Radar Warning Receiver Market Outlook:

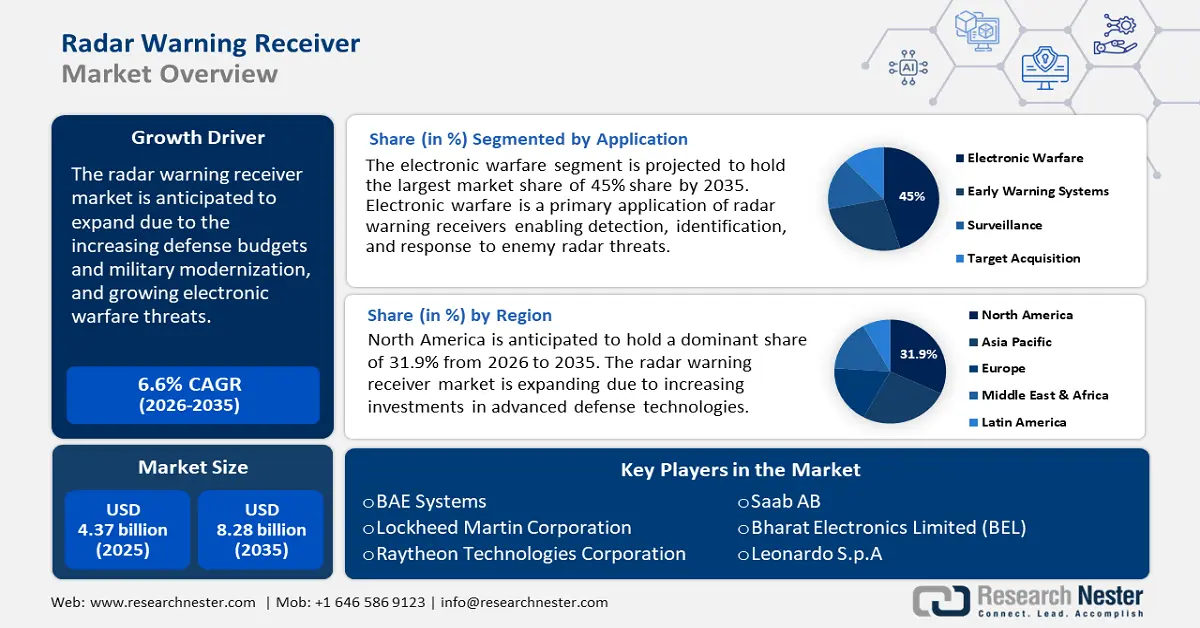

Radar Warning Receiver Market size was valued at USD 4.37 billion in 2025 and is expected to reach USD 8.28 billion by 2035, expanding at around 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of radar warning receiver is evaluated at USD 4.63 billion.

The radar warning receiver market is expanding as a result of increasing defense budgets and military modernization. Governments across the globe are boosting defense expenditure to modernize their armed forces. Major military powers like the U.S., China, Russia, and India are investing in next-generation electronic warfare systems such as radar warning receivers. Due to rising threat sensitivities, and geopolitical tensions, global defense spending rose to USD 2.46 trillion in 2024 from USD 2.24 trillion in 2023. Based on the February 2025 report by the International Institute of Strategic Studies, the US, China, and Russia have been listed as the top three defense spenders with the highest budgets. These investments are anticipated to drive demand for advanced radar warning sensors.

The demand for radar warning receiver is increasing owing to the increased geopolitical tensions and regional conflicts. The nations in the NATO, India, Japan, and Australia are all enhancing electronic warfare capabilities to counter their possible adversaries. For instance, in July 2024, BAE Systems provided AN/ALR-56M advanced radar warning receivers to the US Air Force to protect C-130J Super Hercules aircraft missions. In addition to that, an emphasis on anti-access (A2) or area denial (AD) has enhanced the usage of radar and missile defense systems rendering radar warning receivers more important.

Key Radar Warning Receiver Market Insights Summary:

Regional Highlights:

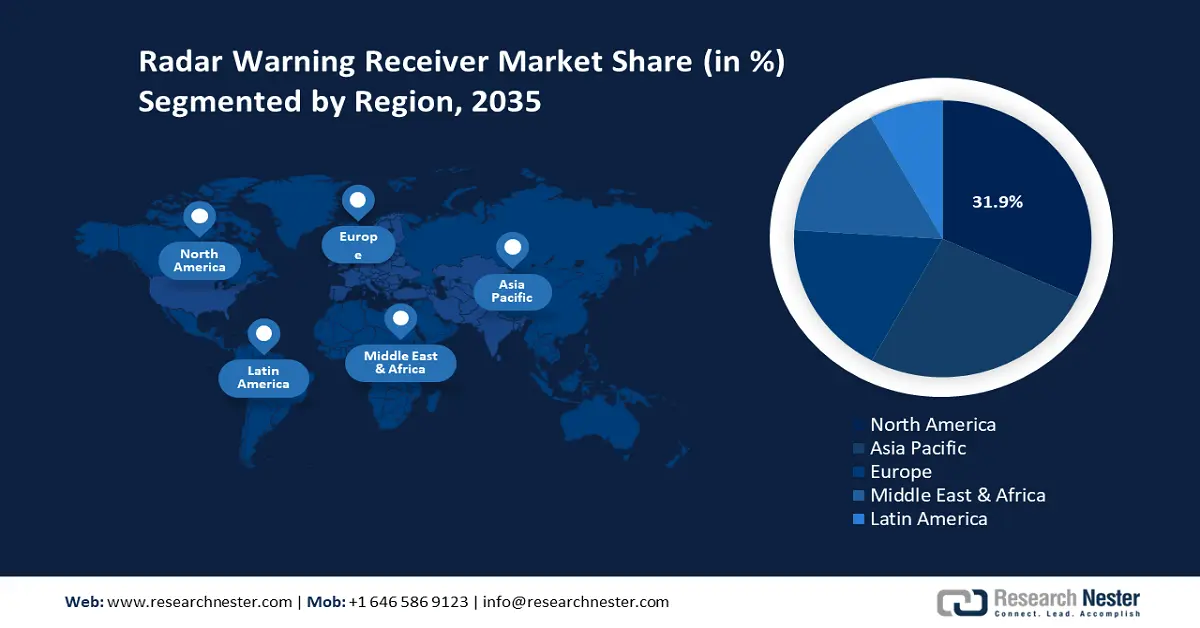

- North America radar warning receiver market will account for 31.90% share by 2035, fueled by increasing investments in advanced defense technologies and military modernization.

- Asia Pacific market will grow rapidly during the forecast period 2026-2035, driven by regional security threats and military modernization programs across countries like China, India, Japan, and South Korea.

Segment Insights:

- The electronic warfare segment in the radar warning receiver market is expected to hold a 45% share by 2035, driven by growing adoption of electronic countermeasures and anti-access tactics.

- Space-based segment in the radar warning receiver market is expected to achieve rapid growth by the forecast year 2035, driven by miniaturization of payloads and AI-driven signal processing enhancing capability.

Key Growth Trends:

- Growing electronic warfare threats

- Increasing deployment of UAVs and drones

Major Challenges:

- High development and integration costs

- Vulnerability to cyber and electronic attacks

Key Players: Lockheed Martin Corporation, Raytheon Technologies Corporation, Saab AB, Duotech Services, Bharat Electronics Limited (BEL).

Global Radar Warning Receiver Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.37 billion

- 2026 Market Size: USD 4.63 billion

- Projected Market Size: USD 8.28 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Russia, China, Israel, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Radar Warning Receiver Market Growth Drivers and Challenges:

Growth Drivers

- Growing electronic warfare threats: The use of sophisticated radar systems by adversaries is increasing, making radar warning receivers essential for survivability. Modern warfare technologies are prone to stealth technology, jamming, and cyber electronic attacks, which increases the demand for warning receivers with enhanced detection capabilities. Therefore, countries are investing in advanced electronic intelligence systems (ELINT) and SIGINT to improve the effectiveness of radar warning receivers. For example, in April 2024, TUALCOM introduced a compact four-channel ESM/ELINT receiver that receives radar signals across 2 GHz to 18 GHz spectrum. This new development instantly generates an output including frequency, amplitude, time of arrival, and so on. These outputs increase awareness and help to decide the next action to be taken to ensure safety during wars.

- Increasing deployment of UAVs and drones: UAVs and drones are being deployed for surveillance, combat, and electronic warfare, increasing the demand for miniaturized and lightweight radar warning receivers. Countries are adopting miniaturized RWRs into drones for reconnaissance and combat missions as they are portable. Unmanned aerial vehicles require radar warning receivers for self-protection in contested air spaces. For instance, in June 2023, Elbit Systems introduced a new radar warning receiver that can locate drones and classify them as a threat. Moreover, Advanced combat drones such as the MQ-9 Reaper, Bayraktar TB 2, and Loyal Wingman require self-protection systems, including radar warning receivers.

- Technological advancements in radar and signal processing: The development of AI-powered radar warning receivers enhances the ability to detect, classify, and react to radar threats more efficiently. Software-defined radar warning receivers are becoming popular as they allow for real-time updates to new threats. For instance, in February 2025, Raytheon developed the first-ever AI/ML integrated radar warning receiver system for a fourth-generation aircraft. This development enables AI models to be integrated into RWR systems for AI/ML processing at the sensor. This integration is likely to improve threat detection and increase aircrew survivability. Thus, the integration of machine learning, and quantum radar countermeasures is shaping the next generation of highly adaptive radar warning receivers.

Challenges

- High development and integration costs: Advanced radar warning receivers require significant R&D investment due to the need for AI, machine learning, and software-defined capabilities. Integration with existing platforms such as fighter jets, UAVs, and naval ships can be complex and expensive. These factors combined hinder the radar warning receiver adoption, limiting the radar warning receiver market growth.

- Vulnerability to cyber and electronic attacks: Radar warning receiver systems rely on electronic databases and real-time signal processing, making them potential targets for cyberattacks and signal spoofing. This limits the radar warning receiver market expansion prospect, as adversaries may develop decoy radars or electronic deception techniques to mislead radar warning receivers equipped with platforms.

Radar Warning Receiver Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 4.37 billion |

|

Forecast Year Market Size (2035) |

USD 8.28 billion |

|

Regional Scope |

|

Radar Warning Receiver Market Segmentation:

Application Segment Analysis

Electronic warfare segment is set to account for radar warning receiver market share of more than 45% by the end of 2035. Electronic warfare is a primary application of radar warning receivers that enables detection, identification, and response to enemy radar threats. The military platforms are aided by radar warning receivers to combat radar directed threats such as missiles, enemy surveillance systems, and enemy aircraft. Additionally, modern electronic warfare strategies rely on AI-powered radio warning receivers to analyze complex radar signals and enhance situational awareness in contested environments.

Stealth aircraft, naval warships, and UAVs use radar warning receivers as part of their self-protection suites, ensuring survivability against hostile radar tracking and jamming. The growing adoption of electronic countermeasures (ECM) and anti-access or area denial tactics is driving continuous innovation in electronic warfare-focused radar warning systems. For instance, the new Viper Shield Electronic Warfare (EW) system by L3Harris provides virtual protection around the aircraft. Recently, in February 2025, the U.S. Air Force used this virtual electronic armour on the F-16 aircraft. The viper shield radar warning receiver can function in impenetrable background radio frequency environments, and successfully detect, and identify multiple threats. These advanced electronic warfare detect threats earlier and utilize the data to increase their survivability.

Platform Segment Analysis

The space-based segment in radar warning receiver market is expected to rise at a rapid pace through 2035. Space-based radar warning receivers are gaining importance due to their capability to detect threats early and electronic warfare resilience. The satellites equipped with RWR payloads can detect, analyze, and track hostile radar emissions from space, enhancing situational awareness. Leading defense agencies such as the U.S. Space Force and Japan JAXA are investing in space-based electronic warfare systems to counter evolving threats. These systems support missile defense, anti-satellite warfare, and stealth aircraft tracking by providing a broader detection range than ground-based radar warning receivers. The miniaturization of electronic warfare payloads and advancements in AI-driven signal processing are further accelerating the growth of space-based radar warning receivers in modern defense strategies.

Our in-depth analysis of the global radar warning receiver market includes the following segments:

|

Application |

|

|

Platform |

|

|

Component |

|

|

Frequency Band |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Radar Warning Receiver Market Regional Analysis:

North America Market insights

North America in radar warning receiver market is expected to capture around 31.9% revenue share by the end of 2035. The market in North America is expanding due to increasing investments in advanced defense technologies by countries such as the U.S. and Canada. Modernization of military platforms including fighter jets and naval ships is driving demand for advanced radar warning systems. Moreover, the rise of cybersecurity threats and global tensions is fueling the need for better radar detection and countermeasures. Additionally, the focus on anti-access and area denial strategies is contributing to market growth.

The radar warning receiver market in the U.S. is growing due to increasing investments in modernizing military platforms, fighter jets, and naval vessels. The demand for advanced electronic warfare capabilities is rising due to evolving radar threats and the need for enhanced situational awareness. To overcome these threats, the government has also increased defense spending to develop advanced technologies. According to the IISS report 2025, the U.S. has the highest share in defense spending accounting for USD 968 billion in 2025. The U.S. military’s focus on countering near adversaries and improving missile defense systems is further boosting the radar warning receiver market. For instance, in October 2024, Lockheed Martin’s development of the Gen 3 Radar frequency interferometer (RFI) for the U.S. Army’s Apache helicopter fleet represents a significant advancement in electronic warfare technology. This system offers enhanced sensor performance in a compact form factor enabling more effective detection and response to evolving radar threats.

The radar warning receiver market in Canada is growing due to increased focus on modernizing defense capabilities and improving electronic warfare systems. For instance, Canada has modernized its CP-140Aurora maritime patrol aircraft, equipping them with advanced radar systems such as the Raytheon AN/APY-10 radar for enhanced surveillance and detection of surface and air threats. Canada is investing in advanced radar detection technologies for its military aircraft. Additionally, Canada’s commitment to enhance its defense partnership with NATO and allies is driving the adoption of next generation radar warning systems.

Asia Pacific Market Insights

Asia Pacific radar warning receiver market is expected to garner a rapid growth through 2035 driven by regional security threats and military modernization programs in countries such as China, India, Japan, and South Korea. The rising geopolitical tensions, particularly in the South China Sea, Taiwan, and Indo-Pacific region are driving demand for advanced electronic warfare capabilities including radar warning receivers. Countries are investing in indigenous radar warning receivers development with companies such as Mitsubishi Electric of Japan and DRDO of India working towards enhancing electronic warfare capabilities to reduce reliance on foreign technology. The integration of radar warning receivers in fighter jets such as F-35, J-20, Tejas MK2, naval warships, and UAVs is fueling market growth with increased focus on AI-powered and software-defined radars.

The radar warning receiver market in China is experiencing significant growth as the country prioritizes military modernization and electronic warfare capabilities. The International Institute of Strategic Studies (IISS) report states that China’s defense budget stood at USD 235 billion. China is reported to be one among the top three countries with the largest defense spending. With its focus on developing advanced stealth technologies and next-generation fighter jets such as the J-20, China is investing heavily in sophisticated radar warning systems to enhance situational awareness and counter radar-guided threats. Leading defense companies such as China Electronics Technology Group Corporation (CETC) are advancing the design of AI-powered radar warning systems for naval, air, and land-based platforms.

The radar warning receiver market in India is driven by the country’s increasing emphasis on self-reliance in defense technology and its commitment to modernizing its military capabilities. The indigenous development of advanced radar warning systems by DRDO is driven by the need for countermeasures against evolving threats, particularly from neighbouring countries. Further government funding for the installation and development of advanced radar warning receivers also drives radar warning receiver market growth. For instance, in 2023, the defense ministry signed a contract with Bharat Electronics Limited (BEL), worth over Rs 3,700 crore (USD 37 billion), to improve the operational capabilities of Indian Air Force. The first contract, worth over Rs 2,800 crore (USD 28 billion), was about supplying Medium Power Radars (MPR) in ‘Arudhra’ for the IAF. Whereas, the second contract, approximately of Rs 950 crore (USD 9.5 billion), was for 'Radar Warning Receivers' (RWR). Additionally, India’s focus on enhancing electronic warfare capabilities across fighter jets, naval platforms and UAVs is a significant growth factor.

Radar Warning Receiver Market Players:

- BAE Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Saab AB

- HENSOLDT

- Teledyne Defence & Space

- Indra Sistemas, S.A.

- Duotech Services

- Bharat Electronics Limited (BEL)

The competition in the radar warning receiver market is moderately fragmented and the key companies are expanding their presence through various strategic mergers and partnerships. Som of the key players dominating the radar warning receiver market include Northrop Grumman known for its advanced electronic warfare systems and radar detection technologies. Lockheed Martin leads with radar warning solutions for fighter jets and naval vessels. Leonardo is also a significant player providing advanced warning systems integrated into airborne and ground based platforms.

Here are some leading players in the radar warning receiver market:

Recent Developments

- In February 2025, Saab is set to reveal the new coast control radar at the International Defence Exhibition and Conference (IDEX) to be held at the United Arab Emirates (UAE). It is the latest next generation, phased array, non-rotating, software-defined radar developed in the UAE.

- In March 2024, Northrop Grumman entered into a 5-year contract to manufacture AN/APR-39E(V)2 radar warning receivers for the U.S. Army. The AN/APR-39E(V)2 uses a smart antenna system and advanced processing to detect a broad spectrum of radio frequency threats, and operate as the survivability controller in various combat scenarios.

- Report ID: 7254

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Radar Warning Receiver Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.