Pulmonary Arterial Hypertension Market Outlook:

Pulmonary Arterial Hypertension Market size was over USD 7.71 billion in 2025 and is poised to exceed USD 12.8 billion by 2035, growing at over 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pulmonary arterial hypertension is estimated at USD 8.07 billion.

Growth trends in the pulmonary arterial hypertension market have been driven by a synergy of factors that include findings in diagnostic methods, greater awareness among healthcare professionals, and expanded treatment options. For instance, in January 2024, it was found and stated in the Institute for Clinical and Economical Review that, before a prescription for an infused or injectable prostacyclin, PAH treatment may involve a third oral therapy, such as an oral prostacyclin or a prostacyclin receptor agonist. In addition to this, the all-cause hospitalization rate and medical expenses were shown to decrease when Selexipag, a prostacyclin pathway agent was started within 12 months of a PAH diagnosis.

Furthermore, demographics, the graying population coupled with the rapidly rising incidence of obesity and other connective tissue diseases are essential contributors to the increased incidence of PAH. For instance, in March 2021, the American Journal of Managed Care revealed that in the US and Europe, PAH is a rare disorder that affects 15 to 50 people per million. Of all PAH cases, 52.6% are idiopathic, heritable, and anorexigen-induced. Women between the ages of 30 and 60 are typically affected by PAH. Moreover, revolutionary therapies are focused on yet other pathways, and the surfeit of studies in patient registries, bring new faces to the management and provide more meaningful epidemiology views for PAH.

Key Pulmonary Arterial Hypertension Market Insights Summary:

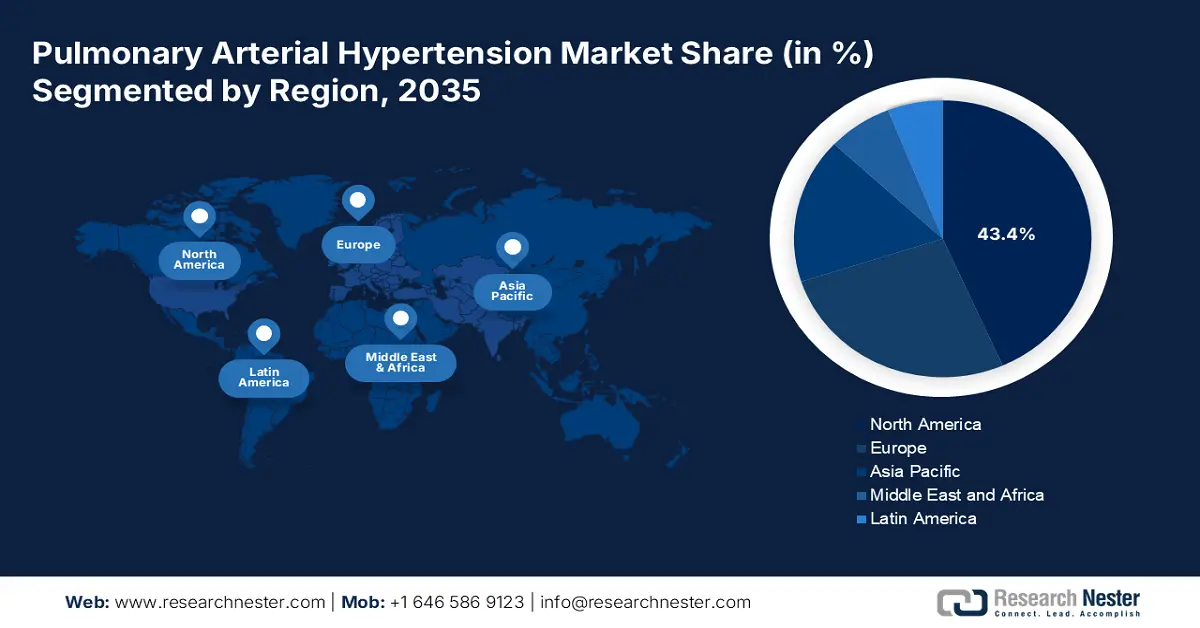

Regional Highlights:

- North America commands a 43.4% share of the Pulmonary Arterial Hypertension Market, driven by supportive government initiatives and high diagnosis rates, solidifying its dominance through 2026–2035.

- The Pulmonary Arterial Hypertension Market in Asia Pacific is expected to see the fastest growth by 2035, driven by sedentary lifestyle choices increasing PAH risk factors.

Segment Insights:

- The Oral segment is forecasted to hold a 53.20% market share by 2035, propelled by patient comfort and improved adherence.

- The Branded segment is expected to see significant growth in the Pulmonary Arterial Hypertension Market from 2026-2035, driven by brand trust and innovative treatment options.

Key Growth Trends:

- Research and clinical trials

- Collaborative care models

Major Challenges:

- Comorbidities

- Variability in treatment response

- Key Players: Arena Pharmaceuticals, Reata Pharmaceuticals, Lung Biotechnology, Acceleron Pharma, Liquidia Technologies, SteadyMed Therapeutics, and more.

Global Pulmonary Arterial Hypertension Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.71 billion

- 2026 Market Size: USD 8.07 billion

- Projected Market Size: USD 12.8 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 13 August, 2025

Pulmonary Arterial Hypertension Market Growth Drivers and Challenges:

Growth Drivers

- Research and clinical trials: A significant growth driver in the pulmonary arterial hypertension market is increased investment in clinical research has helped to describe the pathophysiology of PAH and identify new therapeutic targets. For instance, the NIH awarded Eko approximately USD 2.7 million in September 2022 to develop sophisticated algorithms and integrated technologies to address pulmonary arterial hypertension. In addition, the spurt in clinical research brings an increase in the efficacy and safety profile of existing PAH therapies. For instance, a team of researchers from Cedars-Sinai discovered in December 2023 that a unique-cell-based strategy works well for treating pulmonary arterial hypertension. The study is presently in its first phase of clinical trials.

- Collaborative care models: An essential growth promoter of the pulmonary arterial hypertension market is a multi-disciplinary approach that draws together the expertise of different healthcare professionals. This model unifies pulmonologists, cardiologists, nurses, pharmacists, and other experts to provide proper assessment and tailor-made treatment plans for every individual. For instance, in July 2021, PulmoSIM Therapeutics announced that it partnered strategically with researchers from Brown University and National Jewish Health to develop PT001, an orphan drug. It is a medication that targets multiple responsible pathways in PAH to provide a curative treatment.

Challenges

- Comorbidities: A significant issue concerning the pulmonary arterial hypertension market involves comorbidity that complicates the diagnosis approach and the associated treatment strategy of the patient. Most commonly associated diseases such as heart failure and chronic obstructive pulmonary disease plus connective tissue diseases would severely worsen PAH symptoms with adverse impacts in optimum therapeutic performance. The presence of comorbidities requires a more individualized and more cautious approach to determine whether the same would affect the drug efficacy and safety as well as the outcome. In addition, the management of such conditions places a lot of burden on healthcare systems and exposes such patients to poor compliance.

- Variability in treatment response: The pulmonary arterial hypertension market also introduces another challenge which is the variability of response by different patients toward therapy. This heterogeneity may be due to the genetic aspects of each individual, the concomitance of comorbidities, and the variable progression of disease. Thereby complicating the establishment of an effective treatment schedule for any patient and clinicians might try a trial-and-error method in finding the most appropriate therapy for their patients. This unpredictability determines the outcome of the patient, along with the quality of life, and thus creates challenges in designing a clinical trial. Hence, underlines the importance of personalized medicine approaches in the management of PAH.

Pulmonary Arterial Hypertension Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 7.71 billion |

|

Forecast Year Market Size (2035) |

USD 12.8 billion |

|

Regional Scope |

|

Pulmonary Arterial Hypertension Market Segmentation:

Route of Administration (Oral, Intravenous/ subcutaneous, Inhalational)

Based on the route of administration, the oral segment is projected to account for pulmonary arterial hypertension market share of around 53.2% by 2035, due to its comforting nature. For instance, in February 2023, it was unveiled that, Tenax Therapeutics, Inc. had been developing TNX-103 (oral levosimendan) to treat PAH with heart failure. This is clubbed with preserved ejection fraction and TNX-201. The Phase 3-ready assets TNX-103 and TNX-201 have the potential to greatly enhance patient outcomes and longevity. This desire for oral administration makes the treatment experience itself much better but also induces better long-term patient adherence and management of disease, further cementing the oral segment as a more preferred option within the therapeutic landscape of the market.

Type (Branded, Generic)

The branded segment in the pulmonary arterial hypertension market will garner a lucrative share due to the established efficacy and safety profile with well-established brand recognition. Such innovative therapies are invariably underpinned by clinical research and marketing strategies that ensure a treatment aimed at the complexities of the pathophysiology in PAH. This would bring the reputation of branded medicines among clinicians through trust and improved patients' adherence based on being reliable therapies. For instance, in March 2024, Johnson & Johnson announced that OPSYNVI, a single-tablet combination of tadalafil, a phosphodiesterase 5 (PDE5) inhibitor, and macitentan, an endothelin receptor antagonist (ERA), has been approved by the U.S. FDA. It is used for the chronic treatment of adults with PAH.

Our in-depth analysis of the global market includes the following segments:

|

Route of Administration |

|

|

Type |

|

|

Drug Class |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pulmonary Arterial Hypertension Market Regional Analysis:

North America Market Statistics

North America pulmonary arterial hypertension market is poised to account for revenue share of more than 43.4% by the end of 2035, owing to supportive government initiatives, a high diagnosis rate, and greater awareness. For instance, Million Hearts is a nationwide campaign to prevent 1 million heart attacks and strokes within five years, according to data released by the Centers for Medicare & Medicaid Services in September 2021. It focuses on putting into practice a limited number of evidence-based goals and priorities that can enhance everyone's cardiovascular health.

The U.S. pulmonary arterial hypertension market is witnessing profitable growth due to initiatives and rising awareness. For instance, in November 2024, according to the American Lung Association, to help at-risk individuals receive a timely and accurate diagnosis, the American Lung Association, in collaboration with Merck launched a new campaign called PAH Awareness. The campaign's objectives include educating people with PAH and their caregivers about available treatments and symptom management strategies.

The pulmonary arterial hypertension market in Canada is significantly growing due to an intensified focus on revamping the healthcare infrastructure equipped with state-of-the-art technologies and amenities. For instance, in January 2025, AstraZeneca declared that it would invest USD 570 million in Canada. The investment will enable the company to relocate to more contemporary office buildings in the Greater Toronto Area (GTA). In addition, achieved its global goal of bringing 20 new drugs to patients globally by 2030 and reaching USD 80 billion in total revenue.

Asia Pacific Market Analysis

The pulmonary arterial hypertension market in Asia Pacific is projected to be the fastest-growing market during the stipulated timeframe. Sedentary lifestyle choices such as drinking, smoking, and eating junk food are major risk factors for PAH development. For instance, a study based on assessing the pattern of junk food consumption, conducted by the National Journal of Physiology, Pharmacy, and Pharmacology unveiled that out of 178 adolescents, 10.96% had eaten junk food more than three times in the previous week and 82.02% had done so in the previous seven days. Nearly 49.32% of research participants ate junk food at home (39.3%) and with their families (47.95%). 22.47% of teenagers fell into the overweight category.

The pulmonary arterial hypertension market in India is expanding as a result of the smooth regulatory efforts in receiving approvals for developing and marketing innovative drugs. This fosters a strengthened commitment to bring effectiveness into the treatment ecosystem. For instance, in November 2023, Lupin Limited announced that the U.S. FDA has tentatively approved its abbreviated new drug application for Selexipag for injection, 1800 mcg/vial, single-dose vial. The FDA's approval allowed Lupin to market a generic version of Actelion Pharmaceuticals US, Inc.'s Uptravi® for injection, 1800 mcg/vial in Nagpur.

The Pulmonary arterial hypertension market in China is gaining noteworthy traction owing to funding all across the world to enhance the healthcare ecosystem in the country. For instance, according to the 2024 China Healthcare M&A Outlook, one of China's biggest chains of orthopedic hospitals, Bang Er Orthopedic Hospital, announced in November 2023 that it had raised about USD 110 million in a pre-IPO funding round headed by Xiamen C&D. Such financial investments spur the development and facilitates the revolutionary move in improvising the healthcare benefits.

Key Pulmonary Arterial Hypertension Market Players:

- GlaxoSmithKline

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Actelion Pharmaceuticals

- Gilead Sciences

- United Therapeutics Corporation

- GlaxoSmithKline

- Bayer

- Pfizer

- Arena Pharmaceuticals

- Reata Pharmaceuticals

- Lung Biotechnology

- Acceleron Pharma

- Liquidia Technologies

- SteadyMed Therapeutics

- Complexa Inc.

- Bellerophon Therapeutics

- Innoven Life Sciences.

New treatment development and product line diversification are top priorities for emerging firms in the pulmonary arterial hypertension market. Participation in clinical trials, research collaborations, and strategic alliances are common strategies they employ. For instance, in May 2024, Gyre Pharmaceuticals' application for an investigational new drug for F230 tablets was approved by the Center for Drug Evaluation of China's National Medical Products Administration. By focusing on innovation and developing a strong pipeline, these emerging businesses aim to carve out a niche in the competitive pulmonary arterial hypertension market and advance patients' treatment options.

Here's the list of some key players:

Recent Developments

- In May 2024, Chiesi Farmaceutici S.p.A. and Gossamer Bio, Inc. announced that they have inked a worldwide collaboration and license agreement to develop and market seralutinib.

- In May 2023, Keros Therapeutics presented preclinical and clinical data from its KER-012 Program at the International Conference of the American Thoracic Society.

- In September 2022, Toray Industries, Inc. declared that its Careload tablets for the treatment of PAH have been approved by China's National Medical Products Administration (NMPA).

- Report ID: 7133

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.