Pyridine Market Outlook:

Pyridine Market size was valued at USD 755.16 million in 2025 and is set to exceed USD 1.25 billion by 2035, registering over 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pyridine is estimated at USD 790.5 million.

The pyridine market is expanding due to its increased utilization in agrochemical industries. Pyridine is a nitrogen-containing heterocyclic chemical molecule extensively used as a solvent and reagent in synthesizing pharmaceuticals and a feedstock chemical in the agrochemical industries to produce fungicides, insecticides, and herbicides. The pyridine market has continued to expand as a result of rising crop yields to satisfy global food demands and increasing health consciousness. The United States Department of Agriculture (USDA) reported that the world's population expanded by 45% between 1990 and 2019, and the amount of food produced by the global agricultural system increased by 61% in terms of calories available for consumption.

In contrast, the increasing demand for pyridine in the agrochemical industry emphasizes the crucial role of nitrogen heterocyclic compounds in modern agriculture. Since nitrogen heterocyclic compounds are in high demand across various sectors, including agrochemicals, medicines, and sophisticated materials, the global trade in these compounds is expanding rapidly.

|

Country |

Nitrogen Heterocyclic Compounds Export Value (USD Billion) |

Country |

Nitrogen Heterocyclic Compounds Import Value (USD Billion) |

|

Ireland |

24.4 |

Germany |

19.3 |

|

China |

21.6 |

U.S. |

14.1 |

|

Switzerland |

16.6 |

Ireland |

8.17 |

|

UK |

5.82 |

Belgium |

7.37 |

|

Germany |

5.18 |

Slovenia |

5.79 |

Source: OEC

The Observatory for Economic Complexity (OEC) unveiled that nitrogen heterocyclic compounds held the 32nd position as the most traded, globally, in 2022 with around USD 103 billion in trade. Nitrogen heterocyclic compounds exports increased by 23.4% between 2021 and 2022, from USD 83.4 billion to USD 103 billion. 0.43% of global trade is made up of nitrogen heterocyclic compounds. According to the Product Complexity Index (PCI), nitrogen heterocyclic compounds are ranked 122nd.

Key Pyridine Market Insights Summary:

Regional Highlights:

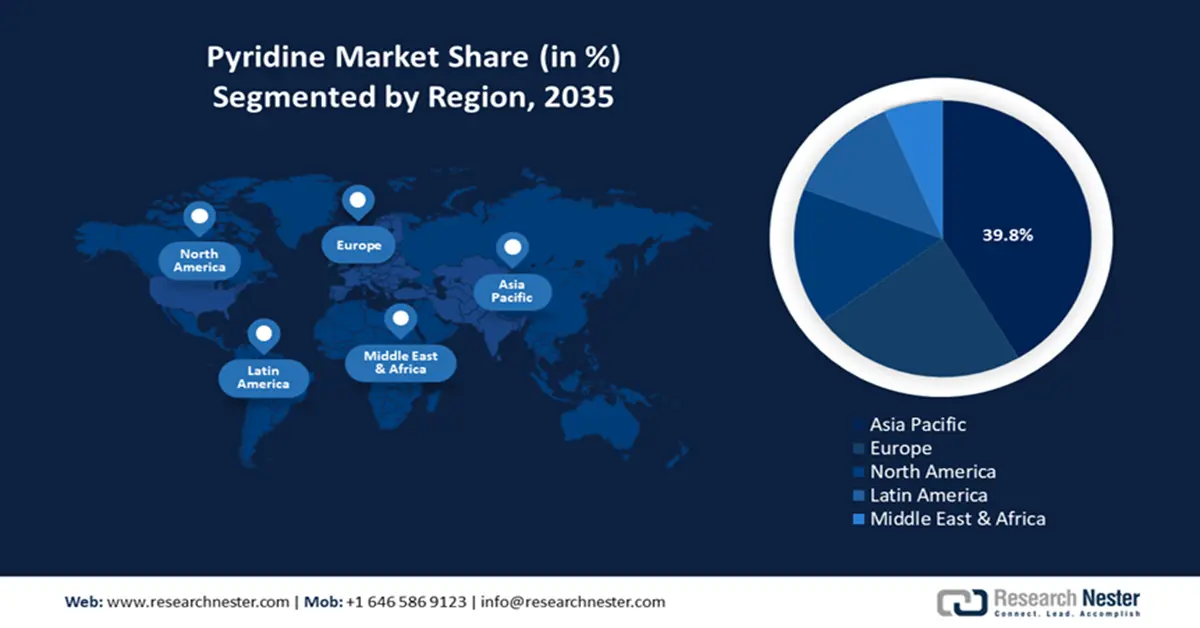

- Asia Pacific dominates the pyridine market with a 39.8% share, driven by the region’s significant agricultural base and rising use of pyridine in agrochemicals, ensuring robust growth through 2035.

- Europe’s pyridine market anticipates substantial growth by 2035, attributed to the region’s aging population and growing demand for innovative medicines.

Segment Insights:

- The Agrochemicals segment is forecasted to exceed 45.4% market share by 2035, propelled by the increased need for effective crop protection and productivity.

- The Beta Picoline segment is expected to hold a notable share in the Pyridine Market from 2026-2035, driven by its wide application in pharmaceuticals and agrochemical production.

Key Growth Trends:

- Increased focus on the sustainable production of pyridine

- Surge in trade economics of pyridine derivatives

Major Challenges:

- Fluctuation in pyridine and beta picoline prices

- Strict regulations and laws

- Key Players: Jubilant Life Sciences Ltd., Lonza Group Ltd., Vertellus Specialties, Inc., Resonance Specialties Limited, DSM-Firmenich, Trinseo, Red Sun Group, Shandong Luba Chemical Co., Ltd., Koei Chemical Co., Ltd., Weifang Sunwin Chemicals Co., Ltd..

Global Pyridine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 755.16 million

- 2026 Market Size: USD 790.5 million

- Projected Market Size: USD 1.25 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Pyridine Market Growth Drivers and Challenges:

Growth Drivers

-

Increased focus on the sustainable production of pyridine: The industrial synthesis of pyridine is based on the amino cyclization reaction (condensation/cyclization) between formaldehyde, acetaldehyde, and ammonia (NH3) using a ZSM-5 catalyst, which produces a mixture of α-, β-, and γ-picoline as byproducts. Despite these synthesis methods, the high demand for pyridine bases has prompted research on using various raw materials, such as aldehydes, ketones, and alcohols, from renewable sources to increase the yield of a desired product.

On the other hand, glycerol has become a key raw material in several catalytic processes, including hydrogenolysis, dehydration, oxidation, and esterification, since it is obtained industrially as a byproduct in the production of biodiesel from vegetable and algae oils. Glycerol and ammonia can undergo a single-step or two-step aminocyclization synthesis to produce pyridine bases. Acrolein and acrolein dialkyl acetals are examples of glycerol derivatives that can be utilized as raw materials for this reaction. In continuous fixed-bed reactors, the primary process variables are the space velocity, the NH3/reactant molar ratio, the reaction temperature, and the reactant concentration in water. - Surge in trade economics of pyridine derivatives: Numerous biological actions, including antibacterial, antifungal, antiviral, analgesic, antidiabetic, and anticancer properties, are exhibited by pyridine and its derivatives. Pyridine derivatives are also crucial for bioimaging applications that diagnose various illnesses. It has improved pharmacological activity due to the inclusion of pyridine and other groups such as imidazole, benzimidazole, pyrimidine, and p-chlorobenzene moieties.

Alternatively, pyridine salts – simple and essential pyridine derivatives – show excellent antibacterial properties against gram-negative bacteria. They are also used in textile and dye industries, where they enhance the properties of fabric and color fastness. Therefore, the demand for pyridine salts across various industries that rely on chemical intermediates, makes their trade a critical factor in the supply chain of these sectors.

|

Country |

Export Value of Pyridine Salts (in USD Million) |

Country |

Import Value of Pyridine Salts (in USD Million) |

|

India |

7850 |

UK |

5470 |

|

U.S. |

2850 |

China |

2640 |

|

China |

1430 |

Japan |

1540 |

|

Ireland |

1250 |

South Korea |

1030 |

|

Japan |

892 |

Indonesia |

869 |

Source: OEC

OEC reported that with a total transaction of USD 169 million in 2022, pyridine salts ranked 3830th in the world in terms of trade. Pyridine salt exports increased by 8.45% between 2021 and 2022, from USD 156 million to USD 169 million. Pyridine and salt trade accounts for 0.00071% of global trade.

Challenges

-

Fluctuation in pyridine and beta picoline prices: Pyridine and its derivatives are highly variable. The manufacturing of pyridine has been significantly damaged by the paraquat ban, which has also affected beta-picoline. The price of beta picoline increased as a result of lower output, rising raw material costs, and rising production costs. Price increases for pyridine and its derivatives have been announced by top producers, including Vertellus and Jubilant Life Sciences.

-

Strict regulations and laws: It is anticipated that stringent rules and guidelines about pyridine use will impede pyridine market expansion. The Occupational Safety and Health Administration (OSHA) states that the Reportable Quantity (RQ) value of pyridine is 100 and the Acceptable Daily Intake (ADI) is limited to 0.002 mg/kg/day for inhalation exposure. When pyridine comes into contact with the skin, it can cause chemical burns, and its fumes can irritate the eyes or the lungs. With vapor concentrations exceeding 3600 parts per million, pyridine poses a significant risk to health since it depresses the nervous system and produces symptoms akin to intoxication. Dizziness, headaches, loss of coordination, nausea, salivation, and appetite loss are some symptoms, that may start several hours later than expected.

Pyridine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 755.16 million |

|

Forecast Year Market Size (2035) |

USD 1.25 billion |

|

Regional Scope |

|

Pyridine Market Segmentation:

End use (Pharmaceuticals, Agrochemicals, Food, Chemicals)

Agrochemicals segment is predicted to hold pyridine market share of more than 45.4% by 2035. Pyridine and its derivatives can be used in a wide range of formulation products, including insecticides, fungicides, and herbicides. Pyridine is regarded as a crucial raw ingredient in the production of numerous herbicides, such as Triclopyr and Picloram. These are often employed in the field to manage pests and weeds to increase agricultural productivity. Due to the increased need for efficient and successful ways to protect crops from pests, illnesses, and soil deterioration, the agrochemical sector is another significant consumer.

Type (Alpha Picoline, Gamma Picoline, 2-Methyl-5-Ethylpyridine, Beta Picoline, Pyridine N-Oxide)

The beta picoline segment in pyridine market will garner a notable share during the forecast period. Since it is widely used in the production of several important agrochemicals and pharmaceuticals, beta-picoline is a significant pyridine market. For example, it is a vital feedstock in the synthesis of vitamin B6, pyridoxine, which is highly sought after in nutritional supplements and food fortification. The chemical is mostly used in the manufacturing of herbicides, such as Picloram, an agrochemical that is highly effective in protecting crops and controlling weeds. Beta-picoline's wide range of applications and significant contribution to the pharmaceutical and agro-based industries account for its dominant market position.

Our in-depth analysis of the global pyridine market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pyridine Market Regional Analysis:

APAC Market Statistics

Asia Pacific pyridine market is predicted to hold revenue share of more than 39.8% by 2035. The market is expanding due to the region's significant agricultural base and the rising use of pyridine in agrochemicals. In India, the need for pyridine-based herbicides and pesticides has increased as a result of the agricultural sector's explosive rise. According to the India Brand Equity Foundation (IBEF), India's agriculture sector was expected to increase at a rate of 3.5% from 2022 to 2023 and 3.0% from 2021 to 2022. Agriculture and related industries' gross value added (GVA) increased by the desired 4% from 2022 to 2023. India ranks among the world's top exporters of agricultural products. The total value of agricultural product exports from April to July 2024 was USD 15.76 billion. India's agriculture exports totaled USD 48.15 billion in 2023 to 2024.

China has become one of the major manufacturers and users of pyridine due to its well-established agrochemical sector. The nation primarily practices large-scale agriculture, which raises demand for crop protection chemicals and solidifies its place in the global pyridine market. Also, the imports of pyridine are growing in China due to its rising demand in various sectors. China received 550 shipments of pyridine between March 2023 and February 2024, according to Volza's data on imports from China. 58 foreign exporters provided these imports to 162 Chinese consumers, representing a 1% increase over the previous 12 months. During this time, China purchased 37 shipments of pyridine in February 2024 alone. This represents a 3% sequential increase from January 2024.

Europe Market Analysis

Europe pyridine market will grow at a substantial rate during the projected period. The market is proliferating due to the region’s aging population and growing demand for innovative medicines. Also, the region’s strict regulations encourage using eco-friendly solvents, and pyridines' relatively low toxicity makes them a suitable choice in various industrial applications such as rubber and textiles. For instance, in 2020, the EU Chemicals Strategy for Sustainability was approved by the European Commission. The Strategy is the first step toward the European Green Deal's goal of zero pollution and a toxic-free environment. The strategy will strengthen the protection of the environment and human health from dangerous chemicals and encourage innovation in safe and sustainable chemicals.

In Germany, the extensive use of electronic devices across many industries and continuous technological developments have propelled the electronics industry's impressive growth. Pyridine compounds are essential to this sector and are used to produce a wide range of electronic materials and components. The widespread use of electronic devices, such as tablets, laptops, and smartphones, has become a significant factor in this industry's pyridine demand. In 2022, smartphones accounted for over USD 13.3 billion, a 9% increase, and continued to drive sales in the local market. Smartphone sales increased at an even faster rate in 2022 after declining in 2019 and showing only modest growth overall in 2020, rising 3.3% to over 11 billion euros and 6.3% to just under 12 billion euros in 2021.

Furthermore, the need for pyridine-based materials has increased due to the growing demand for high-performance electronics. Semiconductors, which are necessary to run electronic devices, are made from pyridine compounds. The semiconductor industry's need for pyridine is increasing along with the desire for quicker, more effective electronic devices.

The demand for pyridine-based products in the agrochemical industry is rising as a result of the UK's substantial agrochemical production. The need for pyridine is also driven by the UK's chemical industry, which produces paints, rubber, dyes, and specialty chemicals. The demand for pyridine in these industries is further fueled by the nation's emphasis on innovation and research & development. Therefore, it is anticipated that the demand for pyridine in Europe will continue to be high as long as these trends persist, propelling the expansion of the pyridine market in the region.

Key Pyridine Market Players:

- Jubilant Life Sciences Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lonza Group Ltd.

- Vertellus Specialties, Inc.

- Resonance Specialties Limited

- DSM-Firmenich

- Trinseo

- Red Sun Group

- Shandong Luba Chemical Co., Ltd.

- Koei Chemical Co., Ltd.

- Weifang Sunwin Chemicals Co., Ltd.

To innovate and diversify their product lines, key players are making significant investments in R&D projects in the pyridine market. This entails creating new pyridine compounds, investigating cutting-edge uses, and enhancing production process efficiency. Also, to meet changing pyridine market demands, research endeavors frequently seek to improve the characteristics and capabilities of pyridine-based compounds. Businesses are adopting more sustainable practices as a result of environmental legislation and concerns. Businesses are seeking ways to use greener production techniques to reduce energy use, and limit waste.

Recent Developments

- In May 2021, DSM-Firmenich, a global science-based company active in Health, Nutrition, and Bioscience, announced that its China Drug Master File (CDMF) for pyridoxine hydrochloride (vitamin B6) has been granted active status. DSM-Firmenich remains the first and only company in the world that can provide both US DMFs and Certificates of Suitability (CEPs) for all 13 vitamins.

- In May 2020, Trinseo, a worldwide materials solutions provider and manufacturer of plastics, latex binders, and synthetic rubber, completed the purchase of Synthomer plc's vinyl pyridine latex (VP latex) business.

- Report ID: 7021

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pyridine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.