Quenching Fluids & Salts Market Outlook:

Quenching Fluids & Salts Market size was over USD 2.4 billion in 2025 and is anticipated to cross USD 3.66 billion by 2035, growing at more than 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of quenching fluids & salts is assessed at USD 2.49 billion.

The market is expanding rapidly globally as more industries are increasingly implementing the use of efficient heat treatment processes in automotive, aerospace, manufacturing, and metallurgical processing industries. For instance, in February 2023, Solar Atmospheres Inc. announced the approval of critical Boeing specifications for oil quenching of alloy steels in conformance with Boeing's specification BAC 5617.

Quenching fluids and quenching salts play a pivotal role in controlling the rate of metal parts cooling after the heat treatment process, increasing their hardness, strength, and durability accordingly. Increased demand for specialized quenching solutions that aim to produce superior material properties in the light of advanced manufacturing technologies, which include additive manufacturing and precision engineering.

This expansion is also supported by ever-increasing demands on high-performance materials in automotive, especially in lightweight components, as well as high-strength alloys. Environmental concerns and regulatory factors also are affecting the quenching fluids & salts market to foster more environmentally friendly and sound quenching fluids, including water-based and biodegradable ones. This added to the steady progress in heat treatment technologies, is likely to drive quenching fluids and salts in the future.

Key Quenching Fluids & Salts Market Insights Summary:

Regional Insights:

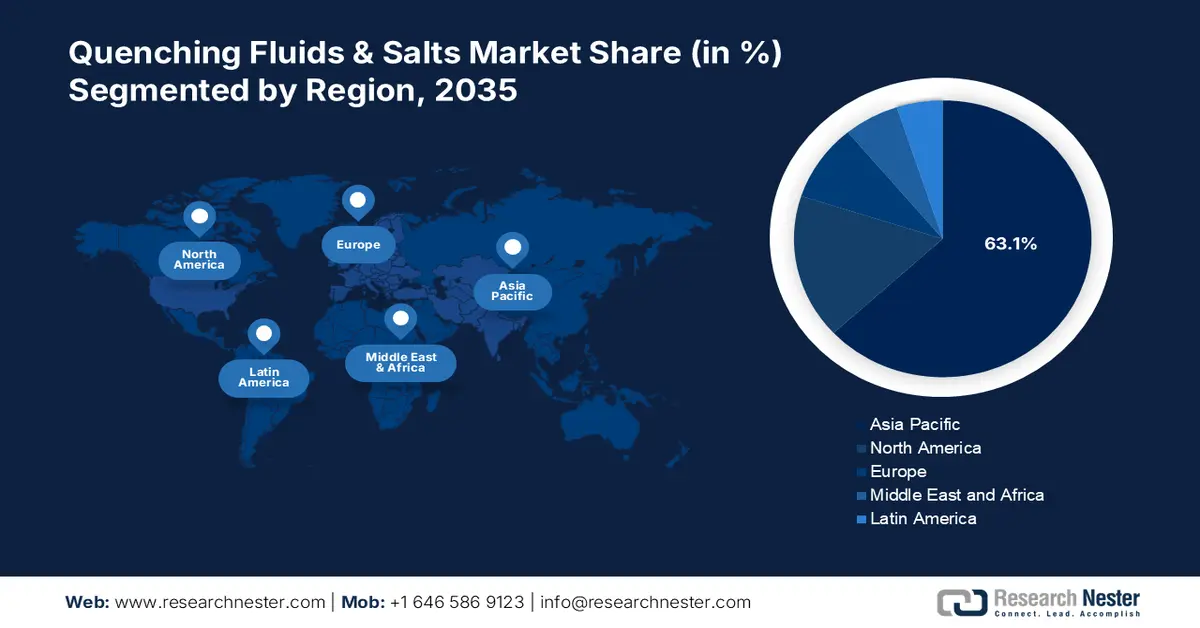

- Asia Pacific is anticipated to secure nearly 63.1% share by 2035 in the quenching fluids & salts market, attributed to growing EV adoption and supportive government policies.

- North America is set to expand robustly through 2026–2035 owing to the region’s favorable business environment and rising commercial heat-treatment activities.

Segment Insights:

- The Oil segment is projected to command over 78.9% share by 2035 in the quenching fluids & salts market, propelled by its superior cooling performance and consistent heat-transfer capabilities.

- The Aerospace segment is expected to remain dominant through 2026–2035 stemming from the industry’s strict need for high-strength, durable metal components.

Key Growth Trends:

- Technological innovations in quenching fluids

- Increased focus on energy efficiency

Major Challenges:

- Health and safety concerns

- High costs of specialized fluids

Key Players: Castrol Ltd., Petrofer, CONDAT, Croda International Plc., Exxon Mobil Corporation, Chevron Corporation, FUCHS, Quaker Chemical Corporation, DuBois Chemicals, Chemtool Incorporated, Quaker Houghton.

Global Quenching Fluids & Salts Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.4 billion

- 2026 Market Size: USD 2.49 billion

- Projected Market Size: USD 3.66 billion by 2035

- Growth Forecasts: 4.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (63.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: South Korea, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 2 December, 2025

Quenching Fluids & Salts Market - Growth Drivers and Challenges

Growth Drivers

- Technological innovations in quenching fluids: The most prominent innovation is the formulation of advanced water-based and biodegradable quenching fluids. It provides quicker cooling rates, has a reduced environmental impact, and performs generally better than traditional oils. For instance, in March 2021, CIMCOOL introduced DuBois Quenching Fluids in Europe. The product portfolio has been engineered to the European legislative requirements allowing for improved corrosion protection, longer fluid life, and optimal health and safety features. As sustainable performance continues to be vital, advancement in quenching technologies is supposed to push quenching fluids & salts market growth.

- Increased focus on energy efficiency: Industries continue to cut down energy consumption and operational costs. Quenching fluids with higher thermal conductivities and faster cooling rates make heat treatments far more efficient, generally decreasing overall manufacturing energy consumption. For instance, in July 2021, Castrol launched a new thermal fluid, ON e-thermal fluid. It’s an innovative dielectric fluid made for direct cooling with battery cells. Thus, it will result in improving thermal management and operating conditions. With manufacturers and industries focusing more on energy-saving technologies to meet economic and environmental targets, demand for high-performance quenching fluids will likely increase-that will boost market growth.

Challenges

- Health and safety concerns: A significant challenge in the quenching fluids & salts market is the inherent health risks the chemical composition of traditional posed by quenching fluids. This calls for safer non-toxic alternatives that have seen increasing demand in industries owing to workplace health risk minimization, in addition to stricter safety regulations. The investment required in R&D to make quenching fluid formulation safer is enormous, therefore, this may deter the market from adopting this innovation as early as it could, increasing production costs.

- High costs of specialized fluids: In the quenching fluids & salts market, especially for small and medium-sized manufacturers, costs pose a vital challenge. Advanced formulations, including biodegradable or customized quenching fluids, are more expensive than traditional ones. This price difference can deter cost-sensitive businesses from adopting these high-performance fluids, despite their potential efficiency gains, long-term sustainability, and superior product quality. Due to this, the adoption of these specialized solutions is not widespread, therefore restricting their growth prospects.

Quenching Fluids & Salts Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 2.4 billion |

|

Forecast Year Market Size (2035) |

USD 3.66 billion |

|

Regional Scope |

|

Quenching Fluids & Salts Market Segmentation:

Product Segment Analysis

Oil segment is projected to dominate quenching fluids & salts market share of over 78.9% by 2035. The oil segment dominates the market based mainly on its superior cooling properties and the ability to provide consistent heat transfer during the quenching process. The better viscosity of oil prevents cracks and distortion of components. For instance, in January 2024, Petrofer offered pre-HT washing and quenching, which is a final cleaning pre-HT welding with experience and energy savings due to lower application temperatures. This reaches from the cleaning before heat treatment through to the choice of quenching oil or polymer. Such reliable performance in demanding heat treatment applications continues making oil-based quenching fluids the preferred choice.

End user Segment Analysis

Aerospace is the dominating segment for quenching fluids & salts market, due to the stringent requirement of the industry for high-performance materials and components. The metal parts for aerospace applications are required to exhibit maximum strength and durability coupled with resistance to severe conditions, which include maximum temperature and pressure tolerance. For instance, in April 2024, Vacu Braze purchased and installed a new American-manufactured Class 3 Pyrometry furnace, featuring a 36”x48” zone to expand its aerospace, defense, and power generation capabilities. Aerospace is therefore the largest end user in the market.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Quenching Fluids & Salts Market - Regional Analysis

North America Market Insights

North America is the most rapidly growing region in the quenching fluids & salts market, driven by the encouragement and benefits of expanding foreign businesses into the region. In addition, commercial heat treatment facilities are likely to increase their rate since the demand for quenching products, supportive government initiatives, and advantageous economic policies for commercial projects will escalate the market share for quenching fluids & salts.

The primary growth driver for the market in the U.S. is spurred by the presence of industry giants dealing in the production and growth of quench fluids. For instance, in November 2024, ExxonMobil announced reported third-quarter 2024 earnings of USD 8.6 billion. Improved earnings highlight the highest production of liquids with 3.2 million barrels per day and 10% above the prior year-to-date.

The quenching fluids & salts market in Canada is evolving at a steady pace attributable to manufacturing capacity in quenching systems. For instance, in August 2024, CAN-ENG Furnaces International Ltd, Niagara Falls, ON, Canada provided mesh belt furnace systems, CAN-ENG PET SCADA systems, and integrated controls. This oil quench and salt quench system was designed with low energy consumption, no part mixing, minimum damage to parts minimal distortion potential, and high uptime productivity.

Asia Pacific Market Insights

Asia Pacific quenching fluids & salts market is poised to capture revenue share of around 63.1% by the end of 2035. Moreover, electric vehicle sales are picking up pace due to the high penetration of the trend in electric-driven vehicles It is also stimulating the development of infrastructure required for them. Furthermore, governments in the region are implementing favorable policies to develop a healthy ecosystem for quenching fluids.

The major characteristic of the India landscape for the quenching fluids & salts market is the increasing demand from manufacturers for sophisticated materials with specific thermal and mechanical properties. Thus, they are focusing on developing quenching solutions to fulfill these changing demands. In addition, the aim rests upon fabricating new quenching technology with cost-effectiveness and scalability.

The China landscape is transforming through the rising demand for aerospace parts in various emerging economies. In addition, increasing per capita income and enhanced air travel are likely to have a positive effect on the quenching fluids & salts market in the country. Furthermore, local governments are aimed at improving their public transportation systems in a bid to curb air pollution levels.

Quenching Fluids & Salts Market Players:

- Castrol Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Petrofer

- CONDAT

- Croda International Plc.

- Exxon Mobil Corporation

- Chevron Corporation

- FUCHS

- Quaker Chemical Corporation

- DuBois Chemicals

- Chemtool Incorporated

- Quaker Houghton

The quenching fluids & salts market is driven by a continuous investment in research and development. It enables the creation of advanced, eco-friendly, and efficient quenching solutions that meet growing demands by industries such as automotive, aerospace, and metalworking. Also, these companies are using global supply chains and customer-centric strategies to sustain competitive advantages in an increasingly regulated and environmentally conscious market.

Here’s the list of some key players:

Recent Developments

- In September 2024, QatarEnergy witnessed the signing of a MoU, to establish QSalt (salt production plant) for USD 274.7 million. It’s a joint venture between Qatar Energy and TAWTEEN that is aimed at boosting local production of industrial salts.

- In July 2024, Lubrizol announced a land acquisition of USD 200 million (initial investment) in India. This acquisition aimed to build a manufacturing facility to meet fluid demand arising from transportation and other industries.

- Report ID: 6737

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Quenching Fluids & Salts Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.