Radio Direction Finder Market Outlook:

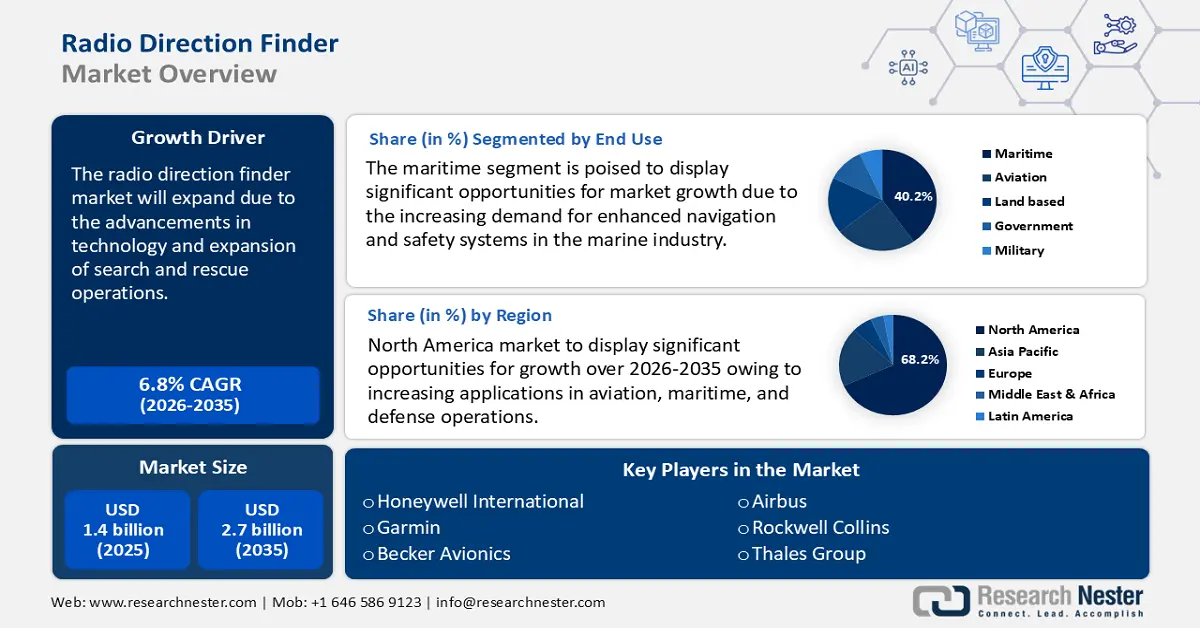

Radio Direction Finder Market size was over USD 1.4 billion in 2025 and is anticipated to cross USD 2.7 billion by 2035, witnessing more than 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of radio direction finder is assessed at USD 1.49 billion.

RDF plays an important role in search and rescue missions by detecting emergency signals from Emergency Locator Transmitters (ELTs) in aviation and Emergency Positions Indicating Radio Beacons (EPIRBs) in maritime rescue. The radio direction finder is beneficial due to its crucial applications in aviation, navigation, and defense operations. Governments and international organizations are increasing investments in safety and emergency response infrastructure. For instance, the Federal Aviation Administration (FAA) and the National Aeronautics and Space Administration (NASA) collaborated on search and rescue missions. The FAA has adopted NASA’s Search and Rescue recommendations regarding the installation and maintenance of Emergency Locator Transmitters (ELTs) in airplanes. These NASA-designed, satellite-aided search and rescue beacons installed in planes will improve aviation safety and save more lives through precise satellite-aided search and rescue operations.

Key Radio Direction Finder Market Insights Summary:

Regional Highlights:

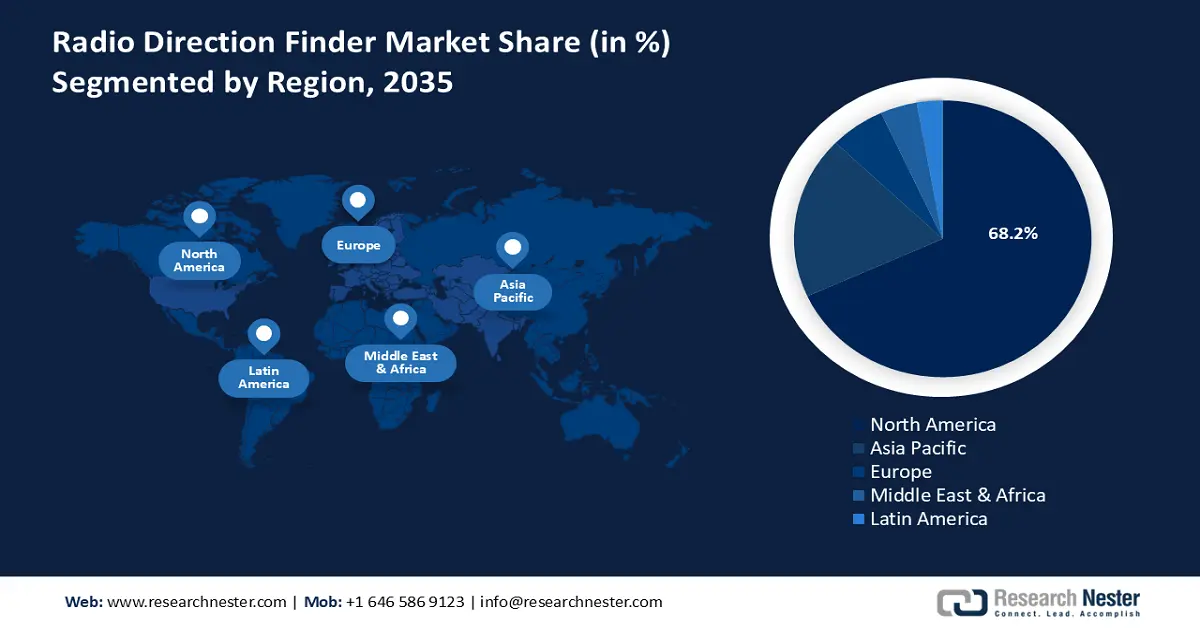

- North America is anticipated to secure over 68.2% share by 2035 in the radio direction finder market, supported by expanding aviation, maritime, and defense applications due to increasing operational deployments.

- The Asia Pacific region is poised to strengthen its share by 2035 as demand rises across maritime security and air traffic management, owing to expanding military surveillance and coastal defense requirements.

Segment Insights:

- The maritime segment is projected to command over 40.2% share by 2035 in the radio direction finder market as it reinforces operational safety and navigation efficiency through increasing demand for enhanced navigation and safety systems.

- The digital radio direction finder segment is expected to grow rapidly by 2035, capturing notable share as adoption accelerates with advanced digital-signal processing capabilities impelled by improved accuracy and reliability.

Key Growth Trends:

- Increasing demand for navigation and surveillance

- Advancements in signal processing technology

Major Challenges:

- High initial costs and maintenance

- Signal interference and accuracy issues

Key Players: Honeywell International Inc., Garmin, Becker Avionics, BendixKing, L3 Technologies, RHOTHETA Electronics GmbH, Rohde & Schwarz GmbH & Co. KG, Shoghi Communications Ltd.

Global Radio Direction Finder Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.4 billion

- 2026 Market Size: USD 1.49 billion

- Projected Market Size: USD 2.7 billion by 2035

- Growth Forecasts: 6.8%

Key Regional Dynamics:

- Largest Region: North America (68.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Australia, Brazil, United Arab Emirates

Last updated on : 3 December, 2025

Radio Direction Finder Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand for navigation and surveillance: A radio direction finder is an essential device used in aviation and maritime industries for locating signals, and guiding aircraft and ships that improve all navigation accuracy. The need for uninterrupted communication and precise positioning in remote or high-risk areas is boosting adoption. For instance, the Indian National Centre for Ocean Information Services (INCOIS) developed a Search and Rescue Aid Tool (SARAT) to aid the Indian authorities involved in Search and Rescue (SAR) operations at sea. The SARAT application can track a range of objects lost at sea, when the time and location of an object missing is given. Thus, the rising adoption of RDF in these sectors for accurate positioning and tracking is fueling radio direction finder market expansion.

Radio direction finder is widely used in electronic warfare, signal intelligence and border security operations to intercept and track enemy communications. Increasing geopolitical tensions and defense modernization programs are driving investments in RDF systems. The growing emphasis on improving maritime and aviation safety is a significant factor driving the demand for radio direction finder (RDF) market. - Advancements in signal processing technology: Modern RDF systems are integrating software defined radio (SDR), AI based signal processing and digital automation making them more efficient and accurate. Modern RDF systems are equipped with advanced features such as enhanced frequency range capabilities, improved signal accuracy, and real-time data processing. These advancements are helping to address critical issues for enhanced signal detection, security operations, and navigation across a wide range of applications.

Another advancement in radio direction finding is the integration of GPS and inertial navigation systems (INS). This comprehensive addition with RDF has resulted in hybrid systems that provide situational awareness. Furthermore, the miniaturization of components has led to the development of portable and more compact RDF units, making them suitable for a wider range of applications such as personal navigation and wildlife tracking. The use of software-defined radio (SDR) technology in RDFs has also enhanced flexibility, allowing these systems to adapt to various signal types and frequencies with ease.

Challenges

- High initial costs and maintenance: Advanced RDF systems require significant investment in hardware, software and skilled professional for installation and operation. Regular calibration and maintenance are necessary to ensure accuracy increasing operational costs. Moreover, these systems require expertise in radio signal processing, data analysis and equipment handling, leading to a shortage of skilled professionals. The complexity of integrating RDF with modern GPS, radar and AI based systems poses technical challenges for adoption.

- Signal interference and accuracy issues: Radio direction finder performance can be affected by radio signal congestion, environmental conditions, and electromagnetic interference (EMI) from other devices. Urban areas with multiple radio sources make it difficult to pinpoint the exact locations of signals. Another key challenge affecting the market growth is the high use of GPS. Devices enabled with GPS are easier to carry tahn RDFs and cost-effective, both in terms of installation and maintenance. Additionally, GPS is more accurate than RDFs as it can predict the exact location of a vessel or device using satellite navigation.

Radio Direction Finder Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 1.4 billion |

|

Forecast Year Market Size (2035) |

USD 2.7 billion |

|

Regional Scope |

|

Radio Direction Finder Market Segmentation:

End use Segment Analysis

The maritime segment is expected to dominate radio direction finder market share of over 40.2% by 2035 due to the increasing demand for enhanced navigation and safety systems in the marine industry. Radio direction finder is used to determine the direction of radio signals from coastal navigation aids, helping ships to locate their position and stay on course. Radio direction finding solutions in support of maritime vessel traffic systems (VTS), interference detection at ports, port and coastal security, and search and rescue (SAR) operations. It provides high DF accuracy to ensure success in critical safety-related applications.

For instance, in December 2023 the U.S Coast Guard utilized VHF direction-finding technology to locate and assist two fishermen in distress. The mariners’ use of a marine-grade radio enabled the Coast Guard to pinpoint their location through search and rescue technology leading to a successful operation. This highlights the critical role of radio direction finders in maritime safety, allowing rescuers to accurately determine their position in emergencies.

Technology Segment Analysis

The digital radio direction finder segment in radio direction finder market is expected to expand at a fast rate owing to its improved accuracy and reliability. A digital radio direction is preferred over an analog radio direction finder due to its advanced features of integrating digital signal processing to accurately determine the direction of radio signals. These digital versions offer higher precision, faster processing, and better resistance to interference. Digital radio direction finders have been increasingly utilized in maritime applications to enhance navigation and safety. Thus, top radio direction finder companies are designing and manufacturing radio direction finding equipment.

Our in-depth analysis of the global radio direction finder (RDF) market includes the following segments:

|

End use |

|

|

Technology |

|

|

Application |

|

|

Frequency Range |

|

|

Antenna type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Radio Direction Finder Market - Regional Analysis

North America Market Insights

North America radio direction finder market is anticipated to capture revenue share of over 68.2% by 2035 due to increasing applications in aviation, maritime, and defense operations. The U.S. Military and Coast Guard use radio direction finders for surveillance, signal intelligence, and search and rescue operations. Advancements in digital RDF technology, such as AI-based signal processing are improving accuracy and efficiency.

The radio direction finder (RDF) market in the U.S. is expanding due to rising investments in military modernization and air traffic management. With rising air traffic, the need for efficient radio direction finders is also increasing. As of 2023, the FAA's Air Traffic Organization (ATO) claims to provide service to more than 45,000 flights and 2.9 million airline passengers. The report also suggests having more than 10,000,000+ scheduled passenger flights yearly. Thus, the FAA integrates RDF systems to enhance flight navigation and easier communication. However, rising concerns over cyber security and signal interference have paved the way towards research in AI-driven radio direction finders. This integration will likely increase accuracy and efficiency in search operations.

The radio direction finder market in Canada is expanding due to its critical role in Arctic navigation and remote area communication. The armed forces in Canada use this technology for border surveillance and search and rescue missions in challenging terrains. With increasing investments in airspace monitoring and maritime safety, radio direction finders are essential for national security. For instance, in 2022, the government of Canada invested USD 4.9 billion to modernize continental defense and ensure security from new emerging threats. The focus on modernizing defense communication networks is further driving the adoption of RDF solutions in Canada.

Asia Pacific Market Insights

The radio direction finder market in Asia Pacific is growing due to increasing maritime security needs and expanding air traffic control infrastructure. Countries such as China, India, and Japan are investing in RDF for military surveillance and coastal defense operations. The rise in commercial aviation and search and rescue missions is driving demand for advanced RDF systems. Technological advancements in software defined radio and AI based radio solutions are improving accuracy and adoption in the region.

The radio direction finder (RDF) market in China is rising due to its strategic focus on electronic warfare and military intelligence. China’s naval and air forces are integrating advanced radio directing systems for coastal defense, surveillance, and signal interception. These systems are also employed in civil aviation and law enforcement to improve communication security and air traffic management.

The radio direction finder market in India is growing due to its widespread use in border security and counter-terrorism operations. The VHF/UHF direction finding system developed by defense technology company, Shoghi Communications is specifically designed to cover a frequency range of 20 to 3000MHz. This system aids in the precise location of radio emitters that offer effective monitoring activities. The Indian Navy is also deploying radio direction finder systems for anti-submarine warfare and maritime surveillance in the Indian Ocean. Additionally, this technology plays a key role in disaster response and search and rescue missions during natural disasters and emergencies in India as about 60% of the landmass in India is prone to earthquakes and over 40 million hectares is prone to floods.

Radio Direction Finder Market Players:

- Honeywell International

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Garmin

- Becker Avionics

- BendixKing

- L3 Technologies

- RHOTHETA Electronics GmbH

- Rohde & Schwarz GmbH & Co. KG

- Shoghi Communications Ltd.

- Astronautics Corporation of America

- Airbus

- Harris Corporation

- Appareo Systems

- Trig Avionics

- Rockwell Collins

- Thales Group

The radio direction finder (RDF) market is dominated by key global companies that provide advanced solutions for defense, aviation, maritime security, and spectrum monitoring. These companies are driving innovation through AI-based radio direction finders, software-defined radio and advanced signal processing technologies. Here is a list of key players operating in the radio direction finder market:

Recent Developments

- In August 2024, Antenna Experts launched its new folded dipole antennas in the U.S. The company aims to provide its new folded dipole antennas for safe and secure communication in a wide range of applications. The new folded dipole antennas are used to transmit and receive a broad spectrum of frequencies. It is an omnidirectional antenna that can work within a frequency range of 3KHz to 300GHz which makes it a flexible wireless solution.

- In May 2024, Epiq Solutions collaborated with DeepSig to use AI and ML directly onto software-defined radios (SDRs). This will make integration easier for Epiq's customers and represents the innovation of signal processing and small form factor SDRs.

- Report ID: 7143

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Radio Direction Finder Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.