Procurement Analytics Market Outlook:

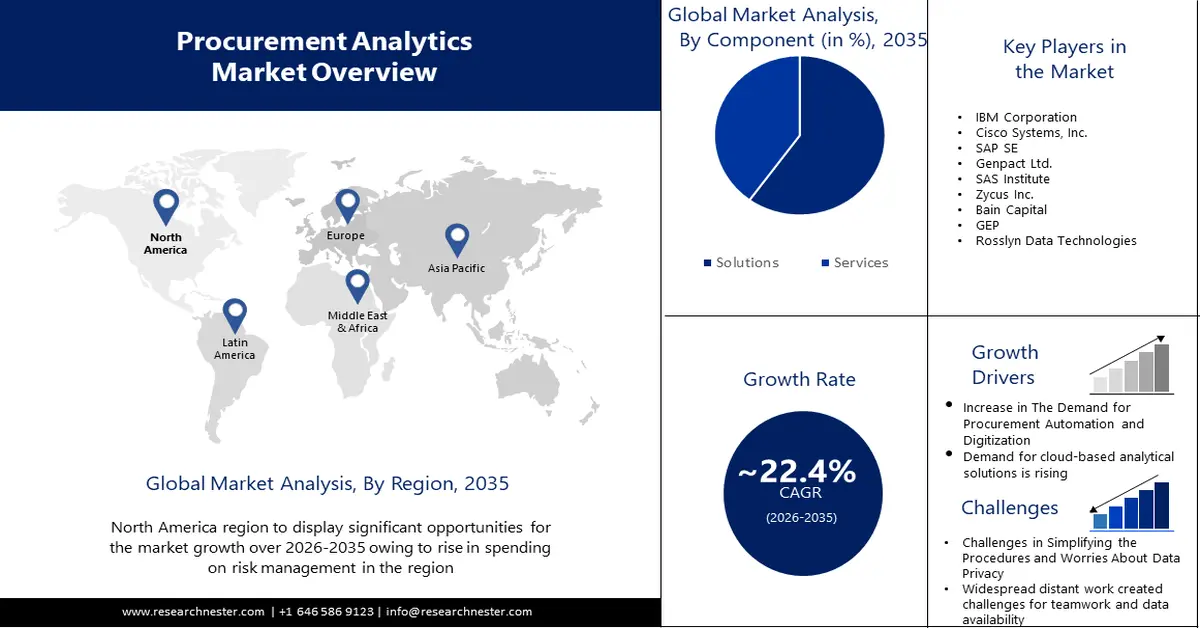

Procurement Analytics Market size was over USD 6.37 billion in 2025 and is anticipated to cross USD 48.08 billion by 2035, growing at more than 22.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of procurement analytics is assessed at USD 7.65 billion.

The use of procurement analytics technology and services is expected to be fueled by rising corporate spending on marketing and advertising, a shifting customer intelligence environment to drive the market, and the expansion of customer channels. The annual global expenditure on advertising is estimated to be USD 674 billion.

In addition, one of the major drivers for procurement analytics is automation. The tremendous requirement that enterprises have for contract and compliance management contributes to the rising demand. For example, the U.S. software giant ServiceNow updated its current product to include a procurement service management component that helps with other field activity management. The goal of ServiceNow is to automate workflows related to and involved in procurement.

Key Procurement Analytics Market Insights Summary:

Regional Highlights:

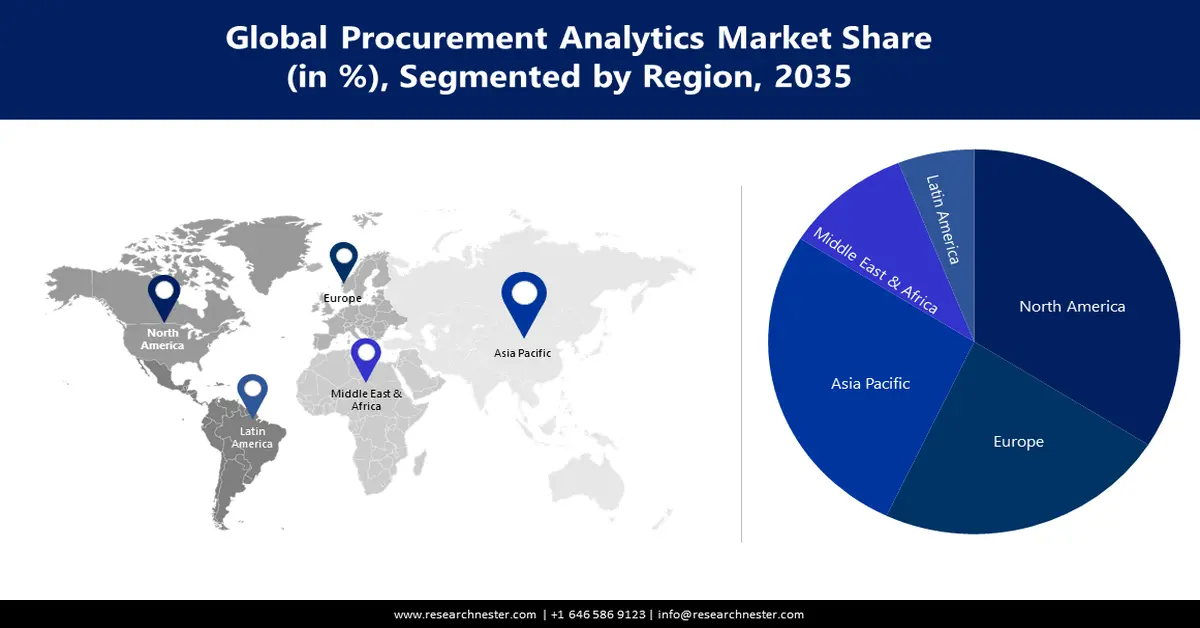

- North America procurement analytics market will hold more than 34% share, driven by early adoption of digital processes and technologies like analytics, along with increased spending on risk management and supply chain analytics, forecast period 2026–2035.

- Asia Pacific market will capture a 27% share, fueled by the integration of big data analytics in supply chain management and increased IoT use in manufacturing processes, forecast period 2026–2035.

Segment Insights:

- The solutions segment in the procurement analytics market is projected to achieve a 60% share by 2035, driven by the increasing use of procurement analytics solutions across various verticals globally.

- The on-premises segment in the procurement analytics market is anticipated to hold a 55% share by 2035, influenced by the need for local security controls and data protection from on-premises data storage.

Key Growth Trends:

- Businesses battle to maintain their place in the cutthroat market

- Demand for cloud-based analytical solutions is rising-

Major Challenges:

- Businesses battle to maintain their place in the cutthroat market

- Demand for cloud-based analytical solutions is rising-

Key Players: Croda International Plc, Oleon NV, Wilmar Group, Occidental Petroleum Corporation, Ercros, S.A., FMC Corporation, Olin Corporation, Tokyo Chemical industry Co., Ltd., Nissan Chemcial corporation.

Global Procurement Analytics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.37 billion

- 2026 Market Size: USD 7.65 billion

- Projected Market Size: USD 48.08 billion by 2035

- Growth Forecasts: 22.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Procurement Analytics Market Growth Drivers and Challenges:

Growth Drivers

-

Businesses battle to maintain their place in the cutthroat market- With the proliferation of emerging technologies like big data, machine learning, and IoT in the market, competition is getting more intense. In all, 72% of the businesses that responded to the survey said they were using or developing machine learning applications. Businesses are working very hard to implement these technologies and grow their knowledge in order to stay in the procurement analytics market . Organizations operating in such a demanding and competitive environment can gain a better knowledge of the procurement risks through the use of procurement analytics tools. Analytics solutions have also aided businesses in swiftly adapting to the shifting demands of the market in order to thrive in the fiercely competitive environment.

- Demand for cloud-based analytical solutions is rising- The procurement analytics solution gives businesses the flexibility and agility to make better decisions faster and at a lower cost. To create better business strategies, a variety of enterprises worldwide are implementing advanced analytics technology integrated with robots and artificial intelligence capabilities. It aids businesses in forecasting market possibilities and optimizing return on investment. An organization's ability to operate properly may be impacted by future procurement outcomes, which is where procurement analytics come into play. Organizations are attempting to migrate their data to the cloud in order to maximize benefits and analyse it for insights that can be put into action, since real-time data accessibility has become more prevalent. It has made it possible for providers of procurement analytics software to offer cloud-based solutions.

- Increase in The Demand for Procurement Automation and Digitization- Businesses are embracing supplier collaboration tools, predictive analytic capabilities, and strategic sourcing solutions to speed up the procurement process, automate manual labour, and enhance productivity. Due to the vast dispersion of businesses, it is becoming more and more important for both big and small enterprises to evaluate and modify digital procurement automation solutions in order to stay competitive and hold onto their market share. Procurement, contract administration, vendor relationships, payments, and other disciplines are impacted by the introduction of procurement automation, which is a deliberate strategy adopted by businesses to digitize work from antiquated methods.

Challenges

-

Challenges in Simplifying the Procedures and Worries About Data Privacy- To properly manage their procurement portfolio, firms must streamline a number of internal processes. To efficiently make procurement decisions, all of the different activities including supply chain, inventory management, accounting, vendor selection, sourcing, and reporting should be streamlined and placed under a single umbrella. Before implementing the analytics solutions on the organization platforms, procurement analytics vendors must streamline a number of processes. The procurement analytics market is not growing as much as it should because of the lack of integration and companies' worries about privacy violations that could damage their brand.

- The market may grow more slowly if advanced analytical technologies are reluctant to be used.

- Widespread distant work created challenges for teamwork and data availability. The combination of these factors caused organizations to prioritize short-term cost-cutting measures over long-term investments in analytics, which in turn slowed down market growth.

Procurement Analytics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

22.4% |

|

Base Year Market Size (2025) |

USD 6.37 billion |

|

Forecast Year Market Size (2035) |

USD 48.08 billion |

|

Regional Scope |

|

Procurement Analytics Market Segmentation:

Component Segment Analysis

Based on component, the solutions segment in the procurement analytics market is expected to hold 60% of the revenue share during the forecast period. Working capital management is improved and growth is accelerated by the procurement analytics software provided by procurement analytics firms. The market offers a wide range of solutions. Oracle and SAP, which offer products including risk analytics, spend analytics, and supply chain management, are a couple of instances of procurement analytics companies. When considering social, economic, and environmental concerns, emerging technologies offer new prospects for sustainable development and green technology. Therefore, one of the main factors driving the use of procurement analytics solutions across verticals globally and driving the market ahead is growing awareness of technology's negative environmental effects. For example, The Hong Kong and Shanghai Banking Corporation Limited is stepping up its efforts to assist companies of all kinds in making the switch to more sustainable business models beginning of October 2020. A little over USD 1 trillion has been invested to funding environmentally friendly companies and creating climate solutions to safeguard the expansion of new firms.

Deployment Mode Segment Analysis

Based on deployment mode, on-premises segment in the procurement analytics market is expected to hold largest revenue share of about 55% during the forecast period. An organization using on-premises solutions must buy a license or a copy of the software. Firms in heavily regulated areas, such as Europe, are required to utilize software that they have bought. The segment's market share in procurement analytics is influenced by variables including local security controls and data protection resulting from on-premises data storage. But because on-premises software needs specialized IT staff, accessibility and support are better within the company.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Application |

|

|

Deployment Mode |

|

|

Organization Size |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Procurement Analytics Market Regional Analysis:

North American Market Insights

Procurement analytics market in North America region is attributed to hold largest revenue share of about 34% during the forecast period due to the early use of digital processes and technologies like analytics. Regional growth is probably going to be driven by the rise in spending on risk management, supply chain analytics, and vendor analytical solutions. Furthermore, leading North American companies in the procurement analytics space are always adding new products to their lineup and improving the ones they already have. To assist clients in enhancing equipment uptime and supply chain resilience, PartsSource announced in June 2022 the release of a visual formulary control and supply chain risk monitor. It is anticipated that in 2023, spending on risk management and information security goods and services would increase by 11.3% to exceed USD 188.3 billion.

APAC Market Insights

Procurement analytics market in Asia Pacific region is projected to hold largest revenue share of about 27% during the forecast period. Big data analytics is revolutionizing businesses and governments in the Asia Pacific area. China and India are two nations that are integrating technology to enhance supply chain management and operations. The expansion of the market is also being driven by an increase in IoT use and data analysis of manufacturing processes. In February 2022, Google Inc. published an article stating that over 200 unicorn companies were located in the region in 2021. The region's increasing start-up scene is probably going to have an impact on the market's expansion.

Procurement Analytics Market Players:

- Key Players

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM Corporation

- Cisco Systems, Inc.

- SAP SE

- Genpact Ltd.

- SAS Institute

- Zycus Inc.

- Bain Capital

- GEP

- Rosslyn Data Technologies

- Honda Motor Co., Ltd.

- Oracle Corporation Japan

- Fujitsu Limited

- NTT DATA Corporation

- Mitsui & Co., Ltd.

- Microsoft Corporation

Recent Developments

- Boston-based private equity firm Bain Capital purchased PartsSource. PartsSource is a healthcare service provider as well as a B2B marketplace. PartsSource links more than 6000 OEM manufacturers with almost 19,000 clinics and hospitals in the United States. With the help of its precision procurement analytics technology, hospitals may cut costs, lower risk, and improve supply chain visibility.

- GEP and Liberty Global, a company that combines broadband, mobile, and video communications, have established a cooperation. Liberty Global uses GEP software to automate all aspects of their source-to-contract process, including sourcing, spend analysis, savings tracking, category workbench, contract and supplier administration, for both direct and indirect procurement.

- Report ID: 5709

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Procurement Analytics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.