Process Automation Market Outlook:

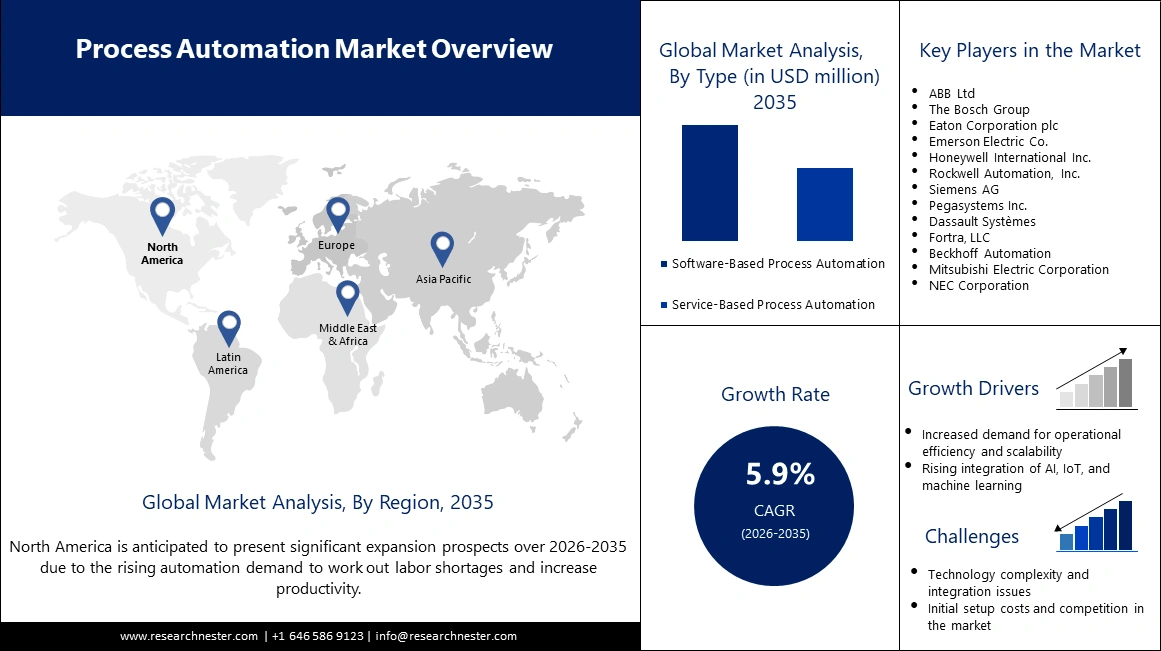

Process Automation Market size was valued at USD 96.33 billion in 2025 and is likely to cross USD 170.89 billion by 2035, expanding at more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of process automation is assessed at USD 101.45 billion.

The market is anticipated to rise steadily as process automation plays a critical role in operational efficiency and smooth business processes. Multiple industry verticals are trying to minimize the scope of manual interference and maximize process optimization via automation solutions. Some other critical drivers include growing IoT adoption, AI, and machine learning to empower better decision-making and improved performance. Automation also supports digital transformation strategies. This allows flexibility for businesses to scale their operations with minimum human effort.

Furthermore, the latest solution launches by several major companies are driving growth in the process automation market. For instance, in August 2024, Emerson Electric Co. launched a next-generation automation platform targeted at improving operational performance with the integration of AI into control systems. Several other players are also working toward extending their automation portfolio into advanced robotics and digital solutions for the manufacturing industries. The development represents a continuous activity of major market operators to support their competitive advantage.

Key Process Automation Market Insights Summary:

Regional Highlights:

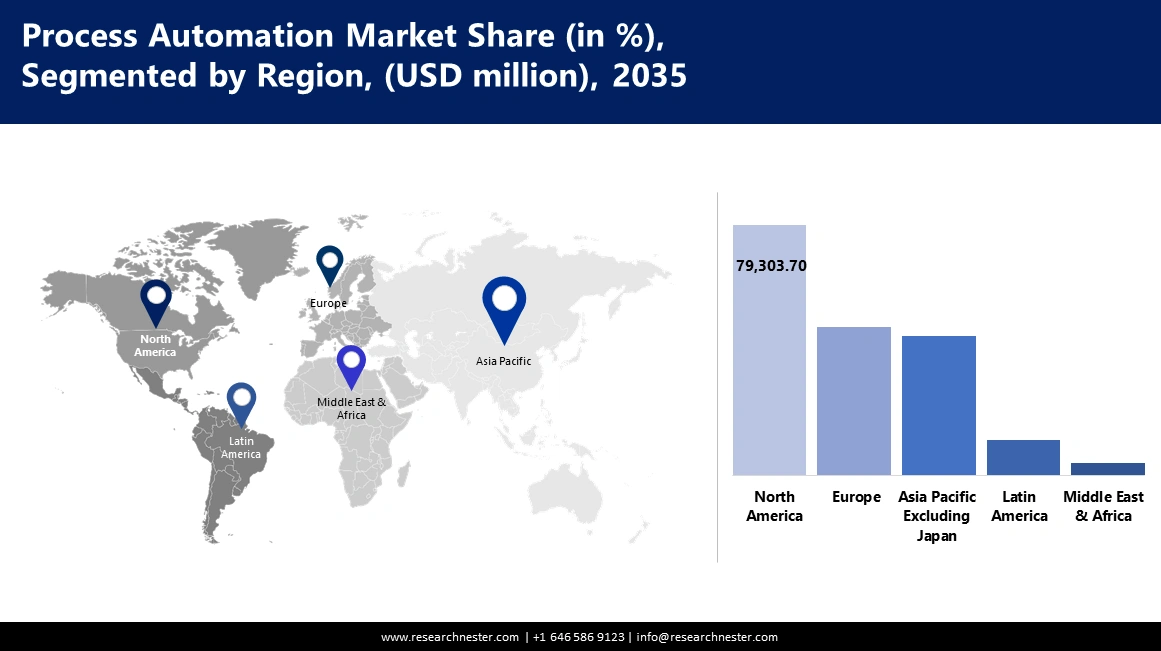

- North America process automation market is anticipated to capture 36% share by 2035, driven by urge to enhance operational productivity, labor scarcity, and digital transformation investments.

- Asia Pacific market will register moderate growth during the forecast timeline, driven by rising demand for efficiency in manufacturing and energy sectors along with government support in China.

Segment Insights:

- The scada system segment in the process automation market is expected to lead market share by 2035, driven by real-time monitoring capabilities and AI-enabled fault detection and optimization.

- The oil and gas segment in the process automation market is projected to witness lucrative growth till 2035, attributed to the adoption of process automation optimizing production capacity and operational control.

Key Growth Trends:

- Technological advancements

- Digital transformation initiatives

Major Challenges:

- Regulatory compliance issues

- Gaps in the skilled workforce

Key Players: ABB Ltd., The Bosch Group, Eaton Corporation plc, Emerson Electric Co., Honeywell International Inc., Rockwell Automation, Inc., Siemens AG, Pegasystems Inc., Dassault Systèmes, Fortra, LLC, Beckhoff Automation, Mitsubishi Electric Corporation, NEC Corporation, Yokogawa Electric Corporation, and Avanade Inc.

Global Process Automation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 96.33 billion

- 2026 Market Size: USD 101.45 billion

- Projected Market Size: USD 170.89 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Process Automation Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements: This includes integrations with AI and IoT, driving the market for automation solutions. These technologies help enterprises in real-time data gathering, process optimization, and decision-making. For example, in June 2023, Siemens brought an AI-powered industrial automation platform into the market, boosting predictive maintenance and reducing the cost of operations. Such a capability to optimize operations with minimum human intervention is of major importance to businesses that are pursuing cost efficiency.

- Digital transformation initiatives: The acceleration of the efforts for digital transformation globally is considered the main growth factor as more business firms are looking to automate, replacing the old legacy systems and operational processes. Companies working in banking and finance are stepping forward with massive investments in automating the back office process. Thus, these organizations are showing an inclination to improve customer service and operational efficiency.

- Rising labor costs and workforce shortages: The shortage of labor and increase in wages, especially in regions like North America and Europe, propel businesses to opt for automation. Most investments are made in the food and beverage industries within automated processing to cover shortages of labor. For instance, in March 2024, Rockwell Automation, in addition to factory automation opportunities announced its expansion to satisfy the growing demand for labor-saving solutions.

Challenges

- Regulatory compliance issues: A major bottleneck for the process automation market involves several government regulations that the market players are supposed to comply with strictly, basically involving data privacy and security. The General Data Protection Regulation or GDPR by the European Union has resulted in compliance issues even at automation providers. Additionally, various automation companies in Europe were asked to rework their data management system in time to meet new security standards. Such types of regulations enhance the complexity of deploying automation solutions.

- Gaps in the skilled workforce: Another challenge in the industry is a shortage of skilled workers who can manage and maintain such automated systems. While most lines of business have increased automation, it is often difficult to find the right talent who can operate and troubleshoot advanced systems. According to a report by the U.S. Bureau of Labor Statistics, more than 100,000 skilled automation engineers are expected to be lacking in the industry due to shortage by 2025. This shortage in supply is holding back the complete potential of automation in industries.

Process Automation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 96.33 billion |

|

Forecast Year Market Size (2035) |

USD 170.89 billion |

|

Regional Scope |

|

Process Automation Market Segmentation:

Application Segment Analysis

By application, the supervisory control and data acquisition (SCADA) system is foreseen to lead the market through 2035, owing to its capacity for real-time monitoring of vital sectors like energy and utilities. In March 2024, Yokogawa Electric Corporation launched an AI-enabled SCADA system that will help enhance fault detection and process optimization to further support its market leadership. With the ability to handle complex processes for granular analytics, SCADA has become vital for industries that want to attain operational control. Its application for critical infrastructure makes SCADA a vital enabler in the process automation market.

End use Industry Segment Analysis

Oil and gas segment in the process automation market is expected to observe lucrative growth through 2035. Process automation enhances overall efficiency in oil and gas industry by optimizing elaborative processes and bringing down human interference and downtimes. With the global demand for energy still growing, there is increased acceptance of automation in the oil and gas industry to expand production capacity. The adoption of process automation enables players in the oil and gas sector to remain competitive in response to growing energy demands at the highest levels of safety and reliability. Such strategic investment in automation not only supports higher productivity but also helps enable more cost-effective and streamlined processes within the sector.

Our in-depth analysis of the market includes the following segments:

|

Type |

|

|

Mode of Deployment |

|

|

Enterprise Size |

|

|

Application |

|

|

Task/Operation Type |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Process Automation Market Regional Analysis:

North America Market Insights

North America industry is estimated to account for largest revenue share of 36% by 2035. The growing urge to enhance operational productivity, coupled with labor scarcity and thereby driving digital transformation by the region, fuels massive investments related to automation. AI, integrated machine learning, and cloud technologies into the automation systems propel optimization of operations, cost reduction, and better decision-making for businesses. In North America, automation has remained a key strategy toward efficiency and competitiveness.

The U.S. is anticipated to dominate the North America process automation market, due to the rising automation to work out labor shortages and increase productivity. Businesses, particularly in the manufacturing, logistics, and energy sectors, make use of automation to ease business operations as much as possible and maximize the supply chain. In April 2024, Honeywell introduced a new cloud-based automation platform to help optimize supply chain logistics and make their responses quicker against changing market conditions. This platform combines real-time data analytics with machine learning, thereby giving flexibility and greater control over operations to businesses.

Canada is also going through rapid growth in the process automation market, majorly in the natural resources of the country. In August 2024, Suncor Energy reportedly adopted automated systems to ensure smoother production without certain operational costs involving oil extraction and processing. Such technologies enable higher productivity among firms with minimum human intervention in these dangerous environments. While the government continues to invest in the development of its industrial infrastructure, the application of advanced automation solutions is expected to further gain momentum in the country.

APAC Market Insights

Asia Pacific process automation market is poised to register moderate growth till 2035 due to the rising demand for efficiency in operations from major sectors like manufacturing and energy. India and China are witnessing a spike in automation adoption in the region on the back of rising labor costs and a productivity enhancement drive. The expanding industrial base in the region and rising adoption of automation in industries such as automotive and pharmaceuticals coupled with energy industries have been one of the major reasons for this growth.

The expanding industrial base of India has made the country a vital player in the process automation market within Asia Pacific. Indian businesses are fast-tracking automation technologies to further improve productivity while concurrently lowering operational costs. In September 2024, Tata Consultancy Services announced the prioritization of automotive labs and a new automation platform that will likely change the way automotive operations in India are performed. The new system uses AI and data analytics within manufacturing to further optimize output and create leaner supply chains.

China continues to be a global leader in manufacturing and a significant contributor to process automation. The government in China is very supportive of the initiative for smart manufacturing; hence, automation technologies are widely being applied in different industries. The government also launched the Made in China 2025 plan to incorporate automation into manufacturing for further industrial productivity and competitiveness. Such initiatives are likely to boost the pace of adopting smart factories. Such initiatives are bound to make China's position in the global process automation landscape stronger with sustained leadership through 2035.

Process Automation Market Players:

- ABB Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Bosch Group

- Eaton Corporation plc

- Emerson Electric Co.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Siemens AG

- Pegasystems Inc.

- Dassault Systèmes

- Fortra, LLC

- Beckhoff Automation

- Mitsubishi Electric Corporation

- NEC Corporation

- Yokogawa Electric Corporation

- Avanade Inc.

The market of process automation is highly competitive and fragmented, with players such as ABB Ltd, Emerson Electric Co., Siemens AG, and Honeywell International Inc. These companies are targeting AI-enabled automation systems and cloud-based solutions to meet the demand for intelligent and more effective processes. Strategic partnerships are also in the spotlight to fortify their market position. Further, the companies invest in R&D and machine learning to increase their offerings of advanced automation solutions, which is a competitive advantage for the companies.

In August 2023, Rockwell Automation extended its relationship with Microsoft by integrating its automation platform into Azure IoT to further enhance connectivity and drive analytics. This points out the significant contribution that cloud technology brings in ensuring wider diffusion of automation across industries. This will help organizations develop insights through advanced analytics, ensure real-time monitoring, and optimize their operations to accelerate the digital transformation of industrial operations.

Here are some leading companies in the process automation market:

Recent Developments

- In May 2024, ABB launched the ABB Ability Symphony Plus SDe Series, a hardware portfolio for modernizing process control systems. It enables seamless upgrades in power, water, oil & gas, pharmaceuticals, and pulp & paper industries. Leveraging existing infrastructure, it supports strategic enhancements for improved efficiency and compliance. The SDe Series offers rugged control products and scalable architecture, future-proofing plant operations cost-effectively.

- In April 2024, Siemens unveiled the Simatic S7-1200 G2 controller, a next-gen industrial automation solution. It features efficient motion control, adaptable machine safety, enhanced performance, and scalability. Integrated with Siemens Xcelerator, it bridges operational and information technology realms. The controller maximizes productivity and cost-effectiveness through standardized engineering.

- In April 2024, Siemens launched SINEC Security Guard, a cloud-based cybersecurity solution for industrial environments. It automates vulnerability mapping and security management for OT assets, integrating with Microsoft Sentinel. The tool provides comprehensive threat detection and response capabilities.

- In February 2024, GE introduced GE Vernova's Autonomous Inspection, a cloud-based AI solution for automating industrial asset inspections. It integrates seamlessly with the APM suite, transforming manual inspections into efficient, automated workflows. The tool enhances safety, expedites timelines, and delivers actionable insights. This drives smarter asset management and operational excellence across industries.

- Report ID: 6436

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Process Automation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.