Pumped Hydro Storage Market Outlook:

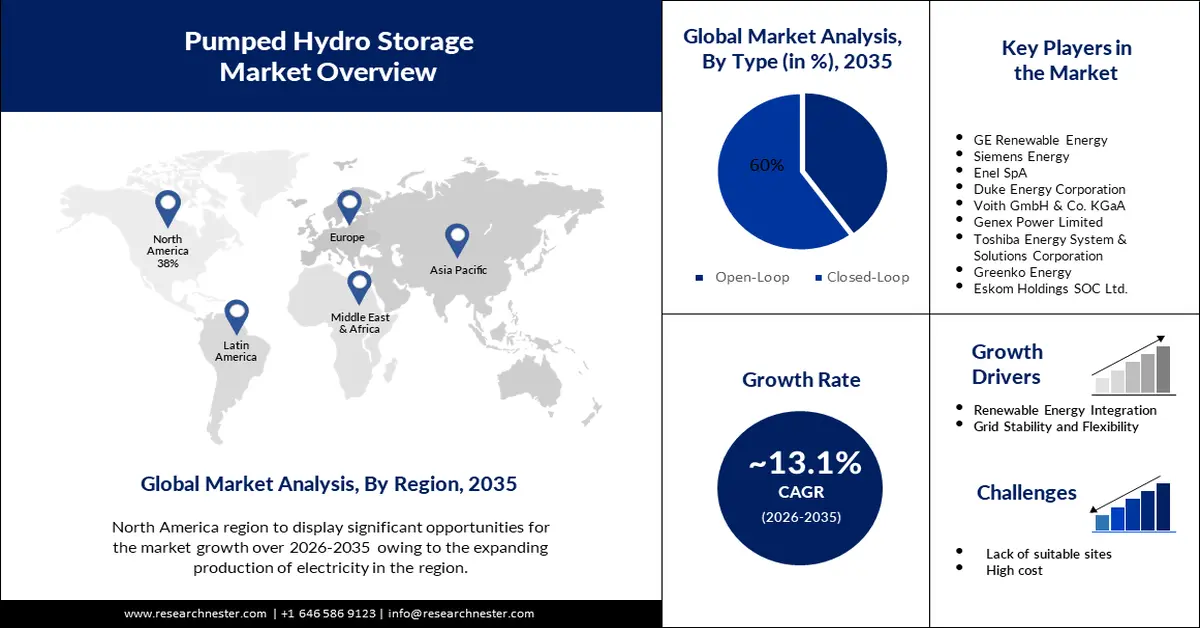

Pumped Hydro Storage Market size was over USD 55.35 billion in 2025 and is poised to exceed USD 189.56 billion by 2035, witnessing over 13.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pumped hydro storage is estimated at USD 61.88 billion.

The reason behind the growth is impelled by the rising initiatives to increase the pumped hydro storage capacity. For instance, The National Energy Administration (NEA) of China announced a mid-term and long-term plan for pumped storage development from 2021 to 2035. According to this proposal, installed pumped storage hydropower capacity in China would be at least 62 GW in 2025, and over 120 GW in 2030. China's existing pumped storage capacity is expected to reach 50 GW by the end of November 2022.

The growing technological developments are believed to fuel the market growth. For instance, an alternate strategy to the traditional pumped-storage hydropower development is being used by Quidnet Energy which is investing in a cutting-edge geo-mechanical pumped-storage (GPS) system that uses wells and other subterranean man-made or natural features for energy storage purposes.

Key Pumped Hydro Storage Market Insights Summary:

Regional Highlights:

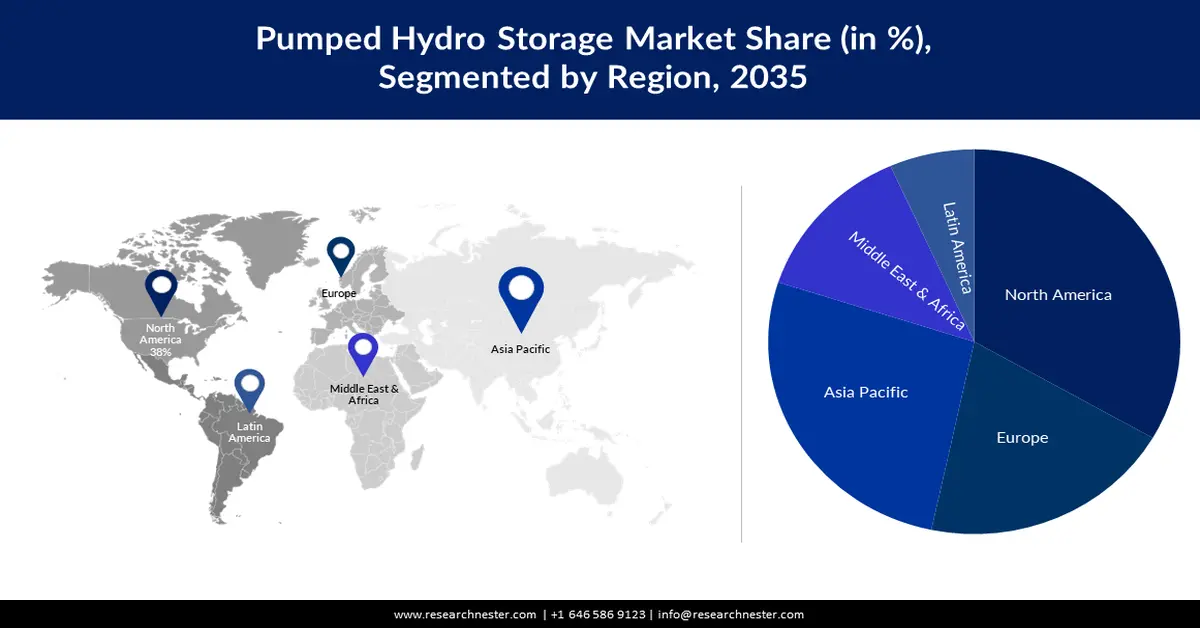

- The North America pumped hydro storage market is projected to capture a 38% share by 2035, fueled by rising production of electricity from pumped hydro storage and capacity to add more PSH plants.

Segment Insights:

- The electricity utilities segment in the pumped hydro storage market is forecasted to secure a 40% share by 2035, driven by the expanding capacity of pumped hydro storage enhancing grid stability and electricity production.

- The closed-loop segment in the pumped hydro storage market is projected to hold a notable revenue share by 2035, fueled by greater flexibility and environmental benefits.

Key Growth Trends:

- Renewable Energy Integration

- Grid Stability and Flexibility

Major Challenges:

- Negative Impact on the Environment

- Lack of Suitable Sites for Hydro Storage

Key Players: Nevada Hydro Corporation, GE Renewable Energy, Siemens Energy, Enel SpA, Duke Energy Corporation, Voith GmbH & Co. KGaA, Genex Power Limited, Toshiba Energy System & Solutions Corporation, Greenko Energy, Eskom Holdings SOC Ltd.

Global Pumped Hydro Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 55.35 billion

- 2026 Market Size: USD 61.88 billion

- Projected Market Size: USD 189.56 billion by 2035

- Growth Forecasts: 13.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, Italy

- Emerging Countries: China, India, Japan, South Korea, Australia

Last updated on : 11 September, 2025

Pumped Hydro Storage Market Growth Drivers and Challenges:

Growth Drivers

- Renewable Energy Integration – The increasing penetration of green energy sources, such as solar and wind, into the power grid requires efficient energy storage solutions to balance supply and demand.

According to the International Renewable Energy Agency (IRENA), global renewable energy capacity reached 2,799 GW in 2020, with hydroelectric power accounting for a significant portion of it.

- Grid Stability and Flexibility - Pumped hydro storage provides grid stability and enhances flexibility by storing excess electricity during periods of low demand and releasing it during peak demand.

Challenges

- Negative Impact on the Environment - Construction of large-scale pumped hydro storage infrastructure leads to various environmental impacts, such as displacement of existing communities, destruction of natural habitats, and changes to water flow and quality. This harms the livelihood of local people living there and thus leads to opposition from local communities and environmental groups. This makes it difficult to receive approvals and permits for the construction and is likely to hamper the pumped hydro storage market growth.

- Lack of Suitable Sites for Hydro Storage

- High Cost of Constructing Dams

Pumped Hydro Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.1% |

|

Base Year Market Size (2025) |

USD 55.35 billion |

|

Forecast Year Market Size (2035) |

USD 189.56 billion |

|

Regional Scope |

|

Pumped Hydro Storage Market Segmentation:

End-User Segment Analysis

The electricity utilities segment is estimated to hold 40% share of the global pumped hydro storage market in the coming years owing to the growing capacity of pumped hydro storage for producing more electricity. This allows for greater flexibility improves the grid stability, and enables the storage of more energy as a result more electricity can be produced to meet the high demand.

For instance, lately, there are more than 120 GW of PHS capacity operating globally, accounting for more than 90% of the world's power storage capacity and around 2% of global electricity generation.

Type Segment Analysis

The closed loop segment is set to garner a notable share shortly. Closed-loop pumped hydro storage is more flexible than open-loop and this is the primary reason for the segment’s growth. Closed-loop systems do not require a nearby natural water source, such as a river or lake, as the water is stored and reused within the system. This makes a closed loop suitable for a wider range of locations, including areas that are not in proximity of water bodies, this makes closed-loop easier to implement. Moreover, closed-loop systems are generally more environmentally friendly than open-loop systems. As these systems do not require natural sources hence, less impact is imposed on aquatic environments.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pumped Hydro Storage Market Regional Analysis:

North American Market Insights

North America industry is set to dominate majority revenue share of 38% by 2035, impelled by the rising production of electricity from pumped hydro storage. Pumped storage hydropower (PSH) is a well-established and widely used form of energy storage system, accounting for 93% of all utility-scale energy storage capacity in the United States.

Moreover, the present-day hydropower plant pumped storage fleet in the United States contains around 22 gigatons of electricity-generating capacity and 550 gigatons of energy storage, with plants in every area of the country. According to the statistics from the Office of Energy Efficiency & Renewable Energy, America presently has 43 PSH plants and has the capacity to more than double its existing PSH capacity by adding enough additional PSH plants.

APAC Market Insights

The APAC Pumped Hydro Storage market is estimated to be the second largest, during the forecast timeframe led by higher construction of storage plant. For instance, Guidelines for promoting pumped storage projects (PSPs) in India were recently released by the Ministry of Power as energy storage is aided by technology, and with the rise of renewable energy, the ministry asserts that this technology is a better option. As a result, the demand for pumped hydro storage may rise in the region.

According to data from 2022, there are currently more than 2 GW of pumped storage projects (PSPs) being built in India, while there are over 22 GW of such projects in various phases of development.

Pumped Hydro Storage Market Players:

- Nevada Hydro Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE Renewable Energy

- Siemens Energy

- Enel SpA

- Duke Energy Corporation

- Voith GmbH & Co. KGaA

- Genex Power Limited

- Toshiba Energy System & Solutions Corporation

- Greenko Energy

- Eskom Holdings SOC Ltd.

Recent Developments

- GE Renewable Energy integrated all the units at 1.2 GW Jinzhai pumped hydro storage power plant in China. The Jinzhai pumped storage plant can conserve up to 120,000 tons of coal and reduce 240,000 tons of carbon dioxide emissions per year by acting as a sustainable gigantic energy storage system.

- Greenko Group announced the investment of RS 10,000 crore to set up a pumped storage project (PSP) with a daily capacity of 11 GWh in Neemuch district, Madhya Pradesh, India. Over 4,000 people are expected to be employed as a result of this initiative.

- Report ID: 4909

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pumped Hydro Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.