapid expansion as advanced communication technologies gain traction while IoT devices spread widely together with the steady deployment of 5G services. In August 2023, MACOM effectively finalized its USD 25 million acquisition of Wolfspeed's RF business, which represents the industry's commitment to scale production facilities while nurturing innovation through its collection of 1,400 RF-related patents and advanced wafer fabrication technology. The worldwide effort to increase data transmission speeds and improve application connectivity keeps RFIC solutions in high demand.

Both governmental actions and major private sector investments drive rapid radio frequency integrated circuit market growth. Broadcom, Inc. announced four new RF front-end modules for Wi-Fi 7 routers and access points in June 2023. The development demonstrates how wireless technology industries maintain their flexibility in response to changing communication standards. Furthermore, the expansion of commercial 5G services creates profitable opportunities for RFIC manufacturers who must meet next-generation network bandwidth needs, thereby becoming essential components of modern digital systems.

Key Radio Frequency Integrated Circuit Market Insights Summary:

Regional Highlights:

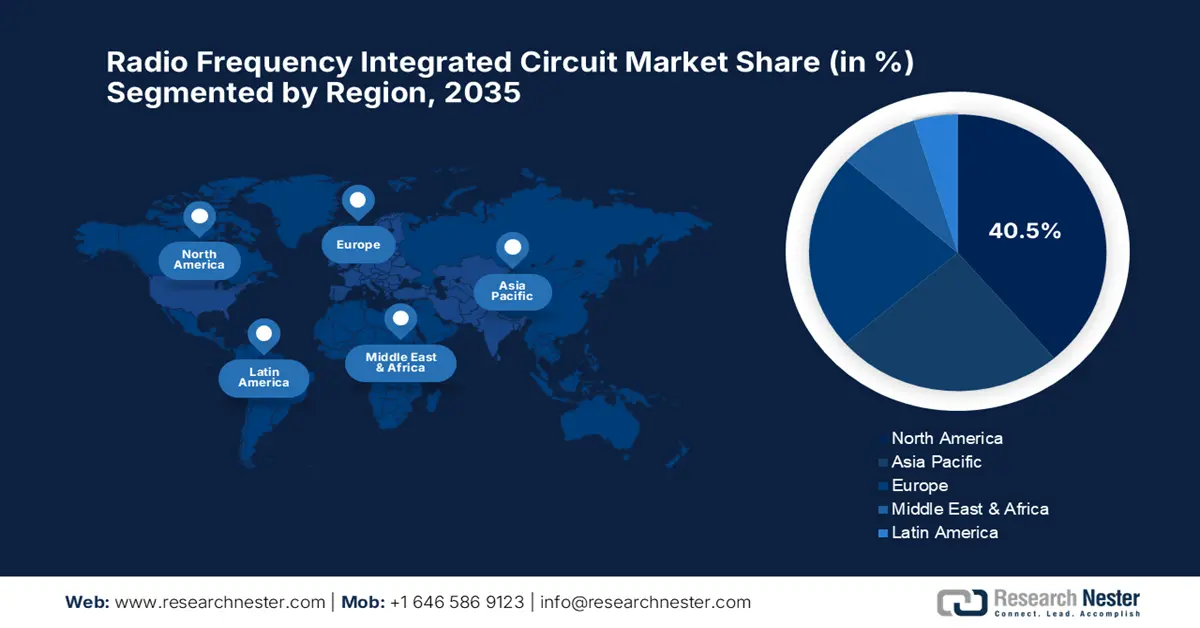

- North America leads the Radio Frequency Integrated Circuit Market with a 40.5% share, driven by expanded semiconductor capacity, telecom investment, and 5G infrastructure, ensuring robust growth through 2026–2035.

- Asia Pacific's Radio Frequency Integrated Circuit Market is witnessing significant growth through 2026–2035, propelled by rapid 5G deployment, IoT adoption, and smart vehicle manufacturing in China and India.

Segment Insights:

- The Transceiver segment is projected to capture over 37% market share by 2035, driven by demand for efficient wireless communication across 5G networks, AR, and satellite systems.

- The Automotive segment is forecasted to hold over 45% share in the Radio Frequency Integrated Circuit Market by 2035, driven by the rise of connected and autonomous vehicle systems integrating RFICs.

Key Growth Trends:

- Proliferation of 5G networks

- Growing IoT adoption

Major Challenges:

- Data privacy and security concerns

- Supply chain disruptions

- Key Players: Qualcomm Technologies Inc., Silicon Laboratories, Cree Inc., Infineon Technologies AG, Qorva Inc., STMicroelectronics, Peak RF, OctoTech Inc., Analog Devices Inc., Skyworks Solutions Inc., Broadcom Inc., Semiconductor.

Global Radio Frequency Integrated Circuit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.01 billion

- 2026 Market Size: USD 30.58 billion

- Projected Market Size: USD 73.98 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 13 August, 2025

Radio Frequency Integrated Circuit Market Growth Drivers and Challenges:

Growth Drivers

-

Proliferation of 5G networks: Radio frequency integrated circuit market growth continues to depend heavily on the worldwide expansion of 5G network infrastructure. RFIC demand has skyrocketed as more than 175 service providers introduced commercial 5G networks by 2023, as they require components to enable high-speed data transmission and network efficiency. Keysight Technologies rolled out the PathWave ADS 2024 software package in June 2023 to support chip designers working on 5G millimeter-wave design problems. Manufacturers can use this advanced design suite to lead innovation while managing modern communication systems' growing complexities.

-

Growing IoT adoption: IoT expansion in healthcare, automotive, and consumer electronics industries requires compact, high-performance RFICs to function effectively. United Microelectronics Corporation introduced their new 3D IC solution for RF-SOI technology in May 2024, which reduced die size by 45% while maintaining full performance capability. The new technology enables smaller IoT devices to incorporate RFICs while meeting market needs for intelligent connectivity in everyday applications.

- Advancements in automotive applications: RFIC demand has surged with the automotive industry's move toward autonomous and connected vehicles. In May 2024, Infineon Technologies introduced the PSoC 4 High Voltage Precision Analog microcontroller, which serves intelligent automotive battery management systems. The integration of high-voltage subsystems with RF capabilities demonstrates the essential function of RFICs for modern automotive safety systems, which deliver efficient operations combined with advanced vehicle connectivity.

Challenges

-

Data privacy and security concerns: The extensive use of RFICs across IoT applications and autonomous vehicles has heightened public worries about data privacy and cybersecurity threats. These devices manage confidential information, which positions them as primary targets for cyber attackers. Manufacturers reduce security threats by integrating advanced encryption protocols, secure key management systems, and tamper-resistant design practices. The difficulty exists in maintaining strong security functionality while keeping device performance intact and avoiding increased costs through ongoing advancements in RFIC development.

-

Supply chain disruptions: RFIC production timelines across the semiconductor industry experience significant setbacks due to ongoing supply chain challenges worldwide. The acquisition of critical components faces blockages because of geopolitical tensions alongside natural disasters and material shortages. The production rate of RFICs has decreased due to various disruptions which results in delayed product releases for telecommunications and automotive industries. Businesses respond to supply chain issues by establishing local supply networks and developing durable infrastructure systems.

Radio Frequency Integrated Circuit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 28.01 billion |

|

Forecast Year Market Size (2035) |

USD 73.98 billion |

|

Regional Scope |

|

Radio Frequency Integrated Circuit Market Segmentation:

Application (Power Amplifier, Transceiver, Wireless USB, Bluetooth, Wi-Fi, Wi-max, ZigBee, GPS, and NFC)

The transceiver segment is poised to capture over 37% radio frequency integrated circuit market share by 2035. Transceivers function as essential components for maintaining efficient wireless communication in 5G networks, EEG devices, and satellite systems. The segment expands due to the rising demand for fast and dependable data transmission services. The Snapdragon Spaces platform with Dual Render Fusion was launched by Qualcomm Technologies Inc. in April 2023, which uses advanced transceiver technology to improve augmented reality projects. The development of telecommunication infrastructure and consumer electronics depends heavily on transceivers as performance and efficiency represent essential requirements.

Vertical (Electronics, Automotive, and Government)

The automotive segment is expected to capture radio frequency integrated circuit market share of over 45% by 2035 due to the accelerated adoption of connected and autonomous vehicle systems. The integration of RFICs allows vehicles to develop advanced driver-assistance technologies alongside vehicle-to-everything communication systems, plus efficient electric vehicle battery management. In May 2024, Infineon Technologies introduced a precision analog microcontroller designed specifically for automotive battery systems, which includes integrated RF functionalities. The automotive industry's focus on safe and efficient mobility with advanced connectivity options will drive increased demand for RFICs during its move toward intelligent, sustainable transportation solutions.

Our in-depth analysis of the global radio frequency integrated circuit market includes the following segments:

|

Application |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Radio Frequency Integrated Circuit Market Regional Analysis:

North America Market Analysis

North America in RFIC market is set to capture over 40.5% revenue share by 2035 as adoption strengthens across the automotive, telecommunications, and consumer electronics sectors. The CHIPS and Science Act enabled the United States to broaden its semiconductor production capacity in 2024, thus bolstering domestic output while minimizing import dependency. Canada continues to direct funds to state-of-the-art telecom infrastructure, which drives increased demand for RFICs in communication systems. Its leadership position in the market is sustained by strong research and development capabilities together with high implementation rates of IoT and 5G technology applications.

The U.S. stands as a central force in North America radio frequency integrated circuit (RFIC) market through its commitment to wireless communication advancement and autonomous vehicle technology development. In 2023, the Federal Communications Commission (FCC) provided substantial financial support for 5G network development, which demonstrates the need for RFICs in next-generation connectivity. Operational efficiency gains in healthcare, as well as manufacturing and logistics sectors, demand RFIC adoption due to IoT technology expansion. The U.S. maintains market leadership through recent advancements that benefit from government backing in domestic semiconductor research.

Across multiple sectors in Canada, RFICs are becoming increasingly adopted, with smart infrastructure and telecommunications leading the way. The Universal Broadband Fund, which targets rural connectivity expansion, is boosting RFIC demand for wireless network support. Furthermore, Canada automotive industry's move towards electric and connected vehicles results in increased use of RFICs within vehicle-to-everything (V2X) communication systems. This progress made by Canada government enables it to become a crucial force driving market growth throughout North America.

Asia Pacific Market Analysis

Asia Pacific radio frequency integrated circuit market is anticipated to experience sustainable growth from 2025 to 2035 as key markets are rapidly implementing 5G technology alongside IoT and automotive advancements. The development of telecom infrastructure and smart vehicle manufacturing receives substantial investment from both China and India leading this marketplace expansion. RFIC producers are discovering profitable opportunities since the region focuses on improving digital connectivity along with technological progress.

India radio frequency integrated circuit market expansion continues at a fast pace due to the country's large-scale 5G deployment strategies. In August 2023, data from the Department of Telecommunications revealed 324,192 5G base stations existed in comparison to 53,590 bases at the start of the year. The increased demand for advanced telecom services, together with high-speed internet, creates this market expansion. The "Make in India" program by the Indian government stimulates local semiconductor production, which continues to strengthen the market.

Asia Pacific RFIC market positions China as its dominant participant owing to its preeminent role in automotive manufacturing and its 5G infrastructure deployment. The China Association of Automobile Manufacturers observed passenger car production climb 14.7% year-over-year and hit 14.8 million units in August 2022. The growing presence of RFICs in connected and electric vehicles demonstrates industry expansion. Through its rapid deployment of 5G networks China establishes itself as a global center for RFIC innovation to meet increasing needs for high-speed communication technologies.

Key Radio Frequency Integrated Circuit Market Players:

- Qualcomm Technologies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Silicon Laboratories

- Cree Inc.

- Infineon Technologies AG

- Qorva Inc.

- STMicroelectronics

- Peak RF (UK)

- OctoTech Inc.

- Analog Devices Inc.

- Skyworks Solutions Inc.

- Broadcom Inc.

- Semiconductor

The radio frequency integrated circuit market faces significant competition among industry leaders, including Qualcomm Technologies Inc., Silicon Laboratories, Cree Inc., Infineon Technologies AG, Qorvo Inc., and Broadcom Inc., to drive forward innovation. These companies direct substantial R&D resources to serve the telecommunications as well as automotive and IoT industry needs. Market competition intensifies as manufacturers seek to develop smaller and more functional products that consume less energy.

Larsen & Toubro declared in September 2024 their intention to launch a fabless chip company concentrating on RF semiconductor production. The industry demonstrates its dedication to regional production strength and inventive approaches as a way to satisfy expanding worldwide market needs effectively. Companies need to adopt both sustainable methods and advanced product development strategies to secure market positions as competition grows in the changing RFIC sector.

Here are some leading players in the radio frequency integrated circuit market:

Recent Developments

- In May 2024, Murata Manufacturing Co., Ltd., under a license from Michelin, announced the integration of advanced Radio Frequency Identification (RFID) technology into automotive tires. This initiative enhances tire management, safety, and traceability, addressing critical needs in the automotive and transportation sectors.

- In February 2024, Qorvo, Inc. partnered with an active antenna IC company to enhance RF front-end solutions. This collaboration aims to deliver integrated end-to-end solutions and System-in-Packages (SiP) for defense, aerospace, and network infrastructure applications.

- Report ID: 7056

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Radio Frequency Integrated Circuit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.