Propylene Carbonate Market Outlook:

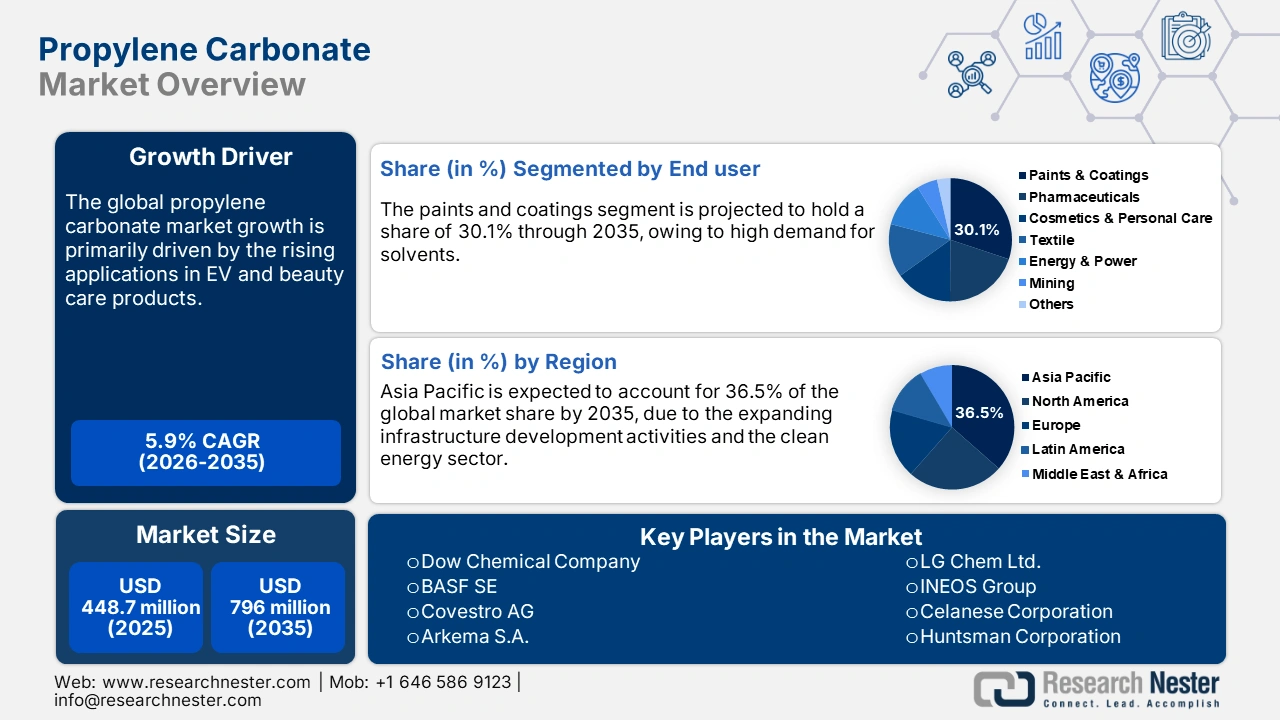

Propylene Carbonate Market size was USD 448.7 million in 2025 and is estimated to reach USD 796 million by the end of 2035, expanding at a CAGR of 5.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of propylene carbonate is assessed at USD 475.1 million.

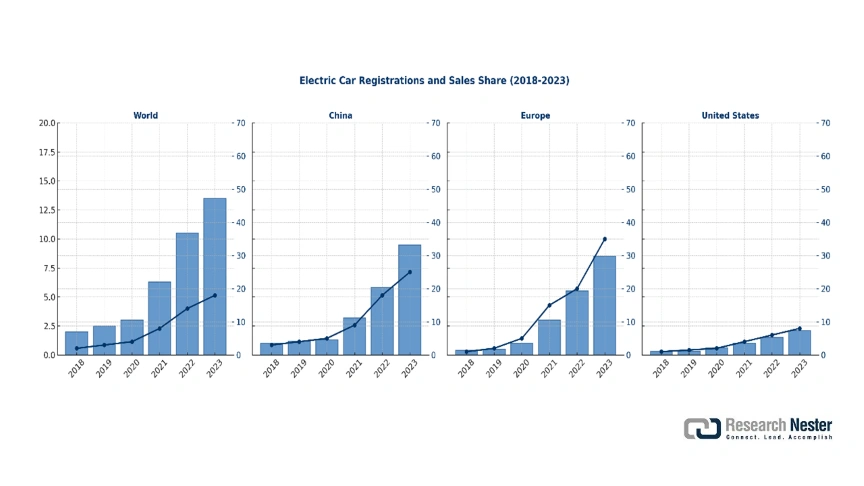

The constant innovations in energy storage technologies are expanding the application of high-grade propylene carbonate. Lithium-ion batteries are the prime end users of propylene carbonate. The report by the International Energy Agency (IEA) discloses that in 2024, the sales of electric cars crossed 17 million. China leads the EV market, followed by the European Union and the U.S. The boasting adoption and production of electric vehicles is anticipated to propel the consumption of propylene carbonate. The clean energy trend and growing environmental awareness among individuals are boosting the sales of electric vehicles, which is subsequently having a positive influence on the consumption of propylene carbonate.

Source: IEA

Key Propylene Carbonate Market Insights Summary:

Regional Insights:

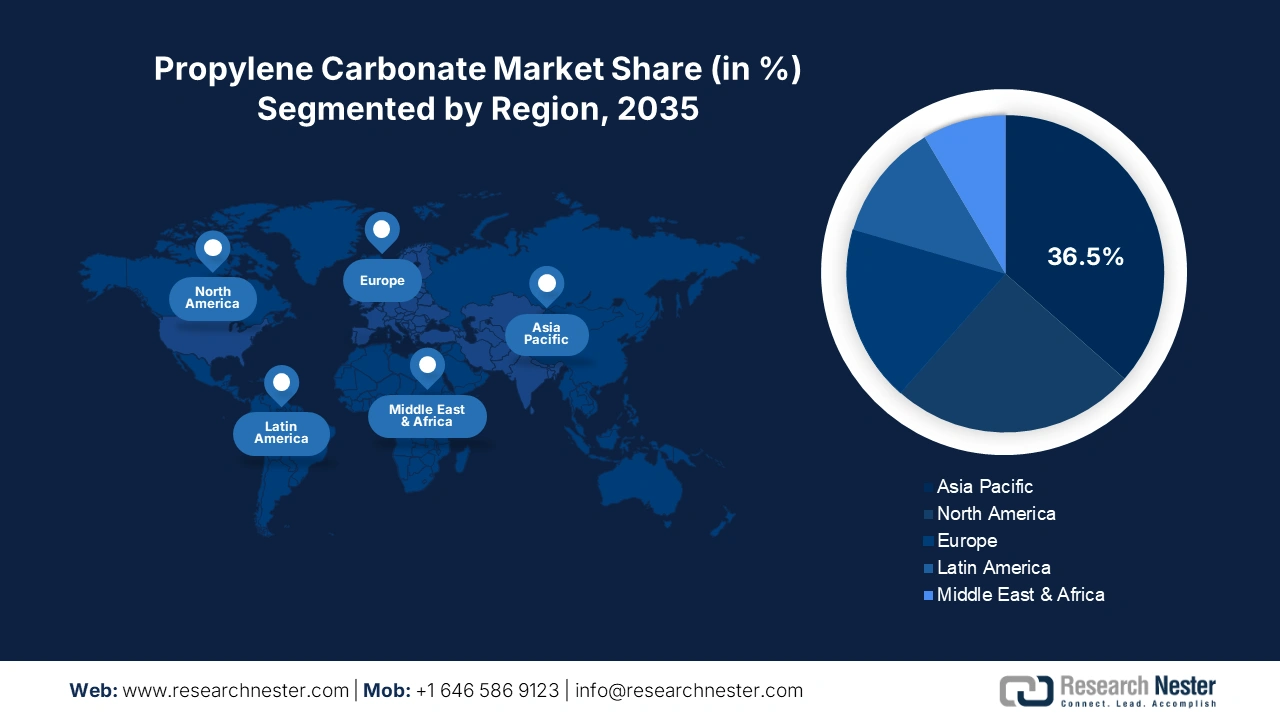

- The Asia Pacific propylene carbonate market is projected to secure a 36.5% share by 2035, owing to rapid industrialization and strong chemical manufacturing infrastructure.

- North America is anticipated to maintain the second-largest share by 2035, resulting from its well-established chemical manufacturing base and expanding export activities.

Segment Insights:

- The film segment is poised to command the leading market share by 2035 in the Propylene Carbonate Market, propelled by its suitability for battery applications and industrial processing.

- The solvent segment is anticipated to capture 38.6% of the global market share through 2035, supported by its versatility, eco-friendly profile, and wide industrial adoption.

Key Growth Trends:

- Industrial growth in coatings & adhesives

- Increasing electronics demand

Major Challenges:

- Raw material price volatility

- Competition from substitutes

Key Players: TCI Chemicals Pvt. Ltd., Haihang Group, Carl Roth GmbH & Company KG, BASF SE, Tedia Company, LLC, LyondellBasell Industries N.V., Empower Materials, Inc., SMS Corporation, Huntsman Corporation, Linyi Evergreen Chemical Co., Ltd.

Global Propylene Carbonate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 448.7 million

- 2026 Market Size: USD 475.1 million

- Projected Market Size: USD 796 million by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 22 September, 2025

Propylene Carbonate Market - Growth Drivers and Challenges

Growth Drivers

-

Industrial growth in coatings & adhesives: The adhesives and coatings industry is creating a profitable environment for propylene carbonate manufacturers. Propylene carbonate is increasingly used in paints and coatings because it helps control thickness, improves flow, and makes products last longer, boosting its sales. The U.S. Bureau of Labor Statistics reports that the producer price index for paint, coating & adhesive manufacturing was 241.214 (P) in July 2025. Furthermore, in the plastics sector, the application of propylene carbonate as a solvent is set to boom.

-

Increasing electronics demand: The expanding electronics sector is among the fast-growing application areas for propylene carbonate. The primary factor boosting the consumption of propylene carbonate in electronics is its high-performance cleaning and processing solvent properties. The Observatory of Economic Complexity (OEC) reveals that the world trade of electrical machinery and electronics stood at USD 3.35 trillion in 2023. The propelling global trade of consumer electronics and machinery is set to amplify the demand for propylene carbonate.

- Expansion in personal care & cosmetics: The personal care and cosmetics industry is the most profitable niche market for propylene carbonate manufacturers. The demand for propylene carbonate is mainly driven by its primary role as a solvent and viscosity regulator in skincare formulations. According to the Food and Drug Administration (FDA), most Americans use between 6 and 12 cosmetic products daily. The rising trade of moisturizers, serums, sunscreens, and anti-aging creams is likely to accelerate the production and commercialization of high-grade propylene carbonate in the years ahead.

Challenges

-

Raw material price volatility: The production of propylene carbonate is heavily dependent on propylene oxide, a petrochemical derivative. The changes in prices of crude oil create significant propylene oxide supply chain disruptions, directly hampering the cost of propylene carbonate. Due to this factor, many small-scale players and new companies refrain from earning high revenues from trending opportunities.

-

Competition from substitutes: The propylene carbonate companies are witnessing major challenges from the strong presence of alternatives. The ethylene carbonate competes with propylene carbonate in battery manufacturing. This is expected to limit the broader penetration of propylene. However, ongoing technological developments are likely to fuel the demand for propylene carbonate in the years ahead.

Propylene Carbonate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 448.7 million |

|

Forecast Year Market Size (2035) |

USD 796 million |

|

Regional Scope |

|

Propylene Carbonate Market Segmentation:

Form Segment Analysis

The film segment is projected to capture the highest market share throughout the study period, owing to its suitability for battery applications and industrial processing. In lithium-ion batteries, used in electric vehicles and electronics, propylene carbonate in film form is gaining traction as it releases steadily and works well in battery electrolyte systems. The enhancement in ion transportation and longer cycle life are likely to accelerate the demand for propylene carbonate films in the years ahead.

Application Segment Analysis

The solvent segment is anticipated to hold 38.6% of the global market share through 2035. The versatility, eco-friendly profile, and wide industrial adoption are prime factors boosting the use of propylene carbonates in solvents. Further, the excellent solvency power of propylene carbonate is boosting its consumption across various industries such as paints and coatings, cleaning agents, adhesives, plastics, and personal care products. The electronics companies also invest in propylene carbonate solvents for safe cleaning of circuit boards and semiconductors.

End user Segment Analysis

The paints and coatings segment is estimated to account for 30.1% of the global propylene carbonate industry share by 2035. The widespread use of paints and coatings in industries such as electronics, automotive, construction, and beauty care products is directly boosting the revenues of propylene carbonate. The U.S. Bureau of Labor Statistics discloses that the producer price index for paint and coating manufacturing stood at 420.351(P) in July 2025. The low toxicity and high solvency are propelling the use of propylene carbonate in paints and coatings.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Form |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Propylene Carbonate Market - Regional Analysis

APAC Market Insights

The Asia Pacific propylene carbonate market is estimated to account for 36.5% of the global revenue share by 2035, due to rapid industrialization and strong chemical manufacturing infrastructure. The large-scale production of lithium-ion batteries, paints and coatings, and consumer electronics is also contributing to the increasing sales of propylene carbonate. China, India, South Korea, and Japan are among the most profitable marketplaces for key investors.

The sales of propylene carbonate in India are projected to expand at a robust pace between 2026 and 2035. The growing electric vehicle (EV) market, helped by supportive government policies and funding, is expected to increase the sales of high-purity, battery-grade propylene carbonate in the coming years. In November 2024, the Ministry of Heavy Industries announced that the PM E-DRIVE Scheme, with USD 1.3 billion, would support the domestic EV industry. The move is anticipated to encourage electric mobility and reduce the use of fossil fuels. The public initiatives supporting renewable energy, clean mobility, and advanced electronics manufacturing are further boosting the consumption of propylene carbonate.

North America Market Insights

The North America propylene carbonate market is expected to hold the second-largest global revenue share throughout the forecast period. The well-established chemical manufacturing sector and booming export activities are expected to double the revenues of domestic players. The rising registrations of electric vehicles and robust expansion of renewable energy infrastructure are also contributing to the high sales of propylene carbonate.

The U.S. market for propylene carbonate is anticipated to be driven by the strong industrial demand and advanced chemical manufacturing capabilities. The expanding construction activities and high demand for paints and coatings are likely to fuel the sales of propylene carbonate. According to the Federal Reserve Bank of St. Louis, the producer price index for paint and coating manufacturing stood at 420.351 in July 2025. Furthermore, the booming investments in grid-scale energy storage infrastructure are also set to create a profitable environment for propylene carbonate manufacturers.

Europe Market Insights

The European propylene carbonate industry is forecast to expand at the fastest CAGR from 2026 to 2035. The electric vehicle and renewable energy storage are the most revenue-generating sectors for propylene carbonate companies. The strong presence of automakers and lithium-ion battery manufacturers is creating a profitable environment for key market players. Furthermore, the sustainability trends and strict environmental regulations are likely to drive innovations in the production of propylene carbonate in the EU.

Germany leads the demand for propylene carbonate due to its mature automotive and chemical manufacturing sectors. The country’s Climate Law outlines a framework to achieve zero net carbon emissions by 2045. Thus, the aggressive domestic EV and battery ecosystem is set to fuel the consumption of high-purity propylene carbonate. The green building trends and technological advancements in electronics manufacturing are further projected to double the demand for propylene carbonate solvents.

Key Propylene Carbonate Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Covestro AG

- Arkema S.A.

- LG Chem Ltd.

- INEOS Group

- Celanese Corporation

- Huntsman Corporation

- Mitsubishi Chemical Corporation

- UBE Industries, Ltd.

- Asahi Kasei Corporation

- Shikoku Chemicals Corporation

- Mitsubishi Gas Chemical Company, Inc.

- Reliance Industries Limited

- Solvay S.A.

The key players in the market are employing several organic and inorganic strategies to boost their reach and revenues. The industry giants are concentrated on investing heavily in research and development activities to develop next-gen solutions. They are also employing merger & acquisition tactics to expand their product offerings. Some of the leading companies are also exploring developing markets to earn hefty gains from untapped opportunities.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2024, Dow announced plans to invest in expanding its production facilities on the U.S. Gulf Coast. The investment is focused on making ethylene derivatives, including carbonate solvents, which are key for lithium-ion battery production.

- In June 2023, CME Group announced the launch of lithium carbonate futures owing to the rising demand for electric vehicles. The lithium carbonate futures are available for trading on COMEX, following its rules.

- Report ID: 4340

- Published Date: Sep 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Propylene Carbonate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.