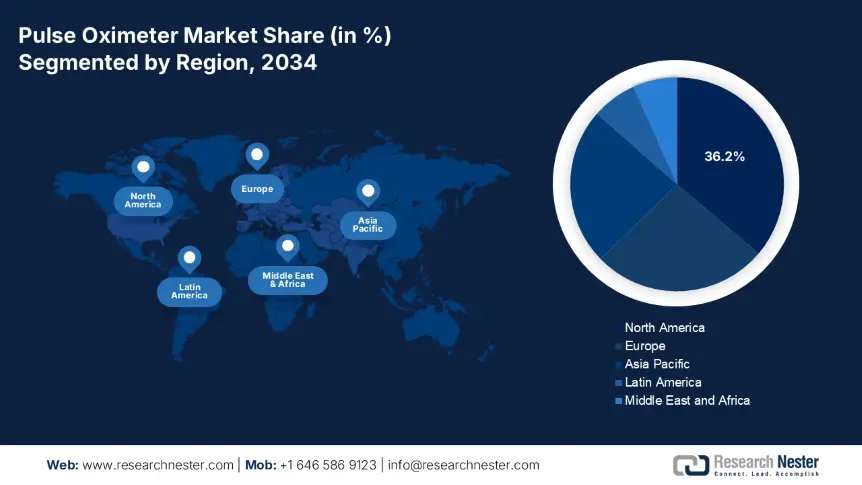

Pulse Oximeter Market - Regional Analysis

North America Market Insights

The pulse oximeter market in North America dominates the market and is expected to maintain the market share of 36.2% at a CAGR of 7% by 2034. Strong public health infrastructure, home healthcare demand, and extensive insurance coverage for remote patient monitoring (RPM) drive the market. Aging populations with a common prevalence of chronic respiratory conditions, and government efforts to decrease hospital burden, have driven the use of pulse oximeters in both clinical and home healthcare environments. Permanent expansion of Medicare's RPM reimbursement policy by the U.S. government and investment in digital diagnostics integration by Canada under provincial care models are key drivers of growth.

The U.S. pulse oximeter market is actively expanding and is driven by strong institutional purchasing, Medicare/Medicaid reimbursement, and strong adoption of remote monitoring. As per the Centers for Medicare & Medicaid Services (CMS) report, the RPM claims increased 49.3% in the past three years, with pulse oximeters being a primary device category. The NIH and CDC allocated $5.3 billion to oxygen saturation monitoring devices and non-invasive diagnostic devices in 2023 via focused health technology R&D initiatives. Medicare spending on oximeter-based monitoring increased 15.6% since 2020 to $800.2 million in 2024, while Medicaid reached $1.6 billion in pulse oximeter reimbursements, also providing an additional 10.4% of reimbursement beneficiaries. Furthermore, the FDA continues to revise safety advice for fair accuracy on all skin tones, supporting the need for next-generation clinical-grade oximeters.

Asia Pacific Market Insights

The APAC is the fastest-growing region in the pulse oximeter market and is expected to hold the market share of 23.8% at a CAGR of 7.6% in 2034. The market is driven by urbanization, the increasing incidence of chronic respiratory and cardiovascular diseases, and increasing access to healthcare. Regionally, public health reforms, the extensive adoption of mobile health, and the growing penetration of telemedicine are bolstering regional adoption. APAC's dependence on domestic manufacturing of sensor and circuit components has reduced supply chain disruption and made the region a low-cost export and domestic supply hub. Combined with robust government procurement, increased per capita healthcare spending, and increased awareness of chronic disease care, the APAC region will continue to expand its market.

China holds the largest share in the pulse oximeter market in the Asia Pacific region and is anticipated to hold the market share of 7.8% by 2034. According to the National Medical Products Administration (NMPA) report, China's public health system raised the spending on pulse oximeters and other related monitoring devices by 15.4% in the last five years. Over 1.8 million patients were diagnosed using pulse oximetry in 2023, with the individuals suffering from chronic obstructive pulmonary disease (COPD) and long-COVID syndrome complications, reflecting increasing statewide need for affordable respiratory monitoring solutions

Country-wise Government Provinces

|

Country |

Policy / Program |

Launch Year |

Pulse Oximeter-Related Funding / Allocation |

|

Australia |

National COVID-19 Response Plan (Telehealth RPM) |

2021 |

AUD 60.4 million allocated for home-based pulse oximetry monitoring kits |

|

Japan |

AMED Non-Invasive Monitoring R&D Grant |

2022 |

¥390.6 billion R&D support through 2024 |

|

India |

Ayushman Bharat Digital Mission (ABDM) |

2021 |

$1.6 billion digital diagnostic infrastructure funding incl. pulse oximeters |

|

South Korea |

Smart Medical Infrastructure Expansion Plan |

2023 |

KRW 1.5 trillion allocated for connected device distribution |

|

Malaysia |

MyHIX - MyHealth Information Exchange |

2022 |

RM 550.7 million investment for telemonitoring & diagnostics |

Europe Market Insights

The Europe market is experiencing steady growth and is anticipated to hold the market share of 26.5% at a CAGR of 6.5% in 2034. The market is driven by strong public health infrastructure, aging populations, and growing government expenditure on remote monitoring and digital diagnostics. Post-pandemic healthcare reforms and a shift towards home-based management of chronic diseases have increased the requirement for clinical-grade pulse oximeters. Further, rising cases of respiratory diseases and comorbidities, especially in Germany, France, and the UK, are pushing hospitals and national health systems to implement pulse oximetry in inpatient and outpatient settings.

Germany leads the pulse oximeter market in the Europe region and is expected to hold the market share of 7.4% by 2034. Germany is the largest pulse oximeter market in Europe, with combined spending amounting to €4.5 billion in 2024, a 12.3% increase in demand compared to 2021. The Federal Ministry of Health (BMG) and German Medical Association (BÄK) endorsed reimbursement reforms that enabled the purchase of pulse oximeters to be covered through statutory health insurance for monitoring chronic disease. Incorporation into hospital telemonitoring systems, especially in geriatric care and postoperative convalescence, is now the norm within German federal states.

Government Investments, Policies & Funding

|

Country |

Policy / Program |

Launch Year |

Pulse Oximeter-Related Budget / Funding |

|

United Kingdom |

NHS@Home & Virtual Ward Program |

2021 |

£450.3 million NHS England funding for home monitoring including pulse oximeters |

|

France |

National Digital Health Strategy (Ma Santé 2022) |

2022 |

€1.6 billion allocated for digital tools incl. pulse oximeter deployment |

|

Italy |

National Recovery and Resilience Plan (PNRR) |

2021 |

€2.5 billion for telemonitoring devices including pulse oximeters |

|

Spain |

Spain Digital Health Strategy |

2022 |

€675.6 million in funding for remote diagnostics including pulse oximetry |