Public Affairs and Advocacy Software Market - Growth Drivers and Challenges

Growth Drivers

- Strategic AI and predictive analytics adoption: Radical embedding of advanced Artificial Intelligence (AI) capabilities is a core growth driver, radically altering the conduct of advocacy campaigns. AI-powered solutions allow teams to automate routine tasks and deliver higher individual personalization in messaging. This enables more informed, data-driven choices that significantly enhance overall campaign performance. This technology push is essential for organizations vying for maximum engagement with optimized staff resources. This convergence is vindicated by the fact that in September 2024, HubSpot introduced a series of AI-fueled product releases like Breeze Intelligence and Copilot. These tools make it possible to automate as well as offer rich, detailed reporting and analysis essential to sophisticated multichannel lead management.

- Needed public sector digital transformation initiatives: Governments globally are placing significant capital on strategic digital modernization, and this spurs the adoption of compliant public affairs software for citizen participation as well as compliance. Strategic digital service enhancement and end-to-end e-governance emphasis create big market momentum. For example, in 2024, the UK government's digital transformation agenda spurred the adoption of cloud-based communication and citizen engagement platforms in the public as well as non-profit sectors. This government drive aims to improve the effectiveness of services, substantially increase civic engagement, and ensure transparency in all public interactions.

- Increased demand for stakeholder and compliance platforms: The complexity of today's policy environment, policymaking, monitoring, and lobbying disclosure is creating strong demand for integrated stakeholder management and compliance platforms. Multi-jurisdictional organizations require centralized dashboards and deep reporting facilities to proactively manage significant legal and reputation exposures. This pivotal market demand is addressed strategically by the fact that in October 2024, Salesforce rolled out Winter '25 releases for Nonprofit Cloud, introducing personalized donor lists. The features also included targeted outreach briefings and program management enhancements, allowing public affairs teams to enjoy the benefits of streamlined stakeholder management.

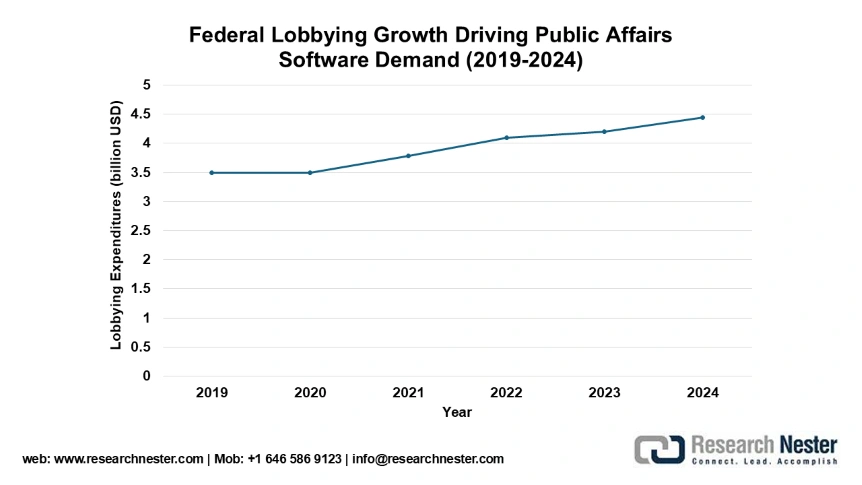

Federal Lobbying Growth Driving Public Affairs Software Demand (2019-2024)

The consistent growth in federal lobbying expenditures, reaching a record $4.44 billion in 2024, directly fuels demand for sophisticated public affairs and advocacy software solutions. This increased investment in government relations requires more efficient tools for stakeholder management, regulatory monitoring, and campaign coordination across multiple channels.

Source: Open Secrets

Federal Lobbying Trends & Public Affairs Software Market Implications

|

Trend |

Evidence |

Software Market Impact |

|

Record-High Spending |

Lobbying expenditures grew from $3.5B (2019) to $4.44B (2024) |

Increased demand for comprehensive public affairs platforms to manage larger advocacy budgets |

|

Healthcare Sector Dominance |

Pharmaceuticals/Health Products spent $387M in 2024 - leading all sectors |

Specialized healthcare policy tracking and stakeholder management features become essential |

|

Technology Sector Growth |

Electronics manufacturing lobbying grew 28% from 2021-2024 |

Rising need for tech policy monitoring and regulatory compliance tools |

|

Multi-Sector Engagement |

10+ industries spending over $100M annually on lobbying |

Demand for customizable platforms serving diverse industry regulatory needs |

|

Sustained Quarterly Activity |

Each quarter of 2023 exceeded $1B in lobbying spending |

Need for real-time monitoring and quarterly reporting capabilities |

Source: OS

Challenges

- Complex and challenging regulatory compliance environments: A dominant challenge is the constantly shifting, geographically fragmented regulatory regime, necessitating relentless, high-expenditure platform replacements to meet core legal compliance. The absence of a common standard for data privacy or lobbying disclosure leads to notoriously convoluted operations. Such regulatory recalcitrance necessitates heavy R&D emphasis on compliance features, often excluding investment in pure technological innovation. This systemic concern is highlighted by the occurrence in May 2024 when Germany's data protection bodies reasserted stringent GDPR enforcement through Federal Data Protection Act amendments and regulation of digital services. This compels organizations to conform to greater privacy, security, and consent safeguards for public affairs software use across the board.

- Persistent data interoperability and ecosystem integration loopholes: Public affairs professionals usually work with a suite of highly technical software applications that lack good communication abilities, producing disruptive data silos and inefficient operational procedures. Smooth and secure data interoperability across the heterogeneous infrastructure is yet a fundamental technical obstacle. This resistance hinders the collection of rich, real-time strategic intelligence across the complete functional spectrum of an entire campaign. This integration challenge of the critique is also explained by the fact that the Office of the Commissioner of Lobbying of Canada released updated enforcement guidelines for the Lobbying Act in April 2025. This demands robust, auditable processes of tracking and reporting of lobbying activity, demanding the exchange of high-level data between internal systems.

Public Affairs and Advocacy Software Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 3.8 billion |

|

Regional Scope |

|