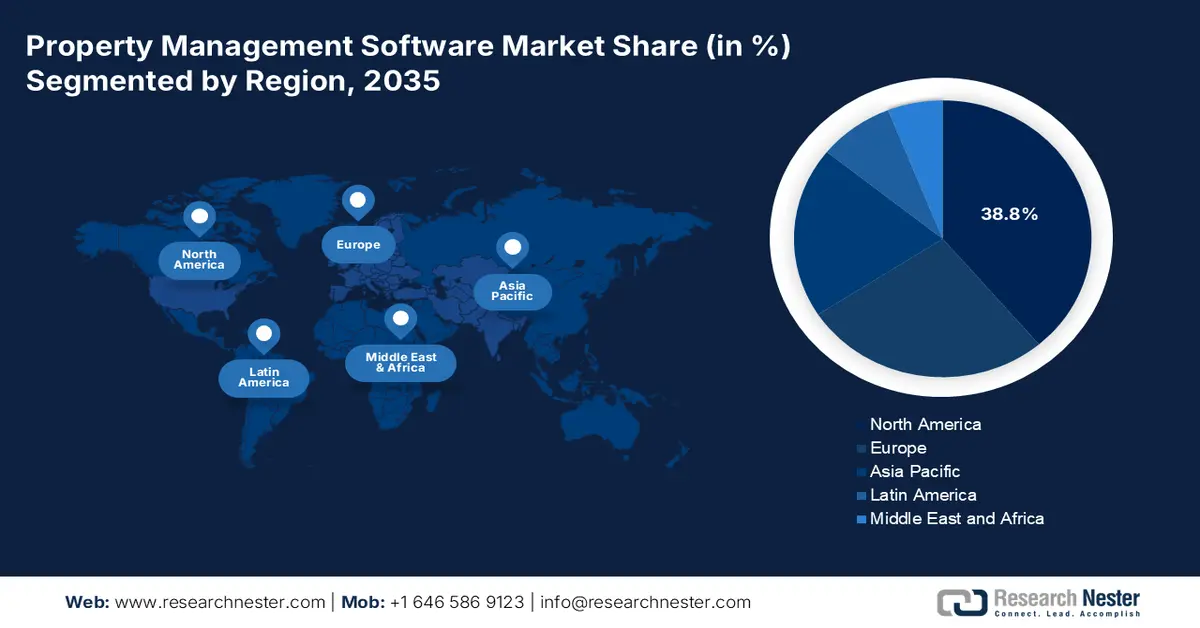

Property Management Software Market - Regional Analysis

North America Market Insights

The North America is dominating the property management software market and is expected to hold the revenue share of 38.8% by 2035. The market is driven by high institutional investment, mature SaaS adoption, and complex regulatory mandates. Dominant drivers include the scale of institutional landlords such as REITs, which demand enterprise-grade software for portfolio management and substantial federal housing subsidies requiring compliant, auditable digital systems. A key trend is the rapid growth of the single-family rental and build-to-rent sectors, which rely on specialized software for managing geographically dispersed assets. Further, the demand is fueled by the energy benchmarking laws and local rent control ordinances, making compliance automation essential. The market is defined by vendor consolidation and a shift towards integrated platforms that serve as central operating systems connecting the property management with smart home, IoT, payment processing, and advanced data analytics for asset performance.

U.S. market is being defined by the structural growth in the rental housing alongside policy-driven administrative complexity. The report from Congress.gov in June 2025 has indicated that the highest level of multifamily units was completed in 2024, with 54% delivered in the high-density building of 50 or more units and 95% built for rent, materially expanding the operational scale of rental portfolios. At the policy level, the 2026 HUD budget proposal, as analyzed by the Congressional Research Service, restructures federal rental assistance into a 36.2 billion state rental assistance program, shifting program design and reporting responsibilities to states and local agencies. This transition, combined with a 17% reduction in HUD management and administration funding, increases reliance on digital systems to manage tenant eligibility, rent flows compliance, and audit readiness with constrained staffing.

HUD FY2026 Budget Request

|

Account |

FY2025 Enacted (USD billion) |

FY2026 Request (USD billion) |

% Change |

|

Salaries & Expenses (Mgmt/Adm) |

2.449 |

2.034 |

-17% |

|

State Rental Assistance (new) |

0.000 |

36.212 |

NA |

|

Tenant-Based Rental Assistance |

36.041 |

0.000 |

-100% |

|

Public Housing Fund |

8.811 |

0.000 |

-100% |

|

Project-Based Rental Assistance |

16.890 |

0.000 |

-100% |

|

Community Development Fund (CDBG) |

3.430 |

0.000 |

-100% |

|

Homeless Assistance Grants |

4.051 |

4.024 |

-1% |

|

Native American Programs |

1.344 |

0.887 |

-34% |

|

Housing for Elderly |

0.931 |

0.000 |

-100% |

|

Housing for Disabilities |

0.257 |

0.000 |

-100% |

Source: Congress.gov 2025

Canada’s property management software market is being structurally reinforced by the federal government’s housing supply expansion and rental affordability agenda under the budget 2024 and Canada’s Housing Plan, which targets 3.87 million new homes by 2031, including at least 2 million net new homes above baseline construction, based on the Government of Canada's April 2024 report. A large share of these additions is expected to be purpose-built rental and affordable housing, supported by over CAD 55 billion in low-cost financing via the Apartment Construction Loan Program, CAD 4.4 billion via the Housing Accelerator Fund, and extensive use of public lands and nonprofit partnerships. These initiatives shift delivery responsibility to provinces, municipalities nonprofits and housing providers increasing the need for standardized systems to manage the tenant eligibility, rent controls, subsidy compliance, asset performance, and multi-level reporting.

APAC Market Insights

Asia Pacific is the fastest-growing market and is expected to grow at a CAGR of 10.2% during the forecast period, 2026 to 2035. The market is driven by the unprecedented urbanization, massive government-led digitalization campaigns, and the rapid professionalization of real estate management. A core driver is the rise of institutional investment and the development of organized real estate investment trusts in markets such as India and Singapore, which demand transport, scalable, and audit-ready software platforms. In India, the Securities and Exchange Board of India has been actively reforming the REIT regulations to attract capital, directly increasing the demand for professional property management software. Further, the trend across the region is toward mobile-first, localized platforms that can handle complex lease structures, facilitate digital payments popular in each country, and integrate with smart building sensors for energy management.

The property management software market in China is dominated by the government-driven digitalization and the sheer scale of its real estate sector. The primary catalyst is the national Smart City and Digital China strategy, which mandates the integration of the technology into urban management and building operations. This creates compulsory demand for a platform that facilitates data collection, energy management, and community services. The report from the People’s Republic of China in October 2025 depicts that the real estate sector’s total output in 2024 reached 32.7 trillion yuan, representing a foundational economic activity that requires advanced management tools. Further, the leading platforms have evolved into comprehensive super apps merging property management with transaction services, smart home controls, and retail, creating a deeply integrated ecosystem that serves massive residential and commercial portfolios.

India’s market is experiencing explosive growth fueled by rapid urbanization, regulatory reform, and government-backed housing initiatives. The most significant demand driver is the Real Estate Act, which enforces project transparency, escrow accounting, and construction timelines, making a compliant software essential for developers. This regulatory push is amplified by the huge public investment in housing. According to the Government of India report in August 2025, Pradhan Mantri Awas Yojana dashboard, over 112.81 lakh houses are grounded, and 93.61 lakh are completed as of 2025. Managing this vast new affordable housing stock requires digital tools for allotment maintenance and community governance. The market trend is toward affordable, mobile-first SaaS solutions that cater to a fragmented base of developers and landlords, focusing on automation and RERA compliance.

Europe Market Insights

Europe market is poised for significant growth. This expansion is driven by the urban rental densities, robust regulatory compliance, and a wave of digital transformation in the real estate sector. A core demand driver is the substantial portion of the population living in rented accommodation, mainly in major economies such as France, Germany, and the Netherlands, which creates a vast, stable base for property administration platforms. Further, the European Union’s strong focus on data protection under the General Data Protection Regulation and various national energy efficiency directives compel the property owners and managers to adopt advanced software to ensure compliance, automate reporting, and manage smart building technologies. This market is also being defined by the professionalization of the rental sector and the entry of investors seeking a scalable, data-driven tool to manage the portfolio efficiently.

In the UK, the property management software market is propelled by the scale of operational identity of the rented housing sector, as indicated by the English Housing Survey report in July 2025. The data highlights that nearly 19% of the households in England live in rented accommodation, split between the private rented sector and social housing, together accounting for nearly 9 million households. The property management software alone accommodates nearly 4.9 million households characterized by shorter tenancies, higher tenant turnover, and frequent repair and compliance requirements. These conditions generate a continuous administrative workload across the rent collection, tenancy management, maintenance response tracking, and regulatory compliance. As landlords, housing associations, and managing agents scale portfolios amid tightening tenant protection and property standards, centralized digital systems become essential to manage volume, consistency, and audit readiness.

UK Rented Housing Segments

|

Rented Sector |

Estimated Size (Households) |

Market Relevance to Property Management Software |

|

Private Rented Sector (PRS) |

~4.9 million households |

High tenant turnover and landlord repair responsibility increase demand for automated leasing, maintenance, and workflow management |

|

Social Rented Sector |

~4.0 million households |

Regulated rents, long-term tenancies, and statutory reporting requirements drive adoption of structured, compliance-ready property data systems |

Source: Government of UK, July 2025

Germany represents Europe’s largest and most stable property management software market, fundamentally underpinned by its exceptionally high rental rate and institutional ownership structures. A key statistical driver is the market composition. The report from the Destatis in April 2025 indicated that nearlt 52.8% of the people in Germany live in rented accommodation in 2024. This creates an unparalleled addressable market for digitized management. The demand is heavily shaped by the rent index regulations and robust energy efficiency laws that require precise data reporting and tracking functions effectively handled by specialized software. The trend is toward advanced platforms that offer deep integrations for utility cost allocation, long-term maintenance planning, and digital communication portals to meet the high expectations of tenants and ensure the landlord's compliance with a complex legal framework.