Prostate Cancer Diagnostics Market Outlook:

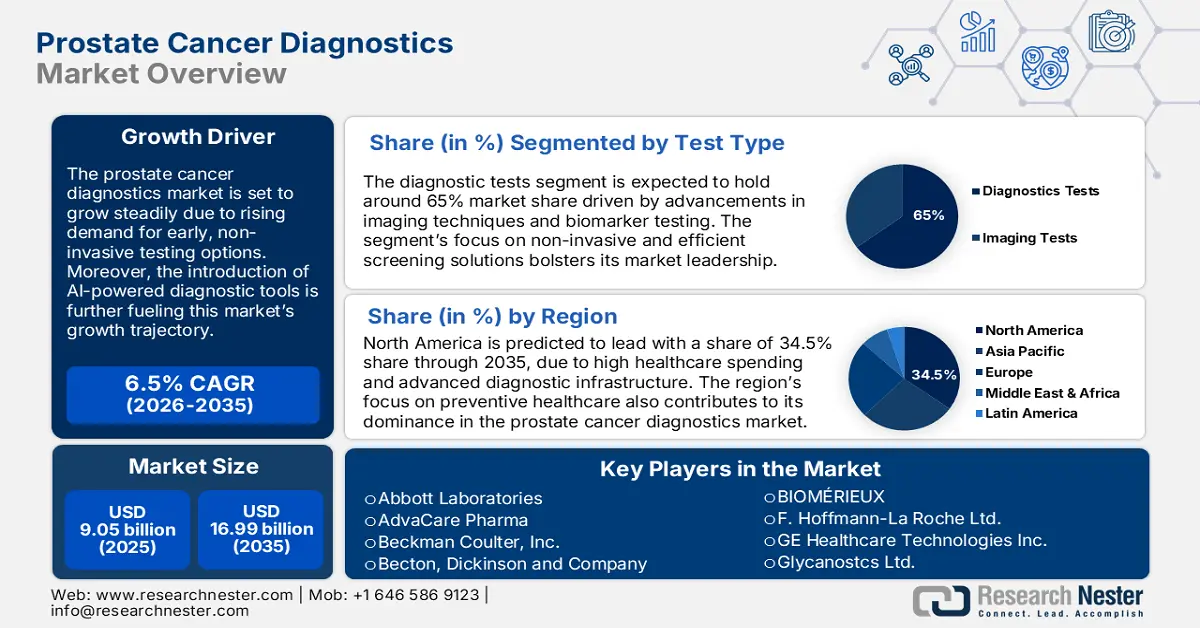

Prostate Cancer Diagnostics Market size was valued at USD 9.05 billion in 2025 and is set to exceed USD 16.99 billion by 2035, registering over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of prostate cancer diagnostics is evaluated at USD 9.58 billion.

The prostate cancer diagnostics market is expected to witness steady growth due to the increasing demand for advanced diagnostic tools, stimulated by increased incidence rates of prostate cancer and an expanding geriatric population. Given the importance of early detection, healthcare providers continue to invest in new technologies while making diagnostic services more widely accessible. For example, Cortechs.ai launched OnQ Prostate in May 2024 which is a software that's been cleared by the FDA to detect prostate cancer. Such advancements, along with a strong emphasis on precision diagnosis, coupled with government-funded initiatives that advance screening capabilities and create public awareness regarding health, boost market growth.

The prostate cancer diagnostics industry is being actively supported by governments worldwide through funds and awareness-raising, especially for early detection and preventive care. Many governmental health departments report their increased investments in cancer screening programs across less privileged regions. In 2024, the U.S. government declared funding of USD 9 million to be invested in August to increase access to cancer screening across health centers in various regions. This governmental support is instrumental in widening the scope of diagnostics of prostate cancer by providing wider access to advanced tools and increasing the rate of early detection, thus improving patients' outcomes.

Key Prostate Cancer Diagnostics Market Insights Summary:

Regional Highlights:

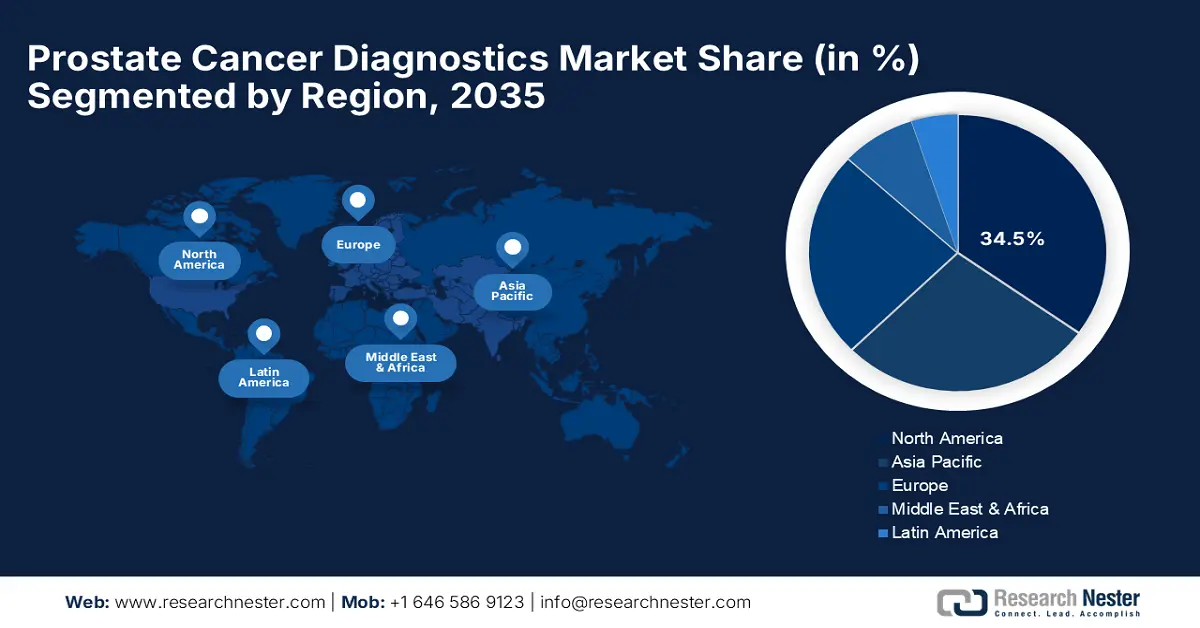

- North America leads the Prostate Cancer Diagnostics Market with a 34.5% share, supported by advanced healthcare infrastructure and proactive screening methods, driving growth through 2035.

- The Prostate Cancer Diagnostics Market in Asia Pacific is poised for significant growth from 2026–2035, fueled by increased health investments and focus on early cancer detection.

Segment Insights:

- The Diagnostic Tests segment is anticipated to hold a substantial share by 2035, driven by innovations in biomarker tests and emphasis on early diagnosis.

- The Prostatic Adenocarcinoma segment is expected to secure more than 76% share by 2035, driven by the high incidence of prostatic adenocarcinoma worldwide.

Key Growth Trends:

- Biomarkers for prostate cancer detection

- Increased demand for personalized medicine

Major Challenges:

- Limited access in low-income regions

- Regulatory and approval challenges

- Key Players: Abbott Laboratories, GE Healthcare Technologies Inc., Glycanostcs Ltd., AdvaCare Pharma, Beckman Coulter, Inc., Becton, Dickinson and Company, BIOMÉRIEUX, and F. Hoffmann-La Roche Ltd.

Global Prostate Cancer Diagnostics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.05 billion

- 2026 Market Size: USD 9.58 billion

- Projected Market Size: USD 16.99 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 14 August, 2025

Prostate Cancer Diagnostics Market Growth Drivers and Challenges:

Growth Drivers

- Biomarkers for prostate cancer detection: The advent of new biomarkers for the detection of prostate cancer has greatly improved diagnostic accuracy and the potential for early detection. Biomarkers facilitate minimally invasive testing, thus recording precise information on the risk and development of cancer. For example, iCAD partnered with RAD-AID in April 2024 to make its AI-powered ProFound Detection solution available in Guyana, further expanding access to advanced diagnostics in low-resource settings. Such developments reflect the recent trends in the market, emphasizing precision diagnostics and creating significant demand for novel biomarker-based diagnostic solutions.

- Increased demand for personalized medicine: Due to the shifts toward personalized diagnosis and treatment in oncology, there is increased demand for companion diagnostics in the treatment of prostate cancer. This helps tailor treatments to the patient's particular needs and, therefore, provides better patient outcomes by reducing some side effects. For example, F. Hoffmann-La Roche extended its partnership with Janssen to develop companion diagnostics in February 2023, indicating a growing demand for personalized treatment. This focus on personalized medicine constitutes one of the main drivers for market growth, aligned with healthcare providers seeking diagnostic tools that fit their needs precisely to enhance treatment efficacy.

- Growing aging population: The aging population drives the prostate cancer diagnostics market, considering that the disease affects mostly elderly males. Therefore, as life expectancy continues to increase globally, the demand for testing and diagnosis of prostate cancer should increase correspondingly. This trend has driven investment in age-specific diagnostics and screening programs. As healthcare systems adapt to serve an aging population, proactive diagnostic measures and age-adjusted screening approaches are becoming essential for managing the expected rise in prostate cancer cases.

Challenges

- Limited access in low-income regions: Accessibility of advanced diagnostics is still limited within low- and middle-income countries, which influences early detection and timely treatment. Poor infrastructure, high costs, and shortages of trained professionals further direct these challenges toward widespread adoption. Efforts to improve access, such as subsidized programs or mobile diagnostics, show promise but often face scalability issues. Thus, this issue of disparity in access remains a highly critical obstacle for the global adoption of prostate cancer diagnostics.

- Regulatory and approval challenges: Probably the most challenging aspect for manufacturers is working through rigorous regulatory pathways, in particular, approvals for new diagnostics and biomarkers. Complex and sometimes very long procedures for approval may delay product launches and restrict access to innovation in some markets. These regulatory demands not only delay the adoption of new diagnostics but also raise costs for the manufacturer, possibly flowing back to healthcare providers.

Prostate Cancer Diagnostics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 9.05 billion |

|

Forecast Year Market Size (2035) |

USD 16.99 billion |

|

Regional Scope |

|

Prostate Cancer Diagnostics Market Segmentation:

Test Type (Diagnostics Tests, Imaging Tests)

The diagnostic tests segment is poised to capture around 65% prostate cancer diagnostics market share by the end of 2035 due to innovation in biomarker tests and mounting emphasis on early diagnosis. Diagnostic tests allow for accurate and less invasive detection of prostate cancer, thus addressing the growing need for accessible prostate cancer screening. In July 2023, Quest Diagnostics introduced AmeriPath's biomarker test for prostate cancer, underlining the dependency on diagnostic tests for early detection. Such product launches indicate the growth prospects of the segment during the forecast period.

Cancer Type (Prostatic Adenocarcinoma, Small Cell Carcinoma, Other Prostate Cancer Types)

By the end of 2035, prostatic adenocarcinoma segment is estimated to account for more than 76% prostate cancer diagnostics market share, as it is among the most prevalent types of prostate cancer. Since prostatic adenocarcinoma has a high incidence worldwide, the demand for diagnostic tools specifically meant for tracking and diagnosis of these types of cancers increases. In August 2023, Myriad Genetics introduced Absolute Risk Reduction for the Prolaris Prostate Cancer Prognostic Test, aimed at helping patients with prostatic adenocarcinoma make more informed decisions regarding their treatment options. This approach by companies to offer diagnostics in prostatic adenocarcinoma offers continued growth in the market.

Our in-depth analysis of the prostate cancer diagnostics market includes the following segments:

|

Test Type |

|

|

Cancer Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Prostate Cancer Diagnostics Market Regional Analysis:

North America Market Analysis

North America industry is set to hold largest revenue share of 34.5% by 2035, driven by advanced healthcare infrastructure, coupled with high incidence rates for cancer and strong support from the government. Furthermore, increased public awareness and proactive screening methods have made North America a lucrative market for companies in the prostate cancer diagnostics market. The U.S. and Canada continue to lead in North America, holding investment prospects for new players.

The U.S. prostate cancer diagnostics market demonstrates strong adoption of advanced diagnostic modalities since the country carries out large-scale screening programs and has substantial funding from the government. For example, Lantheus Holdings announced revenues of over USD 150 million for PYLARIFY, its leading PSMA PET imaging test for prostate cancer, in March 2024. Strong revenue indicates high demand for advanced diagnostic solutions in the U.S., driven by early diagnosis and precision medicine.

Canada healthcare system is becoming another leading adopter of advanced diagnostics due to governmental approvals for new technologies in cancer screening. For example, in May 2023, Health Canada approved the PSMA PET imaging agent known as Illuccix for the diagnostics of prostate cancer. Therefore, this highlights that the country is committed to promoting innovative healthcare solutions. This approval underlines that Canada is proactive in the adoption of cutting-edge diagnostic tools, hence driving North America prostate cancer diagnostics market.

Asia Pacific Market Analysis

Asia Pacific prostate cancer diagnostics market is projected to experience notable growth from 2025 to 2035. This is owing to increased investments by governments in health infrastructure and an increased focus on early detection of cancer. Furthermore, an increasing geriatric population and better access to healthcare services are opening up new avenues for diagnostics providers in the region.

India prostate cancer diagnostics market is rising at a steady pace, with the government investing more in cancer care and making greater efforts to raise public health awareness. For example, the Assam government announced in November 2023 that it would invest INR 135 crore in the Assam Cancer Care Foundation to construct ten cancer hospitals, which would increase access to diagnostics. Thus, the determination of India to counter the rising influence of cancer with better health facilities further promotes market growth.

China prostate cancer diagnostics market growth is propelled by the government’s initiatives to improve access to healthcare, along with agreements with overseas companies for the provision of diagnostics. For example, in October 2023, a collaboration between Sinotau Pharmaceutical Group and Blue Earth Diagnostics introduced a new imaging agent in China used in diagnosing prostate cancer. The collaboration represents the country's commitment to new diagnostic solutions, driving the prostate cancer diagnostics market growth through 2035.

Key Prostate Cancer Diagnostics Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AdvaCare Pharma

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- BIOMÉRIEUX

- F. Hoffmann-La Roche Ltd.

- GE Healthcare Technologies Inc.

- Glycanostcs Ltd.

- Healgen

- KOELIS

- Metamark Genetics, Inc.

- miR Scientific

- Myriad Genetics, Inc.

- Proteomedix

- Siemens Healthineers AG

Leading companies operating in the prostate cancer diagnostics market include Abbott Laboratories, GE Healthcare Technologies Inc., Glycanostics Ltd., AdvaCare Pharma, Beckman Coulter, Inc., Becton, Dickinson and Company, bioMérieux, and F. Hoffmann-La Roche Ltd. Major players are investing in research and development, expanding partnerships, and focusing on product launches to strengthen their market presence, especially as demand for precision medicine grows. Furthermore, these players are making investments in research and development, further expanding the series of partnerships, focusing on product launches, and strengthening their presence in the market.

For example, Proteomedix AG and Blue Water Biotech Inc. merged in December 2023 to form Onconetix Inc., which integrates products for prostate cancer diagnosis and therapy. This trend in the industry reflects the consolidation and collaboration to realize comprehensive diagnostic portfolios. The enlarged capabilities the merger has brought to Onconetix Inc. speak volumes about the competitive outlook that sees increasing interest in expanding product offerings by companies to leverage their synergies by entering alliances. Such moves by players address diverse needs within prostate cancer diagnostics for early detection and to yield better patient care outcomes.

Here are some leading players in the prostate cancer diagnostics market:

Recent Developments

- In September 2024, Cleveland Diagnostics, Inc. relaunched its A PSA on PSA campaign for Prostate Cancer Awareness Month to encourage downloads of a discussion guide from PSAonPSA.com, aimed at enhancing patient-doctor conversations. For each download, Cleveland Diagnostics will donate to ZERO Prostate Cancer, with ZERO matching all donations throughout the month.

- In July 2024, DELFI Diagnostics secured an equity investment from the Merck Global Health Innovation Fund to expedite the development of its AI-driven fragmentomics platform for cancer screening. This partnership aims to enhance diagnostic capabilities and improve cancer detection methodologies.

- In May 2024, Quest Diagnostics announced the separation of PathAI's digital pathology laboratory to sharpen its focus on artificial intelligence integration. This strategic shift is intended to accelerate the adoption of AI technologies within Quest's operations, bolstering its digital pathology capabilities and improving diagnostic accuracy.

- Report ID: 6683

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Prostate Cancer Diagnostics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.